14 minute read

Win Tickets for Liver Forever

Win a pair of tickets to see ‘Live Forever’ in Liverpool

IVE FOREVER is a new touring production celebrating “music that will never die” and comes to Liverpool this Autumn with a stellar line up.

Advertisement

The show at the Eventim Olympia on Saturday September 11th sees the live return of Oasis UK - the world’s number one Oasis tribute act. For any Oasis fan this is not to be missed. The band are the world’s only officially recognised Oasis tribute with (accreditation from Liam Gallagher himself!). Featuring video wall and projector light show using the official Oasis visuals as used on their last tour the band were described by Radio 2 as “the next best thing now that Oasis have split” whilst Nicole Appleton confirmed “Liam was very impressed”. Also joining the bill is the official Oasis and Noel Gallagher HFB tour DJ Phil Smith. Having also been guitar technician for The Stone Roses and toured the world DJing for Oasis, it’s fair to say he knows a thing or two about tunes. Support comes from Laid – A Tribute To James. Playing all the hits including “Sit Down”, “Come Home”, “Laid”, “She’s a Star”, “Tomorrow” and “Getting Away With It”, Laid have received high praise everywhere they play and have marked their territory as the leading tribute to one of the best bands to come out of Manchester.

Completing the line-up is Stipe - A tribute to R.E.M. R.E.M. remain one of the world’s most enigmatic bands. With a string of peerless albums; one eye on the underground and one eye on the soaring chorus; it’s safe to say we will never see their like again. From The One I Love through to The End of the World and more besides. Whether it’s playing major festivals or appearing on the One Show, performing for Michael Stipe himself, Stipe are the definitive R.E.M. tribute - a complete band, and encyclopaedic knowledge of the back catalogue. The boys from Athens’ legacy is in good hands. To be in with a chance of winning the tickets, all you have to do is answer the following question:

Stipe is a tribute to which band?

Please send your full name, address and the date you received the magazine along with your answer to:

insidechestermagazine@gmail.com

Closing date: July 5, 2021.

Liverpool - Eventim Olympia - Saturday September 11, 2021 Doors open: 19:00 Tickets: £17.50 Tickets available from: www.skiddle.com/whats-on/Liverpool/Eventim-Olympia/Live-Forever--Oasis -UKUKLaid-James--Stipe-REM/35796539/

U Z ESLP Z

QUIZ

1 Television licences were first introduced in the UK in 1949 at a cost of how much? a) 2 Shillings; b) £2; c) £20 2 In which city was Byker Grove set? 3 If a Bingo caller shouted ‘Duck and Dive’ what number would he be calling? 4 In what sport would you hear the term ‘Third Man’? 5 In what competition did Wanderers beat the Royal Engineers 1-0? 6 Which of Henry VIII’s wives survived him? 7 In which Shakespeare play would you find the characters of Portia, Antonio and Shylock? 8 Which famous scientist is quoted as saying, ’if you can’t explain it simply, you don’t understand it well enough’?

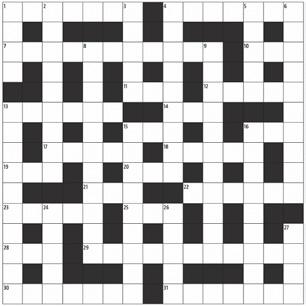

CROSSWORD

Across

1 Flow of cars 4 Wreath 7 Showiness 10 Gallivant (about) 11 The 'U' of IOU 12 Religious souvenir 13 Wallops 14 Persona ... grata 15 Solar energy source 16 Typist's complaint (1,1,1) 17 Peruvian mammal 18 Follow on 19 Cut 20 In favour of 21 Fawn's mother 22 ... & exhale 23 Matter 25 Bar account 28 Anticipated touchdown time (1,1,1) 29 Keeping under the thumb 30 Sugar-coat 31 Rip-off

Down

1 Clump of threads or hair 2 Versatile 3 Shyly 4 Illegal arms dealer 5 Cherub 6 Able to be subtracted 8 Bribes 9 Seriousness 13 Seducers 15 Nappy fastener (6,3) 16 Wed again 24 Stratified stone 26 Tedious people 27 Monster

