19 minute read

Mid-1960s to 1990s

either were doing something good, or you had come out with something better. Electric Vehicle Associates of Cleveland, Ohio, is the best example of the first type. While their Renault 12 conversion and ElectroVan project with Chloride were interesting diversions, they are best known for their Change of Pace wagons and sedans built on AMC Pacer platforms. The Change of Pace four-passenger sedan weighed in at around 3,990 lbs., and used 20 Globe-Union 6-volt lead-acid batteries driving a DC motor via an SCR chopper to achieve 55 mph and a 53-mile range.

Jet Industries of Austin, Texas, once one of the largest and best of the independent EV manufacturers, was also the last to arrive on the scene. Jet’s most popular products were its ElectraVan 600 (based on a Subaru chassis) and 007 Coupe (based on a Dodge Omni chassis). It also offered larger eight-passenger vans and pickups. The 2,690-lb. ElectraVan 600 had a GE 20-hp or Prestolite 22-hp DC series motor, SCR controller, and 17 6-volt lead-acid batteries that could push it to 55 mph with a 100-mile range. Hundreds of ElectraVan 600s and 007 Coupes are prized possessions among Electric Auto Association members today, attesting to their outstanding quality and durability. Jet Industries, alas, is no more.

Needless to say, industry association support of independent EV manufacturers—at its zenith during the previous wave—moved to its nadir during this one. There were no longer any independent electric vehicle manufacturers to support.

Individual Conversions Continue

Individuals assisted by more and better everything during the last wave now had to make do with more modest resource levels. But EV conversions by individuals continued throughout this wave, albeit at a slower pace. The best news of the 1980s was that the resources of the 1970s could still be found and used. During this wave, individual converters still enjoyed relating their conversion experiences at regular Electric Auto Association meetings; they still pushed the outside of the speed and distance envelope at rallies and events; and they still reported high degrees of satisfaction with what they had done.

Mid-1960s to 1990s

This period marked a successively heightened awareness of problems with internal combustion vehicles. Smog problems of the mid-1960s made us aware we were polluting our environment and killing ourselves. Arab oil embargoes, shortages, and gluts of the 1970s, 1980s, and 1990s made us aware of our dependence on foreign oil. Nuclear and oil spill accidents of the 1970s and 1980s made us aware of the long-range consequences of our short-range energy decisions. The internal combustion engine and oil problems that started with a whimper in the mid-1960s turned into a groundswell of public opinion by the 1990s. The net result of new awareness in this period has been the reemergence of electric vehicles. When legislative action mandating zero emission vehicles in the 1990s forced rethinking of basic vehicle design, current technology applied to the EV concept emerged as the ideal solution.

Twilight of the Oil Gods

By the middle of the 1960s, many in government and industry around the globe became aware that something was very wrong with this picture. Although United States movement towards energy alternatives such as natural gas and nuclear fission (started decades earlier) was rapidly bringing new alternative capacity online, dependence on

oil was becoming worse, and smog and environmental issues began coming into the foreground. Passage of the Clean Air Act of 1968 was one result. The 1975 passage of a corporate average fuel economy (CAFE) standards bill was another. The problem was obvious to some, but most of the public chugged merrily along in their internal combustion–powered vehicles.

After the “first shock”—the Arab embargo that followed the October 1973 Yom Kippur War—everyone knew there was a problem. By cutting production 5 percent per month from September levels, and cutting an additional 5 percent each succeeding month until their price objectives were met, the Organization for Petroleum Exporting Countries (OPEC) effectively panicked, strangled, and subverted the industrialized nations of the world to their will. The panic was exacerbated by nations and oil companies scrambling for supplies on the world market, overbuying at any price to make sure they had enough, and consumers doing the same by waiting in lines to “top off their tanks” when weeks before they would have thought nothing of driving around with their gas gauges on empty. When the dust settled, the United States consumer, who had paid about $0.30 a gallon for all the gas he could get a few months earlier, now paid $1 a gallon or more at the height of the crisis, and waited in line to get a rationed amount. Figure 3-9 shows the drastic change.

