10 minute read

The world’s richest Indians 1

from 2018-07 Sydney (1)

by Indian Link

MUKESH AMBANI Industry India $39.9 billion

Mukesh Ambani remains the richest person in the Indian diaspora. His Reliance Industries Limited is a petrochemicals, oil and gas giant which provides around 5% of the Indian government’s tax revenue. In the telecom sector he has launched 4G services called Jio, which in one year has secured 130 million subscribers by offering free or virtually free services. Reliance also directly or indirectly controls several television channels, including news networks. According to an MBA student at Stanford Business School in California, his home in Mumbai is the world’s most expensive residential property. He owns about a third of his company. His interests include ownership of Mumbai Indians in the Indian Premier League and promoting the Indian Super League football.

AZIM PREMJI India

Software

$19.4 billion

After his father’s death in 1966, Azim Premji had to cut short his studies in electrical engineering at Stanford University to take charge of the family business. He turned it from a seller of hydrogenated cooking fats, soaps and other consumer products into Wipro (short for Western Indian Vegetable Products), the third largest Indian software exporter, which has since 2000 been quoted on the New York Stock Exchange. His acquisitions include Florida based insurance technology rm HealthPlan Services. He has pledged 39% of his stake in Wipro to his charitable trust.

HINDUJA FAMILY UK/Switzerland/India

Various

$18.6 billion

The Hinduja Group have assets in truck-making, lubricants, banking, energy, chemicals and cable TV. The Old War Of ce in London that they bought for £350 million, is being re-launched as a hotel. They also started NXT Digital, a digital TV distributor, in India. Captained by the second of four brothers, Gopichand, their businesses include India’s second biggest truck maker Ashok Leyland, British electric bus maker Optare, interests in Gulf Oil, US chemical company Houghton and IndusInd Bank, which has a presence in Switzerland, India and Britain.

DAVID AND SIMON REUBEN UK/Switzerland Property & Internet $17.8 billion

Born in Mumbai, the Jewish family started out in metals. Their property portfolio includes prime buildings in London, airports and heliports. They are leading investors in the UK’s Metro Bank and still own 51% of Global Switch, a data hosting company, having sold 49% to Chinese investors Elegant Jubilee for $3 billion less than a year ago. Grosvenor House Hotel in London and Plaza Hotel in New York are mortgaged to them against loans granted to Sahara India. Reubros and Aldersgate Investments, controlled by them, are estimated to be worth $14 billion.

PALLONJI MISTRY India/Ireland Construction & Investments

$17 billion

The Mistry family have a stake of 18.5% (the largest) in the $126 billion Tata Group. His son Cyrus is locked in a legal battle with the Tatas, after being ousted as chairman of Tata Sons in 2016. Mistry heads Shapoorji Pallonji Group, pioneering builders in India since the 1860s, credited with the creation of some of India’s most iconic structures. Since the 1970s, the company has also had a signi cant presence in the Gulf. It is presently engaged in a $200 million venture to construct 20,000 affordable homes in India. Mistry, recipient of the Padma Bhushan - is now an Irish citizen.

Shiv Nadar

India

Software

$13.3 billion

HCL Group, co-founded by Shiv Nadar in 1976, began by selling microcomputers, and is now India’s 4th largest software rm. Its customers include Boeing, Microsoft, Cisco and UBS. HCL also invested $780 million in an intellectual property partnership with IBM. Nadar also possesses a $100 million art collection.

LAKSHMI MITTAL AND FAMILY UK Steel $16.9 billion

As chief executive of the Luxembourg-headquartered ArcelorMittal, Lakshmi Mittal seems to be as strong as the steel he makes. After a $7.9 billion loss in 2015 due to an industry-wide crisis caused by over-capacity and dumping by China, the world’s largest steelmaker made a pro t of $1.8 billion in 2016. Mittal moved from Kolkata to Indonesia before settling in Britain in 1995, where he was declared the wealthiest person for eight years, but is now only 11th on the Sunday Times Rich List.

Kumar Mangalam Birla

India

Aluminium, Cement & Telecom

$12.6 billion

Hindalco Industries, a part of Birla Group, is India’s second largest aluminium maker. It acquired Atlanta-based Novelis for $6 billion in 2007 and bought the rival Jaypee Group for $2.4 billion. Birla also launched a fashion portal abor.com. He merged his rm Idea Cellular with Vodafone India to compete with Reliance Jio.

