2024 Market Report

Third Quarter Performance

Third Quarter Performance

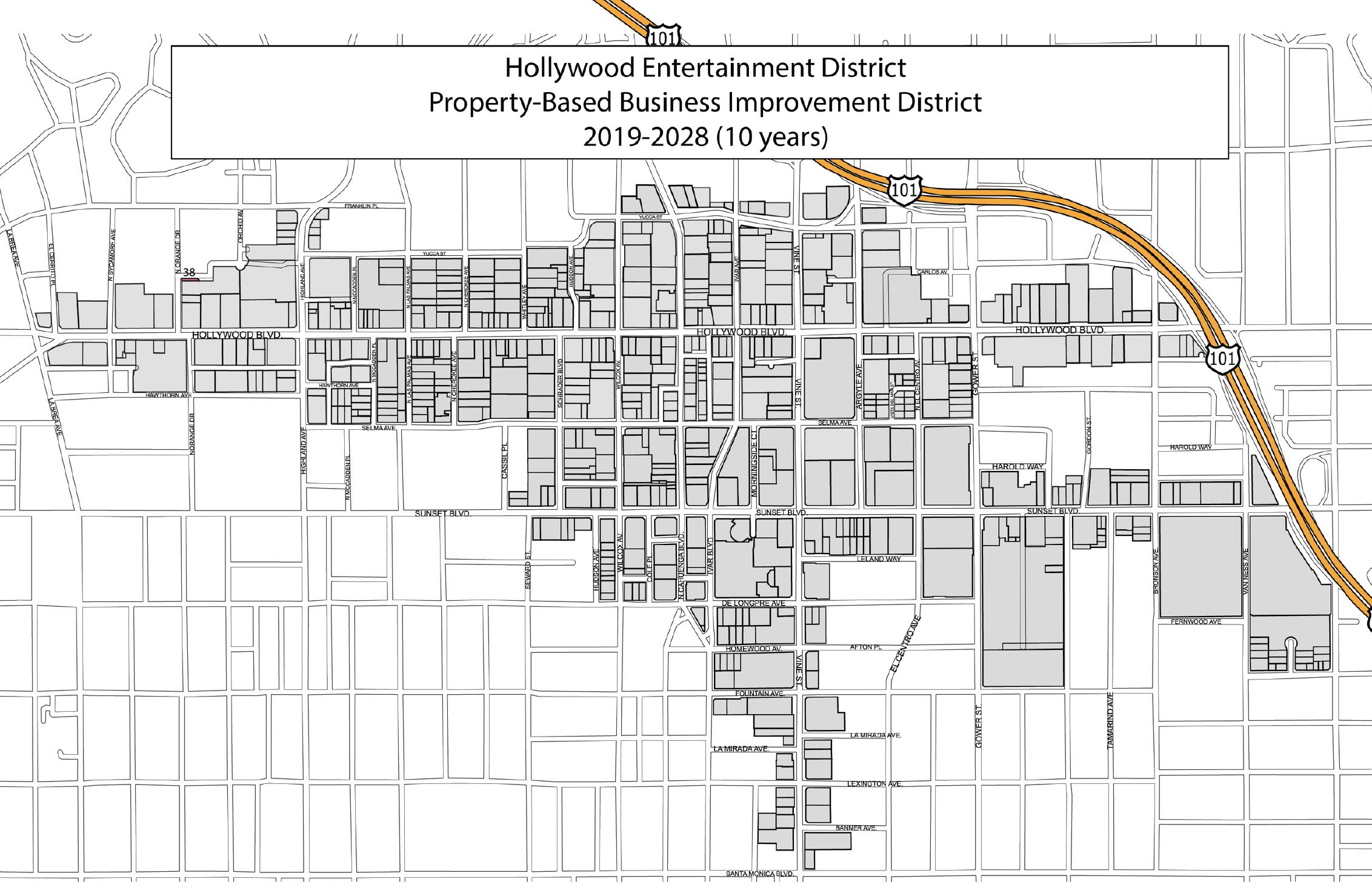

The Hollywood Partnership (THP) is a non-profit organization that manages the public realm within the Hollywood Entertainment District (HED), which is a Property Based Business Improvement District (PBID). Simply, this means that the organization is funded by property owners within the district to provide enhanced services to promote the cleanliness, safety, beautification, and economic vitality of our neighborhood.