How could it happen? Easy. The oil crises in 1951 (Iran’s shutdown of Abadan), 1956 (Egypt’s shutdown of Suez Canal), and 1967 (Arab embargo following June SixDay War) were effectively managed by joint government and oil industry redirection of surplus United States capacity. But by the early 1970s there was no longer any surplus capacity to redirect—the United States production peak of 11.3 million barrels of oil per day occurred in 1970. Up until the 1970s, the oil industry focused on restraining production to support prices. Collateral to this action, relatively low oil prices forced low investment and discovery rates, and import quotas kept a lid on supplies. But rising demand erased the need for production-restraint tactics and the surplus capacity along with it.

The “second shock” occurred after the Iranian oil strikes began in November 1978. Iran was the second largest oil producer, exporting 4.5 million barrels per day. The strikes reduced this to 1 million in mid-November, and exports ceased entirely by the

$100

$80

$60

$40 Nominal Real (in 2006 Dollars)

1861–1944: U.S Average 1945–1985: Arabian Light posted at Ras Tanura 1986–2006: Brent Spot Source: Energy Information Administration

$20

$0 1861 1871 1881 1891 1901 1911 1921 1931 1941 1951 1961 1971 1981 1991 2001

Figure 3-9 Oil prices from 1861–2006 (Source: Wikipedia—Created b y Michael Ströck, 2006. Released under the GFDL).

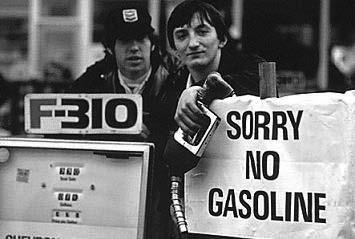

Figure 3-10 The oil embargo—not fun at all!

end of December. While loss of this supply was partially offset by other suppliers within OPEC, burgeoning TV-network coverage, simultaneously broadcast throughout the world, of the Shah’s mid-January 1979 departure and the Ayatollah Khomeini’s arrival (along with other internal Iranian events) convinced the world that Iran would never return to its pro-Western ways, and initiated a 1973-style hoarding and panic buying spree. What started as a 2 million barrel per day shortfall became 5 million barrels per day as governments, oil companies, and consumers scrambled for supplies. Hoarding at all levels exacerbated the problem, gas lines appeared again, and oil prices went from $13 to $34 a barrel (see Figure 3-10).

Although Iranian exports returned to the market by March 1979, the ill-timed Three Mile Island nuclear accident of March 28, 1979 further intensified the panic surrounding energy awareness, in addition to forever altering public opinion on nuclear power. Several other factors contributed to making the gasoline crisis that occurred during 1979 in most industrialized nations of the free world more severe than any previous crisis. Many refineries set up to process light Iranian crude could not deliver as much gasoline from the alternate heavier crude oil they were forced to accommodate. Uncooperative (and in some cases, conflicting) policies by federal, state, and local governments and oil companies disrupted the orderly distribution of the gasoline supplies that were available. The appearance of oil commodity traders, who could make huge profits on the play between the long-term contract and spot prices for oil, artificially bid up the price of spot oil in response to the prevailing buy-all-you-can-getat-any-price mentality. Lengthy gasoline lines and rationing interfered with all levels of business and personal life. By the time the Iran hostage crisis began, a state of anarchy existed in the world oil market that President Carter’s subsequent embargo of Iranian oil and freeze on Iranian assets did little to ease.

The “third shock” occurred in the opposite direction—prices went down. The selfcorrecting market forces that swing into action after any shortage or glut accomplished what the world leadership could not, this time with a vengeance. At the OPEC meeting of June 1980, the “official” price averaged $32 per barrel, but OPEC inventories were high, and approaching economic recession caused price and demand to fall in consuming

countries, further swelling their inventory surplus. When Iraq attacked Iran, one of the first steps in its war plan was to bomb the Abadan refinery (September 22, 1980). The net result after reprisals was that Iran oil exports were reduced during the war, but Iraq exports almost ceased. After Saudi Arabia raised prices from $32 to $34 a barrel in October 1981, an unprecedented boom was created, and drillers came out of the woodwork.

