1 minute read

THE REAL COST STUDENTS DISCUSS THE IMPACT OF TAXING

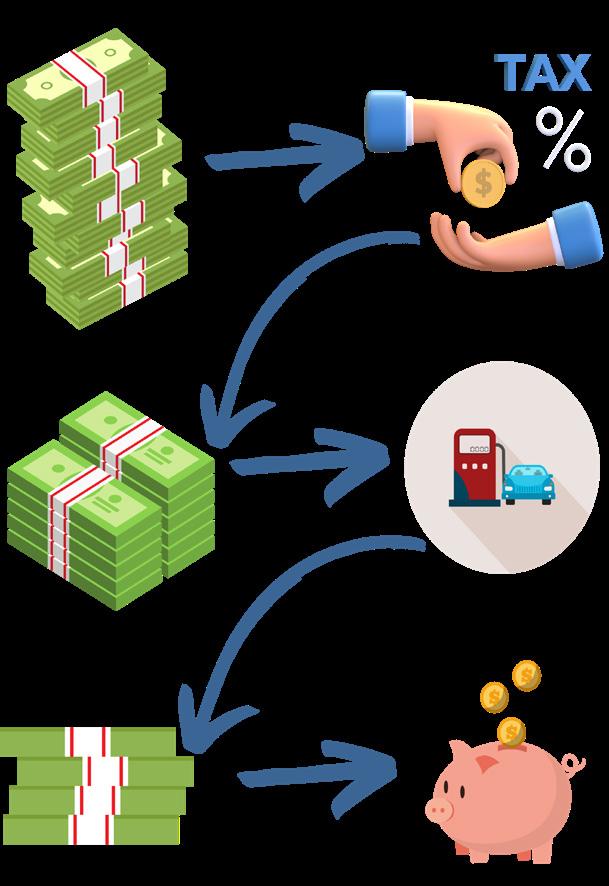

At the age of 14, a teenager is legally allowed to work, with restrictions given by the United States government. Laws are set in place to provide minors with guidance and assistance in getting fair and just treatment in the working community. As an employee, minors are also required to pay taxes, which can significantly affect a teen’s savings plans and goals. The tax on minors will at some point affect a teen’s ability to pay and save for future expenses.

“I am expected to pay for college, insurance for my car, and other expenses,” junior Colson Lamm said. “I feel like taxes can set me back, but I also understand why we have to pay them.”

Advertisement

Teens are expected to pay for their college tuition and yearly fees with minimal the help of from their guardians. A teen on average will make around 30,000 dollars a year, while college tuition payments cost around 35,000 a year.

“According to the Bureau of Labor Statistics (BLS) data, the median they look forward to every year. The answer to whether Valentine’s Day matters is truly relative and will always vary depending on who is being asked. Story by Caio Menegardo. salary of 16- to 19-year-olds is $609 per week,” Amelia Josephson from Smartasset said. “Which comes out to

$31,668 per year.”

The $30,000 a year does not all go to college savings, as paycheck deductions start with taxes, then expenses, then savings, leaving the teen with very little left to spend on themselves or on other unplanned expenses.

“After taxes and expenses, I am left with little to no money left,” senior Skyla Thorpe said.

The cost of college increases yearly, and most young adults are left with college debt which is partially due to the amount of money they lost while paying taxes as a minor.

“As of 2022, about 45 million Americans were saddled with student debt,” said Daniel Kurt, journalist for Investopedia.

Decreasing the amount of taxes, a minor has to pay could potentially decrease the amount of debt a college student will face. Story by Mackenzie Roberts.