4 minute read

Closing the Purchase Agreement at the Bottom of the Ninth Inning!

when either Seller/Buyer decide to get the deal closed and avoid many hours of additional agony.

By Len LaPorta Managing Director, Wiley Bros.-Aintree Capital, LLC

Len LaPorta is a managing director of Investment Banking at Wiley Bros.-Aintree Capital, LLC – a 75-year-old firm, located in Nashville, TN, focused on investment brokerage and underwriting municipal bonds for utility districts in the state of Tennessee. Len brings to the Firm experience in crossborder M&A transactions between USA and Europe, advises business owners on sell-side and buy-side transactions, capital advisory, and valuations. Len is a graduate of the U.S. Naval Academy with MBA from Boston College and a veteran of the U.S. Navy. He is also a member of INDA’s non-woven Technical Advisory Board. llaporta@wileybros.com or (615) 782-4107.

Interpretation of standard language in the Purchase Agreement leads to many differences between Seller and Buyer. M&A advisors, various legal counsels and accounting professionals have experience in these matters and are able to provide their perspectives during the negotiations. Some items are like “flipping a coin” as to which side is correct.

In many cases, some contentious items resolve

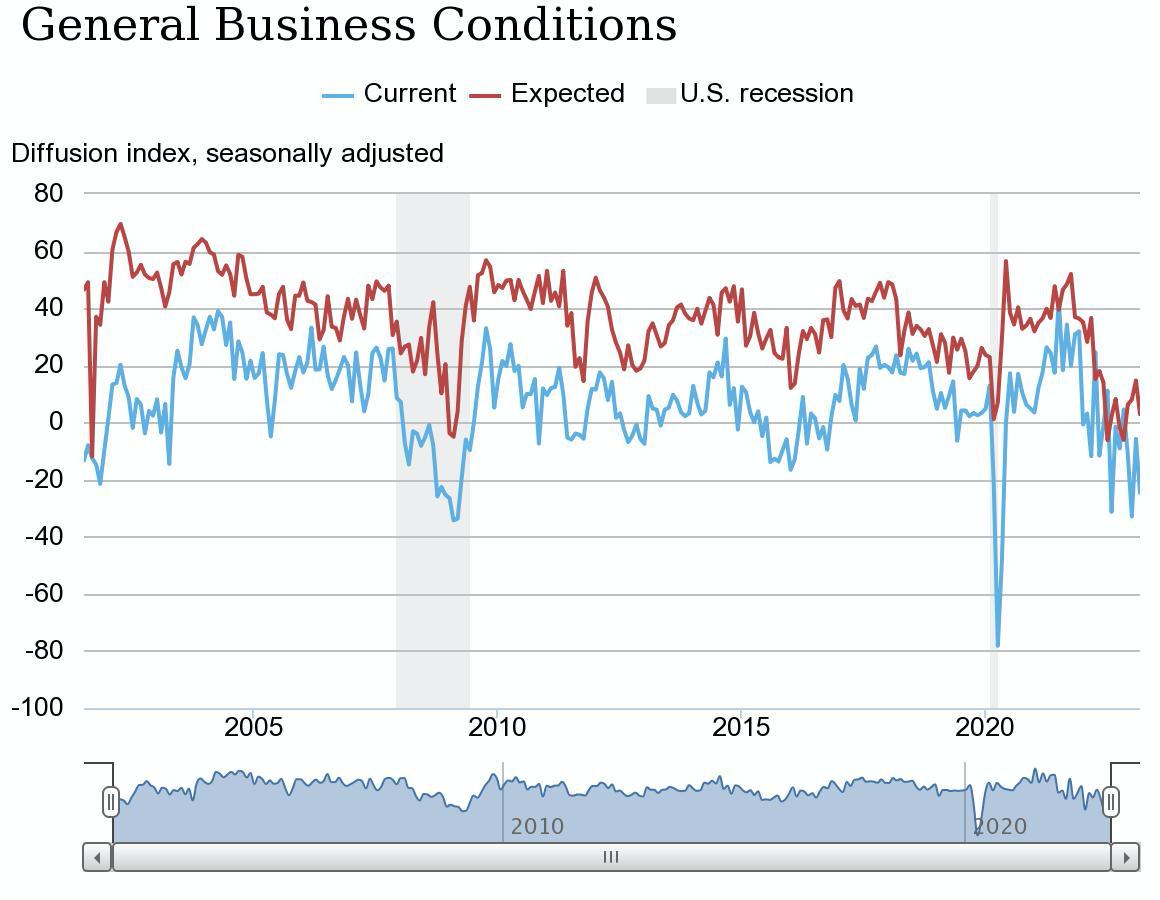

Manufacturing activity continued to decline in New York State, according to the March survey. The general business conditions index fell nineteen points to -24.6, continuing the see-saw pattern of ups and downs within negative territory seen in recent months.