Earlier fears of shortage at the beginning of the 1920s and mid-1940s had ended in surplus and glut because rising prices had stimulated new technology and development of new areas. This pattern was repeated with $34 a barrel oil. High OPEC oil prices created a major non-OPEC production build-up in Mexico, Alaska, and the North Sea, as well as in Egypt, Malaysia, Angola, and China. Technological innovations improved exploration, production, and transportation. Meanwhile, demand was reversed by the economic recession, higher prices, government policies, and the growth of nuclear power and natural gas alternatives. Not only did the oil share of the world energy market decrease from 53 percent in 1978 to 43 percent by 1985, but conservation shrank the entire market as well—the 1975 United States CAFE legislation doubled auto fleet mileage to 27.5 miles per gallon by 1985, and this alone removed nearly 2 million barrels per day from the demand side of the world oil ledger. By 1985, the collapse in demand combined with the relentless build-up of non-OPEC supply (and everybody dumping inventory) reduced demand on OPEC by 13 million barrels per day. By the May 1985 Bonn economic summit, excess oil capacity around the world exceeded supply by 10 million barrels per day, the exact opposite of the 1979 situation, but twice as bad!

West Texas Intermediate crude on the futures market plummeted from its all-time high of $31.75 a barrel in November 1985 to $10 a barrel in only a few months. Some Persian Gulf cargoes sold for as little as $6 a barrel. The ensuing “buyers market” saw oil commodity traders sell oil to anyone at any price as spot prices plummeted and sellers scrambled to get out of their long-term contracts. By the time the dust settled and OPEC established a new “official” oil price of $18 in December 1986, consumers were again jubilant, and all fears of permanent oil shortage had been laid to rest. Meanwhile, the Chernobyl nuclear accident in April 1986 gave the now energy-aware public another boost of environmental awareness. The 1989 Exxon Valdez tanker accident in Alaska further heightened this awareness. As oil and internal combustion engine vehicles headed into the 1990s, they faced a tripartite alliance of issues: CAFE standards, environmental standards, and unstable supply dominated by foreign interests.

When the “fourth shock” occurred, the invasion of Kuwait by 100,000 Iraqi troops in August 1990, it removed both the Kuwait and Iraq oil supplies from the market and again sent oil prices climbing. Iraq’s Saddam Hussein had problems—his eight-year war with Iran and enormous weapons purchases had run him out of money, his oil production was in disarray, and his political popularity at home was potentially at risk. He needed money, oil, and a new external threat upon which to focus Iraqi citizens’ attention. Kuwait had money and oil and was conveniently located at the border. Hussein need only get assurances from the U.S. State Department that it would look the other way, and mock up a few sovereignty claims. (Iraq had claimed ownership of Kuwait before OPEC in 1961, right after Kuwait became independent of Britain, but in fact Kuwait’s origins go back to 1756, predating Iraq’s origin. Iraq was formed out of the three former provinces of the Turkish empire by the British in 1920.) Having taken care of both these steps, Saddam Hussein’s military might had no problem in quickly dispatching Kuwait’s defense and occupying it. Unfortunately for Saddam Hussein, he had stepped on the industrialized world’s oil jugular, the implied threat being first

Kuwait, then Saudi Arabia and the rest of the peninsula, and total domination of the world’s oil supply. Never before had the industrialized world acted so quickly (and in concert), and Iraq was dispatched in short order. Fortunately for Saddam Hussein, he remained to fight another day.

The Iraq-Kuwait war, 9/11, and now the new Iraq War and its aftermath brought the real priorities of all the industrialized world’s citizens, now linked together by realtime TV network news coverage, into clear focus. The supply of foreign (mainly Middle Eastern) oil that makes everything work is, and will continue to be, highly vulnerable. We are now in the fifth shock with oil costing over $140 a barrel! While the majority of earth’s citizenry continue to drive their internal combustion engine vehicles as if the supply of oil was secure and inexhaustible, fouling the air with pollutants and soiling the lands, rivers, and seas with toxic byproducts, more and more individuals are waking up. The stage is set for rising individual responsibility and the reemergence of the electric vehicle.

Electric Vehicles Rise Again

While electric vehicles of all kinds continued to be built in the United States and overseas during the 1920s through the 1950s, the resurgence of interest in EVs directly coincided with the environmental problems of 1960s, as well as the first, second, fourth, and fifth oil shocks. Unfortunately, the lull between these four waves—particularly the third oil shock glut—was equally responsible for retarding further EV development after each interest peak. What guarantees the lasting impact of the fourth wave are the following universal perceptions:

• The security of our oil sources is a serious problem affecting the whole world. • Our environment is at risk. • There is a real need to conserve our scarce planetary resources and nonrenewable fossil fuel supplies.

