1 minute read

Crook County Property Summary Report

Report Date: 3/14/2023 1:28:29 PM

Mailing Name:

Account Information Tax

Status:

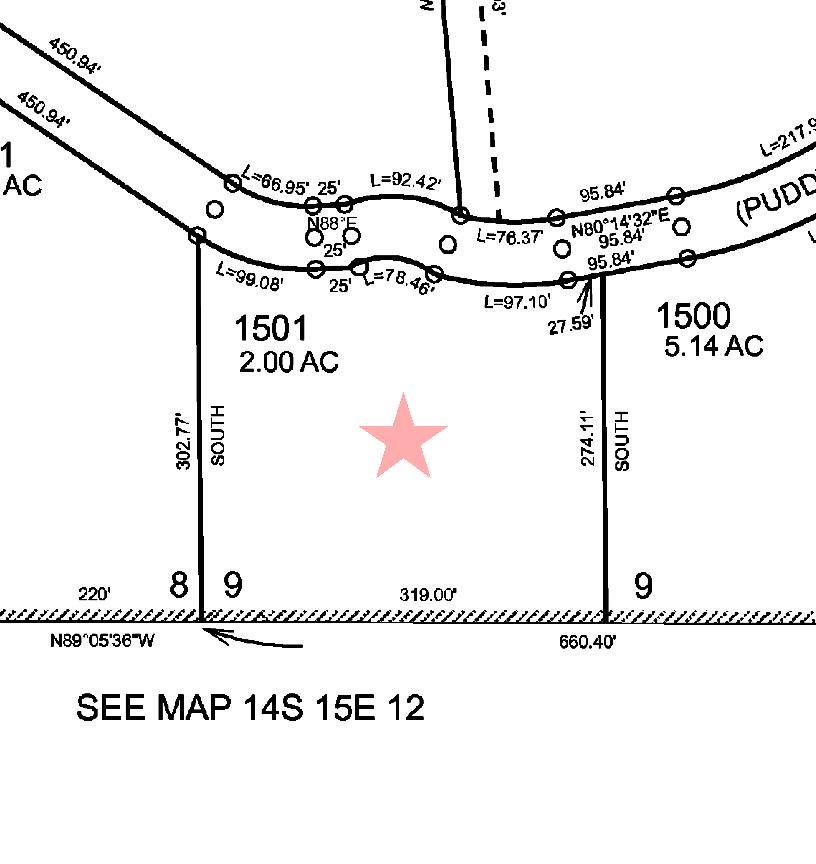

Subdivision: Block: 0 Lot:

141512A0-01501-9115 9115

Taxable

7877 NW COUNTRY LOOP, PRINEVILLE OR 97754

SHEFFIELD BOLT

Mailing Address: Map and Taxlot:

