2 minute read

FINANCIAL SUMMARY

Council’s financial position continues to remain sound. A summary of our performance is outlined below. Detailed information relating to council’s financial performance is included within the Financial Statements and Performance Statement sections of this report.

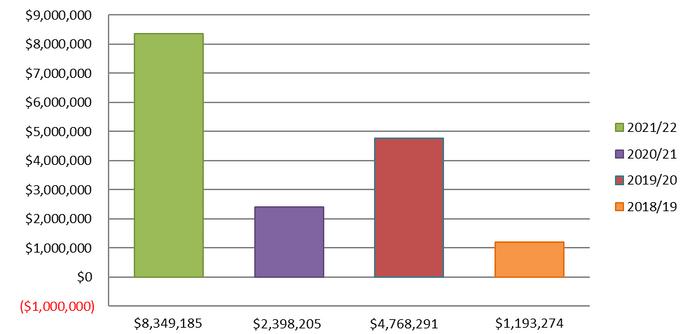

Operating Position:

Advertisement

Council reported a surplus of $8.35 million in 2021/2022. As per the Comprehensive Income Statement in the Financial Report, the favourable variance is due mainly to the early payment of $3.836 million from the Commonwealth Government Financial Assistance grants received in April 2022 for the 2022/2023 financial year.

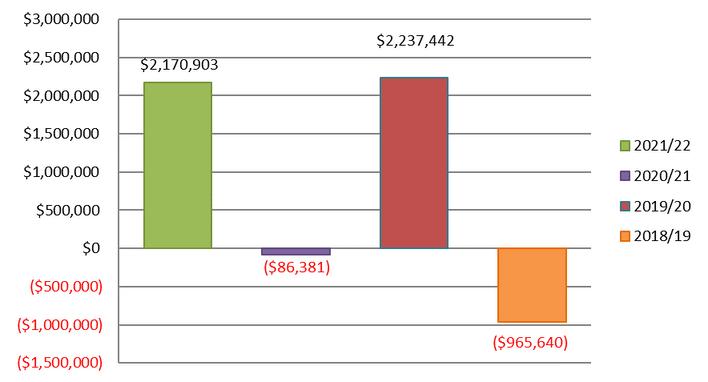

Surplus / (deficit) for the year Council’s adjusted underlying result, that is, the result after removing non-recurrent capital grants, cash capital contributions and non-monetary capital contributions, is a surplus of $2.17 million.

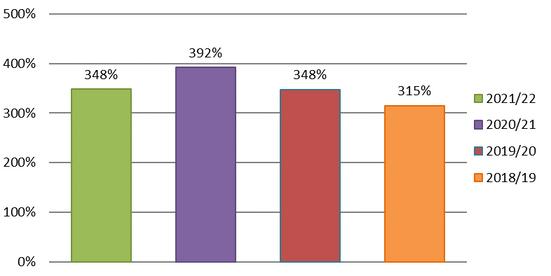

Liquidity:

Cash decreased by $2.339 million from the previous financial year. A significant number of capital works projects that were paid during 2020/2021 were completed during 2021/2022 including the Albacutya Bridge. The working capital ratio which assesses Council’s ability to meet its current commitments is calculated by measuring Council’s current assets as a percentage of current liabilities. Council’s result of 348% is an indicator of Council’s strong financial position and well within the band of 150% or more for the Victorian Auditor Generals Office (VAGO) assessment as ‘low risk’ .

Working capital ration %

Obligations:

Council aims to ensure that it is able to maintain its infrastructure assets at the expected levels, while at the same time continuing to deliver the services needed by its community. With land, building and infrastructure assets valued at more than $150 million, it is a challenge to maintain them with an income of just $26.57 million. Assets deteriorating faster than their maintenance and renewal can be funded creates an ‘infrastructure renewal gap’ . To bridge this gap, Council invested $6.29 million in infrastructure renewal works during the 2021/2022 year. Council’s asset renewal ratio which is measured by comparing asset renewal expenditure to depreciation (the reduction in the value of our assets over time, due in particular to wear and tear) was 139%. Council’s budget is focused on renewal expenditure as a priority and utilises grants for new assets and upgrades to assets.

Asset renewal ratio %

Stability and efficiency:

Council raises a wide range of revenues including rates, user fees, fines, grants and contributions. Despite this, Council’s rates concentration which compares rate revenue to total revenue was 34% for the 2021/2022 year which is below the expected target band of 40% - 80%. Council continues to advocate for additional grants and appreciates the State Government’s COVID recovery grants and increase in the Victorian Grants Commission Grant payment, as well as the Federal Government’s Local Roads and Community Infrastructure grants. Average residential rates per residential assessment for 2021/2022 was $1,111 which compares favourably to similar small rural councils.

Rates concentration ration %

Rates per residential assessment