1 minute read

Real Estate Talk Have interest rates peaked?

Over the past week, there has been a big shift in expectations and forecasts for RBA cash rate movements over the course of 2023. This change has stemmed from a banking crisis in the US caused by falling bond values, inflation declining faster than expected and a softer outlook for economic growth. So, I thought I’d provide you with an update on what the new interest rate outlook is.

Short Version

Advertisement

Economists think the cash rate has now peaked at 3.60% and will remain steady and/or fall over the remainder of 2023. This change in thinking was caused by a banking crisis is US, inflation falling faster than expected and economic growth stalling.

The “Market” priced in a 46% expectation that RBA will cut rates next month (My personal opinion is that the RAB will hold rates steady in April).

If RBA holds, or cuts, in April it should have a positive effect on property markets, as buyers will perceive this as a sign we that we have “hit the bottom”. This should see the recent lift in buyer enquiry and demand remain in place and potentially rise.

Longer Version

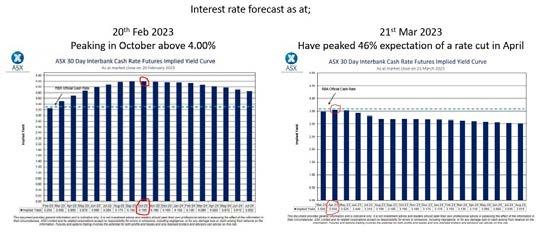

The two charts attached show the dramatic movement in the “Markets” forecast for the RBA cash rate over the past month.

The first chart (20th Feb) shows that the Market was pencilling in rate hikes all the way through to October this year and peaking above 4%.

The second chart (21st Mar) shows that the Market has now changed its tune with a 46% expectation that there will be a rate cut in April. And even if no rate cut eventuates next month, the expectation is that interest rates have peaked.

Two main reasons for the change; Banking crisis in US - this has stemmed from rapidly rising interest rates and falling bond prices. This is expected to limit borrowing to businesses, undermine confidence and therefore weigh on economic growth (both US and Global).

Inflation is expected to come down quicker