8 minute read

Navigating The Illinois Soybean Superhighway

An Analysis of the Future of Soy Transportation along Highways, Rails, Waterways and Oceans

By Mace Thornton

Like a Chicago expressway at rush hour, the soy transportation system constantly teeters on the brink of a traffic jam and is in persistent need of upgrades and maintenance. From railroads and inland waterways to roads and bridges, the intricate network that moves Illinois soy to the many markets it supplies is elaborate yet fragile.

Keeping Illinois soybeans flowing to market is affected by a wide range of complex issues that can be local, national and even global in scale. Factors such as shifting market needs in relation to existing railroad infrastructure, balanced river levels and shipping container availability are compounded by macro events such as economic shifts, geopolitical strife and evolving labor resources.

According to a new soy transportation benchmark report commissioned by the Illinois Soybean Association (ISA) and compiled by the firm Civil Design, Inc. (CDI), there is no question about the vital role transportation plays in adding value to Illinois soy.

“Transportation is so inherent in the value for soy products because we have developed a supply that gives us the ability to take soy products to market,” said lead analyst Dr. Lee Hutchins. “And it’s not just to markets in Indiana or Missouri. It's around the globe. So we have to be able to get it there within the time and quality constraints that exist.”

According to Hutchins, having a comprehensive understanding of all the aspects affecting the transportation system is just as important. Possessing a comprehensive view of the system and balancing its many complicating factors can mean the difference between operating with the efficiency of a beehive or the dysfunction of a lone computer-printer serving the needs of an entire office complex.

The CDI study, titled "Transportation Network Evaluation of Soybean and Soy Product Movements," highlights the complex soy transportation network in Illinois and beyond, as well as the importance of addressing infrastructure needs.

From the old Baltimore and Ohio Canal to the Interstate Highway System, Hutchins said the U.S. has benefited greatly from the historical recognition of the importance of transportation. Although the tangible emphasis on transportation systems may not be as great today as it was during the middle 20th century, understanding the data behind how the system functions is as important as the system itself.

“Data is out there in ways we never envisioned before,” Hutchins said. “What I've done in the last 10 years is to take bundles of data and put them together. What does it tell us? We can measure and be rigorous about it.”

Hutchins shares a story about a client literally dancing in the boardroom after an analysis showed he could save more than 20 percent of his transportation capital budget simply by making an adjustment based on data.