The Hollywood Entertainment District (HED) experienced a vibrant summer tourism season in Q3 2024, attracting 9.5 million domestic visitors alone. Hollywood came alive with acclaimed productions like Hamilton at the Pantages Theatre, highprofile movie premieres, and a series of new business openings, including Laya, The Palm & The Pine, Chicken Guy! by Guy Fieri, Rokusho Hollywood, and Wake and Late.

The district’s culinary scene also received a boost as UKA Restaurant at Japan House LA was awarded a Michelin Star, reinforcing Hollywood's reputation as a dining destination.

Key investments added to this momentum, including a $50 million acquisition of the Dolby Theatre, which is slated for a complete reimagining of programming, and the completion of a multi-million dollar renovation at the W Hollywood. Additionally, the iconic Yamashiro property has gone on the market, signaling potential for further revitalization in the area.

The Hollywood Partnership (THP) remains committed to promoting these investments and enriching the visitor experience. Programs like "Park, Dine, and Enjoy the

Show" collaborate with local businesses to streamline parking and dining for theater and concert goers, while "REEL Hollywood" social media dining tours highlight the district’s diverse bar and restaurant offerings.

Beyond tourism, Hollywood's residential appeal is growing. The HED’s residential population has increased by 6% in the last four years, with occupied housing units up by 10%, and more than 6,700 residential units entitled or under construction in Greater Hollywood. Rental rates in the district average $2,783, significantly above the citywide average, demonstrating demand for living in vibrant, urban neighborhoods like Hollywood.

However, the commercial retail and office sectors continue to face leasing challenges, both locally and nationwide. Developers are increasingly incorporating residential options as a flexible alternative, as seen with projects like Sunset + Highland and 1360 Vine, to ensure viability.

The entertainment sector, a core part of Hollywood’s economy, is showing promise with major projects like the Sunset Las

Palmas Studio expansion and Echelon Studios. Governor Gavin Newsom has proposed a significant increase in the state’s film and TV tax credit, from $330 million to $750 million, which could drive renewed local filmmaking if approved by the legislature.

Community partnerships are central to addressing local challenges. THP continues to work closely with the City of LA’s Inside Safe program and Hollywood 2.0 to support both temporary and permanent housing solutions for those in need.

In summary, Hollywood remains resilient and poised for growth, with significant opportunities for reinvention and revitalization. We thank you for your continued commitment and encourage you to explore our Q3 2024 Market Report for further insights.

Kathleen Rawson President & CEO

55,662 Source: ESRI Community Analyst, Placer.ai

Homelessness is on the decline across Los Angeles, marking the first reduction in over six years. While challenges persist, initiatives such as the LA County Department of Mental Health's Hollywood 2.0 pilot, the expansion of affordable housing, and Mayor Bass's Inside Safe program are driving meaningful progress. Over the past year, Hollywood 2.0 has successfully placed 102 individuals in interim housing and secured permanent supportive housing for 115 people, significantly reducing the number of unsheltered individuals in Hollywood. Inside Safe has removed 67 encampments and provided temporary hotel shelter for 3,254 people, with nearly 23% (741 individuals) transitioning to permanent housing. In August alone, 38 unsheltered individuals from a site at Hollywood and Gower were moved into housing. THP looks forward to continued collaboration with our county and city partners in the efforts ahead.

Recent survey data reveals strong enthusiasm for future travel among American travelers, with 90% of U.S. travelers, including 90% of California residents, expressing excitement about leisure travel over the next 12 months. In Q3 2024, Los Angeles International Airport (LAX) reported 14 million domestic passengers, a slight decrease of 1.8% year-over-year, while international traffic increased by 3.5% to 6.5 million passengers. Hollywood Burbank Airport experienced a 13% year-over-year increase, reaching 1.8 million passengers. Both airports are undergoing significant renovations and expansions, with LAX’s People Mover to open in 2026, enhancing access to terminals and connections to LA Metro.

In July 2024, LA Metro released the draft EIR for the K-Line Northern Extension (KNE) to connect key destinations across four major rail lines, including Hollywood’s B Line. Additionally, Waymo launched its fully electric driverless cars in Hollywood in August 2024.

