2 minute read

Deschutes County Property Information

Report Date: 2/27/2023 2:50:07 PM

The information and maps presented in this report are provided for your convenience. Every reasonable effort has been made to assure the accuracy of the data and associated maps. Deschutes County makes no warranty, representation or guarantee as to the content, sequence, accuracy, timeliness or completeness of any of the data provided herein. Deschutes County explicitly disclaims any representations and warranties, including, without limitation, the implied warranties of merchantability and fitness for a particular purpose. Deschutes County shall assume no liability for any errors, omissions, or inaccuracies in the information provided regardless of how caused. Deschutes County assumes no liability for any decisions made or actions taken or not taken by the user of this information or data furnished hereunder.

Account Summary

Account Information

Mailing Name: Tax Status:

JUDSON, JORDAN

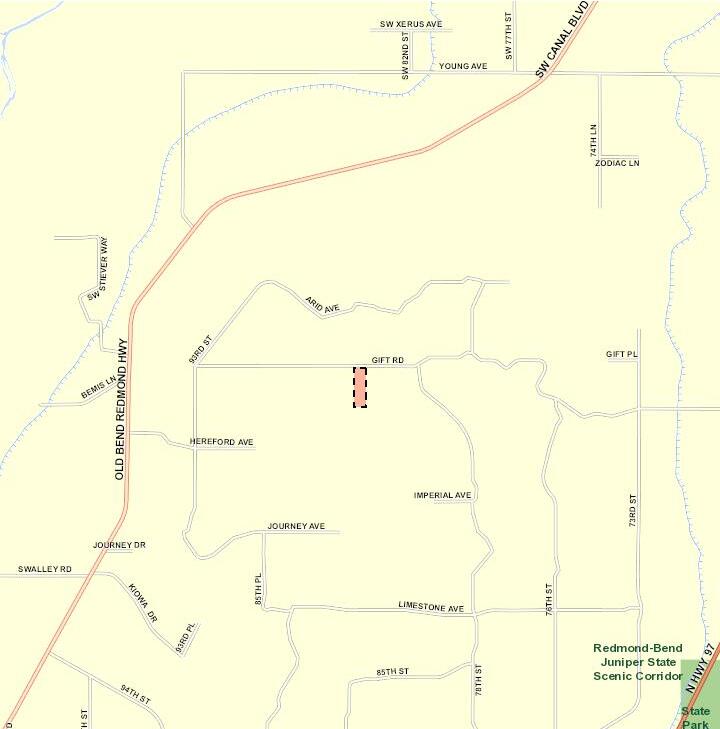

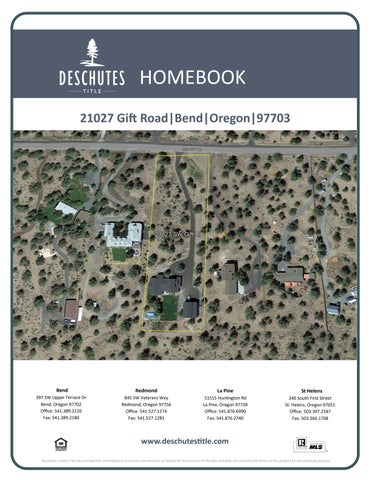

161215D004600 130665 21027 GIFT RD, BEND, OR 97703 Assessable

Property Taxes Assessment Tax Code Area: Current Tax Year: 2004 $8,476.65

Subdivision: Block: 21 Lot:

ESTATES 22 Assessor Acres:

Property Class: 401 -- TRACT

Warnings, Notations, and Special Assessments

Ownership

JUDSON, JORDAN

21027 GIFT RD

BEND, OR 97703

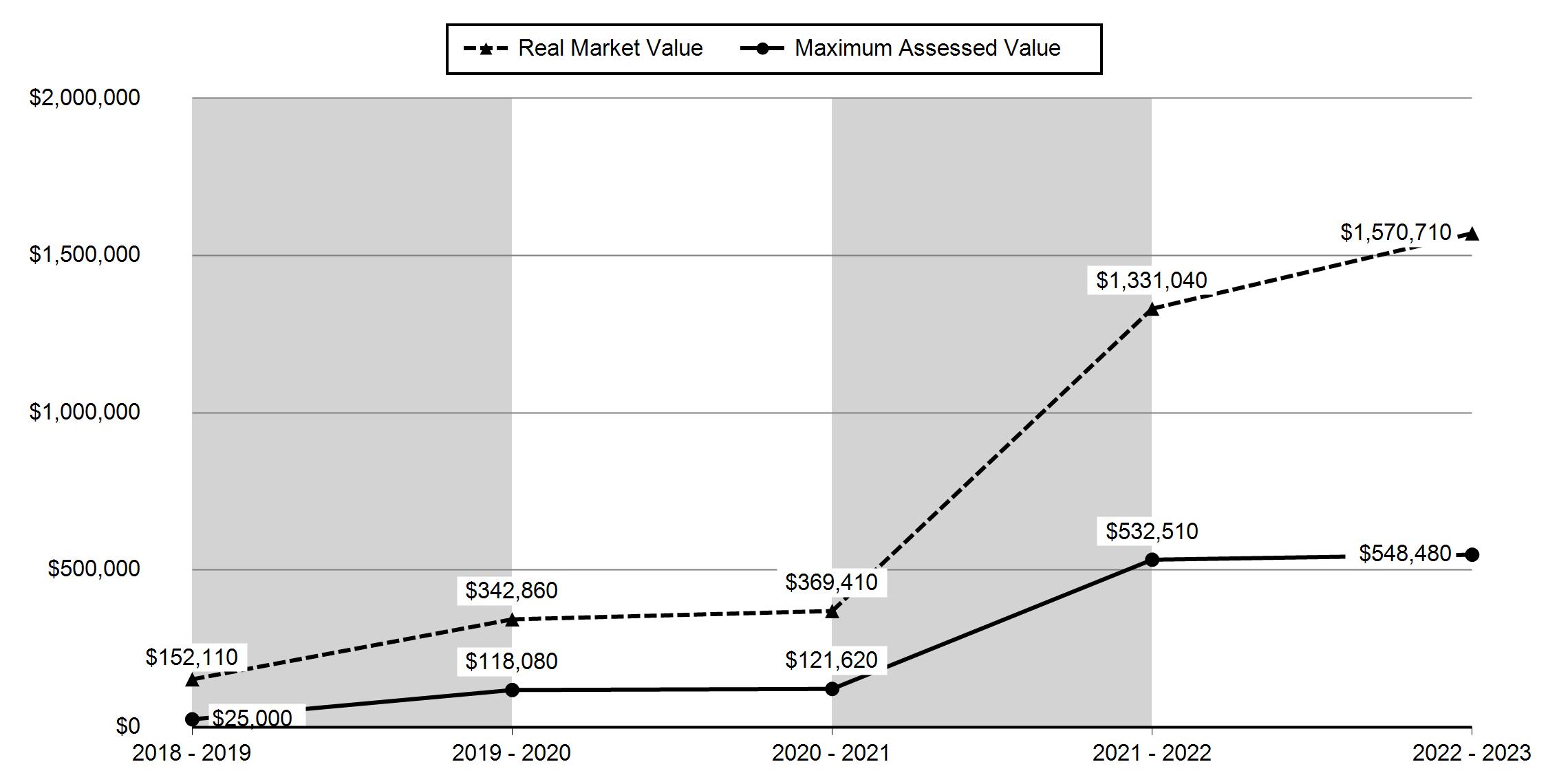

Current Assessed Values:

Maximum Assessed Assessed Value

Veterans Exemption

2018 - 2019 2019 - 2020 2020 - 2021 2021 - 2022 2022 - 2023 Real Market Value - Land $152,110 $175,280 $188,420 $221,810 $306,190 Real Market Value - Structures $0 $167,580 $180,990 $1,109,230 $1,264,520 Total Real Market Value $152,110 $342,860 $369,410 $1,331,040 $1,570,710 Maximum Assessed Value $25,000 $118,080 $121,620 $532,510 $548,480 Total Assessed Value $25,000 $118,080 $121,620 $532,510 $548,480 Veterans Exemption $0 $0 $0 $0 $0 Valuation History All values are as of January 1 of each year. Tax year is July 1st through June 30th of each year. Deschutes County Property Information Report, page 1

Tax Payment History

Sales History

Structures

Related accounts apply to a property that may be on one map and tax lot but due to billing have more than one account. This occurs when a property is in multiple tax code areas. In other cases there may be business personal property or a manufactured home on this property that is not in the same ownership as the land.

No Related Accounts found.

Service

Please contact districts to confirm.

Development Summary

Statement Of Tax Account

TAX BY DISTRICT

TAX ACCOUNT: 130665

JUDSON, JORDAN 21027 GIFT RD BEND OR 97703

PROPERTY DESCRIPTION

CODE: 2004

SITUS ADDRESS: MAP: 401 CLASS: 161215-D0-04600

21027 GIFT RD BEND

SECOND ADDITION TO WHISPERI 22 21 LEGAL:

VALUES: REAL MARKET (RMV) LAND

This is your copy and not a bill if your mortgage company is responsible for paying your taxes. This statement was sent to: EVERGREEN HOME LOANS

Full Payment with 3% Discount

Discount is lost after due date and interest may apply PAYMENT OPTIONS:

* Online www.deschutes.org/tax

* By Mail to Deschutes County Tax, PO Box 7559 Bend OR 97708-7559

* Drop Box located at 1300 NW Wall Street, Bend or 411 SW 9th Street, Redmond

Please include this coupon with payment. Please do not staple, paper clip or tape your payment.

Please select payment option

Full Payment (3% Discount)

Two-Thirds Payment (2% Discount)

Next Payment Due

One-Third Payment (No Discount)

Next Payment Due

Payment Due November 15, 2022

TAX ACCOUNT: 130665

(Mailing address change form on reverse)

THIS IS NOT A BILL IF LENDER IS SCHEDULED TO PAY