8 minute read

Village Heritage Award

The fresh new Hotel Cashiers’ commitment to preserving the marvelous touches that’ve always beguiled its guests has earned it the coveted 2020 Village Heritage Award.

(L to R): Daniel Fletcher, Owner/ Operator Hotel Cashiers; John Barrow, Cashiers Historical Society Village Heritage Award Chair

The Cashiers Historical Society recently announced that the Hotel Cashiers is the recipient of the 2020 Village Heritage Award.

Presented annually by the Historical Society, the Village Heritage Award recognizes buildings that have been adapted for use as an active business and contribute to the vitality of the community. Awardwinning structures are those that best exemplify the village character of Cashiers. In announcing the Hotel Cashiers as this year’s winner, Village Heritage Award committee chair John Barrow noted that “the hotel is an excellent example of the ways in which creative entrepreneurs can preserve the charm and unique character of older structures in Cashiers while simultaneously providing much needed facilities featuring up-to date comforts and conveniences. The renovation of the hotel celebrates the past while successfully meeting the present day needs of its guests.”

The Hotel Cashiers exists because of the vision and determination of co-owners Brett Stewart and Daniel Fletcher. With backgrounds in the hospitality industry, Stuart and Fletcher recognized the need for additional lodging in Cashiers. In 2019, they purchased a well-situated but sleepy, old motel on the hillside overlooking Slabtown Road.

Instead of demolishing or radically altering the building, the new owners decided to preserve the original structures and integrate them with up-to-date, modern amenities.

They installed all new mechanical systems, added high internet connections to each room, completely redid the interiors, and refreshed the exterior and grounds, while maintaining the building’s historic character.

Older guests have commented that the establishment is reminiscent of the old motor courts that became popular in Western North Carolina in the 1940 and 1950s as highways began to connect scenic mountain communities with large metropolitan areas.

Kathleen Rivers, who nominated Hotel Cashiers for this award says, “I can think of no property that better showcases the mission of the Village Heritage Award – to restore rather than tear down an older property by bringing it up to date as a contributing member of the Cashiers business community. Hotel Cashiers is the kind of success story that makes our village proud.”

by Mary Jane McCall

LIFESTYLES & WELLNESS Pages 100-105

photo by Susan Renfro

marriage & meatloaf

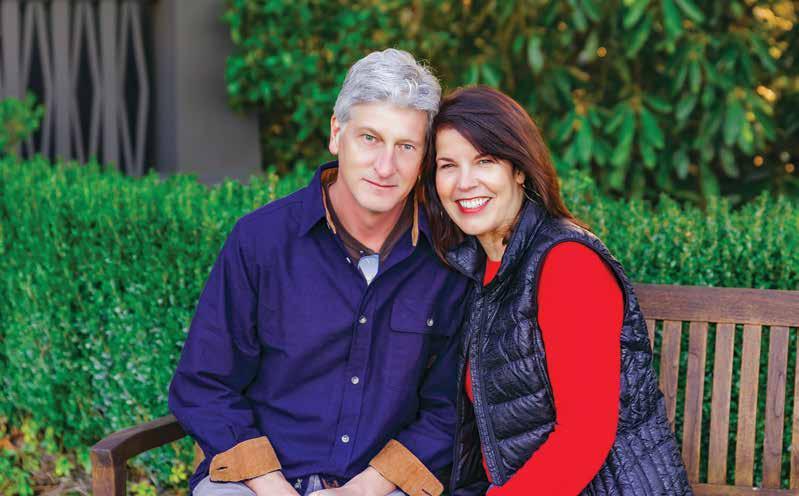

Thomas and Kay Craig

Though they were raised blocks apart, Kay and Thomas Craig took their time before they truly discovered one another. It’s a relationship made stronger by working together, working apart, and always, an abiding love.

The story of Kay and Thomas Craig’s marriage is the tale of a relationship that was years in the making, of becoming friends first and partners much later. Perhaps the bond between them that reveals itself upon meeting them is rooted in their common upbringing.

Kay and Thomas first met in eighth grade in Jackson, Mississippi. Thomas’ father, a contractor, had built Kay’s family home, their siblings were friends and they lived blocks apart in the same neighborhood.

Yet despite the physical and social connections, it would be nearly eight years before they would connect romantically – seeing each other only rarely through the middle and high school years.

In any case, Thomas left Jackson for Auburn and architecture, and Kay for Mississippi State and then SMU and studies in Fine Art and Art History.

During those early college years, they corresponded, but did not date. Then towards the end of their time away at university, Thomas invited Kay to a party at a home he worked on in Washington, DC.

