3 minute read

All signs point to a PROPERTY price hike.

from 2013-02 Melbourne

by Indian Link

For all of you reader’s that have been following my column over the many years where I have indicated that the property market will rebound in 2013 and 2014 with property price increases that could rise by up to 10 per cent per year; what are the reasons?.

We have all heard of the expression history repeats itself; The HIA-CBA Housing Affordability index shows that national affordability in the September quarter 2012 rose to the highest level since 2009 to be just shy of the highest level in a decade.

When the December quarter data is available around the middle of February, affordability will have had a further significant boost, perhaps to be at or near a multidecade high.

This is because during the December quarter, mortgage interest rates fell by around 40 basis points as the Reserve Bank sliced the official cash rate by 50 basis points. The level of interest rates is a critically important aspect in determining whether or not buyers are able to step up in the property market and borrow more and pay more for the property.

Another reason behind my expectations of a strong rise in property prices this year, are linked to issues associated with housing affordability (interest rates, current house prices and wages) plus the consistently low unemployment rate, a tight rental

DISCLAIMER: market and a likely positive wealth effect from what has been a strong lift in the stock market. Acceleration in population growth is another factor that is likely to add to the underlying demand for housing.

Furthermore, I draw your attention to the comparison of the economic conditions of 2003 and the Great GFC conditions of 2009. In 2003 when mortgage interest rates were under 7% (like now) and the unemployment rate was at 6 per cent or less (like now), annual house price growth averaged over 15 per cent during a two-year period. In other words, house prices rose by more than 30 per cent in just two years.

Even the GFC-inspired dip in mortgage interest rates in 2009, coincidently when the unemployment rate was anchored below 6 per cent, saw a peak 18.8 per cent annual lift in house prices unfold during 2010.

Adding to these bullish factors is the fact that the unemployment rate has remained low, below 5.5%. This means that the scope for rising confidence for borrowing is favourable. Added to that, consumer finances are in sound shape. Saving levels have been replenished over recent years and many borrowers have taken advantage of the current interest rate cutting cycle to pay off the principal in their current mortgage.

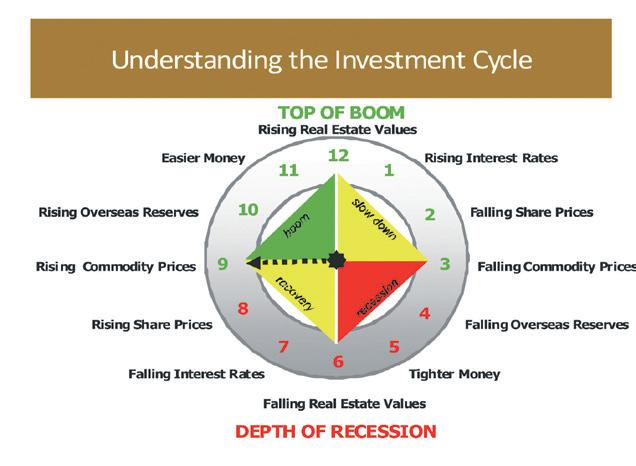

This all adds to a resounding confidence boost in the market place and the fact that property market has never been in decline for more than 2 years in a row. May I point out a study of the investment cycle and where I believe it to be right at the moment? A study of the graph to our left indicates that this is the best time to be investing in property as I believe we are now poised to get the best capital growth in property investment for the foreseeable future.

May I also add that MBIC has had significantly more enquiry for property in the first 10 days of 2013 than in the last 4 months of 2012 and it is somewhat interesting to note that property prices in Melbourne in the first ten days of 2013 have already risen by 0.6 per cent as reported by RP data. .

All the fundamental factors are aligned to support higher house prices in 2013. The fact that so many people are optimistic on property prices only adds to the scope for a sharp rebound in prices as there is a rush to catch up through pent-up demand needing to be satisfied.

Favourable affordability, low unemployment and interest rates, and with the pent-up demand all point to what could be a corker of a year for property price growth.

MBIC with its associated business partners offer a range of services for your consideration:

• How to use your home equity as “leverage” and purchase an investment property without a cash deposit?

• How to invest in property using your Superannuation?

• How to qualify for $100,000 from the government to purchase NRAS property?

MBIC will be holding the 1st seminar for the year on Wednesday 20th February 2013 at 7pm.

Should you have any question or would like to seek further assistance on property investment options, please feel free to call me on 03 9813 8188, Mobile: 0417 483 355 E-mail: carlo@mbic.com.au

We promise not to disappoint you.