1 minute read

Finance

A word from our Mortgage Broker

As both expected and hoped for, we have seen in the month of May two lenders reduce their serviceability buffer to open the doors for people to refinance to a better loan, and enter the property market

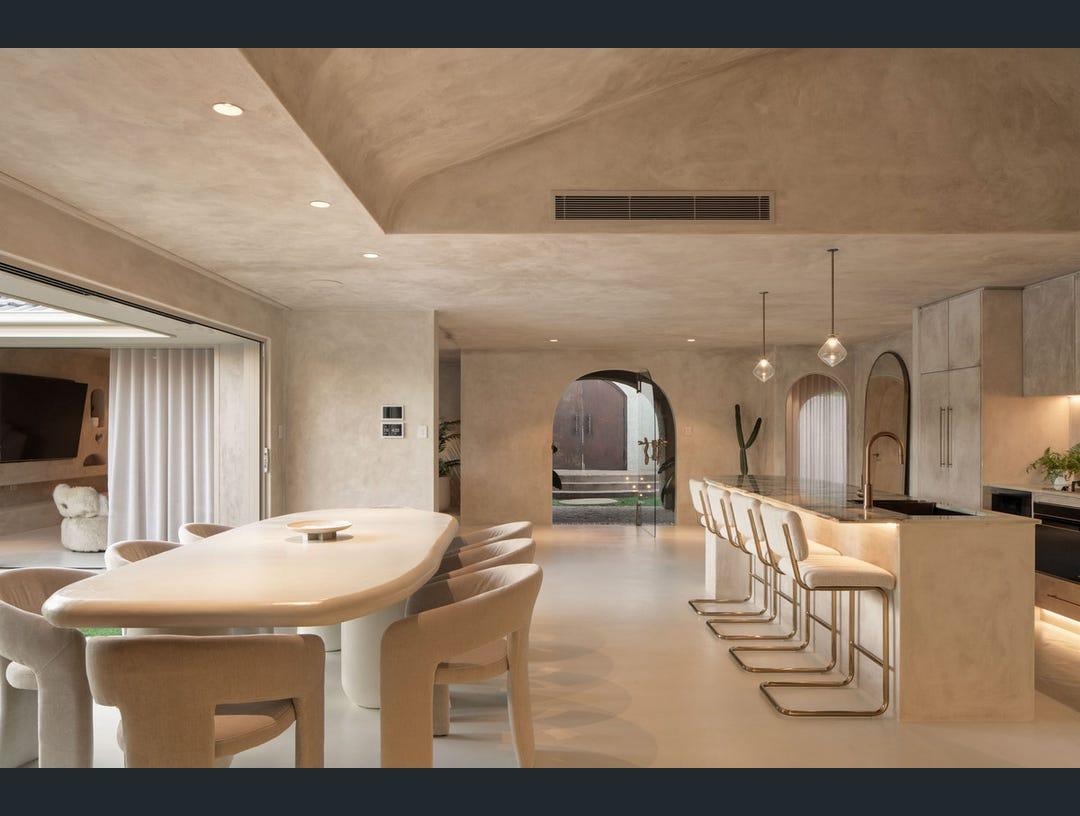

Advertisement

Westpac Group has announced it will be lowering the stress test on select refinance applications from a current 3% buffer down to 1%

Resimac, a smaller lender has dropped their buffer rate to 2% for refinances, debt consolidation, and purchases, opening the door for people to enter the property market

The current 3% buffer in an increasing interest rate environment has been a roadblock for borrowers to refinance to a cheaper lender and achieve loan approvals required to enter the property market, given they don’t pass the new bank’s serviceability test at higher rates

From the 29th of May, select refinancers who do not pass Westpac’s standard serviceability test can be re-tested using a modified serviceability assessment rate

Borrowers must be refinancing to a loan that has lower monthly repayments than their existing one