GODREJ FAMILY India Various $14.2 billion

In 1918, the Godrej Group, now headed by MIT graduate Adi Godrej, with brother Nadir and cousins Jamshyd and Smita Crishna-Godrej part of the empire, launched the world’s rst soap product made from vegetable oil. After 120 years, it is now involved in real estate, industrial engineering, appliances, furniture, security, agriculture, and consumer goods – ranging from mosquito repellents to refrigerators – that are also sold in other parts of Asia, Africa and South America. Godrej Properties is now developing its vast and nearly 100-year land holdings – its biggest asset - in suburban Mumbai.

DILIP SHANGHVI India

Pharmaceuticals $11.6 billion

Despite drop in shares, Shanghvi’s company remains India’s biggest rm in the sector and the 5th largest generics maker in the world after acquiring rival Ranbaxy Industries for $4 billion in 2014. In 2016 it introduced a generic version of Gleevec, a cancer drug made by Novartis, in the US.

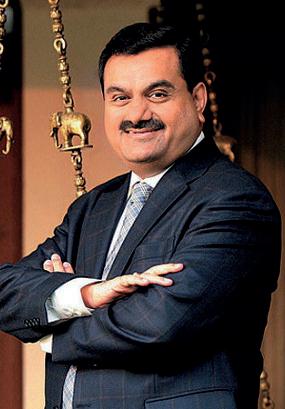

GAUTAM ADANI AND FAMILY India

Infrastructure & Energy

$11 billion

Adani is known as much for his business interests in ports and power as he is for his association with Narendra Modi. In 2014, he acquired major ports in eastern and southern India. He has received approval for a coal-mining project in Queensland but the plan has also raised environmental concerns.

RADHAKISHAN DAMANI India

Investor

$9.6 billion

A jump from No 134 to 14, Damani’s net worth is a result of an IPO of his hypermarket chain D-Mart. He has a 26% share in cigarette maker VST Industries and in India Cements. Damani has also acquired the Radisson Blu Resort in Alibag, a beach getaway near Mumbai.

UDAY KOTAK India

Financial Services

$10.2 billion

Uday set up Kotak Capital Management Finance in 1985 and converted it into Kotak Mahindra Bank in 2003. After acquiring ING Vysya Bank, it is now India’s 4th largest bank. It also has a stake in MCX, India’s largest commodities exchange. Kotak Mahindra Bank also owns Business Standard, an Indian financial daily.

CYRUS POONAWALLA India

Pharmaceuticals

$8.9 billion

From owning stud farms in Pune, Cyrus Poonawalla and his brother Zavaray launched Serum Institute of India in 1966. It is now the world’s largest producer of vaccines; every second child in the world is inoculated by a vaccine from SII. Its range of new vaccines includes one for dengue.

SUNIL MITTAL AND FAMILY India

Telecom

$10.2 billion

Bharti Airtel, controlled by Mittal with SingTel of Singapore, is the world’s third largest telecom company by way of subscribers. Airtel is engaged in a price war with Reliance Jio in the 4G data space. It enjoys a presence in 18 countries in Asia and Africa. Mittal has also launched Airtel Payment Bank.

SAVITRI JINDAL AND FAMILY India Steel, Power & Energy

$7.6 billion

Savitri Jindal took charge after the death of husband Om Prakash in 2005, and delegated the four divisions of the company – steel, power, mining and oil and gas – to her sons, Prithviraj, Sajjan, Ratan and Naveen. Apart from JSW Steel operated by Sajjan, the other businesses have declined.

Migration Law n Skilled Migration Visas n 457 Visas/Visitor Visas n Business Investment Visas n Partner Visas and Family Visas n AAT Merits Review and Federal Appeals

Family Law n Divorce n Property Settlement n Parenting Orders/Plans n Domestic Violence ADVO n Consent Orders, Financial Agreements

Business Law n Shareholders and Share Sale Agreement n Drafting of Contracts, Leases, Debt Recovery n Sale and Purchase of business, including franchises

Property Law/Conveyancing n Sale/Purchase of Residential and Commercial Property

VIKRAM LAL India Motorcycles

$6.8 billion

Eicher, which used to make tractors, switched to manufacturing motorbikes by acquiring a stake in Enfield India. After growing more than 50% annually since 2010, it has partnered with Volvo to make trucks and personal utility vehicles. Vikram Lal, who oversees operations with his son Siddhartha, commands a 55% share.

