89 minute read

Rural

The Canadian-designed, Nuhn Self Propelled Alley Vac, will help clean up The Shoalhaven The Shoalhaven is a step closer to cleaner farms and clean energy, with the arrival of Australia’s frst manure vacuum truck in Nowra.

The Canadian-built, Nuhn Self Propelled Alley Vac, will play a key role in the collection of manure from local dairy farms, for the $17 million Nowra Bioenergy Facility due to open in 2023.

Innovating Energy’s industrial scale bioenergy plant, will aggregate cow manure from 19 Nowra dairies, mixed with local food and organic waste, to generate renewable energy and produce nutrient rich fertiliser.

The plant will use innovative European technology to turn farm and food waste into biogas, or poo power, that will generate electricity that gets fed back into the grid.

Effuent collecting machines are widely used in North America and Europe, however, the Nowra dairy farms will be the frst to use the technology in Australia. Philip Horan, Founder Innovating Energy, said the Alley Vac is an integral part of their effuent management system and gives 19 dairy farmers the technology they need to collect as much manure as possible from their farms. Nicknamed the Poover, the Alley Vac is designed to vacuum up signifcant amounts of manure from milking and feed pad areas and concrete and hardstand areas, in a single pass. Giant blades manoeuver to follow the contours of uneven ground, a short wheelbase and four-wheel steer allows for a tight turning radius, and a full-length auger makes for fast unloading. The purchase of the Alley Vac was made possible by a $455,000 grant awarded by the Coles Nurture Fund last year. The Coles-funded grants program recognises small to medium businesses contributing to sustainable farming. Charlotte Rhodes, General Manager - Home Brand, Quality and Responsible Sourcing Coles, said Coles was delighted to fund the purchase of the Alley Vac. “At Coles we want to help to Australian farmers and food producers to drive sustainability and innovation, so when we heard about Innovating Energy’s plan to collect, transport and convert dairy effuent into electricity, we knew it was something we wanted to support with a grant from the Coles Nurture Fund,” Mrs Rhodes said. Member for Gilmore, Fiona Phillips MP, is also positive about the renewable energy project and said it was a real win for the Shoalhaven community.

“The ingenuity of local dairy farmers is on full display, and I am so proud to support this fantastic project,” Mrs Phillips said.

The Shoalhaven is one of the oldest dairying regions in the country and one of the fattest. When heavy rains hit, quite a lot of effuent can leach into the Shoalhaven River. When the plant is operational next year and the Alley Vac gets to work, the environmental benefts for the region will be signifcant.

“The dairy farmers feel strongly about their environmental responsibilities and were impressed by the proposed facility’s green credentials and the benefts of the biogas plant for the community,” Mr Horan said.

“One of the things the farmers really understood about this project, is that it’ll greatly contribute to an environmental clean-up of their farms. They’ll drastically reduce their CO2 emissions and wastewater pollution,”

“The facility will produce a constant 2.2 megawatts of clean, green energy from the outset, with zero emissions. That’s enough to power 20,000 homes. Unlike renewable energy from wind and solar, the plant will generate baseload green energy 24/7, 365 days a year, ”

“And the output will increase to 3.3 megawatts in time.” he said.

Mr Horan said some of the produced power will be sold to the participating dairy farmers at a reduced rate, which will cut their power bills and slash farm overheads. The rest will be sold to the grid for the community to buy at competitive market rates.

The farmers will also enjoy free nutrient-rich fertiliser: a by-product of biogas production. “We’re also going to see 30,000 tonnes of green waste saved from landfll,” Mr Horan said. “We need organic food waste and farm waste to create biogas, which means local supermarkets, clubs, pubs and processing companies will play their part in the plant’s production of clean energy.” The facility will be built at the former Nowra Wastewater Treatment Plant site in Terara, just outside Nowra, and operations will be fully enclosed, which means no noise and no odours.

“Which is great news for residents.” Mr Horan said.

Innovating Energy has lodged an Environmental Impact Statement and is planning to start groundworks once fnal approval is granted.

CONTACT US - The Northern Rivers Times Rural Edition ✆ 1300 679 787

SALES 02 6662 6222 sales@nrtimes.com.au ✆ Albury - 02 6080 9520, Casino - 02 6662 6222, Dubbo - 02 5858 4078, Grafton - 02 5632 3041, Moree - 02 6794 3889, Tamworth - 02 5719 1656, Wagga Wagga - 02 5940 8516 Directors, co-owners and co-founders: Jeffrey Gibbs (jeff@heartlandmedia.com.au) and Sharon Bateman (sharon@heartlandmedia.com.au) ISSN: 2652-7928 a Heartland Media company ABN: 84 134 238 181 All rights reserved © 2022 Distribution Coffs Harbour north to Southport and west to Tenterfield weekly.

Farmers applaud NSW clean storage announcement

Farmers for Climate Action has welcomed news the NSW Government will invest $44.8 million into fve new pumped hydro projects across NSW.

Farmers for Climate Action CEO Fiona Davis said the race was on to create regional jobs by building clean energy and storage to replace ageing coal power stations being closed by their owners.

“The NSW Government says these fve pumped hydro projects will create 2300 jobs and add a whopping 1.7 gigawatts of vital long duration storage,” Dr Davis said.

“FCA welcomes investment in projects which create regional jobs while reducing reliance on fossil fuels. Lithgow, Muswellbrook, Yetholme, Wollomombi, and Bowral look to be big jobs winners from this investment.

“We look forward to more announcements of this kind in other states and territories, and more regional jobs created by investment in clean energy.”

Shuttle stallion elite touch down in Australia

An elite stable of dedicated Post Entry Quarantine offcers is ensuring some of the world’s most valuable shuttle stallions are happy, healthy – and won’t pose a biosecurity risk while on stud duties in Australia. The 55 horses – hailing from Europe, Japan, the USA and Canada, and worth a combined $450 million – have touched down in Australia for the Southern Hemisphere Thoroughbred breeding season.

Head of Biosecurity at the Department of Agriculture, Fisheries and Forestry, Dr Chris Locke said despite how famous or valuable these horses are, they still need to adhere to strict biosecurity requirements. “They will stay in our Post-Entry Quarantine (PEQ) facility at Mickleham for a minimum of 14-days under the watchful eye of our caring and committed PEQ staff,” Dr Locke said. “While there, they are tested for horse diseases that Australia is offcially free from including equine infuenza. “The import of these horses is another example of how our biosecurity system helps manage potential risks associated with animal imports, and why the work of our PEQ staff is so important.”

Fast Facts: A few of the horses are destined to the famous studs in NSW’s Hunter region, with others heading off to studs in Victoria and QLD. The horses are referred to as shuttle stallions, as they are ‘shuttled’ between the northern and southern hemispheres to align with the relevant breeding season. On average, a Thoroughbred stallion will cover between 150 and 200 mares per breeding season. Many stallions have a dedicated groom that travels with them on

the fight to Australia

and continues to care for them at each destination while in Australia. These grooms will

then fy out with the

stallions when they return overseas for the northern hemisphere breeding season in January 2023. All stallions have a ‘tail’ to tell through race track performances and historical family bloodlines.

Heightened Alert for BioSecurity risks in Livestock Industries

The presence of footand-mouth disease and Lumpy Skin Disease in Indonesia has put Australia on heightened alert for the risk of an incursion into Australia. Australia is free of both diseases, and since their appearance, Indonesia is making good progress on getting them under control. However, if an outbreak of either were to occur in Australia, the economic consequences for livestock production and exports could be severe.

An outbreak would jeopardise the export of many (if not all) livestock and livestock products, at least in the short-term. Australia’s biosecurity system continues to keep out both diseases and is actively monitoring the situation in Indonesia.

These risks and their consequences highlight the importance of Australia’s biosecurity system, as well as compliance with good biosecurity practices, in protecting agricultural industries from damaging pests and diseases.

Australian Dollar to weaken 2022-23

In 2022–23 the Australian dollar is assumed to average US70 cents, a depreciation of 3% from the US73 cents averaged in 2021–22. A lower Australian dollar will increase the competitiveness of Australia’s agricultural exports in international markets.

The value of the Australian dollar has depreciated in recent months, from an average of US74 cents in April to US69 cents in July. This refects a broad strengthening of the US dollar in response to rapid interest rate rises by the US Federal Reserve. Rising interest rates increased the demand for US dollars due to investors seeking higher returns on US interest-bearing assets.

The magnitude of this demand increase for US dollars in recent months has more than offset higher prices for Australian commodity exports and caused the Australian dollar to depreciate. In 2022–23, Australian commodity export prices are expected to decline due to the assumed slowdown in Chinese construction. Slower growth in China’s real estate sector will cause an easing of Australia’s terms of trade and decrease the demand for Australian dollars.

RECENT CATTLE MARKET REPORTS

CASINO

NRLX Market Report Week Ending Friday 9 September

Agents yarded a total of 1,122 head at the Northern Rivers Livestock Exchange regular prime sale on Wednesday 7 September. With the return to fne weather, restockers were very active on the quality lines of vealer steers and heifers on offer. Regular processors and feeder buyers were also in attendance. Heavy cows sold to rates similar to last week with processors also very active on the heavy bulls penned.

Cow prices were slightly stronger this week averaging 339c/kg and reaching a top price of 546c/kg. Heifer prices saw an increase with lighter stock up to 250kg averaging 564c/kg and topping their category at 688c/kg. Heavier heifers over 250kg averaged 463c/kg and reached a top of 592c/kg.

Bull prices also increased this week with 28 head sold averaging 342c/kg and 675kg. Steer prices were stronger with lighter steers up to 250kg averaging 649c/kg and reaching a top of 780c/ kg. Heavier steers over 250kg averaged 531c/kg and topped their market at 712c/ kg.