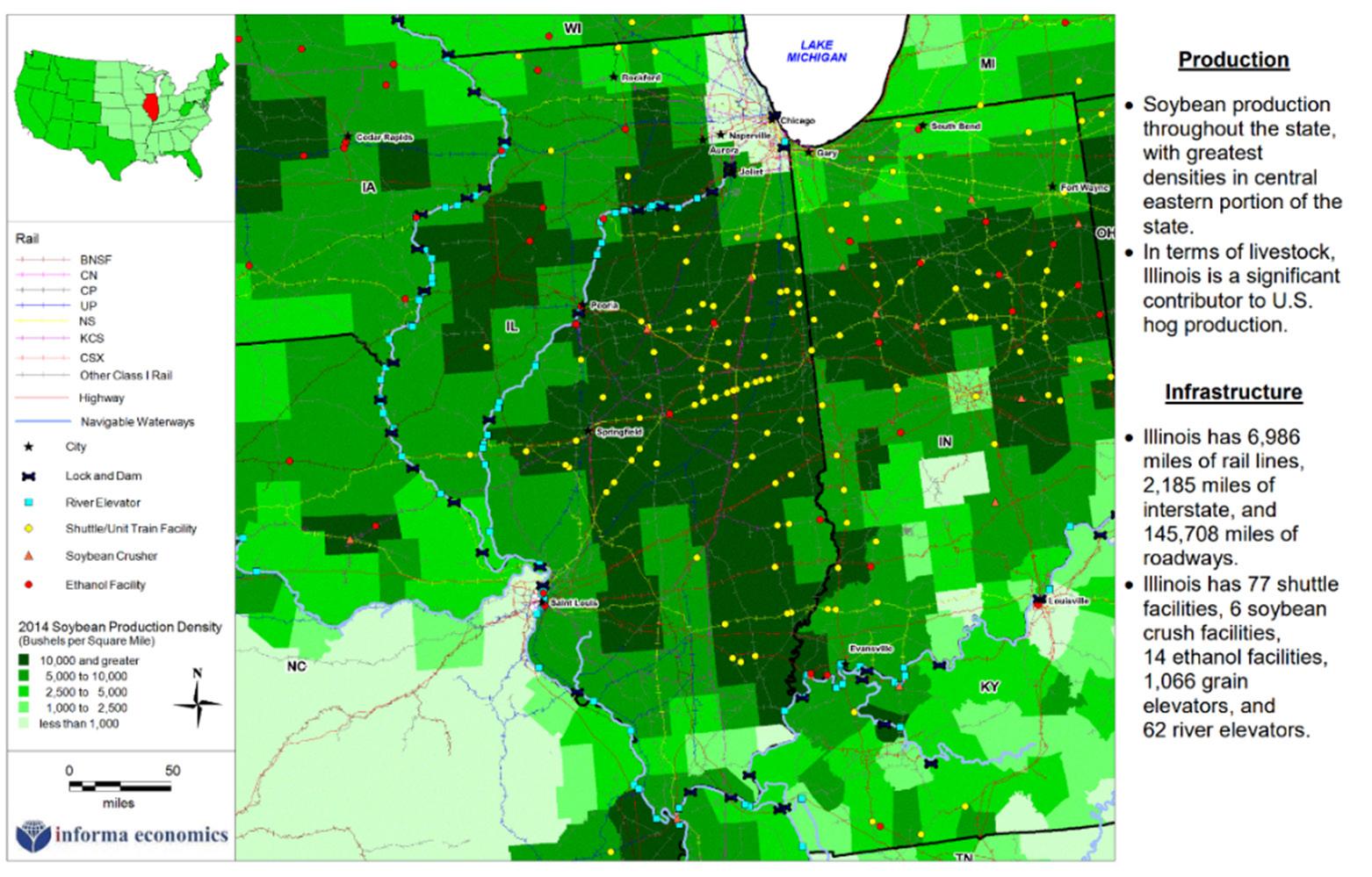

Overall, the report for ISA found that there is no other sector impacted more by transportation than agriculture. And Illinois, the nation’s largest soy-producing state, is one of the originating hubs for the domestic and international shipment of soybeans. Focusing on existing data from the system provides insights to successfully transport Illinois soybeans to their final shipping destination.

The study focused on the transportation of soybeans, soybean meal and soybean oil along the state’s Primary Freight Network. The study highlighted the critical importance of maintaining and selectively upgrading that shipping network, which currently provides access to approximately 86% of the state's soybean production.

“We’ve taken a first cut in looking at USDA's data, tracking soybean production by county in Illinois in relation to the state's freight transportation network,” Hutchins said. “That's a really good thing to know. And then when you look at the difference between transload terminals or the distance to port loading facilities, it gives you an idea of how best to transport soybeans to a place where they can be loaded for shipment. The work we've done so far is a first cut to see what the data tells us about what we can further examine.”