The entertainment industry contributes over $115 billion annually to the regional economy, yet it faces significant challenges in the post-strike landscape, including heightened competition from other states for tax incentives, a reduction in filming and production days, and fewer job opportunities. Mayor Karen Bass has underscored the industry's critical role in sustaining Los Angeles's economic strength and cultural identity. In response, local initiatives such as Mayor Bass's Entertainment Industry Council and LA County's 2024 Business Interruption Fund have been established to aid in the sector's recovery. Additionally, Governor Newsom has proposed increasing the annual film tax credit from $330 million to $750 million, pending legislative approval, with a potential start date of July 2025. Despite current obstacles, promising developments are underway, including a proposed $8 billion merger between Paramount and Skydance, the $50 million acquisition and reimagining of the Dolby Theatre, and several Echelon studio

Hollywood is renowned for its world-class theaters and concert venues, such as the iconic Pantages Theatre and the Hollywood Bowl. To enhance the visitor experience, The Hollywood Partnership (THP) has collaborated with 14 local businesses to streamline parking and dining for guests coming into the district for shows. Through this program, visitors can take advantage of valet parking at one of Hollywood’s exceptional restaurants and leave parking concerns behind for the evening. Enjoy a delicious pre-show meal at a partner restaurant, conveniently located just minutes from various entertainment venues. Whether you're seeking fine dining or a more casual experience, THP’s partners offer a range of options, ensuring a relaxed, enjoyable evening from start to finish.

At its heart, Hollywood is a mecca for creativity and storytelling. Buoyed by a robust entertainment production ecosystem and brandishing a priceless name representing a neighborhood and an industry, Hollywood combines the best of laid-back Southern California culture with dedicated work, creative energy, and drive. While the community is home to a substantial share of entertainment production jobs consistent with its global brand, Hollywood features a diverse employment base. Other major employment clusters include information and technology firms, healthcare, personal and professional services, and abundant retail and food & beverage industry jobs. Regarding employment types, 71% are White Collar, 20% are Services, and 10% are Blue Collar. That diversity of employment translates directly to the diversity of the workforce, which is always on display throughout the neighborhood.

46,139

32,274

5,700,000

$90,000

Hollywood is home to various employment sectors, lending economic resilience to the area.

In Q3 2024, non-resident employee visits to the HED reached 1,525,183, a modest 2% increase from Q3 2023. However, this figure remains below the pre-pandemic average of 1,621,929, reflecting an 81% recovery rate. Compared to Q3 2019, the current visits represent a 76% recovery. While Q1 and Q2 2024 showed return-to-work levels nearing 2019 figures, the trend suggests that summer work visits may continue to lag due to the rise of remote work.

The availability of U.S. office space has reached an all-time high, surpassing 1B SF for the first time, while new office construction has dropped to its lowest level in a decade. This trend is largely driven by the rise of hybrid work (28% adoption nationally), along with caution around new leasing, elevated construction costs, challenging market fundamentals, and high capital costs due to rising interest rates. The national office vacancy rate now stands at 20.9%. In Los Angeles, factors such as tenant downsizing and the lingering effects of industry strikes have pushed office vacancies even higher, with an overall

vacancy rate of 25%. Some submarkets show even more pronounced vacancies, with rates of 31% in Downtown LA, 30% in Mid-Wilshire, and 37% in Glendale. Reflecting this broader trend, Hollywood’s vacancy rate has reached 24.5%, similar to the Westside’s 24%. On a positive note, leasing activity in Hollywood is gaining traction, with 60,902 SF leased in Q3 2024. Hollywood’s Class A office market outpaces Los Angeles in asking rents ($4.43 compared to $3.79), though rates have decreased from $5.17 a year ago in Q3 2023 and have stabilized around $4.39 since Q4 2023.

HOLLYWOOD OFFICE MARKET: Q3 2024

Overall Asking Rents (PSF/monthly)

Class A Asking Rents (PSF/monthly)

Overall Vacancy Rate

Class A Vacancy Rate

-0.9% QoQ (+2.9% citywide)

-7.2% YoY (-5.6% YoY citywide)

Compared to $3.45 citywide

-1.8% QoQ (+3.8% QoQ citywide) -14% YoY (-3.3% YoY citywide)

Compared to $3.65 citywide

+2.5% QoQ (+0.4% citywide)

+7.0% YoY (+1.3% citywide)

Compared to 24.4% citywide

-0.5% QoQ (+0.8% citywide)

+1.1% YoY (+2.9% citywide)

Compared to 27.0% citywide

NET ABSORPTION: Q3 2024

GREATER HOLLYWOOD + HED

5 9 2 8 1 3

2,462,328

1,769,533

NOTABLE Q3 OFFICE SALES AND LEASES

GREATER HOLLYWOOD

Lease Lease Lease

Passes, 720 Cahuenga Blvd (HQ Creative), 25,609 SF, $4.58 NNN, 69-month term, Class A office space