BENU GOPAL BANGUR India

Cement

$6.3 billion

Inheriting an underperforming cement company in a family carve out in 1992, Bangur turned it around. Kolkata-based Shree Cement has in recent years maintained its buoyancy despite bearish demand. Bangur is reputed to reside in a 51,000 square foot mansion which possesses a temple, home theatre, a gym and volleyball court.

ACHARYA BALKRISHNA India Consumer Goods

$6.6 billion

A new entrant, Acharya Balkrishna’s rise has been meteoric. Patanjali Ayurved is a joint venture with Baba Ramdev, a yoga teacher who is close to the current ruling party in India. Balkrishna holds 98.6% of the company, which sells a range of products, including toothpastes, cosmetics, noodles and jams.

NUSLI WADIA India

Various

$6 billion

The Wadia Group, a marine construction company for Britishers, today owns Bombay Dyeing and Manufacturing Company, Bombay Burmah Trading Corp, Britannia Industries and many properties in Mumbai. It also promoted Go Air, an Indian airline. Ness, Nusli Wadia’s son, has a stake in IPL Twenty20 cricket franchise King’s XI Punjab.

SRI PRAKASH LOHIA Indonesia Petrochemicals

$6.4 billion

Indorama is the world’s largest producer of polyester. In addition to Indonesia, it has production plants in Malaysia, India, Sri Lanka, Uzbekistan, Turkey and Senegal. In London, he and his wife Seema bought and restored a 1772 five storey mansion known as Sheridan House for around $66 million.

KUSHAL PAL SINGH India Urban Development

$5.9 billion send Money Overseas most reliably and securely within 10 minutes through moneygram send Money to any bank account at the best rate and flat fee of $15 (No Limits applicable on amounts) exchange your currency with us, we give the best rates and do not charge any commission send money to our own branches in all major towns and cities in Fiji and New Zealand

He heads DLF, India’s largest urban development company with son Rajiv. Shares have tumbled by a third in 2015-16 due to low demand and debt rose to $3 billion. But Singh sold his 40% stake in DLF’s rental arm to Singapore sovereign wealth fund GIC for $1.9 billion to stabilise the situation.

Ask us about our commercial business, we do import payments and all international business related remittance at best rate and a flat fee of $15.00 only

VIVEK CHAAND SEHGAL Australia/India

Auto Parts

$5.9 billion

Co-founded in 1975 by Sehgal and his mother, it is now a leading manufacturer of car components, with a tie-up with Japan’s Sumitomo, which owns 25% of the company. Its clients include Volkswagen, Porsche, Mercedes-Benz, BMW, Ford and Toyota, with 230 factories in 37 countries including Europe and South America.

Rahul Bajaj and family

$4.7 billion (Motorcycles) India

Ajay Piramal

$4.7 billion (Various) India

M A Yusuff Ali

$4.6 billion (Retail)

UAE

Subhash Chandra

$4.5 billion (Media) India

Kalanithi Maran

$4.5 billion (Media)

India

Kapil and Rahul Bhatia

$4.3 billion (Aviation and Hotels)

India

Harsh Mariwala and family

$4.2 billion (Consumer Goods) India

Pawan Munjal and family

$4.2 billion (Motorcycles) India

Mangal Lodha and family

$4.1 billion (Property Development)

India

Micky Jagtiani $4 billion (Retail & Hotels)

UAE

Ravi Pillai

$3.8 billion (Construction)

UAE

Bavaguthu Shetty $3.8 billion (Healthcare & Foreign Exchange)

UAE

Vinita and Nilesh Gupta

$3.6 billion( Pharmaceuticals)

India

Kuldip Singh and Gurbachan Singh

Dhingra

$3.5 billion (Paint)

India

Sudhir and Samir Mehta

$3.5 billion (Pharmaceuticals & Power)

India

PANKAJ PATEL India

Pharmaceuticals

$5.6 billion

Pankaj Patel’s Cadila Healthcare claims to have discovered a new drug for diabetes. Its Zydus Wellness division makes a popular sugar substitute called Sugar Free. It took a hit when US authorities warned it of contravening manufacturing standards. Around 30% of its annual revenues come from the US.