Twenty percent of respondents reported that conditions had improved over the month, and forty-five percent reported that conditions had worsened. The new orders index fell fourteen points to -21.7, indicating that orders declined substantially, and the shipments index fell fourteen points to -13.4, pointing to a decline in shipments.

Examples of negotiating points and possible resolution during the process of developing the Purchase Agreement:

Section Seller’s Position Buyer’s Response Proposed Resolution

Article 1 “Adjusted EBITDA”

Definition of Adj. EBITDA to include any expenses outside of the ordinary course of business that are reasonable and necessary in Buyer’s reasonable business judgement, with the consent of the Owner.

Buyer has rejected the Owner consent requirement. Buyer has added expense arising out of or relating to unexpected events that have or may cause damage to the assets, operations, or financial performance of the business.

See Buyer response Buyer has added the obligation for Seller (and its Affiliates) to pay and satisfy, in due course, all Excluded Liabilities.

Restore. Substitute president of company for Owner to provide consent.

Section 2 Earnout Payment Security

Section 6 Removal of Personal Property

In the event that payment of the Earnout is delayed beyond a certain date, any amounts owed to Seller will accrue interest at a rate of 18%.

Owner will have 3 months following Closing to remove all personal items from the office, at Buyer’s expense and with Buyer’s cooperation.

Rejected

Add clarification that no personal obligations will be imposed on Owner to enforce this provision. Do not want to convert entity obligations to personal obligations.

Restore. Seller should not be forced to subsidize Buyer’s inability to pay the deferred purchase price when due.

Section 7 Conditions to Obligations of Seller

Removal period reduced to 2 months. All expenses to be borne by Owner without cooperations by Buyer. Owner is restricted from interrupting normal business operations during that period and will be confined to his office (and no other areas of the premises).

Buyer to deliver a certificate of the Manager of Buyer attaching the authorizing resolutions for the transaction. Rejected

Needlessly antagonistic. Allow until the end of quarter.

This is a standard deliverable. Need consent from parent for issuance too.

Section 9 Governing Law/Forum Ohio Virginia New York p Empire State Manufacturing Survey (March 2023) Federal Reserve Bank of New York

The monthly survey of manufacturers in New York State conducted by the Federal Reserve Bank of New York. https://www.newyorkfed.org/survey/empire/empiresurvey_overview Note: Survey responses were collected between March 2 and March 9.

The unfilled orders index came in at -6.7, a sign that unfilled orders continued to decline. At -7.6, the delivery times index was negative for a second consecutive month, indicating that delivery times shortened. The inventories index moved down eight points to -1.9, indicating that inventory levels held steady.

Good luck closing your transaction!

This article has been prepared solely for informational purpose. This article does not constitute an offer, or the solicitation of an offer, to buy or sell any securities or other financial product, to participate in any transaction or to provide any investment banking or other services, and should not be deemed to be a commitment or undertaking of any kind on the part of Wiley Bros. –Aintree Capital, LLC (“WBAC”) or any of its affiliates to underwrite, place or purchase securities or to provide any debt or equity financing or to participate in any transaction, or a recommendation to buy or sell any securities, to make any investment or to participate in any transaction or trading strategy. Any views presented in this article are solely those of the author and do not necessarily represent those of WBAC. While the information contained in this commentary is believed to be reliable, no representation or warranty, whether expressed or implied, is made by WBAC, and no liability or responsibility is accepted by WBAC or its affiliates as to the accuracy of the article. Prior to making any investment or participating in any transaction, you should consult, to the extent necessary, your own independent legal, tax, accounting, and other professional advisors to ensure that any transaction or investment is suitable for you in the light of your financial capacity and objectives. This article has not been prepared with a view toward public disclosure under applicable securities laws or otherwise.

By Matt O’Sickey Director of Education & Technical Affairs, INDA

Matt O’Sickey, PhD is Director of Education & Technical Affairs at INDA, Association of the Nonwoven Fabrics Industry. Matt was previously Director of Technology for RKW-North America and Global Director of Market Development for Tredegar Film Products and may be reached at mosickey@inda. org or +1 919 459-3748.