WORKING IN HOLLYWOOD

E.L.F Cosmetics, 959

Seward St/BASE, 25,000 SF, New Lease

Undisclosed Tenant, 17201728 Whitley Ave (Whitley Court). 1,000 SF, Creative, Class B office space Source: The Hollywood Partnership, CoStar Group, Cushman & Wakefield, LA Times, Urbanize LA

Following the release of the initial study and a notice of preparation, Hudson Pacific Properties held a public scoping meeting for the Sunset Las Palmas Studio Expansion project in September 2024. With approvals pending for a zone change, general plan amendment, and other required entitlements, construction on the expansion is anticipated to start in 2026 and finish in 2028. The project plans to develop four new soundstages and a four-story, 70K SF production support building, replacing existing surface parking, small office buildings, and support facilities. Gensler is set to lead the design.

Few places carry the same immediate name recognition or intrigue as Hollywood, attracting a diverse mix of people from all over the globe to live and work in the world’s creative capital. With its central location, modern amenities, and walkable scale as the “most walkable neighborhood” in Los Angeles, Hollywood has its own unique character that appeals to modern-day creatives.

The Hollywood population is primarily renters, has a median age of 35.1, is upwardly mobile, with 54% having a bachelor’s degree or higher and with a median household income of $58,782. Hollywood residents are more likely to take transit, walk, or work from home compared to citywide averages. As a result, there is high demand for living in Hollywood, particularly in the HED.

Source: ESRI Community Analyst

Hollywood’s residential population includes a diverse mix of people from all age groups and generations, with millennials being the most well-represented group. It is worth noting that figures indicate that residents desire to remain in their current homes for the next five years.

Source: ESRI Community Analyst

7,362 $2,783 6.7% 47,496 $2,319 6.4%

476,450 $2,246 5.7%

MARKET DATA: Q3 2024

Residential Vacancy Rate (%)

Asking Rent Per Square Foot

While multifamily residential vacancy rates in the HED and in Hollywood are higher than in Los Angeles, they often spike in correlation with an increase in deliveries. The 2023 annual average vacancy rate in the HED was 7.4%. The 6.7% Q3 2024 vacancy rate has leveled to become more on par with citywide rates.

Group

Over the past decade and a half, the HED’s annual population has increased more than regional rates. Hollywood's longitudinal upward trend in residential population continues to support the growing demand for multifamily residential options. Over the past decade, the HED has experienced a notable increase in its residential population, with a 17.0% increase since 2010, significantly higher than the 0.9%

growth observed citywide. The district witnessed a 6% increase in its resident population between 2020 and 2024 alone, while the citywide growth rate decreased by -2%. Since 2000, occupied housing units have increased 12% citywide and by more than double that (30%) in the HED. In the past four years (2020-2024), occupied housing units have increased 10% in the HED and just 1% citywide.

Source: ESRI Community Analyst

The HED offers a broad mix of housing options, including micro workforce units, middle-income housing, co-living spaces, affordable units, market-rate options, and artist-collective housing. With 96% of HED residents renting, this range of choices is essential to meeting diverse needs. Reflecting increased demand, the number of occupied housing units in the HED rose by 29% from 2010 to 2024, including a 10% increase in the past four years alone.

Currently, 44 residential projects are entitled or under construction across Greater Hollywood, with 12 of those located within the HED. The district accounts for 71% (4,776 units) of the approximately 6,758 residential units under development in Greater Hollywood, highlighting both the district's high density and its rapid population growth. Of the 7,281 residential units planned, entitled, or under construction within the HED, 21% (1,529 units) are designated as affordable housing. Looking specifically at projects now seeking entitlement, 34% (859 units) of proposed units in the HED and 41% (342 units) in Greater Hollywood are slated for affordable housing.

Despite challenges in the office market, both locally and nationally, Hollywood’s residential market remains strong. Some projects are even considering shifting from office to residential use, as seen with CMTY Culture’s Sunset and Highland development at 6767 Sunset Blvd. Originally planned as an office space, this project is now also seeking entitlements for a residential alternative.

