4 minute read

Investormind

from Investormind

by Investormind

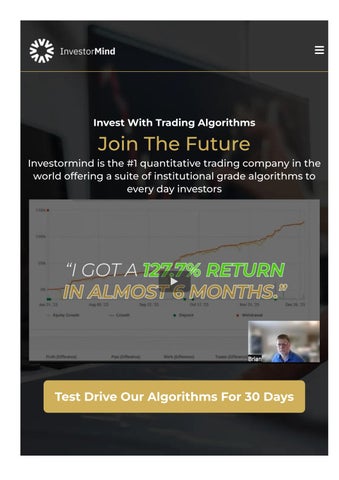

Transform Your Investment Strategy with Investormind’s Revolutionary AI-Powered Trading AlgorithmsIn the dynamic world of finance, staying ahead of the curve requires innovation, precision, and adaptability. Investormind, a leading platform in the financial technology space, offers a game-changing solution with its AI-powered trading algorithms. These advanced tools are designed to revolutionize your investment strategy, providing a competitive edge in the market. This blog will delve into how Investormind’s AI-powered trading algorithms work, their benefits, and how they can transform your investment approach.

Understanding AI-Powered Trading Algorithms

AI-powered trading algorithms leverage artificial intelligence and machine learning to analyze vast amounts of market data, identify patterns, and make informed trading decisions. These algorithms are capable of processing information at speeds and accuracy levels far beyond human capabilities. Key components of these algorithms include:

1. Data Analysis

AI algorithms analyze historical and real-time market data, including price movements, trading volumes, and economic indicators. This comprehensive analysis helps in identifying trends and making predictions.

2. Pattern Recognition

Through machine learning, AI algorithms recognize patterns and anomalies in market behavior. They learn from past data to predict future price movements and identify profitable trading opportunities.

3. Automated Execution

Once a trading signal is generated, AI algorithms can automatically execute trades. This ensures timely and efficient trade execution, minimizing the risk of missed opportunities due to human delay.

Benefits of Using Investormind’s AI-Powered Algorithms

Investormind AI-powered trading algorithms offer numerous advantages that can significantly enhance your investment strategy:

1. Enhanced Accuracy and Precision

AI algorithms process and analyze vast datasets with high precision, reducing the likelihood of errors in trading decisions. This leads to more accurate predictions and better-informed trades.

2. Speed and Efficiency

Automated trading through AI ensures rapid execution of trades, capitalizing on market opportunities in real-time. This speed is crucial in volatile markets where timing can significantly impact profitability.

3. Objective Decision-Making

AI algorithms eliminate emotional biases from trading decisions. Unlike human traders, AI operates based on data-driven insights, ensuring consistency and objectivity in trading strategies.

4. Adaptability and Learning

Machine learning enables AI algorithms to continuously learn and adapt to changing market conditions. This adaptability ensures that trading strategies remain effective even as market dynamics evolve.

5. Risk Management

AI-powered algorithms can incorporate risk management strategies, such as setting stop-loss orders and diversifying portfolios. This helps in mitigating potential losses and managing risk effectively.

Real-World Applications and Success Stories

Investormind’s AI-powered trading algorithms have been successfully integrated by numerous traders, leading to significant improvements in their investment outcomes. Here are a few examples:

1. Jane M., Professional Trader

“Investormind’s AI algorithms have transformed my trading strategy. The precision and speed with which trades are executed have allowed me to capitalize on market opportunities more effectively. My returns have improved significantly, and I have more confidence in my trading decisions.”

2. Michael T., Part-Time Investor

“As a part-time investor, I struggled to keep up with market trends and make timely trades. Investormind’s AI-powered tools have been a game-changer. They analyze the market for me and execute trades automatically. It’s like having a professional trader working for me around the clock.”

How to Get Started with Investormind

Getting started with Investormind’s AI-powered trading algorithms is straightforward:

1. Sign Up and Create an Account

Visit the Investormind website and sign up for an account. The registration process is simple and quick.

2. Explore the Platform

Once registered, take some time to explore the platform. Investormind offers a user-friendly interface with tutorials and guides to help you understand how to use their tools effectively.

3. Customize Your Algorithms

Investormind allows you to customize trading algorithms to suit your investment goals and risk tolerance. You can choose from pre-built strategies or create your own.

4. Backtest and Deploy

Before deploying your algorithms in live markets, use Investormind’s backtesting feature to test them against historical data. This helps refine your strategies and ensure they perform well.

5. Monitor and Optimize

After deploying your algorithms, monitor their performance and make adjustments as needed. Investormind provides real-time data and analytics to help you stay informed and optimize your strategies.

Conclusion

Investormind AI-powered trading algorithms offer a revolutionary way to enhance your investment strategy. With their ability to analyze data, recognize patterns, and execute trades with precision, these tools provide a significant edge in today’s competitive financial markets. Whether you are a seasoned trader or a part-time investor, integrating AI into your trading approach can unlock new levels of success. Embrace the future of trading with Investormind and transform your investment strategy today.

Visit Us: https://solo.to/investormind