Light vealer prices saw an increase this week with those up to 250kg averaging 621c/kg and reaching a top of 788c/kg. Heavier vealer over 250kg were easier averaging 442c/kg with a top price of 634c/kg.

T&W McCormack and Ramsey & Bulmer held a joint store sale at the NRLX on Friday 9 September with 1,666 head going under the hammer. Steers topped their category at 868c/ kg and averaged 614c/kg and 244kg whilst heifers reached a top of 694c/kg and averaged 518c/kg and 230kg. Cows reached a top price of $2,225 whilst Cows & Calves topped their market at $2,925.

Ray White Rural will hold a store sale this Friday 16 September. Bookings are welcome.

WARWICK

LIVESTOCK MARKETS WARWICK SALES W/E 9/09/2022

The weather again impacted on volume for the weekly livestock sales, fall of up to 2 inches meant many producers and transport operators had diffculty accessing stock and yards. Cattle numbers were down to just under 400 with the sheep and lamb numbers rising to 1724 mainly with the numbers drawn from further districts which were not as affected as local producers. The exporters and local processors kept the markets on a par with all looking to fll orders.

Vealer steers averaged 534.2c/kg topping at 600c/kg or $1173.17 to $1639.55 Vealer heifers averaged 472c/kg topping at 638.2c/kg or $1130.33 to $1887.50

Feeder steers averaged 473.2c/kg topping at 590.2c/kg or $1980.65 to $2200.00

Feeder heifers averaged 449.5c/kg topping at 470c/kg or $1865.48 to $2084.81

Yearling steers averaged 547.6c/kg topping at 632.2c/kg or $1698.15 to $2175.01

MCDOUGALL AND SONS SHEEP & LAMB REPORT

Agents today yarded 1724 head for the weekly sale with some good runs of lambs from the South West as well as local and Eastern vendors making the run to the sale. The export lambs were keenly fought for as well as the breeding lambs and the light trade lambs. Mutton was a bit frmer, and the ram market was frm for the fnished article or breeder. Lambs topped at $198 to average $145.65($11up), hoggets topped at $201 to average $149.42($38up), ewes topped at $164 to average $96.04($18down), wethers topped at $145($56up), rams topped at $172 to average $132($17up), lamb rams topped at $170 to average $86.60($51down), ewe lambs topped at $198 to average $178.84. The yarding averaged $141.27 across the board, up by $12/head average compared to last sale. Giltrow Family sold Dorper ewe lambs 66.25kg to Thomas Foods for $197, 57.85kg to Eversons for $183, 60.3kg to Thomas Foods for $183, 53.09kg to restockers for $185, 63.3kg wether lambs to Thomas Foods for $186, 56.4kg to Eversons for $176, 51.25kg to Take It Easy Meats for $184, 63.5kg hoggets to Eversons for $150, ewe hoggets to Lackland P/L for $201 George Moore sold 51.9kg Merino lambs to Gr Prime for $150, 45.5kg to Gr Prime for $137, 55kg hoggets to Eversons for $133 Barry Hunter sold full wool Xb wethers to Eversons for $145, rams to Whites Trading for $128 Wayne & Jodie Frank sold Dorper x lambs 53kg to Jock Young for $182

Yearling heifers averaged 487.3c/kg topping at 520.2c/kg or $1613.45 to $2080.17

Steers averaged 408.4c/kg topping at 498.2c/kg or $1894.39 to $2621.97 Heifers averaged 380c/kg topping at 438.2c/kg or $1912.09 to $2881.44

Manufacturing steers averaged 354.6c/ kg topping at 410c/kg or $1972.51 to $2275.50

Cows averaged 349.7c/kg topping at 404.2c/kg or $1999.42 to $2998.74

Bulls averaged 335.6c/kg topping at 427.2c/kg or $2241.24 to $3575.99

Lambs topped at $198 to average $145.65 up $11/head

Hoggets topped at $201 to average $149.92 up $38/head

Ewes topped at $164 to average $96.04 down $18/head

Wethers topped at $145 to average

Melrose Station sold Dorper x lambs 37.14kg to Luck Meats for $149

Rory & Kathy Frost sold Dorper lambs 44kg to Jock Young for $179

Daryl Martin sold Dorper lambs 37.5kg to GR Prime for $130, ewe lambs 38.1kg to Gr Prime for $126, 67.5kg hoggets and 4tooth ewes to Eversons for $164

Rangemore Estate sold Dorper x lambs 47.5kg to Uniplaza Meats for $151, hoggets 52.5kg to Uniplaza Meats for $169 Larry & Shirley Hill sold Dorper lambs 47.5kg to Jock Young for $160, 40.25kg to Jock Young for $142, 33.3kg to Mark Palmer for $100

$126.88 up $56/head

Rams topped at $172 to average $132 up $17/head

Lamb rams topped at $170 to average $86.60 down $51/head

Ewe lamb topped at $198 to average $178.84

The yarding of 1724 head averaged $141.27 a rise of $12/head

Sows sold from $150 to $315, Boars sold from $155 to $260, L/Pork sold from $105 to $147, Stores from $89 to $165, Groups of goslings sold to $62.50, groups of chicks to $40, ducklings to $45, hens to $4, roosters to $20, Ducks to $17.50, Turkeys to $30

Parsons Family sold Merino wethers 1/4 wool to Eversons for $125

Coolmunda P/S sold cfa Merino ewes to GR Prime for $70

David Turvey sold 65.2kg White Suffolk ewe lambs to restockers for $198

Banaba Past Co sold Xbred lambs off crop 63kg to Thomas Foods for $190, 58.7kg to Warwick Meats for $183, 57kg to Eversons for $180, 52kg to Warwick Meats for $170

There would be a large price response to FMD in Domestic Markets

In the event of an outbreak exporters would suddenly be unable to sell livestock products in most, if not all international markets. There would be an immediate and large increase in the supply of livestock products to domestic markets. Australia exports around three-quarters of its livestock products which would mean the existing domestic market would be unable to absorb the increased supply, particularly in the short term. Even in the case of a small, localised outbreak, if all the beef currently destined for export markets was diverted to the domestic market, it would represent an increase of 270% in the volume currently supplied to the domestic market.

After initial shortages caused by restricted movement of livestock products domestically, the result could be a substantial fall in the domestic farmgate price of livestock and the retail price of meat. The domestic farmgate price of cattle and sheep would be expected to fall substantially over the frst few months of an outbreak. Prices could fuctuate rapidly and change as participants in the supply chain adjusted their production decisions.

The short-term oversupply of meat in the domestic market and resulting price reductions would be moderated to the extent that producers hold back livestock from slaughter. Producers would likely respond differently to such a large price fall, with decisions to hold or sell their livestock depending on a number of factors. These factors include pasture and feed availability, meat processing capacity and access, the size and nature of herd and focks, availability of transportation, the willingness of producers to sell their products at reduced prices and expectations of how quickly market access might be restored.

After the price shock in the frst few months, and once producers had started to respond to the

New iPhone’s ‘lifesaving’ feature good news for the bush

NSW Farmers says satellite emergency connectivity on the new iPhones could save lives in the bush if it gets rolled out in Australia.

The new feature, which Apple says will allow users to send preset “SOS” messages to emergency services using direct satellite connections, would partly solve a major issue for rural and remote communities.

At present, large parts of NSW have limited or no mobile phone reception, meaning anyone who runs into trouble or has an accident is unable to call for help without dedicated equipment.

The rollout of this feature on new mobile phones would eventually put safety in more pockets across the country, NSW Farmers Rural Affairs committee chair Deb Charlton said.

“While this won’t help us deal with the issue of data connectivity or being able to run your business from the paddock, this promises to be a major step forward for safety,” Mrs Charlton said.

“Of course we will continue to advocate for improved mobile phone coverage for farmers and rural communities, because it is a major factor holding country businesses back.

“But what this new feature means is that even if you’re stuck without a signal and a long way from help, you’ll be able to tell someone where you are, and that’s a good thing.”

At present, the Emergency SOS via satellite capability will only be available in the United States and Canada, but Mrs Charlton said she hoped to see that expand around the globe, and onto more devices.

“Like any new technology it won’t be available everywhere, and it won’t be cheap – the price of the new iPhone 14 starts at $1399,” Mrs Charlton said.

“But what we’ve seen in the past with safety technology like seatbelts is they become more common, other manufacturers adopt them, and eventually they’re a regular feature.

“For a great big land like Australia, being able to call for help when you’re out of coo-ee will be a gamechanger.” oversupply, the domestic price would be expected to increase from the low resulting from the shock. As turn-off of cattle and sheep decreases and production falls, the price of meat would begin increase depending on how much confdence producers in unaffected areas have of regaining at least some market access quickly. The greater the confdence, the more they will hold onto livestock. While the price would increase, it would remain below what it would have otherwise been with no incursion. ABARES modelling from 2013 modelled two small outbreak scenarios which estimated that 12 months after the incursion the price to be 12-16% lower than it would have been otherwise, under relatively favourable timelines for restored market access.

While pigs are also susceptible to FMD, there would be less of a direct impact to the supply of pig meat in the Australian market, as Australia exports less than 8% on average of what it produces. Similarly, only around 3% of chickens, which are not susceptible, are exported on average. The price impacts of these products are uncertain. Notwithstanding the potential for supply chain constraints caused by restricted movement of livestock to cause some localised shortages, the price of pig meat and chicken meat could fall, as consumers substitute to lower-priced beef and sheep meat. However, if consumers instead seek to buy more of other sources of protein, prices could instead rise.