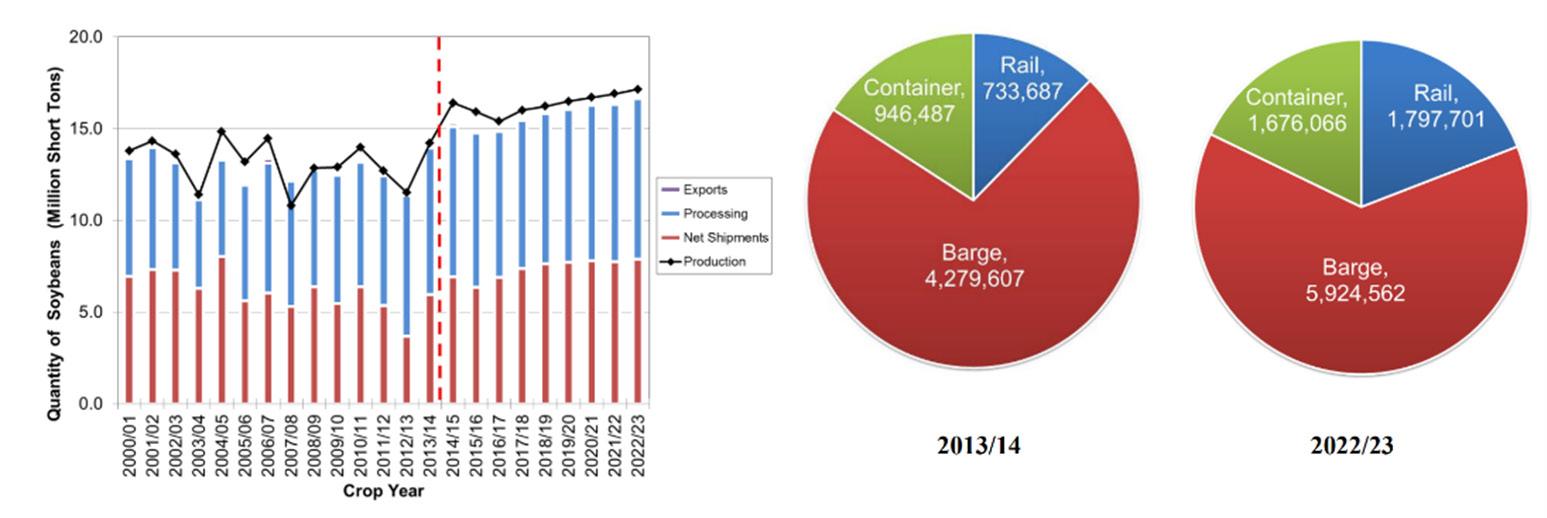

The report also showcases data related to Illinois soybean and soy product movements as production volumes continue to grow over time. Illinois soybean production is expected to increase in productivity by 15% to 30% over the next two decades. While this is promising, it also raises concern about heightened competition for transportation resources. This could lead to potential system stresses and increased delays for soybeans, as well as for other shippers. With many shipping ports available to Illinois soy, including the Canada, the East Coast, New Orleans and the Pacific Northwest, data-informed balance is the key to handling additional volume.

Although trucking is an essential mode of transport from the farm to the first purchaser, the report highlighted that railroads, waterways and ocean ports play an essential role in expanding the reach of Illinois soybeans and their export to global destinations.

Railroads, especially Class I railroads, help ensure efficient transportation. The Canadian Pacific/Kansas City Southern rail merger could further enhance services, broadening Illinois' reach and transportation capacity, according to Hutchins.

“All things being equal, our rail system can be very effective in giving you access to different global market destinations because you can get to different ports,” Hutchins said. “It can be very flexible with a known schedule. It's not quite as immediate as trucks, but it's still responsive and it's got a lot more capacity.”

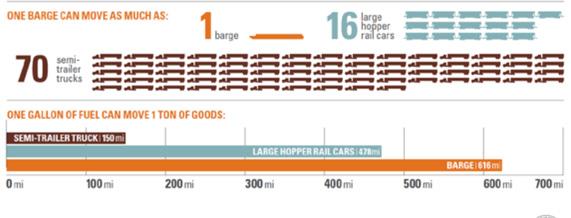

On the other hand, Hutchins explained that barge traffic on inland waterways is less flexible in routing. It moves cargo from one set point on the waterway to the next, though barge shipping offers a price advantage to rail.

“It costs a lot less to ship by barge,” he said “Gravity is your friend, like going down river to New Orleans for export. So that makes life generally easier.”

From a competitive standpoint, the report emphasizes that for inland waterways to continue to play a crucial and competitive role in bulk soybean transportation, infrastructure improvements are needed, such as those coming online along the Illinois and Mississippi rivers.

Port developments, including dredging and freight handling equipment, have the potential to influence how soybeans and soy products reach markets. The study also mentioned the use of containers as one way to expand soy shipping, particularly for identity-preserved beans with specific qualities.

“If Illinois soybeans can get to markets where identity preservation is more valuable, or more important, they'll make more money,” Hutchins said. “Using containers more gives you more shipping options.”

The report also underscored the dynamic and multifaceted nature of freight transportation, where various parties own and operate the components of the supply chain. To address challenges and opportunities, the report encouraged ISA to form coalitions and collaborate with other stakeholders to help ensure better coordination throughout the soy shipping network.

According to the study, environmental stewardship remains a critical factor in transportation, considering the challenges of climate change, air and water quality, and biodiversity. The report suggests that soybeans and soy products can help offer flexible and renewable solutions and benefits in addressing these challenges.

Addressing the U.S. soy transportation network holistically to find efficiencies is more important as competing nations such as Brazil continue to upgrade their infrastructure, but Hutchins said competition from South America may not be the biggest factor to consider.

“It's a medium-level concern,” he said. “There's a lot of other things that matter. We would be well served to address them (rather) than focus on specific infrastructure investments by other countries.”

Hutchins said political instability and possible disruptions from changing weather patterns can loom large in the nation’s ability to keep up with transportation demands. He said the U.S. could face challenges from lower river levels that could impact domestic shipping, just as the lack of fresh water for backfill is currently limiting the number of vessels using the Panama Canal.

“Are we going to find ourselves in a position where we need to consider significant changes? I think that's looming bigger than we have realized so far. While I think we have some real pluses going for us, we all too often encounter significant institutional disconnects.”

The ISA Market Development Committee commissioned the study and played a pivotal role in determining the study's target end markets. The Soy Transportation Coalition also provided a snapshot of the soy transportation network by state, further illustrating the potential opportunities and gaps in the national transportation network.

The CDI study, titled "Transportation Network Evaluation of Soybean and Soy Product Movements," was conducted in collaboration with logistics experts, subject matter specialists and data scientists. For additional information about the study, contact ISA’s Director of Market Development, Todd Main, todd.main@ilsoy.org