Thanks to the miracle of instant global TV and telecommunications, almost everyone in the industrialized world now knows this. The individual citizens of the advanced industrialized nations, nagged by the increasingly insistent urgings of their conscience, find it harder to conduct “business as usual” if it involves polluting the air, land, or water, or wasting a suddenly precious, precarious, and limited commodity, oil. The handwriting is on the wall. The heydays of gas-guzzling cars are gone forever, as are smoke-belching junkers. Even so, these beg the ultimate question—our proven oil reserves should last us 40 years, as shown in Chapter 2, but what then? Isn’t there a better way than oil today?

Of course there is: electric vehicles and renewable energy sources. But before EVs could reappear in quantity on our streets and highways, consumers had to believe in them, and companies had to believe they would be profitable to invest in. All this has taken time. Heading toward 2010, the momentum seems to be supporting electric drive as a potentially dominant technology, but there is still work to be done. This section will explore how the interaction of five diverse areas set the stage for EVs to rise again:

• Interest in electric vehicle speed records • Interest in electric vehicle distance records • Development of electric vehicle associations

• Development of U.S. legislation • Expansion into other electric drive technologies

The remainder of the chapter will explore how the four waves influenced the production history of EVs in the United States, Europe, and Japan.

Manufacturers, in response to growing public interest and awareness, gradually increased their own awareness of electric vehicle feasibility, and established a more open development climate. This fostered technological innovation and, fueled by global competition among United States, European, and Japanese companies, led to the actual rise of today’s modern, technically sophisticated electric vehicles.

Setting the Stage for Electric Vehicles

Even those not in the marketing profession know the power of word of mouth. People talk. They tell others about what they like and don’t like. In the automotive field, they talk about speed and distance records and automobiles. They go to gatherings to see what’s going on and read about the gatherings that they missed. When enough people get together and talk to the government about something, the government listens. Speed and distance records, associations, legislation, and events put EVs back on the map.

The Need for Speed

In Chapter 1 you read about the “speed myth” and learned that you can make electric vehicles go as fast as you want. Each step involved a bigger motor, more batteries, a better power-to-weight ratio, and a more streamlined design.

The very first land speed record of any kind was set by an electric vehicle in 1899 at 66 mph. In the same year the first speeding ticket awarded to any sort of vehicle went to a Manhattan electric cab zipping along at 12 mph. Just after the turn of the century, a Baker Electric went 104 mph.

After interest in electrics resumed, Autolite reached 138 mph in 1968, EaglePitcher bumped it to 152 mph in 1972, and Roger Hedlund’s “Battery Box” pushed it to its present 175 mph in 1974. In 1992, Satoru Sugiyama, in the Kenwood-sponsored “Clean Liner,” was going to try for 250 mph at the Bonneville Salt Flats, using a 650-hp motor Fuji Electric motor from a Japanese bullet train and 113 Panasonic lead-acid batteries. Unfortunately, a simple component failure prevented the first day’s run, and wind or weather wiped out the next six days of his Speed Week window.

When you consider that GM’s Impact dusted off a Mazda Miata and Nissan 300ZX in 0- to 60-mph standing-start races, there should be no question in your mind that today’s electric vehicles can go fast and get there quickly. If you have difficulty with the concept, remember that France’s T.G.V. electric train routinely goes 186 mph en route (it can go 223 mph) and the Swedish-built X2000 electric train rode the Washington, D.C. to New York corridor at 125 mph (it can go 155 mph) starting in early 1993. An electric train is nothing more than an electric vehicle on tracks (and with a long cord!). Meanwhile, no one is saying electric vehicles are wimpy in the speed department anymore.

The Need for Distance

You also heard the “range myth” debunked in Chapter 1; it’s possible to build EVs with ranges comparable to many traditional internal combustion vehicles.