Other livestock products would also be affected, however, there may be a different dynamic to how markets respond. For example, wool would be affected by export market access issues, as it is largely sold into international markets. Very little shorn wool is sold into the domestic market. Wool producers would have the option to consider storing wool until access to international markets are restored.

INDEPENDENT REPORT BACKS FLOODPLAIN HARVESTING MODELS

An independent peer-reviewed report commissioned by the Murray Darling Basin Authority has confrmed the accuracy of the NSW Government modelling used for foodplain harvesting laws.

Minister for Lands and Water Kevin Anderson welcomed the report and further evidence validating the State’s data.

“The NSW Government’s foodplain harvesting policy is the biggest environmental reform in this area we have ever seen. This reform will strengthen protection for the environment and downstream water users,” Mr Anderson said.

“When it comes to managing water in NSW my view is healthy rivers, healthy farms and healthy communities. This report from independent experts shows we’re on the right track.

“It is encouraging to see this report confrms that water being licensed is within existing legal limits. The NSW Government models have been independently scrutinised and verifed many times over and the fact remains our modelling is accurate.”

The new report is the most recent review in a long series dating back to 2009, which have been conducted by independent specialists in water industry reform, policy development and modelling.

“The report found our models are valid, scientifcally rigorous and underpinned by the best available data,” Mr Anderson said.

“They ensure licensed foodplain harvesting water take will be restricted where necessary to ensure total diversions are less than the established legal limits, including the cap.

“This reform will beneft water users, downstream communities, and the environment, with up to 100 billion litres of water to be returned to the foodplains in the northern river valleys each year.”

OFFICIAL

OFFICIAL

Floodplain harvesting licences have already been issued for the Border River and Gwydir valleys, with licences for the Macquarie, Barwon-Darling, and Namoi valleys to be determined later this year and in early 2023.

For more information on the NSW Government’s foodplain harvesting policy, visit: https://

www.industry.nsw. gov.au/water/plansprograms/healthy-

foodplains-project/ nsw-foodplain-

harvesting-policy.

To read the independent report, visit the MDBA’s website here: https://

www.mdba.gov. au/publications/ independent-reports/ independent-reviewsproposed-new-southwales-baselinediversion

Making jackfruit jump off the supermarket shelves

Australian jackfruit is a tropical treasure: a fruit rich in vitamins, minerals and many phytochemicals that are known to have positive health benefts, and it is incredibly versatile in its culinary uses.

When ripe, its sweet fruit segments are akin to the tropical tastes of banana, mango, and pineapple and when unripe, its stringy texture is known to be a healthy meat substitute increasingly popular in western cuisine.

And yet, jackfruit remains an underutilised food source in Australia perhaps due to its spiky exterior, rock hard rind and cumbersome size; a jackfruit can weigh up to 50 kilos and is the world’s largest tree-grown fruit. With transportation and labour costs high in Australia, jackfruit production which is predominantly located in the Northern Territory and Far North Queensland, has plateaued in recent years. However, new research has indicated that the industry has the potential to grow signifcantly with forecasts of production of $5 -$10 million by 2025.

In a project funded by AgriFutures Australia as part of its Emerging Industries Program and in conjunction with the Northern Territory Government’s Department of Industry, Tourism and Trade, Monash Food Innovation were commissioned to pull jackfruit apart and explore how the industry can drive more consumer demand for the versatile but largely unfamiliar fruit - to fnd ways to process jackfruit into ready-to-eat products and ingredients and make jackfruit jump off the supermarket shelves.

“Results suggest that Australians are interested in consuming more jackfruit products, due to its high nutritional value and favour, but a big barrier is the availability of products outside growing regions in northern Australia. There are many opportunities for the Australian jackfruit market to capitalise on the development of new products and to help grow the emerging industry,” says lead researcher, Dr Leonie van ’t Hag from the Department of Chemical and Biological Engineering at Monash University.

The multidisciplinary project team from Monash Food Innovation, the Department of Chemical and Biological Engineering and the Monash Business School used innovation methodologies to develop and evaluate new jackfruit products.

Their fndings have now been released in a report Processing jackfruit into ready-to-eat products and ingredients published by AgriFutures Australia which outlines the market opportunities for the industry to grow in Australia.

Over one thousand consumers were engaged in testing and evaluating jackfruit to determine new consumer applications, the potential to utilise greener fruit with the skin and seeds as by-product, and diverse processing applications for different stages of the fruit’s maturity. This included sensory evaluations, based on sense of taste, smell, texture/feel and sight.

Further research has also helped understand how crop genetics and market capitalisation can grow the jackfruit industry and overcome the current supply chain challenges.

Dr Leonie van ’t Hag from the Department of Chemical and Biological Engineering says the results showed that processed jackfruit could be introduced to consumers through familiar formats and new ideas including snacking, treats, meat alternatives, home cooking and restaurants, as well as quick and easy meals.

“Jackfruit has so many benefts; it is high in fbre, minerals such as calcium, phosphorus and magnesium, and it is a good source of vitamin A, B1 and B2,” Dr van ’t Hag says.

“Compared to other tropical fruits the protein content in the seed and young fruit is high. It is a good source of Lysine, an amino acid that vegetarians and vegans can struggle to obtain in their diet. Research also suggests that jackfruit has many classes of phytochemicals that have anti-cancer, anti-hypertensive, anti-ulcer, and anti-ageing properties.”

Jackfruit grows abundantly in South and South East Asia but unless it gets processed it doesn’t have much market value due to the large size of the fruits. This is replicated in northern Australia where the costs of labour and transport are high.

“Jackfruit is a nutritious fruit, and it is evident that novel processing techniques could appeal to consumers and ensure the industry can maximise its value for production,” says Dr Olivia Reynolds from Agrifutures.

The estimated gross value of production of the Australian jackfruit industry is currently $2.6 million. The research has found that if a quarter of this supply was diverted to processing, an estimated $3.3 million of value would be added each year from existing production.

The Department of Industry, Tourism and Trade’s Director of Plant Industries, Dr Muhammad Sohail Mazhar, says there are opportunities to increase the demand for jackfruit and grow the industry over the next decade.

“Through this research project, we aimed to support Northern Territory growers who are planting clonal varieties of jackfruit suitable for processing over the next 5 years. As these trees reach maturity over the next 45 years, there will be an increase in demand for jackfruit species which can be diverted into processing activities. This has the potential to substantially boost the jackfruit industry in the Northern Territory and Australia.”

Cedardale Park Pet Pet Crematorium Crematorium

Personalised, Individual Pet Cremations

Please feel free to phone Andrew Pittaway at Cedardale Park on 02 6688 8304 www.cedardalepetcremation.com.au

As veg prices fall by 60, 70 and even 90 per cent, Harris Farm Markets proves great food doesn’t have to literally cost the earth

Harris Farm Brothers As the sky high prices for vegetables in Australia tumble by 60, 70 % or even up to 90% as the effects of the foods subsides, Harris Farm Markets Co-CEO Tristan Harris predicts further savings over Spring due to the company’s commitment to Best in Region by Best in Season.

“This is where seizing what’s in season, and local, shows up in real savings at the cash register,” he said.

“Lettuce for example, has gone from $10 to $3, representing a 70% decease; Silverbeet has gone from $8 to $3 meaning it is over 60% lower; beans from $40 to $3, over 90% lower; corn has dropped from $4 to $1.50, a saving of over 60% and Broccoli has gone from $12 to $3, representing a 75% saving. This is all a result of Harris Farm championing what’s in season, and it’s the best way to do business,” he said.

“There is also value in mushrooms, herbs, strawberries & sweet delight tomatoes amongst others, with food impacted areas such as the Sydney basin now fush with great quality crops. It’s time to support these growers who have had a really tough time.”

“We anticipate even more price relief over coming weeks.”

“Our guiding principle is that when nature gives us more, our customers will pay less; when it’s in season, we seize it; we give a fair go to those who grow, and for that wonderful range of bumpy veg (imperfect picks), we bump down the price. This has always been our commitment, it’s not new, but it is important we educate people, because the providence of produce matters.”

He said transparency in 2022 was important.

“In an increasingly hyper-sensitive pricedriven economy, we want to show the ‘how’ and ‘why’ behind our products and their pricing, and to encourage customers to embrace value, with values.

“There’s a difference between buying an avocado from Harris Farm Markets and buying one anywhere else. It’s the same difference in buying eggs… The difference is that Harris Farm Markets maintains a very real commitment to the farmers and producers behind our shelves of fruit and veg, and a promise that low costs aren’t provided at all cost, because ultimately that cost will be to the farmer.”

He continued: “Why are sweet delight tomatoes great value this month? Because there’s a bumper crop. Why are these carrot cheaper than usual? Because there’s loads with delicious bumpy bits but they are just as perfect on the inside. Why is our fresh guacamole affordable and delicious? Because we bumped out the middleman and make it ourselves with a tonne of love and the best avos in the country (from Toowoomba BTW),” he said.

“Treating farmers fairly is a no-brainer for us. Our suppliers aren’t strangers – they’re our partners. We expect a lot from them, so a fair go is the least we owe.”

“We know what it takes to grow a great crop, raise a happy herd or develop a new product that reduces waste. It’s these relationships that make it possible for us bring you the best that nature has to offer at a price that’s fair for all. That’s value with values.”

“For example, to the farmers whose crops we buy in full, we are unique in that we offer a ‘total crop solution’. Rather than buying just the largest or prettiest produce, we buy the lot – every piece of fruit off the tree, or veg in the ground as we do with avocados from Toowoomba Balmoral Orchards,

“This way our farmers don’t get stuck with half a harvest that they can’t sell. Yes, it makes it harder for us to manage but it’s the right thing to do, by farmers and by the environment.”

