6 minute read

THIS IS WHY YOU SHOULD INVEST IN EMBU COUNTY

This is Why You Should Invest in Embu County, the Land of Opportunities

Advertisement

BY INVERSK TEAM

nvestment in real estate has been on the increase in Kenya mostly in towns and now clustered in Counties in the current legal systems of County Government contributing to over 7% to Gross Domestic Product (GDP) directly and therefore one of the key Sectors in Kenya.

Formerly the headquarters of the Eastern Province, Embu County, with a population of more than 650 000 occupying 2,821 km² of land offers investment opportunities for people looking for a serene metropolitan area.

As an agricultural hub, Embu holds a great opportunity for real estate investors due to the increased demand for proper and affordable housing.

In 2016, Embu was reported as one of the key Counties in Kenya, with a fastgrowing need for housing and a rising number of investors in real estate, residential and large commercial houses attracting over five international investors in the last three years (2015- 2018).

Embu town is also a major trading centre for Agriculture, which is the backbone and livelihood of the people of Embu County, and Industrialization which ensures cash flow in the region. I

County government Support Embu County Governor Martin, Nyaga Wambora, who in his first term together with his government resolved to create opportunities for people to invest in the region, announced that ample land would be made available to investors who want to set up in the county, seeking to boost trade with private investors. The government also has a functioning

Infrastructure, Energy & Housing department that ensures passable, proper road network and proper housing, availability of power and safe transport.

Embu has an expansive road network with coverage more 120 km of tarmac including the Meru-Embu Highway and Embu-Kĩrĩtirĩ connecting the county regions easing transport. On the other hand, there is an Airstrip located at Don Bosco in Embu town making possible for domestic air travels.

Property Availability Embu County is naturally endowed with plenty of lands with slopes on the Eastern side of Mt. Kenya and it is less steep which makes it ideal construction of houses and industries and it is available to investors.

“Land will be made available to investors,” said Governor Wambora during a business connect dinner in Embu organized by Kenya National Chamber of Commerce and Industry (KNCCI) in 2015.

Endowed with tourism attraction Embu allows for investment in the hospitality and hotel real estate. On December 28th, 2018, the County governor signed two laws that enabled the county government to partner with the private sector to establish investments in tourism and other areas in order to spur development.

The Tourism Development Act enables investors to exploit the nascent tourism potential while the Embu County Investment and Development Corporation Act allowed the county to set up an investment arm through which private entities can do business with the Embu county government. 15KM from Embu town along the Siakago bypass lies Wezesha Real Estate’s Amani Gardens, the county’s most ambitious project on an expansive 70-acre piece of land. The project offers the most ideal place for investors looking for a place to retire away from the populous Nairobi city as well as those looking for futuristic capital gain.

Investors interested to get a piece of Amani Gardens can SMS the word Embu to 40073 or call 0731 000111. 1/8 acre is selling at Ksh 299,000 where one deposits Ksh 100,000 and clear balance in 6 months. However, the company is giving cash buyers get a discount of Ksh 20,000.

Is it okay to Buy land with a charge?

This requires a trustworthy developer who does not divert the money.