Sunset + Highland, also known as the CMTY Culture Campus, is a significant mixed-use project proposed for the iconic intersection of Sunset and Highland. Adapting to evolving market demands, the project team—led by Philip Lawrence and Thomas St. John, in partnership with Lincoln Property Company—is pursuing entitlements for both office and residential uses to ensure flexibility. By entitling two options, the team positions the project for viability upon securing approvals, allowing them to create “a project at this storied corner in the heart of Hollywood” that “honors its rich past while looking boldly to the future.”

The team’s vision extends beyond function to purpose: “We aspire to make an important and valued place that welcomes the neighborhood and, whether driven by commercial or residential uses, captures the essence of Hollywood and fills a need in the community.”

HED

Eastown

Eastown was purchased by Arrive Hollywood for $190.98M with a 7.9% vacancy rate at sale, 6201 Hollywood Blvd.

Greater Hollywood

Hollywood

1445 Las Palmas, Hollywood Tower The Sophia Hollywood Residency at the Entrepreneur Hollywood

1445 Las Palmas Ave., (North Vermont Associates)

1360 Vine St., (Onni Group), Zoning Approved so construction can start

1759 Gower St. 1527-2657 Western Ave., (Greystone)

Artisan Hollywood Montecito II: Senior Housing

6350 Selma Ave., (Artisan Ventures), Approved by City Council rejecting an appeal 6650 Franklin Ave., (Thomas Safran & Associates)

For decades, Hollywood has brought joy to so many through the magic of its bedrock roots in entertainment. The neighborhood’s unique blend of creativity and commerce continues to offer one-of-akind experiences for both visitors and residents. While constantly on the cutting edge, Hollywood retains a timeless glamor that permeates

our hotels, restaurants, and attractions. Those who visit Hollywood hail from nearby California cities and faraway countries, as this neighborhood’s many hotels and entertainment destinations appeal to all walks of life.

Pre-Pandemic average represents the annual average of visits from 2017-2019.

In Q3 2024, Greater Hollywood's hotel market reported an 82% occupancy rate, a $238 average daily rate (ADR), and a $194 revenue per available room (RevPAR). Hollywood hotels have consistently outpaced the citywide average in ADR over time. While occupancy rates have held steady compared to Q3 2023, they remain 7.5% below Q3 2019 levels. Attracting more visitors to Hollywood will be crucial to reversing this downward trend.

Currently, there are seven active hotel projects either underway or approved in Greater Hollywood, set to add a total of 1,170 hotel rooms to the area. Of these, four projects are dedicated solely to hotel accommodations, while three are part of mixed-use developments. Notably, five of the seven projects are within the Hollywood Entertainment District (HED). Nationally, hotel construction is experiencing a slowdown, with an increasing number of projects stalling in the planning stages. In Hollywood, two entitled hotel projects—the Palmer Hotel and the Schrader Hotel—are inactive and no longer being pursued, while others, like the La Brea Hotel, 1415 Cahuenga, and 1909-1915 Highland Ave., are currently on hold.

Additionally, MetLife Investment Management and Loews Hotels & Resorts are selling the Hollywood Loews for $125 million, presenting a redevelopment opportunity or the chance for a new brand to enter the market. However, there has been some positive momentum, such as the Whitley Hotel at 1719 Whitley Ave., which successfully overcame an appeal in July 2024, updating its project findings and entitlements. The Whisky Hotel Hollywood is also set to open in 2026. Earlier this year, The Aster and The Prospect Hollywood were awarded a prestigious one-key rating from the MICHELIN Guide, marking the first-ever MICHELIN Key honors in Los Angeles, with two of the seven recognized hotels located in Hollywood.

Marriott International announced the grand opening of the newly renovated W Hollywood, the West Coast flagship of its luxury lifestyle W Hotels brand. The 319-room, 300,000-SF hotel underwent a complete renovation following its $197 million acquisition by Trinity Fund Advisors and Oaktree Capital Management in 2021. Updates include redesigned guest rooms, a refreshed fitness center, and newly introduced dining and event spaces. The hotel now features standout amenities such as a rooftop bar with panoramic views, a reimagined outdoor garden, and an immersive audiovisual system in the event spaces, all designed to enhance the guest experience with dynamic, interactive offerings. The renovation reflects Marriott’s vision to cater to modern luxury travelers, incorporating bespoke design elements and experiential amenities.

According to Sr. Vice President and Global Brand Leader for W Hotels, George Fleck, “This hotel was tailor-made for the modern traveler who craves authenticity, creativity, and a deep connection to the cultural fabric of Hollywood. We have crafted an experience that not only reflects the vibrant spirit of this iconic destination, but also sets a new standard for what W Hotels represents on a global scale.”