He said their focus on animal welfare and ethical farming practices had not waned, in fact was increasing.

“Harris Farm Markets has not sold a cage chicken egg in the last fve years – something we are very proud of and happy to celebrate – and we love working with farms like the family-run Pirovic Farm on the NSW Central Coast, our supplier since 1982!!

Harris Farm Markets continues to shine the light on Imperfect Picks.

“Imperfect Picks is Harris Farm Markets’ seasonal range of fruit and vegetables that might not look perfect from the outside but are as full of favour as ever on the inside,” said Harris. “Our Imperfect Picks program helps reduce the astonishing statistics that *25 per cent of Australian crops currently never leave the farm gate because they are a bit, well, unattractive, and do not meet the visual specifcations of some supermarkets and consumers.”

“It means that every time you buy an Imperfect Pick, you are helping us take more from our farmers, you are helping reduce food wastage, and importantly, you are saving up to 50 per cent!”

“In the past six years we have saved more than 28 million kilograms of fruit and vegetables from going to landfll as a result of our Imperfect Picks range. This equates to approximately 100,000kg of perfectly good fruit and vegies per week. At each store and at our online shop, we have doubled the Imperfect Picks range which gives Aussie shoppers a wider variety of products to select from and makes a huge impact in preventing food waste.”

He said he was immensely proud of the community work done, especially over the past few months.

It’s been a tough time; the pandemic was devastating and then foods wiped out whole areas our customers and farmers call home.

“Because we can, we did. During the pandemic we were giving away 1,000 boxes of fruit & veg a day to vulnerable people who couldn’t’ come to our shops. This year’s infationary pressures has seen us continue to donate pallets of fresh vegies every week to Ignite store in western Sydney, and pallets of vegies to Ukrainian refugees.”

“During the foods in the Northern Rivers we donated truck loads of vegies to the people of Mullumbimby and Lismore and delivered fresh fruit to Brisbane’s food army. Being a business doesn’t stop us being human. This is what Value with Values is all about.”

WHAT’S IN SEASON THIS WEEK:

• Berries are inseason! Blueberry crops from northern NSW and Queensland are increasing and prices are starting to ease. • Queensland strawberries are fully favoured and the weather remains. • All citrus is well supplied, as are apples and pears. • Navels are now at their best and keeping well. • There is an excellent line of Kanzis Applies in store this week. • Vegies are the real winner as earlier food impacted crops are now starting to fush, especially in the Sydney Basin. Tomatoes, lettuce, zucchini, imperfect eggplant, midi cos lettuce and broccoli are all stand outs.

PERSONAL IMPORTS OF MEAT BANNED IN FMD CRACKDOWN

The Australian Government has banned the importation of meat products for personal use from all countries with foot and mouth disease (FMD).

The Minister for Agriculture, Fisheries and Forestry, Murray Watt said the new restrictions, which came into effect from midnight, were the next step in the Government’s strong, three-pronged approach to tackling FMD.

“While Australia remains FMD-free, we must remain vigilant to biosecurity threats from overseas,” Minister Watt said.

“Under existing rules, no animals or animal products are allowed into Australia unless they meet our strict biosecurity requirements.

“When FMD was frst detected in Indonesia, the Department of Agriculture tightened the rules for commercial imports of FMD-risk products from Indonesia.

“Then, when the outbreak reached Bali, the Albanese Government moved swiftly to increase the screening of all products arriving from Indonesia via mail.

“But prior to these new changes, private citizens were able to bring in some highly processed meat products for personal use – products like pâté, pork crackling or meat foss.

“With the ongoing spread of diseases like FMD and lumpy skin disease, I asked my department to review our import settings for risk products from all countries with FMD, not just Indonesia.”

Minister Watt said while FMD had been endemic in countries around the world for decades, this was the frst time such strong measures had been enforced.

“The former Government did not take this action in response to previous overseas outbreaks, but after considering the evidence, we are not prepared to accept this risk,” he said.

“Biosecurity is everyone’s responsibility, and together we can all do our bit to keep Australia pest and disease free.”

High infation for food and inputs clouding outlook

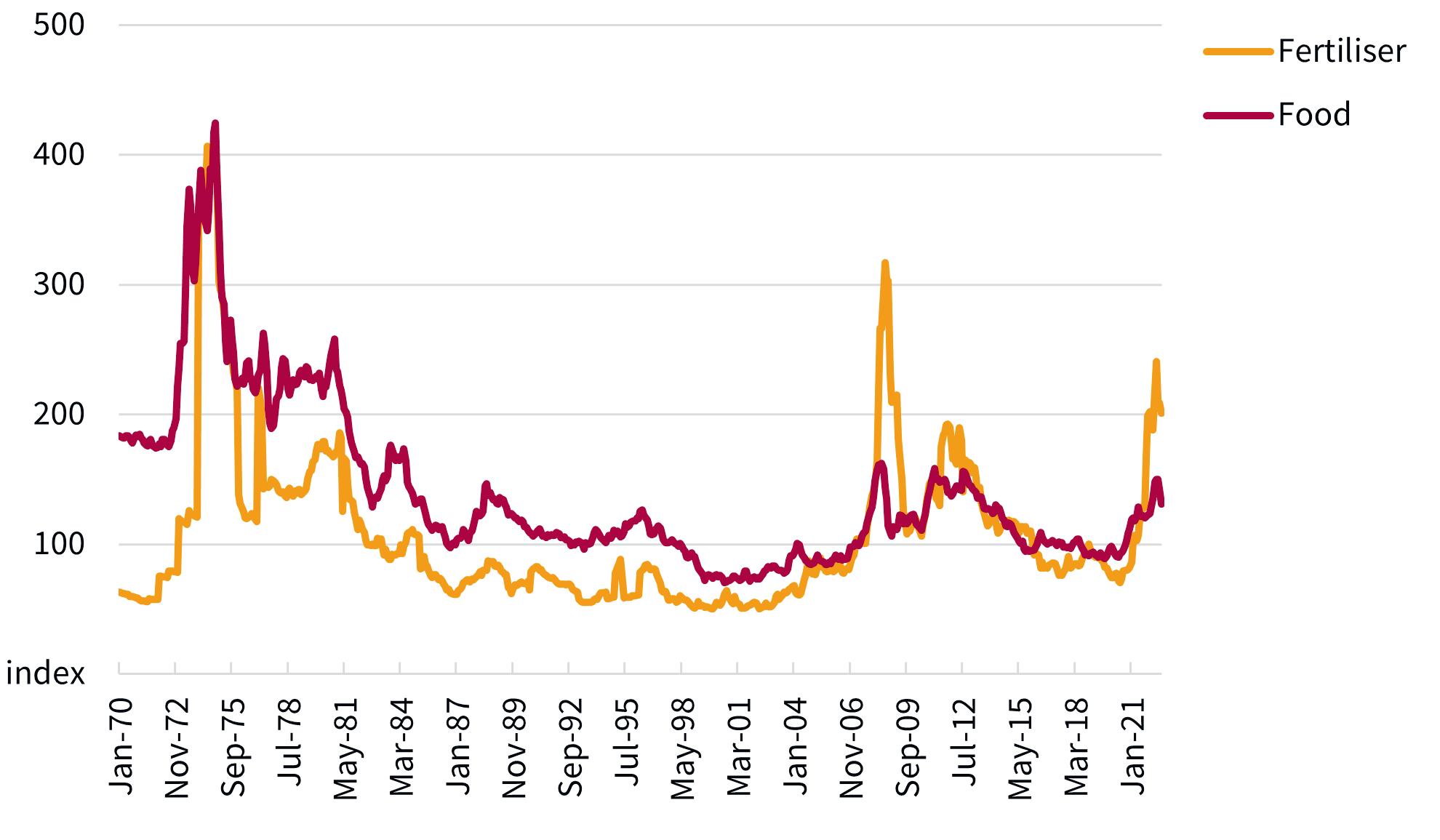

Global growth expectations have been lowered due to widespread infation and a sluggish Chinese economy (see the Economic overview). The cost of food and fertiliser remains very high worldwide, despite falling a little in recent months (Figure 1.2). The World Bank now expects that global food prices will remain at very high levels through the end of 2024, worsening food security and reversing years of development gains. Many countries have continued their restrictions on trade in agricultural products, although the level of restrictions has fallen from peaks.

Urea (a nitrogen fertiliser) imports to Australia have not slowed despite prices being around 3 times higher than average (Figure 1.3). This indicates that fertiliser supplies will be suffcient over the 2022–23 season, although higher costs will erode farm margins. As fagged in ABARES 2021–22 farm survey results, higher input costs did affect farm incomes, and the full effect of higher fertiliser costs is likely to be felt in farm returns for 2022–23. Average farm incomes in 2021–22 are projected to be the highest on record at an average $278,000 per farm.

Real world food and fertiliser prices, January 1970 to July 2022 Note: Data shown in real terms. Original data is in nominal US dollar terms and is defated by the US Consumer Price Index for All Urban Consumers. Source: World Bank

Volume and price of urea imports to Australia, Jan 2015 to June 2022 Source: ABS

Another Bumper Year Forecast

The gross value of agricultural production is forecast to be $81.8 billion in 2022–23, down 4% from the record $85.3 billion of 2021–22 (Figure 1.1). Another near-record Australian crop harvest is forecast with good soil moisture stores and a wetter than average outlook for spring. Global supply of cereals continues to be tight, so high prices are forecast to persist. The value of livestock production is forecast to be little changed with domestic restocking demand easing, contributing to lower prices at saleyards for cattle and sheep. Herd and fock numbers are forecast to recover to predrought levels by the end of 2022–23. Global food and fertiliser prices have fallen from peaks earlier in 2022 but remain very high.

