3 minute read

UCCS Economic Forum - September 2023

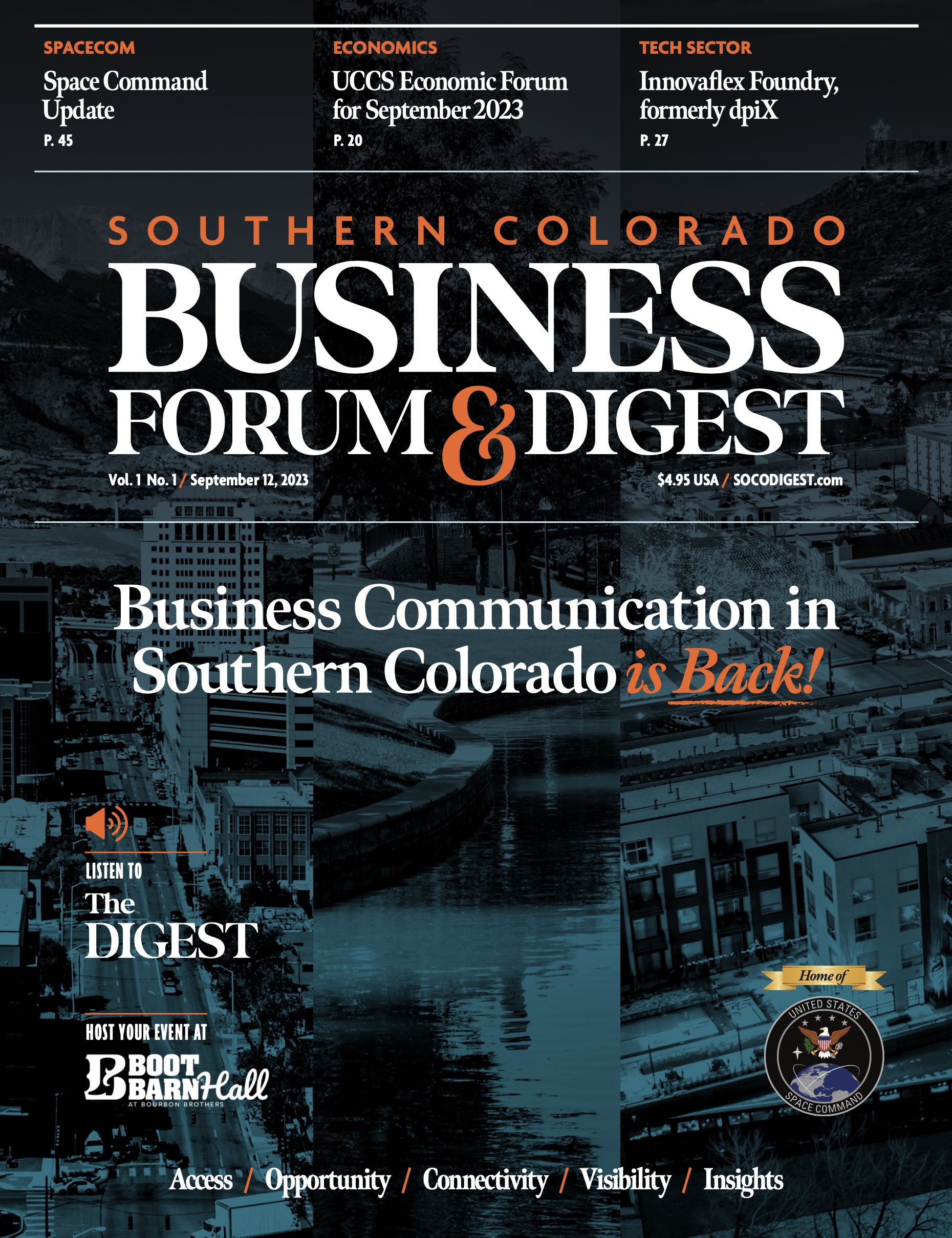

from SoCo Business Forum & Digest Vol.1 No.1

by Colorado Media Group :: NORTH, The Digest/CSBJ & So. Colorado Insider!

ON INFLATION, THE WORST IS BEHIND US

by DR. BILL CRAIGHEAD

Despite remarkable gains in employment over the past several years, consumers have felt negatively about the economy due to inflation. That may be starting to change.

Employment dropped precipitously during the pandemic, but it recovered much more rapidly than it did following previous recessions. According to the Bureau of Labor Statistics, non farm payrolls were back to pre-pandemic levels in June 2022, 16 months after their peak in February 2020. After the 2008-09 recession, it took over six years for employment to match its previous peak.

Local employment has been even stronger – this June, payrolls in the Colorado Springs area are 5.9% above pre-pandemic levels, compared with a 2.5% gain for the US as a whole.

Despite the strong employment recovery, negativity has reigned – the University of Michigan’s consumer sentiment index bottomed out at 50 in June 2022, a steep drop from 101 in February 2020.

It’s easy to understand why –American consumers have felt the sting of high inflation for the first time since the early 1980s. The Fed is using its interest rate tools to get inflation back down, but high interest rates are another source of hardship.

The good news is that inflation is coming back down.

During the pandemic recovery, the rate of increase for wages and prices both accelerated, but, for most of 2021 and 2022, price increases outpaced wage growth, which meant that the purchasing power of paychecks was falling.

Now, both inflation and wage growth are coming down, but the decline in inflation has been sharper than the deceleration in wages. Since this spring, wages have been growing faster than prices, which means that workers are finally seeing gains in purchasing power. So, it’s not surprising that

Americans are staring to feel a little better about the economy –consumer sentiment has bounced back from its lows last summer, hitting 71.6 in July 2023.

While the volatility of energy and food prices means there could be some bumps in the road, the overall downward trend in inflation looks set to continue. Before too long, the feeling of “sticker shock” we all seemed to experience whenever we went shopping will just be a bad memory.

Read more of the So. Co. Business Forum & Digest here: