1 minute read

Crook County Property Summary Report

Report Date: 4/12/2023 2:18:53 PM

Account Information

Mailing Name: Tax Status:

Mailing Address: Map and Taxlot: Account:

141632DC-05813-20031 20031

BALCOM FAMILY TRUST PO BOX 1749

Property Taxes Assessment Tax Code Area: Current Tax Year: 0002 2022

Subdivision: Block: 13 Lot:

Taxable SKATE PARK

1024 NE CRISTA CT, PRINEVILLE OR 97754

Assessor Acres:

Property Class: 101

Warnings, Notations, and Special Assessments

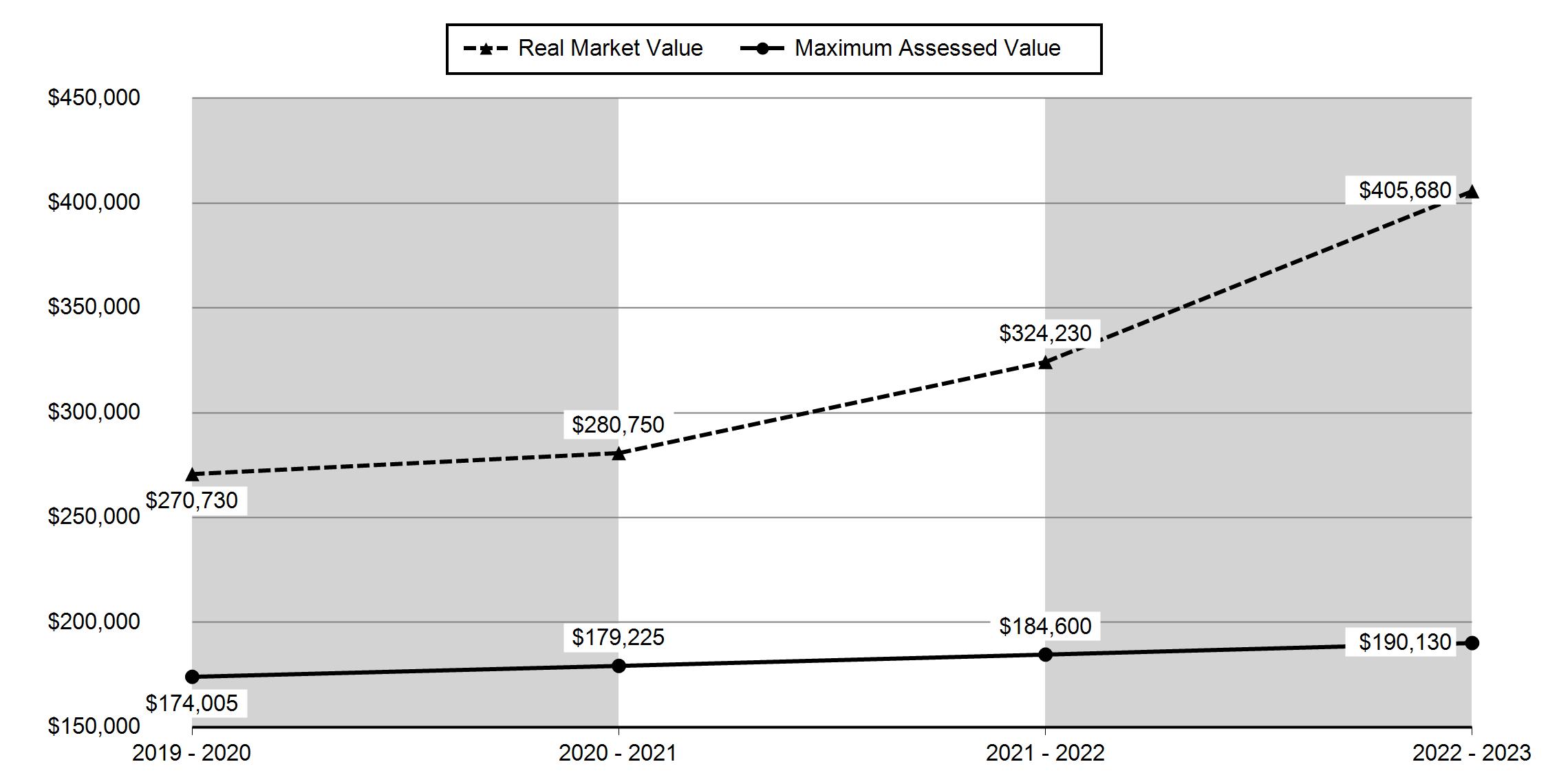

2019 - 2020 2020 - 2021 2021 - 2022 2022 - 2023 Real Market Value - Land $50,000 $53,000 $57,760 $77,920 Real Market Value - Structures $220,730 $227,750 $266,470 $327,760 Total Real Market Value $270,730 $280,750 $324,230 $405,680 Maximum Assessed Value $174,005 $179,225 $184,600 $190,130 Total Assessed Value $174,005 $179,225 $184,600 $190,130 Exemption Value $0 $0 $0 $0 Valuation History All values are as of January 1 of each year. Tax year is July 1st through June 30th of each year. Property Information Report, page 1

Tax Payment History

Structures

Related Accounts

Related accounts apply to a property that may be on one map and tax lot but due to billing have more than one account. This occurs when a property is in multiple tax code areas. In other cases there may be business personal property or a manufactured home on this property that is not in the same ownership as the land.

No Related Accounts found.

PARTITION PLAT 2002

37 PARTITION PLAT 1998

36