A third straight La Niña event forecast for late 2022 is now the climate model consensus – roughly a once-every-30-years event (see the Seasonal conditions overview). While good for national production prospects, this could result in signifcant localised impacts such as fooding, livestock losses, and quality downgrades for crops like those seen in 2021–22.

Exceptional growing conditions and high global prices are continuing to beneft Australian agricultural production and exports.

The ABARES September quarter Agricultural Commodities Report released today is forecasting agricultural export earnings to climb to a record $70.3 billion for 2022-23 – almost 50% more than what it was 10 years ago after accounting for infation.

ABARES Executive Director Dr Jared Greenville said industry’s overall forecasted gross value of $81.8 billion shows it is performing strongly, with cropping leading the way.

“Winter crop prospects in Australia are looking very promising at the beginning of spring - we’re forecasting a 55.5 million tonne harvest,” Dr Greenville said.

“Meat production is also rebounding, with the national herd and fock returning to pre-drought levels.

“Favourable seasonal conditions are expected to persist, but global infation and rising costs of farm inputs could cloud outlook for demand and farm incomes.

“It’s the frst time our exports are expected to exceed $70 billion, showing the ability of our farmers to navigate considerable global economic uncertainty and to make a strong contribution to global food supplies.”

Dr Greenville said the latest ABARES forecasts factored in tapering global growth – and the likelihood of a third straight La Niña, roughly a once in 30-year event.

“Widespread infation and a sluggish Chinese economy are the main watchpoints,” he said.

“Global food and fertiliser prices remain very high despite falling from peaks earlier in 2022.

“The World Bank expects high global food prices through to the end of 2024 which will have adverse implications for global food security.

“We’re seeing Australian agriculture leaning into this uncertainty, with continued global demand for our food and fbre, another bumper winter crop and the forecast of continued favourable growing conditions.

The value of cotton exports is forecast to reach a record $7 billion in 2022–23 to be the third most valuable export commodity after wheat ($11.7 billion) and beef ($10.2 billion).

“Harvesting delays mean most of the bumper 2021–22 cotton crop will be exported during 2022–23,” Dr Greenville said.

The ABARES September 2022 Australian Crop Report, also released today, is forecasting near record levels of wheat and canola production for 2022-23.

“For wheat we’re looking at 32.2 million tonnes, and for canola we’re expecting 6.6 million tonnes, just shy of the records last year,” Dr Greenville said.

“Barley production has also been strong and is forecast to reach 12.3 million tonnes, the fourth largest on record.”

Planting of summer crops in 2022–23 is forecast to be well above average, supported by available soil moisture and signifcant areas of land previously left fallow during winter.

Regaining Access to export markets will take time

WOAH is the World Trade Organization reference organisation for standards relating to animal health. WOAH sets international standards for diagnosis, control and prevention of animal disease including FMD. WOAH also provides guidance for safe international trade in livestock and livestock products. There are established procedures for regaining recognition of FMD-freedom by WOAH following an outbreak.

At a minimum, WOAH will require three months from the disposal of the last animal killed using a ‘stamping out’ policy without vaccination, and an application to demonstrate appropriate steps have been taken to eradicate, monitor and protect from further incursion.

However, following an outbreak and separate to the assessment and WOAH’s offcial recognition of reinstatement of freedom from FMD, Australia would need to negotiate regaining market access with its trading partners. The timeframe for the recommencement of trade will be dependent on the nature of the outbreak, control program used, response of our animal health system, recognition of freedom by WOAH and the importing country’s own FMD freedom recognition guidelines. In order to recommence trade, the department will need to submit for the consideration of a trading partner, a comprehensive submission outlining the action undertaken, surveillance and other animal health data, traceability information (including current modernisation measures if completed) and national systems controls (among other references). This will require time to prepare and signifcant internal, state and territory representative and industry engagement.

Historical analysis of FMD outbreaks, suggest that even if an FMD outbreak is controlled quickly (such as in the case of Ireland which was within 2 days), the fastest anticipated FMD freedom recognition by a trading partner (the United States as an example) was 228 days. The longest time taken to recommence trade after an outbreak was in Japan, where trade to the United States did not recommence for 774 days.

Coraki Rural & Hardware Supplies

102-104 Queen Elizabeth Drive CORAKI

SUPPORTING FARMERS THROUGH TOUGH TIMES EARNS UNISA DOUBLE NATIONAL ACCOLADE

Drought, fres, foods, and now potential disease – in the past few years Aussie farmers have been hit hard from all sides. But amid the turmoil, many farmers have engaged the support of ifarmwell – an online resource that provides free support to help farmers cope with stress and uncertainty of life on the land.

Today, the creator of ifarmwell, UniSA’s Dr Kate Gunn, is being recognised for her substantial work in supporting the mental health and wellbeing of farmers as she receives a national award for Excellence in Agricultural Research as part of the Australian Farmer of the Year awards.

The award follows another national accolade – the National LiFE Award for Innovation from Suicide Prevention Australia – presented to Dr Gunn earlier this week in recognition of the vital support that ifarmwell is providing to Australian farmers and rural communities.

In Australia, farmers are twice as likely to die from suicide than other employed people. ifarmwell has been designed by Australian farmers for Australian farmers. Based on over 10 years’ research, it builds on farmers’ strengths, beliefs, and preferences, so that health and wellbeing strategies are meaningful, and more likely be adopted in the real world.

Dr Gunn says working with and helping rural communities is close to her heart.

“Having grown up on a farm, I’ve seen frsthand how poor mental health and wellbeing can affect close-knit communities,” Dr Gunn says.

“Living on the land can be wonderful. But it can also be isolating and challenging.

“ifarmwell has been designed in partnership with farmers. It takes in their unique skills, beliefs, and strengths, and helps them build a range of practical strategies that can help them manage life’s ups and downs.

“We know that farmers are great practical problem solvers. Through ifarmwell, we’re providing manageable and relatable tools to help farmers increase their ability to cope effectively with the things they cannot control or fx.

“It is very exciting to me that the importance of farmers’ mental health and wellbeing has been recognised nationally in these ways. I also hope that these awards serve as a helpful reminder to farmers that we all need to deliberately invest time in maintaining and improving our own wellbeing; ifarmwell is freely available to help them do that.”

The economic impacts could vary based on severity and prevalence of FMD

Real value of livestock product exports, major trading partners, 2019-2020 to 2021-22 Source: ABARES; ABS As with the case for responding to any FMD incursion, the economic impacts could vary widely depending on the number of areas affected and the effectiveness of the response and eradication strategy. Prior modelling by ABARES explored different scenarios. In smaller outbreak scenarios which were modelled, Australia was quicker to eradicate the disease and regain market access. In the worst-case, large multi-state outbreak scenario, which was modelled, it would take longer to eradicate and substantially longer to regain market access than the smaller outbreaks and could cost the Australian economy $80 billion over ten years. In all scenarios, the cost would be overwhelmingly due to losing access to Australia’s high value livestock export markets. Awareness of the disease and early detection of initial infected properties would limit an incursion to a much smaller outbreak, reduce time to eradicate and regain market access, and lead to a signifcantly smaller direct economic impact. The WOAH Terrestrial Animal Health Code recommends that importing countries have controls in place to prevent movement from affected countries of potentially infected animals or animal products. In the event of an incursion, trading partners may undertake their own risk assessments for imported commodities and evaluations of Australia’s FMD status to satisfy their own appropriate level of protection. It would mean that Australia’s livestock exports would cease until appropriate evaluations are undertaken. Restoring trade takes time and will vary among Australia’s trading partners. To put the value of Australia’s livestock export markets in context, Figure 1 shows the value of the top fve export markets for Australian livestock and livestock products (including meat, wool, dairy and animal byproducts) for the three years to 2021-22. This is not intended as a direct measure of potential economic cost, rather to outline that Australia’s export markets are valuable and investment in their protection is vital. Even after market access is regained, there could be a risk that consumers’ preferences in foreign markets, particularly those in high-value markets, may change as a result of the incursion and perceptions around the food safety of Australian products. Australian agricultural production currently maintains a reputation internationally as high-quality. It receives a premium in many markets based on this reputation. While FMD is not a food safety issue, FMD being associated with Australian animal and animal products exports may damage this reputation and reduce demand in international markets. There are also direct costs associated with control measures, such as culling infected and high-risk animals, vaccinating animals, and decontaminating farms and equipment (for which there are measures designed to help compensate producers). In addition to the direct costs there would also be down-stream impacts across the supply chain, including for feedlots, transportation, processing, and distribution. Downstream impacts would vary depending on the characteristics of regions affected and the size of an outbreak.

Export restrictions contribute to global food price pressure

Moves by governments to restrict exports only exacerbate price rises and increase food insecurity, according to the latest Insights report from ABARES.

Executive Director of ABARES Dr Jared Greenville said there were lessons to be learnt from the 2007-08 food crisis.

“Often when there is an increase in world food prices, governments respond by placing export restrictions on their own commodities,” Dr Greenville said.

“The aim is to moderate domestic prices and ease the burden on their own populations, which is understandable in the circumstances.

“However, export restrictions reduce the supply of food in world markets and increase prices, creating greater incentives for other countries to restrict exports.

“For this reason, widespread export restrictions have a negative impact on global food security and hurt the poorest people who are already struggling to put food on the table.

“We are starting to see the use of export restrictions rise as food prices begin to rise due to Russia’s invasion of Ukraine, poor growing conditions in major exporting countries and the impacts of the COVID-19 pandemic.