7877 NW COUNTRY LP

MILES

Property Class: 401

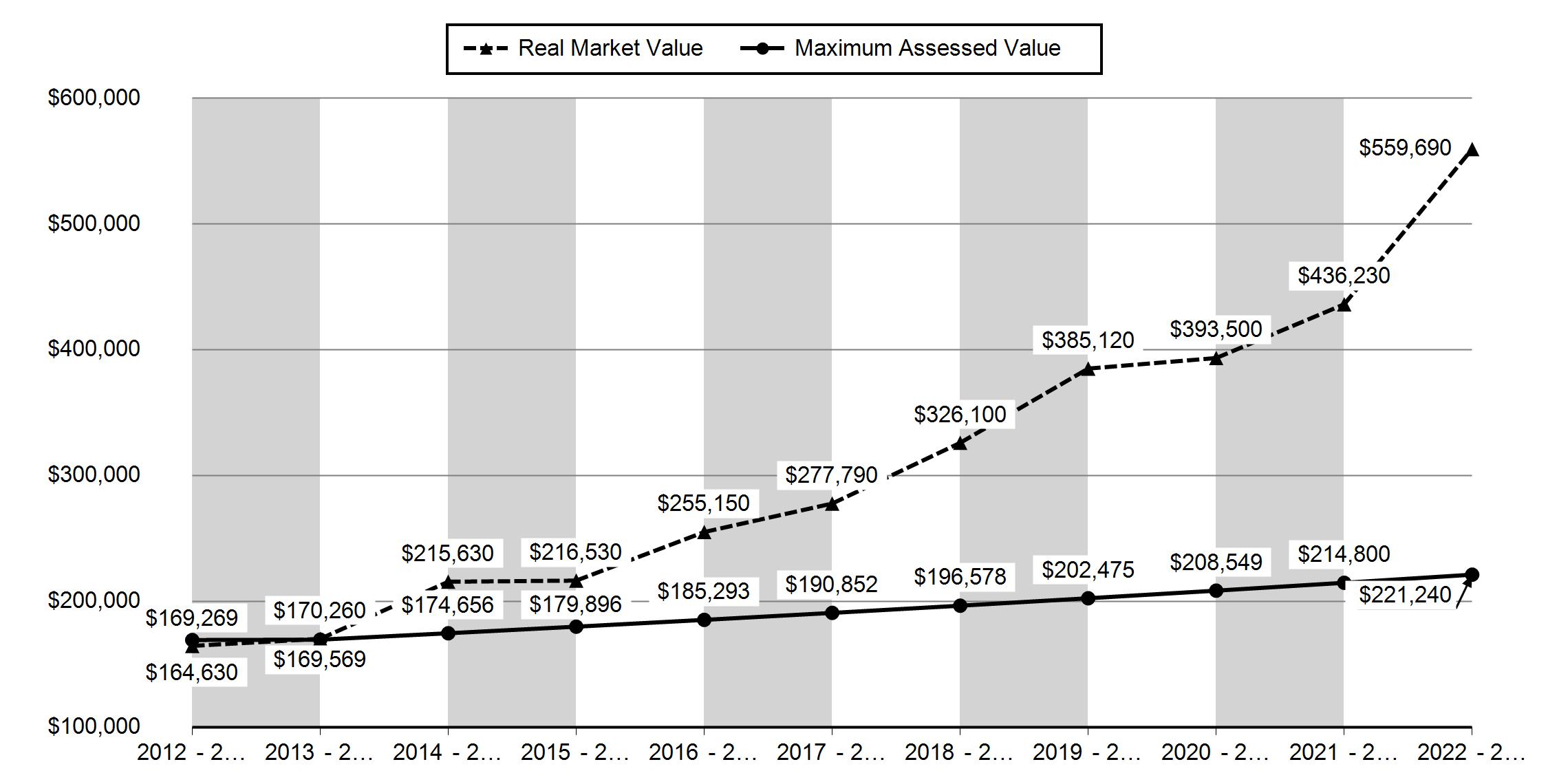

Disclaimer 2012 - 2013 2013 - 2014 2014 - 2015 2015 - 2016 2016 - 2017 Real Market Value - Land $59,210 $49,450 $51,050 $52,050 $57,820 Real Market Value - Structures $105,420 $120,810 $164,580 $164,480 $197,330 Total Real Market Value $164,630 $170,260 $215,630 $216,530 $255,150 Maximum Assessed Value $169,269 $169,569 $174,656 $179,896 $185,293 Total Assessed Value $164,630 $169,569 $174,656 $179,896 $185,293 Exemption Value $0 $0 $0 $0 $0 Valuation History All values are as of January 1 of each year. Tax year is July 1st through June 30th of each year. Property Information Report, page 1

Tax Payment History

Sales History

Structures

Related Accounts

Related accounts apply to a property that may be on one map and tax lot but due to billing have more than one account. This occurs when a property is in multiple tax code areas. In other cases there may be business personal property or a manufactured home on this property that is not in the same ownership as the land.

No Related Accounts found.

Ownership

CODE: 0012

SITUS: 141512-A0-01501

SHEFFIELD

VALUES:

THIS IS NOT A TAX BILL IF... Your mortgage company is reponsible for paying for taxes. Keep this statement for your records.