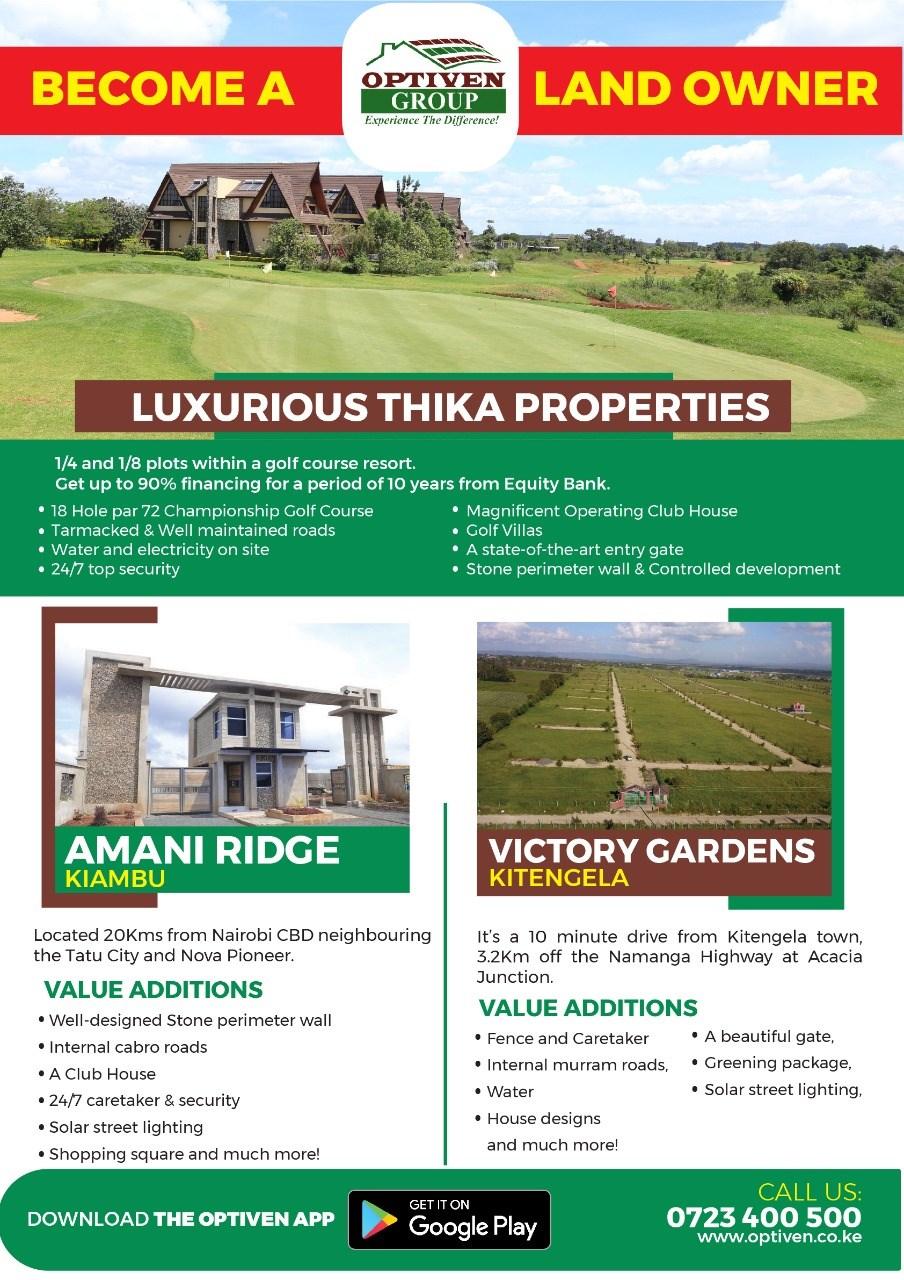

BY OPTIVEN GROUP

ere is the big question: Is it okay to buy land with a charge? Or in other words, is it okay to buy land that has been purchased by a developer through a bank loan? It is highly likely that the portion of land or the plot of land that you are about to purchase from any of the wellestablished land developers in Kenya is funded by a financier.

Most of these huge developers, the world over, and across the real estate industry, usually buy huge chunks of land that is mostly funded by either: private equity, joint ventures or bank loans among other financing options.

“A land with a charged title means that the entire property at hand is funded by a bank, and the title is held by the bank as security for the loan led. Which is a good thing for you, since you are assured of thorough due diligence on the property at hand. In such a case, the property developer will always give you a bank escrow account so that once you have completed paying for your particular plot of land; you automatically get partial discharge of charge as part of your completion documents,” says George Wachiuri, Optiven Group CEO.

Mr. Wachiuri adds that “this requires a trustworthy developer who does not divert the money.”

An escrow account on the other hand simply means an account that is owned by both the land owner and the bank. Once H

you get your partial discharge of charge, your small portion of land cannot be taken back by the bank if the landowner or developer fails to honor the loan.

Mr. Wachiuri further observes that buying a property that has been financed by a loan then, is a very common thing. He also points out that the price of such property, just like any other property that has been individually financed, is independent of the bank loan associated with it and only determined by the prevailing market price and as per its valuation. He notes, “Such an arrangement is only but very in-house, only involving a developer and their financer, and does not in any way affect the retail purchasers of the plots that are hived off the main piece of land.”

A partial discharge of charge is a one page document in 3 copies and it is prepared by a lawyer, stamped and signed by the bank, and that is anchored against the lands act 2012 and the registered land act, 1963, now repealed, (cap 300).

“This document means that the buyer of a portion of land or a plot for that matter is officially, legally and safely out of the development loan and has no risk whatsoever of losing their fully paid property.

Having completed your payment, you now also have a subtitle that has your name on it and legally speaking, you are not only the rightful owner of your property, but now you are also completely out of any attachment to the developer versus their bank’s loan,” says Wachiuri.

This document comes in triplicate –one copy to the client, a copy to land Registry and one copy to the financier. The document is a proof that you are not part of the loan and financier cannot repossess your property in case the principal borrower fails to honour the loan obligations.

The CEO notes that over the years, Optiven Real Estate has undertaken a number of massive projects and partial discharge of charge is part of the completion documents. He adds: “There are very few real estate developments that are done on cash basis, save for a few smaller projects.” Other completion documents include original title deed or certificate of title, rates and rent clearance certificate, sellers pin and a copy of a national identity card. If selling is by company, the certificate of registration, a CR 12, three copies of transfer forms, consent to transfer, among other depending on the nature of the property ownership document.

So, the only property buyer who can lose their property due to a loan that has been taken by a developer is those who have not paid through an escrow account and who have not been given a partial discharge of charge after completing their payment of their portion of land.