“Currently, around 24 countries have introduced export restrictions.

“Removing export restrictions, or agreements to avoid implementing them in the frst place, can help to ensure food is more available globally and increase the stability of food supplies.

“Short-term humanitarian aid, market transparency and cutting trade barriers all help to alleviate the stresses of global food insecurity.

“And having free and open trade through multiple trading relationships gives households options that help limit the risk of food insecurity.”

NSW Crop Report

Note: Yields are based on area planted, except cotton which is based on area harvested. Area based on planted crop that is harvested, fed off or failed. Percent changes are relative to last year. Source: ABARES

Note: Yields are based on area planted, except cotton which is based on area harvested. Area based on planted crop that is harvested, fed off or failed. Percent changes are relative to last year. Source: ABARES

Winter crop production in New South Wales is forecast to reach 15.2 million tonnes in 2022–23. This forecast is 36% above the 10-year average to 2021–22 but 19% below the nearrecord production of last year. An excellent start to the winter cropping

season in southern regions has helped most growers to fully realise their large planting intentions. High levels of soil moisture at the time of planting and the favourable spring rainfall outlook are also expected to support very high yield potentials in southern parts of the state. However, an exceptionally wet start to the season in the Central West and north of the state has signifcantly delayed planting, resulting in some felds being left fallow. The wet weather in the Central West and north has signifcantly impacted growers’ ability to manage crops and it is expected that crops planted in these regions will have lower yield potential.

Area planted to winter crops in New South Wales is forecast to be 5.9 million hectares, 9% above the 10-year average to 2021–22 but falling by 4% compared to last year. This comes as autumn rainfall in

most cropping regions reached above the 80th percentile of historical years, providing timely and solid conditions for the planting of winter crops and allowing expansion into some marginal areas. However, in large parts of central western and northern New South Wales, heavy and ongoing rainfall during late autumn has limited access to felds which has prevented growers from planting a full program.

Waterlogging issues have persisted in these areas during June, and some felds have been left fallow. It is expected that many of these will be planted to summer crops.

Seasonal conditions have allowed growers to focus plantings to wheat and canola, driven by higher prices of these crops relative to others. Area planted to wheat is expected to reach 3.6 million hectares, a 3% fall from last year. This fall is mostly due to a greater focus in Central and Northern New South

Wales towards planting canola and reduced areas planted in some parts due to heavily saturated soils.

Area planted to canola is forecast to increase by 13% to 900,000 hectares, with this increase coming largely at the expense of area planted to barley and chickpeas. The possibility of above average rainfall provides a risk to the outlook and may delay harvest. This may also result in a greater proportion of low-protein wheat and an increased likelihood of damaged and downgraded grain.

Total summer crop production is estimated to fall 12% in 2022–23 to 2.6 million tonnes, 32% above the 10-year average to 2021–22. Many growers that missed a winter crop in 2022–23 are likely to take advantage of high levels of soil moisture and plant felds that were fallow over winter to sorghum.

However, sorghum seed availability is expected to limit area expansion in 2022–23. Further, cotton

production is expected to fall from a near record high as a steep decline in cotton prices (albeit with prices remaining historically high) and a forecast increase in water prices in the Murrumbidgee growing region are reducing growers’ incentive to plant. A continuation of the current wet conditions through spring and early summer could prevent feld access, presenting a large downside risk to summer crop production.

However, for summer crops that are sown to schedule, high water availability and a favourable rainfall outlook will support strong yields across dryland plantings.

CROPS DRIVING RECORD FORECAST FOR VALUE OF EXPORTS

The value of agricultural exports is forecast to reach a record $70.3 billion in 2022–23, driven by crop exports. Grain shipments are running at record pace after successive large winter crops, but not fast enough to ship crops within a single fnancial year. Australia’s cereal grain exports averaged 3.5 million tonnes per month in the frst half of 2022, with shipments going to 63 countries.

The 2021–22 harvest will still make major contributions to export value in 2022–23. This is most apparent in the case of cotton exports, where harvesting delays mean most of the bumper 2021–22 crop will be exported during 2022–23. The value of cotton exports is forecast to reach a record $7.0 billion in 2022–23 and be the third most valuable export commodity after wheat and beef – the highest ranking for cotton on record (since 1988).

The value of livestock exports is forecast to fall due to lower prices for red meat and wool.

GLOBAL HEADWINDS SLOWING GROWTH OUTLOOK

Global growth expectations have been downgraded since the June Agricultural Commodities Report due to higher-thanexpected infation and a worse-than-expected slowdown in China. Global growth is assumed to be 3.2% in 2022 and 2.9% in 2023, downgrades of 0.4 and 0.7 percentage points from the June edition respectively.

Infation has continued to rise globally, dampening growth prospects by eroding the spending power of consumers and prompting central banks to raise rates. Infation has largely been driven by high energy prices as a result of the Russian invasion of Ukraine and COVID-related disruptions, however it is also becoming increasingly broadbased. At the same time, Chinese growth has been downgraded due to substantial disruption from its strict COVID-19 lockdowns and ongoing debt distress in its realestate sector. This has signifcant implications for global growth and will reduce demand for goods and services from China’s trade partners, including Australia.

Economic growth assumptions for advanced economies have been revised down by 0.8 percentage points in 2022 to be 2.5%. This has been primarily driven by a substantial downgrade to the growth prospects in the United States. US growth has been revised down by 1.4 percentage points in 2022 to 2.3%. The US revision follows two quarters of negative growth to begin the year and refects rapidly rising interest rates which are expected to slow consumption and investment. Growth assumptions for the Eurozone in 2022 have also been revised down by 0.2 percentage points due to worsening infation. However, there are regional variations in Europe and countries more reliant on Russian energy imports have been downgraded by more than those with alternative sources of energy.

Growth assumptions in emerging and developing economies have also been revised down in 2022 (revised down 0.2 percentage points to be 3.6%). A substantial downgrade in Chinese growth prospects has been somewhat offset by upgrades to growth assumptions for major commodity exporting economies, such as Brazil and some Middle Eastern countries. These economies have beneftted from higher commodity prices over the frst half of 2022.

FARMERS URGED TO JOIN THE FIGHT AGAINST FMD

Farmers are being encouraged to participate in the NSW Government’s largest ever pest management campaign to minimise the risk of Foot and Mouth Disease (FMD) spreading through feral animal populations if an incursion was to occur.

Minister for Agriculture Dugald Saunders said the NSW Government’s Spring Offensive program will not only reduce the risk of FMD spreading across the country, it will also play a critical role in protecting primary producers’ top-quality food and fbre.

“The NSW Government has already carried out pest management on more than 60 million hectares of land in regional NSW over the last 12 months, but we are now calling on farmers to ramp up control efforts by participating in baiting and trapping on private land and allowing aerial culls,” Mr Saunders said.

“Our absolute priority is ensuring FMD never reaches Australian shores, but we need to be prepared for the worst-case scenario. If FMD did enter NSW, the danger of the disease spreading from property to property through feral animals is real, particularly following back-to-back seasons of favourable conditions for pests.

“Coordinated pest management, in collaboration with landholders, is the only way to get on top of feral populations, which is particularly important in preparedness for a potential outbreak of FMD in Australia.”

Over the past 12 months, almost 38,000 pest animals have been culled through Local Land Services’ aerial culling operations, including more than 32,000 feral pigs.

In the same time period, aerial baiting operations have dropped baits along nearly 20,000km of bait lines, equivalent to a distance almost halfway around the globe.

Mr Saunders said while NSW is leading the way in coordinated pest management, now is not the time for complacency.

“We are asking landholders to get in touch with Local Land Services about what control programs they can take part in to make the campaign as effective as possible,” Mr Saunders said.

“If you’re not already part of a local biosecurity group, Local Land Services can provide advice and also connect you with neighbours to talk about pest management operations that can be done together.

“Local Land Services will also work with public land managers including NSW National Parks and Wildlife Services, Forestry Corporation and Crown Lands to deliver control programs.”

Local Land Services provides specialist advice on pest control techniques and can assist land managers with training, supply of poisoned baits and implementation strategies.

To discuss pest management on your property contact Local Land Services on 1300 795 299.

Remove barriers to export success says farm chief

NSW Farmers President Xavier Martin has welcomed predicted record farm exports, but says worker shortages, supply chain congestion and biosecurity threats all remain a serious concern.

On Tuesday the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) forecast agricultural export earnings would climb to a record $70.3 billion for 2022-23 – almost 50 per cent higher than 10 years ago – but farmers were reporting big problems across the industry that would continue to limit this growth.

Ongoing supply chain congestion leftover from COVID meant on-farm grain storages and market operators were full, while high fuel and energy costs combined with worker shortages were putting signifcant pressure on agricultural proftability. The continuing threat of a biosecurity incursion such as foot and mouth disease or African swine fever were also cause for concern.

While the federal government’s recent Jobs Summit discussed the issue of worker shortages, Mr Martin said there were other important issues that needed to be addressed to deliver certainty.

“Our farmers produce health plants and healthy animals, and families enjoy the results of this hard work three times a day,” Mr Martin said.

“It’s important to note this is the third harvest in a row where we’ve had great growing conditions, but it seems like external forces hold us back at every turn.

“We know the worker shortage won’t be solved overnight, but it’s critical we address these barriers to success sooner rather than later.”

NSW Farmers wanted to see better and more competitive port and rail access, which could reduce both the cost of export and the number of trucks on the road, and more investment into research and development to unlock future growth potential.

“I love seeing paddocks full of healthy wheat, but I love the thought of people enjoying a loaf of bread made from that wheat even more,” Mr Martin said.