Hollywood’s retail market is essential to the neighborhood’s vibrancy, with a substantial inventory of 6.9M SF of retail space, half of which (3.5M SF) is located in the HED. As of Q3 2024, the HED has approximately 607,000 SF of available retail space, with average

annual asking rents at $42.32 PSF ($3.53 PSF monthly). District rents in the HED have remained stable over the past five quarters, with a slight 1% increase compared to Q3 2023.

Hollywood Rooftop Restaurant & Bar at Madame Tussauds

Prince St Pizza Drive-Thru (Temporary Pop-up)

Chicken Guy! by Guy Fieri

WAKE & LATE

Rokusho Hollywood

Hang On to the Dream Theatre

6933 Hollywood Blvd

The Palm & The Pine

1624 Cahuenga Blvd

5920 Sunset Blvd

6201 Hollywood Blvd

6334 Selma Ave

6634 Sunset Blvd

1625 Las Palmas

Source: CoStar Group, The Hollywood Partnership

Koreheim Korean Beauty

6801 Hollywood Blvd

Be Unique Shoes Boutique

Continental Kitchen

The Brownstone by Citizen News

6370 Hollywood Blvd

6464 Sunset Blvd 1615 Cahuenga Blvd

In Q3 2024, the retail vacancy rate in the HED rose by 0.9%, moving from 11.7% to 12.6%, with a year-to-date negative net absorption of 30,733 SF. Retail vacancies in the HED have been steadily increasing since 2019, with average annual vacancy rates climbing from 2.0% in 2019 to 4.1% in 2020, 6.4% in 2021, 8.6% in 2022, 8.8% in 2023, and reaching 11.3% year-to-date in 2024.

HED

Gr. Hollywood City of LA

Mixed-use development is a golden standard in Hollywood. Currently, 33 projects entitled or under construction include a retail component. In the HED, this equates to 19 projects with 262K new SF of retail via the mixed-use projects entitled or under construction.

24

9

17

2

513,981

17 8

262,038

Photo: www.japanhousela.com

In August 2024, UKA was among seven new restaurants awarded a prestigious MICHELIN Star in the 2024 MICHELIN Guide California. “Chef Yoshitaka Mitsue and Chef Shingo Kato focus meticulously on every detail at this sleek hideaway within Japan House at Ovation Hollywood. Fish is sourced directly from Japan, arriving twice a week, then cured or aged in-house. Locally sourced ingredients are chosen for optimal quality, all contributing to the refined kaiseki dining experience at UKA, where guests can enjoy six- or nine-course meals. Most dishes stay true to tradition, such as kabutamushi—a dumpling made with shredded turnip and filled with Japanese sea bream—while some incorporate French influences, like grilled abalone with butter ponzu sauce and wagyu paired with a red wine jus and miso butter sauce.”

On August 2, 2024, the LA City Council unanimously approved the transfer of the lease and programming license for the Dolby Theatre to Jebs Hollywood Entertainment, LLC—a seasoned team featuring a movie producer, former studio head, advertising entrepreneur, restaurateur, and a member of the United Arab Emirates royal family. With the Municipal Facilities Committee’s recommendation and the City Council’s approval, the authorization can now proceed. While the process may take time, the vision is to transform the 3,400-seat cinema into a premier, year-round entertainment venue.

Christopher Bonbright, managing director and principal at Avision Young, commented, “The new owners plan to increase the number of annual live events at the venue from the current 100 to 300. This deal demonstrates their strong confidence in Hollywood and in the future of live entertainment.”

Photo: www.historictheatrephotos.com

The Hollywood Partnership tracks upcoming development regularly to keep you apprised of the latest projects planned or under construction in the HED and Greater Hollywood. Explore our Development Map, or check out our Development Matrix for a quick glimpse.

Click Here

To Explore Our Development Map

Click Here

To View Our Development Matrix

*The Hollywood Partnership tracks development projects that are proposed, fully entitled, and under construction. Information included here reflects the status of each project as of the current quarter, and The Hollywood Partnership makes no representations as to the likelihood of completion for any individual project in light of market conditions.

6922 Hollywood Blvd., Ste. 925 Hollywood, CA 90028

323.463.6767

info@hollywoodpartnership.com

hollywoodpartnership.com