Radhe Shyam Agarwal & Radhe Shyam Goenka

$3.5 billion (Health & Personal Care Products) India

Karsanbhai Patel $3.5 billion (Various) India

Shashi and Ravi Ruia

$3.4 billion (Energy & Logistics) India

Ashwin Dani $3.3 billion (Paints) India

Baba Kalyani $3.3 billion (Various) India

Samprada Singh and family $3.3 billion (Pharmaceuticals) India

Anil Agarwal $3.2 billion (Metals & Oil) UK/India

Romesh Wadhwani $3.1 billion (Private Equity) USA

Indu Jain and family $3 billion (Media) India

Ashwin & Mahendra Choksi and family $3 billion (Paints) India

Rakesh Gangwal $3 billion (Aviation) USA

Rai Gupta family $3 billion (Electricals) India

Rakesh Jhunjhunwala $3 billion (Investor) India

Hasmukh Chudgar $2.9 billion (Pharmaceuticals) India

P V Ramprasad Reddy $2.8 billion (Pharmaceuticals) India

Raj Kumar & Kishin R K $2.8 billion (Property Development) Singapore

Rajan Raheja and family $2.8 billion (Various) India

Chandru Raheja $2.8 billion (Property Development) India

Sameer Gehlaut (Property Development) $2.8 billion India

Kishore Biyani and family $2.8 billion (Retail) India

Feroz Allana $2.7 billion (Food) UAE

Rishad Naoroji $2.7 billion (Inheritance) India

Abhay Vakil and family $2.7 billion (Paints) India

M G George Muthoot and family $2.7 billion (Financial Services) India

Rajesh Mehta and family $2.6 billion (Jewellery) India

Vijay Chauhan and family $2.5 billion (Biscuits) India

Abhay Firodia $2.5 billion (Vehicles) India

A Krishnamoorthy and family $2.5 billion (Tractors) India

Dalmia family $2.5 billion (Cement) India

Murugappa family $2.4 billion (Various) India

MADHUKAR PAREKH AND FAMILY India

Adhesives

$4.8 billion

Pidilite Industries, owned by the Parekhs, owns Fevicol, M-Seal and Dr. Fixit, household names in India. Its share values continue to rise. Madhukar, who has an MSc degree from Wisconsin University, inherited Pidilite from his father who died in 2013. The family have a 70% stake in the business.

Vinod Khosla $2.4 billion (Private Equity) USA

Aloke Lohia $2.4 billion (Textiles) Thailand

Mansoor and Aminmohammed Lalji & family $2.35 billion (Property Development) Canada

Sunil Vaswani $2.3 billion (Transport and Food) UK/Nigeria/UAE

Kiran Mazumdar-Shaw and John Shaw $2.3 billion (Bio-Pharma) India

Sunny Varkey $2.3 billion (Education) UAE

Rajendra Agarwal and family $2.3 billion (Pharmaceuticals) India

Anil Ambani $2.2 billion (Various) India

Murali Divi (Pharmaceuticals) $2.2 billion India

Harsh Goenka $2.2 billion (Various) India

Leena Tewari (Pharmaceuticals) $2.2 billion India

Sanjiv Goenka $2.1 billion (Various) India

Kavitark Ram Shriram $2.1 billion (Private Equity) USA

Mofatraj Munot $2.1 billion (Property Development) India

Jitendra Virwani $2.1 billion (Property Development) India

Vikas Oberoi $2.1 billion (Property Development) India

Vivek Chand Burman $2 billion (FMCG & Natural Healthcare) India

B Parthasaradhi Reddy $2 billion (Pharmaceuticals) India

Arvind Tiku $2 billion (Oil & Gas) Singapore

Lachhman Das Mittal $1.95 billion (Various) India

Murli and Bimal Gyanchandani $1.95 billion (Detergents) India

N R Narayana Murthy $1.9 billion (Software) India

Juneja family $1.9 billion (Pharmaceuticals) India

Simon, Bobby and Robin Arora $1.9 billion (Retail) UK

Ranjan Pai $1.9 billion (Education & Healthcare) India

Anurang Jain $1.9 billion (Auto Parts)

India

Anand Burman $1.8 billion (FMCG & Natural Health Care)

India

Genomal family $1.8 billion (Garments) India

Singhal family $1.8 billion (Agrochemicals) India

Nandan Nilekani $1.75 billion (Software) India

Year 3 4 Young Achiever Program

Year 4 5 High Achiever Program

Book now by calling 9415 1977 or visit any of our campuses or download the enrolment form at www.north-shore.com.au

Exam Content:

Exam Date: Location: Cost: Closing Date: Results:

One Written assessment and 3 multiple choice tests consisting of English, Mathematics & General Ability

Sunday, 19 August 2018 (1:30 - 5:30pm)

Southee Complex (Hall 5A), Sydney Olympic Park $50 (Non-refundable fee)

Sunday, 12 August 2018