“Sadly, the adverse implications of an ineffcient supply chain are high global food prices, and there are predictions of this will continue through to the end of 2024.

“The best way to address food security is to grow more food, and our farmers are clearly ready to do their bit – we just need to take the handbrake off.”

NSW Farmers President Xavier Martin

People Product Partnerships

6.00 News. 9.00 News. 10.00 Landline. (R) 11.00 Antiques Roadshow. (R) 12.00 ABC News At Noon. 1.00 Rosehaven. (PG, R) 1.25 Vera. (Mv, R) 3.00 Escape From The City. (R) 4.00 Think Tank. (PG, R) 4.55 Anh’s Brush With Fame. (PG, R) 5.25 Hard Quiz. (PG, R) 6.00 WorldWatch. 9.15 Peer To Peer. (PG) 10.15 Food Markets: In The Belly Of The City. (PG) 11.15 Grayson’s Art Club. (PG) 12.10 WorldWatch. 2.05 Greek Island Odyssey With Bettany Hughes. (PGadn, R) 3.00 Going Places. (R) 3.30 Destination Flavour China Bitesize. (R) 3.40 The Cook Up. (PG, R) 4.10 The Supervet. (PGa, R) 5.05 Jeopardy! 5.30 Letters And Numbers. (R)

6.00 The Drum. 7.00 ABC News. 7.30 7.30. 8.00 Australian Story. 8.30 Four Corners. Investigative journalism program. 9.20 Media Watch. (PG) 9.35 Planet America. (Return) 10.05 ABC Late News. 10.20 The Business. (R) 10.40 Q+A. (R) 11.45 Baptiste. (Malv, R) 1.40 Harrow. (Mav, R) 3.25 Rage. (MA15+adhlnsv) 4.25 The Drum. (R) 5.25 7.30. (R) 6.00 Mastermind Australia. (R) 6.30 SBS World News. 7.30 Lighthouses: Building

The Impossible. (PG) 8.30 DNA Family Secrets. (Final, PG) 9.40 24 Hours In Emergency. (Ma, R) 10.35 SBS World News Late. 11.05 Beforeigners. (MA15+av) 12.00 Outlander. (Mav, R) 1.00 Miss S. (Mav, R) 4.00 Food Safari. (R) 4.35 Bamay. (R) 5.00 NHK World English

News Morning. 5.30 ANC Philippines The

World Tonight. 6.00 Sunrise. 9.00 The Morning Show. (PG) 11.30 Seven Morning News. 12.00 MOVIE: Hidden

Intentions. (2018, Msv, R) 2.00 What The Killer Did Next. (Mav, R) 3.00 The Chase. 4.00 Seven News At 4. 5.00 The Chase Australia. 6.00 7News Local. 6.30 7News @ 6:30. 7.00 Home And Away. (PG) 7.30 Farmer Wants A Wife. (PGal)

Hosted by Natalie Gruzlewski. 9.00 MOVIE: Sweet Home Alabama. (2002, PGl, R) A New York socialite returns to Alabama to divorce the man she married, and left behind, years earlier. Reese Witherspoon, Josh Lucas. 11.15 The Latest: Seven News. 11.45 Heartbreak Island

Australia. (Mls) 1.00 Home Shopping. 5.00 Seven Early News. 5.30 Sunrise. 6.00 Today. 9.00 Today Extra. (PG) 11.30 Morning News. 12.00 The Block. (PGl, R) 1.30 Getaway. (PG, R) 2.00 Pointless. (PG) 3.00 Tipping Point. (PG) 4.00 Afternoon News. 5.00 Millionaire Hot Seat. 6.00 NBN News. 7.00 A Current A air. 7.30 The Block. (PGl) 8.40 Emergency. (Mm) 9.40 100% Footy. (M) 10.40 Nine News Late. 11.10 Fortunate Son. (Ma) 12.00 Emergence. (Mhv, R) 1.00 Hello SA. (PG) 1.30 TV Shop: Home Shopping. (R) 2.30 Global Shop. (R) 3.00 TV Shop: Home Shopping. (R) 4.00 Believer’s Voice Of Victory. (PGa) 4.30 A Current A air. (R) 5.00 News Early Edition. 5.30 Today. 6.00 The Talk. (PGa) 7.00 Judge Judy. (PG, R) 7.30 Bold. (PG, R) 8.00 10 News First: Breakfast. 8.30 Studio 10. (PG) 12.00 Dr Phil. (PGa, R) 1.00 To Be Advised. 2.30 Ent. Tonight. 3.00 Judge Judy. (PG, R) 3.30 Freshly Picked. 4.00 Everyday Gourmet. 4.30 The Bold And The Beautiful. (PG) 5.00 10 News First. 6.30 The Project. 7.30 The Amazing Race Australia. (PGal) Hosted by Beau Ryan. 8.30 Have You Been Paying

Attention? (Malns) Celebrity panellists compete to see who can remember the most about events of the week. 9.30 Just For Laughs Australia. (MA15+l) Hosted by Nath Valvo. 10.00 The Montreal Comedy

Festival. (Mals, R) 11.00 The Project. (R) 12.00 The Late Show With

Stephen Colbert. (PG) 1.00 Home Shopping. (R) 4.30 CBS Mornings.

CONSUMER ADVICE (P) Pre-school (C) Children (PG) Parental Guidance Recommended (M) Mature Audiences (MA15+) Mature Audiences Only (AV15+) Extreme Adult Violence (R) Repeat (CC) Closed Captions (a) Adult themes (d) Drug references (h) Horror (s) Sex references (l) Language (m) Medical procedures (n) Nudity (v) Violence.

ABC TV PLUS (22) 6am Children’s Programs. 7.20pm Bluey. 7.30 David Attenborough’s Global Adventure. 8.25 George Clarke’s Amazing Spaces. (Return) 9.15 Restoration Australia. 10.15 Catalyst. 11.10 Would I Lie To You? 11.40 Penn & Teller: Fool Us. 12.20am Ghosts. 12.50 Red Dwarf. 1.20 ABC News Update. 1.25 Close. 5.00 Clangers. 5.15 Hoot Hoot Go! 5.20 Sarah & Duck. 5.30 Late Programs. VICELAND (31) 6am WorldWatch. 9.30 Shortland St. 11.00 The Therapist. Noon Front Up. 12.30 Black Lives Matter: A Global Reckoning. 1.25 Donkmaster. 1.55 Years Of Living Dangerously. 3.55 WorldWatch. 5.15 Shortland St. 5.45 Joy Of Painting. 6.15 Forged In Fire. 7.05 Jeopardy! 7.35 8 Out Of 10 Cats Does Countdown. 8.30 Dark Side Of The ‘90s. 9.25 The Casketeers. 10.25 VICE. 11.25 Final Space. 11.50 Late Programs. 7TWO (62) 6am Home Shopping. 6.30 Travel Oz. 8.00 Home Shopping. 8.30 Million Dollar Minute. 9.30 NBC Today. 10.30 To Be Advised. Noon The Surgery Ship. 1.00 Million Dollar Minute. 2.00 Weekender. 2.30 Sons And Daughters. 4.30 Emmerdale. 5.00 Coronation Street. 5.30 Escape To The Country. 6.30 Bargain Hunt. 7.30 Doc Martin. 8.30 A Touch Of Frost. 10.45 Criminal Confessions. 11.45 Late Programs. 9GEM (82) 6am Morning Programs. 7.30 TV Shop. 9.30 Newstyle Direct. 10.00 Danoz. 10.30 Pointless. 11.30 My Favorite Martian. Noon Days Of Our Lives. 12.55 The Young And The Restless. 1.50 The Bizarre Pet Vets. 2.50 Antiques Roadshow. 3.20 MOVIE: The Story Of Gilbert And Sullivan. (1953) 5.30 Murder, She Wrote. 6.30 Antiques Roadshow. 7.30 Death In Paradise. 8.40 Dalgliesh. (Premiere) 10.40 Late Programs. BOLD (51) 6am Home Shopping. 8.00 The Doctors. 9.00 Escape Fishing With ET. 9.30 iFish. 10.00 Demolition Down Under. 11.00 MacGyver. Noon NCIS: New Orleans. 1.00 Walker, Texas Ranger. 3.00 Bondi Rescue. 3.30 The Love Boat. 4.30 Star Trek: The Next Generation. 5.30 MacGyver. 7.30 NCIS. 10.20 Blue Bloods. 12.15am Home Shopping. 2.15 L.A.’s Finest. 3.10 Star Trek: The Next Generation. 4.05 MacGyver.