That August they had their first date. Thomas was clearly smitten, the spark ignited at last. Whether it was as Thomas said, that Kay “looked great in a pair of jeans” or “was the only girl who would put up with his orneriness,” it was clearly the case that Kay was his ideal partner, “smart, great looking, and dark haired.”

They wed in 1988 following graduation and moved to Highlands.

Kay began work at the Highlands Decorating Center, helping with interior design and eventually getting into the cabinet business with the center’s owner.

Thomas got his contractor’s license, the beginning of a 20-year career in the construction business. Their son, Samuel was born in 1995 and their daughter Leah Grace in 2000.

In 2003 Thomas built the building that now houses The Ugly Dog and Kay moved her cabinet business to the Fourth Street location, sharing the space with other retail tenants. By the time the recession hit, and tenants vacated, Kay’s cabinet business had already moved to the upstairs of the building. As building and remodeling had come to a stand still, Kay suggested opening

photos by Susan Renfro

a pub. It took Kay about three months, and the advice of other restaurateurs, to talk Thomas into the idea.

Despite some warnings (and Thomas’ skepticism), they forged ahead and the Ugly Dog opened in 2010. As anyone who has ever visited Highlands knows, the restaurant has since become a mainstay of the city’s attractions, expanding and adding venues multiple times in the years since. Kay is the gregarious face of the “front of the house,” while Thomas ensures that everything is in its place and working – “if it can be fixed with a screwdriver, I’m your guy.”

Their marriage has flourished as well. Interviewed for this story, their monologues reveal what each love about the other, the secret to the success of a marriage that many consider to be a marvel of a longevity in an age of divorce,

“We’re best friends, we enjoy each other’s company and our children, have a lot of the same interests, and have a real understanding of each other’s strengths and weakness.”

Their words underscore the sentiments of violinist Itzhak Perlman, who famously compared marriage to meatloaf. “Both fall apart,” he said, “without the proper ingredients. A successful marriage has to do with the art of communication.’’

by Marlene Osteen

Time for New Year’s Financial Resolutions

Many of us probably felt that 2020 lasted a very long time. But now that 2021 is upon us, we can make a fresh start – and one way to do that is to make some New Year’s resolutions. Of course, you can make these resolutions for all parts of your life – physical, emotional, intellectual – but have you ever considered some financial resolutions?

Here are a few such resolutions to consider:

Don’t overreact to events. When the coronavirus pandemic hit in mid-February, the financial markets took a big hit. Many people, convinced that we were in for a prolonged slump, decided to take a “time out” and headed to the investment sidelines. But it didn’t take long for the markets to rally, rewarding those patient investors who stayed the course. Nothing is a certainty in the investment world, but the events of 2020 followed a familiar historical pattern: major crisis followed by market drop followed by strong recovery. The lesson for investors? Don’t overreact to today’s news – because tomorrow may look quite different.

Be prepared. At the beginning of 2020, nobody was anticipating a worldwide pandemic and its terrible consequences, both to individuals’ health and to their economic well-being. None of us can foretell the future, either, but we can be prepared, and one way to do so is by building an emergency fund. Ideally, such a fund should be kept in liquid, low-risk vehicles and contain at least six months’ worth of living expenses.

Focus on moves you can control. In response to pandemic-related economic pressures, some employers cut their matching contributions to 401(k) plans in 2020. Will some future event cause another such reduction? No one knows – and even if it happens, there’s probably nothing you can do about it. Instead of worrying about things you can’t control, focus on those you can. When it comes to your 401(k) or similar employer-sponsored retirement

plan, put in as much as you can afford this year, and if your salary goes up, increase your contribution.

Recognize your ability to build savings. During the pandemic, the personal savings rate shot up, hitting a record of 33% in April, according to the U.S. Bureau of Economy Analysis. It fell over the next several months, but still remained about twice as high as the rate of the past few years. Of course, much of this surge in Americans’ proclivity to save money was due to our lack of options for spending it, as the coronavirus caused either complete or partial shutdowns in physical retail establishments, as well as dining and entertainment venues. But if you did manage to boost your own personal savings when your spending was constrained, is it possible to remain a good saver when restrictions are lifted? Probably. And the greater your savings, the greater your financial freedoms – including the freedom to invest and freedom from excessive debt. When we reach a post-pandemic world, see if you can continue saving more than you did in previous years – and use your savings wisely.

These aren’t the only financial resolutions you can make – but following them may help you develop habits that could benefit you in 2021 and beyond.

This article was written by Edward Jones for use by your local Edward Jones Financial Advisor. Edward Jones, Member SIPC

Mary Beth Brody