Answers page 42

Unlock the cash from your home If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could:Unlock the cash from your home and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could: Unlock the cash from your home If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could: Unlock the cash from your home If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could: Unlock the cash from your home and are looking to boost your retirement finances, your home could Unlock the cash from your home If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could Unlock the cash from your home If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could: Unlock the cash from your home If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could: help. By releasing tax-free cash from your home, you could: Unlock the cash from your home Unlock the cash from your home

Gift money Go on Clear credit cards Make home and and are looking to boost your retirement finances, your home could and are looking to boost your retirement finances, your home could garden improvementshelp. By releasing tax-free cash from your home, you could: help. By releasing tax-free cash from your home, you could: to family holiday and loans Make home and Gift money Make home and Go on Gift money Clear credit cards The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement. Replace the car Pay off an existing mortgage Clear credit cards and loans The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, to familygarden improvements The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, to family holiday and loansgarden improvements Replace the car Pay off an existing mortgage Clear credit cards and loans Gift money to family Go on holiday Pay off an existing mortgage Clear credit cards and loans Make home and garden improvements Gift money to family Go on holiday Clear credit cards Make home and garden improvements Gift money to family Go on holiday Clear credit cards Make home and garden improvements Unlock the cash from your home

To find out more or to arrange a FREE, no-obligation consultation, contact me The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement.so we’ll be able to recommend the equity release plan that could help transform your retirement.The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, homeowner aged over 55 and are looking to boost your retirement finances, your home could on the details below; so we’ll be able to recommend the equity release plan that could help transform your retirement.To find out more or to arrange a FREE, no-obligation consultation, contact me To find out more or to arrange a FREE, no-obligation consultation, contact me so we’ll be able to recommend the equity release plan that could help transform your retirement.so we’ll be able to recommend the equity release plan that could help transform your retirement.The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, Unlock the cash from your homehelp. By releasing tax-free cash from your home, you could: Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk To find out more or to arrange a FREE, no-obligation consultation, contact me Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of on the details below; Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk on the details below; Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk To find out more or to arrange a FREE, no-obligation consultation, contact me Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) To find out more or to arrange a FREE, no-obligation consultation, contact me on the details below; Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk To find out more or to arrange a FREE, no-obligation consultation, contact me on the details below; so we’ll be able to recommend the equity release plan that could help transform your retirement. Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk To find out more or to arrange a FREE, no-obligation consultation, contact me The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement. Replace the car Pay off an existing mortgage Clear credit cards and loans To find out more or to arrange a FREE, no-obligation consultation, contact me on the details below; so we’ll be able to recommend the equity release plan that could help transform your retirement. Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk To find out more or to arrange a FREE, no-obligation consultation, contact me The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement. Replace the car Pay off an existing mortgage Clear credit cards and loans The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement. To find out more or to arrange a FREE, no-obligation consultation, contact me on the details below; To find out more or to arrange a FREE, no-obligation consultation, contact me on the details below; The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement. Gift money to family Go on holiday Replace the car Pay off an existing mortgage Clear credit cards and loans Make home and garden improvements If you’re a homeowner aged over 55 and are looking to boost your retirement finances, your home could help. By releasing tax-free cash from your home, you could: To find out more or to arrange a FREE, no-obligation consultation, contact me on the details below; The Equity Release Experts’ advice is independent, face-to-face and covers the whole of the market, so we’ll be able to recommend the equity release plan that could help transform your retirement. Gift money to family Go on holiday Replace the car Pay off an existing mortgage Clear credit cards and loansgarden improvements the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk Matt Jones 07827 536 808 Matt.jones@equityrelease.co.uk may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) Equity release may involve a lifetime mortgage, which is a loan secured on your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Equity Release may involve a lifetime mortgage, which is a loan secured against your home, reducing the value of your estate and may affect your entitlement to means tested benefits. You should always think carefully before securing a loan against your home. Unless you decide to go ahead, The Equity Release Experts’ service is competely free of charge; as our usual advice fee of 1.99% of Unless you decide to go ahead, The Equity Release Experts’ service is completely free of charge; as our usual advice fee of 1.99% of 15 the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020) the amount released would only be payable on completion of a plan, subject to a minimum advice fee of £1,499. CKP702 (02/2020)