ABC ME (23) 6am Children’s Programs. 1pm The Dengineers. 3.35 The Penguins Of Madagascar. 4.30 The Inbestigators. 5.00 Space Nova. 5.30 Kung Fu Panda: Legends Of Awesomeness. 6.00 Amelia Parker. 6.30 Operation Ouch! 7.00 Horrible Histories. 7.35 Dragons: Defenders Of Berk. 8.00 The Deep. 8.25 Kong: King Of The Apes. 8.45 SheZow. 9.00 Find Me In Paris. 9.25 School Of Rock. 9.45 Rage. 11.10 Close. SBS MOVIES (32) 6am Morning Programs. 8.00 Without A Clue. (1988, PG) 10.00 The Four Musketeers: Revenge Of Milady. (1974, M) Noon The Enigma Of Arrival. (2018, M, Mandarin) 2.05 The Forbidden Kingdom. (2008, PG) 4.00 Hoot. (2006, PG) 5.40 Bill. (2015, PG) 7.30 The Jane Austen Book Club. (2007, M) 9.30 A Dangerous Method. (2011, MA15+) 11.20 Late Programs. 7MATE (63) 6am Morning Programs. 1.45pm Rides Down Under: Workshop Wars. 2.45 Motor Racing. Extreme E. Round 3. Island X-Prix. 4.00 Motor Racing. Motorsport Australia Rally Championship. Round 5. Gippsland Rally. 5.00 Seven’s Motorsport Classic. 5.30 Storage Wars: TX. 6.00 American Pickers. 7.00 Pawn Stars. 7.30 AFL Brownlow Medal: Red Carpet. 8.15 AFL Brownlow Medal. 11.00 Late Programs. 9GO! (83) 6am Children’s Programs. 12.10pm Inside Legoland. 1.00 Inside British Airways. 2.00 Say Yes To The Dress: UK. 2.30 Full House. 3.30 Raymond. 5.30 The Nanny. 6.00 3rd Rock. 6.30 That ’70s Show. 7.00 Young Sheldon. 7.30 RBT. 8.30 MOVIE: Sahara. (2005, M) 11.00 Young Sheldon. 11.30 Up All Night. Midnight Smash. 1.00 Say Yes To The Dress: UK. 2.00 Inside British Airways. 2.50 Late Programs. PEACH (52) 6am Friends. 9.30 The Big Bang Theory. 10.00 The Middle. Noon This Is Us. 2.00 The Big Bang Theory. 3.00 The King Of Queens. 4.00 Becker. 5.00 Frasier. 6.00 Friends. 8.00 The Big Bang Theory. 9.30 Seinfeld. 11.00 Frasier. Midnight Home Shopping. 1.30 The Late Show With Stephen Colbert. 2.30 The Late Late Show With James Corden. 3.30 The King Of Queens. 4.30 Home Shopping.

ABC NEWS (24) 6am News Programs. 3pm News. 4.00 Afternoon Brie ng. 5.00 ABC News Hour. 6.00 ABC Evening News. 7.00 ABC National News. 7.30 7.30. 8.00 ABC News Tonight. 8.45 The Business. 9.00 ABC Nightly News. 9.30 Kurt Fearnley’s One Plus One. 10.00 The World. 11.00 The Drum. Midnight News. 12.15 The Business. 12.30 7.30. 1.00 News. 1.30 Breakfast Couch. 2.00 Late Programs. SBS FOOD (33) 6am Morning Programs. 2pm Make This Tonight. 2.30 My Market Kitchen. 3.00 License To Grill. 3.30 Travel, Cook, Repeat. 4.00 David Rocco’s Dolce Tuscany. 4.30 Cook And The Chef. 5.00 Nigellissima. 5.30 River Cottage Aust. 6.30 Food Safari. 7.00 The Cook Up. 7.30 Food Heroes. 8.00 Poh & Co. 8.30 Jamie & Jimmy’s Food Fight Club. 9.30 Dine With Me UK. 10.00 Late Programs. NITV (34) 6am Morning Programs. 1.30pm Amplify. 2.00 Shortland St. 2.30 Going Native. 3.00 Jarjums. 4.35 Spartakus And The Sun Beneath The Sea. 5.00 Our Stories. 5.30 APTN National News. 6.00 Bamay. 6.30 Wiyi Yani U Thangani. 6.40 News. 6.50 Arctic Secrets. 7.40 Through The Wormhole With Morgan Freeman. 8.30 Karla Grant Presents. 9.00 Cold Justice. 10.00 Superstition. 10.50 Late Programs. 9LIFE (84) 6am Morning Programs. 8.00 Good Bones. 9.00 Flip Or Flop. 10.00 Rehab Addict. 11.00 Postcards. 11.30 Getaway. Noon Flipping Virgins. 1.00 Flip Or Flop. 2.00 Zombie House Flipping. 3.00 The Block. 4.00 Flip Or Flop Nashville. 4.30 Log Cabin Living. 5.00 Good Bones. 6.00 House Hunters Int. 7.00 House Hunters. 8.30 Outgrown. 9.30 Self Made Mansions. 10.30 Backyard Envy. 11.30 Late Programs. SKY NEWS (53) 6am Morning Programs. 10.00 AM Agenda. 11.00 NewsDay. Noon NewsDay. 1.00 Piers Morgan Uncensored: Encore. 2.00 Afternoon Agenda. 3.00 Paul Murray Live. 4.00 Afternoon Agenda. 4.30 Business Now With Ross Greenwood. 5.00 The Kenny Report. 6.00 Peta Credlin. 7.00 Bolt Report. 8.00 Paul Murray Live. 9.00 The Rita Panahi Show. 10.00 The Front Page. 10.30 NewsNight. 11.30 Late Programs.

TUESDAY, September 20

ABC TV (2)

6.00 News. 9.00 News. 10.00 Foreign Correspondent. (R) 10.30 Planet America. (R) 11.00 Dementia & Us. (PG, R) 12.00 News. 1.00 Miniseries: Marriage. (Ml, R) 1.55 The Durrells. (PG, R) 3.00 Escape From The City. (R) 4.00 Think Tank. (PG, R) 4.55 Anh’s Brush With Fame. (PG, R) 5.25 Hard Quiz. (PG, R) SBS (3)

6.00 WorldWatch. 9.05 Peer To Peer. (PG) 10.05 Food Markets: In The Belly Of The City. (PG) 11.05 Grayson’s Art Club. (Final, PG) 12.00 WorldWatch. 2.00 Cook Up With Adam Liaw Bitesize. (R) 2.05 Greek Island Odyssey With Bettany Hughes. (PGav, R) 3.00 Going Places. (R) 3.40 The Cook Up. (PG, R) 4.10 The Supervet. (PGa, R) 5.05 Jeopardy! 5.30 Letters And Numbers. (R)

6.00 The Drum. 7.00 ABC News. 7.30 7.30. 8.00 Take 5 With Zan Rowe. 8.30 Old People’s Home

For Teenagers. (PG) 9.30 Home: The Story Of Earth. 10.30 ABC Late News. 10.45 The Business. (R) 11.00 Four Corners. (R) 11.45 Media Watch. (PG, R) 12.05 The Capture. (Final, Mlv, R) 1.05 Harrow. (Mv, R) 2.50 The Durrells. (PG, R) 3.40 Rage. (MA15+adhlnsv) 4.25 The Drum. (R) 5.25 7.30. (R) 6.00 Mastermind Australia. (R) 6.30 SBS World News. 7.30 Great Coastal Railway

Journeys. (PG) 8.30 Insight. 9.30 Dateline. 10.00 SBS World News Late. 10.30 The Point. (R) 11.00 Atlanta. (MA15+ls, R) 12.20 DNA. (Mal, R) 3.40 Food Safari. (R) 5.00 NHK World English

News Morning. 5.30 ANC Philippines The

World Tonight. SEVEN (6)

6.00 Sunrise. 9.00 The Morning Show. (PG) 11.30 Seven Morning News. 12.00 MOVIE: Watch Your

Back. (2015, Mlv, R) 2.00 What The Killer Did Next. (Mav, R) 3.00 The Chase. 4.00 Seven News At 4. 5.00 The Chase Australia. 6.00 7News Local. 6.30 7News @ 6:30. 7.00 Home And Away. (PGas) 7.30 Hey Hey It’s 100 Years. (PGasv, R) Hosted by Daryl Somers. 9.20 Extreme Weddings:

Australia. (PGal) A couple plan a wild wedding with their camels in the scorching heat of the NSW outback. 10.20 10 Years Younger In 10 Days. (PGa) Presented by Cherry Healey. 11.20 The Latest: Seven News. 11.50 Chicago Fire. (Ma) 1.00 Home Shopping. 5.00 Seven Early News. 5.30 Sunrise. NBN (8, 80)

6.00 Today. 9.00 Today Extra. (PG) 11.30 Morning News. 12.00 The Block. (PGl, R) 1.00 Emergency. (Mm, R) 2.00 Pointless. (PG) 3.00 Tipping Point. (PG) 4.00 Afternoon News. 5.00 Millionaire Hot Seat. 6.00 NBN News. 7.00 A Current A air. 7.30 The Block. (PGl) 8.40 The Hundred With Andy

Lee. (Ms) Comedy panel show. 9.40 Botched. (Malmn, R) 10.40 Nine News Late. 11.10 Law & Order: Organized

Crime. (Mv) 11.55 See No Evil. (Mav) 12.45 Tipping Point. (PG, R) 1.30 TV Shop: Home Shopping. (R) 4.00 Believer’s Voice Of Victory. (PGa) 4.30 A Current A air. (R) 5.00 News Early Edition. 5.30 Today. TEN (5)

6.00 The Talk. (PGa) 7.00 Judge Judy. (PG, R) 7.30 Bold. (PG, R) 8.00 10 News First: Breakfast. 8.30 Studio 10. (PG) 12.00 Dr Phil. (PGal, R) 1.00 To Be Advised. 2.10 Ent. Tonight. 2.30 My Market Kitchen. (R) 3.00 Judge Judy. (PG, R) 3.30 Freshly Picked. 4.00 Everyday Gourmet. 4.30 The Bold And The Beautiful. (PG) 5.00 10 News First. 6.30 The Project. A look at the day’s news and events. 7.30 The Amazing Race Australia. (PGl) Hosted by Beau Ryan. 8.30 The Cheap Seats. (Mal) Presenters

Melanie Bracewell and Tim McDonald take a look at the week that was. 9.30 NCIS. (M, R) Gibbs and McGee head to Alaska as the team works to uncover the conspiracy behind the serial killer. 10.30 NCIS: Los Angeles. (M, R) 11.30 The Project. (R) 12.30 The Late Show With

Stephen Colbert. (PG) 1.30 Home Shopping. (R) 4.30 CBS Mornings.