5 minute read

COVID-19 AND CHANGES TO THE DESIGN OF THE NEM

Dr Kerry Schott AO | Chair, Energy Security Board

Prior to COVID-19, the National Electricity Market (NEM) was experiencing a major transition as large and small-scale renewable generation entered the market in significant volumes. In response to this significant increase in variable renewables, the Energy Security Board was tasked by the then COAG Energy Council to recommend changes to the design of the NEM. These changes were to accommodate increasing renewable generation while maintaining reliability, security and affordability. The scale of growth in renewables that is expected is set out in Figure 1 below. At present, the NEM sometimes runs with 25 to 30 per cent variable renewables. By 2025 the ESB expects this may be closer to 50 per cent.

Figure 1 Instantaneous penetration of wind and solar generation, actual in 2019 and forecast for 2025

Source: AEMO, Integrated System Plan, 2020. Central scenario and Step Change scenario

The need to redesign the NEM continues despite COVID-19 – and if anything has intensified. This is due to the economic impacts of COVID-19. Retail revenue is down significantly as customers struggle to meet their bill payments and disconnection to manage this risk is neither a moral or regulatory permitted option.

Revenue from generation is also down for two reasons. First, most business customers have cut back their operations and working from home has not replaced that demand. Second, the wholesale electricity price has fallen, partly in response to the entry of so much low-cost renewable power into the NEM.

THE PROBLEM WITH THE DESIGN OF THE NEM

Because of the recent changes in the industry, the design of the NEM is no longer fit-for-purpose. The existing design developed market-based mechanisms and coordinated regulation of monopoly networks across the jurisdictions. In 1998, the NEM brought together the electricity industries in Queensland, New South Wales, the Australian Capital Territory, Victoria, South Australia and Tasmania. It was designed to drive greater efficiencies and better utilisation of resources and has served the nation well until the past decade.

Initially the NEM design was characterised by:

relatively few large thermal generating units

an established transmission network to take that generation to the load (mainly in the cities), and

distribution networks that were one directional and where customers interacted with their energy retailer or local network in a very limited way.

This market context and existing technology drove the key design choices for the NEM:

energy-only spot market with significant constraints through the market price cap, price floor, and cumulative price threshold

open connection access to networks for generators

monopoly regulated networks

contracting and spot markets to link physical needs of the system to financial interests of participants, and

a limited market for a small number of ancillary services to keep the system in a secure operating state.

Technology and market conditions have now changed substantially. The main three changes include:

Consumer relations: In the original NEM design, customers are regarded as passive unless they are one of the few business customers (like a smelter) with a very large demand profile. Customers in the original NEM interact with their retailers to pay their bills (or sometimes switch), and they interacted with their local network only when there was an outage.

Customers now have smart appliances, and possibly solar PV on their roof and an associated battery. They may even be owners of an electric vehicle. These technology changes make for a different relationship with retailers and networks, as customers have services of value that can be incorporated into the market. Much of this change has been caused by digital improvements in equipment and is not solely related to the energy industry.

Customers can sell their excess generated energy if the network is designed to manage two way flows. Services like frequency could be sold by customers to assist with system security if the market design permitted. Since customers can now manage their demand, they could be rewarded for demand response, which is very valuable at certain times of

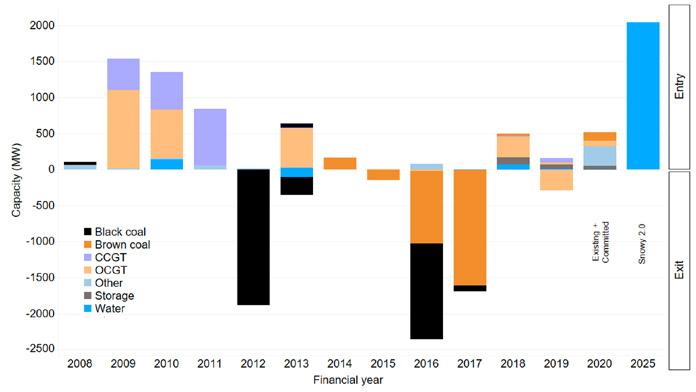

Figure 2 Thermal generation is exiting the NEM Most of the current generation fleet is aged thermal generation, for which maintenance and operating costs tend to increase with the age of the plant. The integration of variable renewables exacerbates this challenge as their dispatch limits the time that thermal generation can be dispatched, thus further constraining revenue. This commercial viability issue has been exacerbated by the economic impacts of the pandemic. For many aged coalfired generators, financial viability was difficult before COVID-19 and is now worse, with the likelihood of early retirements greater. FOR MORE INFORMATION PLEASE CONTACT 2.

3. day and during certain seasonal conditions. In aggregate, this customer response (probably through aggregators) would help the system operator shape load to meet available supply- alongside traditionally managing supply to meet demand.

Increased volatility and uncertainty: The substantial increase in large and small-scale variable renewables is accompanied by volatility and uncertainty in the market. When variable renewables are available, they are the lowest cost form of power but this availability is weather-dependent and not always predictable, meaning market prices are more volatile and uncertain.

Variable renewables are displacing more costly thermal generation and with that various essential services are being removed from the market. These services are typically valued properly at present as they have been provided as complementary energy services by the thermal generators. A new market design would value frequency control, inertia and system strength more appropriately.

Need for capital replacement: As plants become commercially unviable and retire over the next 10 to 15 years and beyond, the energy and essential services they provide will need to be replaced. Changes in the market are shown in

Source: AEMO and AEMC material prepared for the ESB, 2020

Figure 2 below.

Dr Kerry Schott AO

Chair, Energy Security Board E: kerry.schott@gmail.com

Further, as many investors in variable renewables know, the transmission system is not yet configured to meet their connection needs. It was built decades ago for thermal generators in very different locations. The anticipated transmission investment needs are set out in AEMO’s Integrated System Plan, which has just been updated for 2020 and released. Investment in the required upgrades is underway and will continue.