4 minute read

Investing in India has never been easier

from 2020-01 Melbourne

by Indian Link

The Indian diaspora in Australia continue to maintain surprisingly strong ties with the country of their birth.

Family and friendship bonds are resilient, and thanks to social media, the major trends in the society they have now left behind continue to be at their fingertips. It would be safe to say they are quite ‘India-aware’.

And yet, to invest in India, especially the stock market, is put in the too-hard basket.

The Indian Australian community now has an option to connect with the longterm growth story of the Indian economy through an Australian fund which invests directly in the Indian stock market - the Ellerston Capital India fund.

The major investments include blue chip Indian companies like Reliance, TCS, ICICI, Hindustan Unilever, HDFC and Bajaj Finance. To tell us more about the Ellerston India fund, we spoke to Dr Mary Manning, Portfolio Manager.

Why should India be in everybody’s portfolio?

As at the end of October 2019 diversification. growth. So investing in India gives investors exposure to a high growth economy and high growth stocks.

There are

3 reasons why India should be in everyone’s portfolio: size, growth and

India is one of the fastest growing economies in the world, unlike Australia which is struggling to achieve 2% GDP

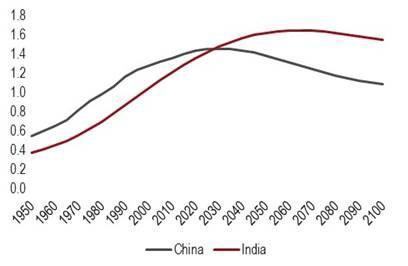

Secondly, India is getting too big to ignore. By 2030, India is expected to be the 3rd largest economy after China and the US. Most investors in Australia have exposure to the other 2 economies either directly or indirectly, but very few have exposure to India. India also has a rapidly growing middle class and a young population with over 400 million millennials so from a consumption perspective, investors can’t afford to ignore India as a market.

Finally, India offers diversification, especially for investors based in Australia. Australia is a commodity exporter while India is not, so the structure of the economies are very different. India is also one of the best and most developed IT services sectors in the world with global leaders like TCS and Infosys. Australian investor don’t have access to large cap IT services companies in domestically so India offers diversification.

Why did Ellerston Capital start the Ellerston India Fund?

Ellerston Capital has an Asia fund and a Global fund. India is less than 10% of Asian benchmarks while China is well over 50%. So investors in an Asia fund get significantly more China than India and the benefit of India often gets trumped (no pun intended) by China’s macro. Similarly, India is less than 2% of MSCI AC World index so investors don’t get meaningful exposure to the Indian market via a global fund.

Therefore, investing directly in India is the best way to go, but as you and your readers know, India is not an easy market for offshore retail investors to access directly.

So we started the India fund to provide that access to investors in Australia.

What are your favourite stocks in India right now?

The large cap private banks, ICICI Bank, HDFC Bank, Axis Bank, have been very strong performers in our portfolio. Both ICICI and Bajaj have doubled since 2017. In the large cap IT services companies, TCS is our top pick. It remains attractively valued even though it has performed very well over the last few years. IT services should continue to do perform if the INR depreciates due to twin deficit concerns.

And we really like Reliance. This stock has been an amazing performer in the last 2 years. We like it for the option value if and when it spins off Jio and Reliance Retail into separate entities. Reliance is now a $200 billion market cap company which is great for India – a home grown mega-cap national champion. The stocks I’ve mentioned above are all very well-known India companies. Less well known stocks that we like are PVR the movie theatre company and Britannia, the biscuit company.

What are your 1 year returns and thoughts for medium to long term?

Over the last year the Ellerston India fund is up 21.7% (as of Oct 31, 2019).

Since inception our per annum return is 8.9% and we expect this to be maintained in the medium to long term. We have outperformed the benchmark on a 6 month, 1 year, 2 year and since inception basis.

Can you tell me a bit about your investment process? How much time do you spend on the ground and how do you decide what stocks you invest in?

Ellerston India is a growth fund and we only invest in high quality growth stocks with valuation upside, good management and good ESG. You can think of our process as a hurdle race where the athlete needs to jump over a series of hurdles to stay in the game. If they trip over one of the hurdles (growth, valuation, management, ESG), they are out of the game.

What are you expecting from Modi’s second term and how will this impact your portfolio?

So far the policies in Modi’s second term have been disappointing and some of the reforms of Modi’s first term, like demonetization and GST, have started to have delayed negative impacts on the economy. As a result of this, the economy has slowed materially since before the election and policy makers do not seem to be proactive in addressing the root causes of the slow down. Lower interest rates, addressing the NBFC issues and a personal income tax cut would be welcome policy changes in the near term. That said, we remain excited about Modi’s second term and expect a focus on Infrastructure and Make In India to be important hallmarks.

Who should invest in the Ellerston Capital India Fund?

Anyone who wants growth and diversification in their portfolio.

The minimum investment amount is $10,000, so the hurdle to invest is not extremely high.

We believe everyone should have some Indian exposure in their portfolio. For more details, log in to www.ellerstoncapital.com or email india@ellerstoncapital.com