• In 1900, a French B.G.S. Electric went 180 miles on a single battery charge. • A Nissan EV-4H truck went 308 miles on lead-acid batteries in the 1970s. • Horlacher Sport pushed that to 340 miles using Asea Brown Boveri sodiumsulfur batteries in 1992 and BAT International bumped it to 450 miles later in the year using proprietary batteries/electrolyte in a converted Geo Metro. The Horlacher averaged nearly 75 mph during its 10-hour test period, an impressive speed. The BAT Geo Metro was driven at a more sedate 35 mph.

There should also be no question in your mind that electric vehicles can go far. Given the fact that most Americans average less than nine miles a trip, and electricity is ubiquitous in most American urban areas, an electric vehicle is no more likely to run out of juice than an internal combustion vehicle would run out of gasoline, certainly less likely than running out of diesel or any of the new alternate fuels that aren’t carried in every filling station! The Need for Association

There were two types of associations started in this period: those for government and commercial interests, and those for individuals. The government/commercial types can be further divided into associations for sharing information (the British formed the first in 1934); associations for lobbying (like the Electric Vehicle Council, Electric Vehicle Development Corporation, and Electric Vehicle Association of the Americas, now known as the Electric Drive Transportation Association); and consortium associations for advancing research like the U.S. Advanced Battery Consortium and CALSTART.

Not all government/commercial associations for sharing information are created equal. The British association was very “loose,” but had the world’s largest EV population by the 1970s—approximately 150,000 vehicles of all kinds. The German Gesellschaft fur Electrischen Strassenzerkehr (GBR) clearinghouse, a subsidiary of their largest electric utility, was instrumental in focusing German EV efforts; and Japan’s Electric Vehicle Association, under the guidance of its Ministry of International Trade and Industry (MITI), gave them a definitive EV mission statement—focus on urban acceleration and range. In contrast to the earlier efforts of the British, and the focused EV efforts of the Germans and the Japanese in the 1970s, the United States didn’t have any focused industry effort until the USABC and CALSTART consortia of the 1990s.

Although individual members of the Electric Auto Association (formed in 1967) were a “voice in the wilderness” during this period, they made it increasingly difficult for people to say “it couldn’t be done” after they were already doing it.

The Need for U.S. Legislation

It is an enigma that we had the legislation (the U.S. government-funded National Aeronautics and Space Agency–guided Apollo program) to put an electric vehicle on the moon before we had the legislation to develop EVs on earth.

When the very first bills were being introduced in Congress in 1966 to sponsor electric vehicles as a means of reducing air pollution, government-funded contractors had Lunar Rover EV prototypes already working at their facilities. While the pros and cons of EVs were argued during various congressional hearings in the early 1970s, leading to the passage of the landmark Public Law 94-413, the Electric and Hybrid Vehicle Research, Development and Demonstration Act of 1976, Lunar Rover electric

Figure 3-11 Apollo 17 Lunar Rover vehicle on the moon with astronaut Eugene A. Ceman at the controls.

vehicles had already performed flawlessly on the moon during three separate 1971 and 1972 Apollo missions.

The Lunar Rover, shown in Figure 3-11, was optimized for light weight. It had four 0.25-hp series DC motors, one in each wheel, and woven wire wheels and aluminum frame that gave it a mere 462-lb. weight (which could carry a 1,606-lb. payload). Its silver-zinc nonrechargeable batteries gave it an adequate one-time 57-mile range and 8-mph speed. Future moon travellers only have to bring a new set of batteries with them—three Lunar Rovers are already there!

The point is, legislation and subsequent funding, along with the focus and emphasis provided by consolidating the major federal energy functions into one Cabinet-level Department of Energy in 1977, were vital components. Until these pieces were in place, EV development and renewal could not proceed.

But while the government-funded early ETV-I and ETV-II programs in 1977 provided the impetus to jumpstart electric vehicle activity again, it was clear that government legislation and funding amounted to the merest beginning, not the path for introducing electric vehicles in widespread numbers. The testimony of one General Motors executive at the June 1975 Congressional hearings drives home the point: “General Motors does not believe that much can be gained by subsidizing the sale of electric vehicles …we feel that building more electric vehicles is a waste of resources.”

Fifteen years later, the world’s largest automaker appeared to have had a turnaround in opinion (although it didn’t last for long in the early 2000s). An August 1991 Motor Trend article noted, “Among all the automakers, General Motors is by far the most vocal in support of the electric car as a real alternative in the U.S. market.”