12 minute read

Shannon Wagers

by Dave Rivord

New Mexico rightfully prides itself on being a land of many cultures. But one group that often gets overlooked in the tourist literature are the Mormon pioneers who figured prominently in the settlement of our western borderlands.

From its founding in 1830, the Church of Jesus Christ of Latterday Saints—better known as the LDS Church or the Mormons— had been the target of persecution as a result of its unorthodox

Advertisement

Family Caregivers, FREE Support! Do you provide care for a loved one with a chronic illness? Program focuses on education, support, problem-solving skills, and stress management for family caregivers of people with a chronic illness. Ongoing, 9-week, 90-minute, FREE classes.

Contact Sharon Lewis, RN, PhD, FAAN at 830-377-1484, slewis2@unm.edu

beliefs and practices, particularly polygamy, or “plural marriage,” as it was known. After being forcibly driven out of several eastern states, the Saints, under the leadership of Brigham Young, migrated en masse to Utah’s Salt Lake Valley in 1847.

The earliest Latter-day Saints to visit New Mexico were the soldiers of the Mormon Battalion, which was the subject of an earlier column. (Prime Time, May 2017.) But the battalion only passed through on its way to California during the 1847-‘48 Mexican-American War. No permanent Mormon settlements were established here at that time.

In the years that followed, the Saints colonized all of Utah and parts of the surrounding territories, and began to proselytize among the native inhabitants. They enjoyed some success at Zuni Pueblo, baptizing a number of converts there, as well as among the neighboring Navajos. So, at the direction of church leaders, a mission was

RECUERDA A CÉSAR CHÁVEZ COMMITTEE 27TH ANNUAL

CÉSAR

CHÁVEZ

DAY

WITH SPECIAL GUEST DOLORES HUERTA

SATURDAY MARCH 28 2020

10 am Dedication: Naming of Avenida Dolores Huerta (Avenida César Chávez / Avenida Dolores Huerta) Presented by Las Mujeres

10:30 am La Marcha Begins at the NHCC (Avenida César Chávez / Avenida Dolores Huerta)

12–3 pm La Fiesta Featuring Ivón Ulibarrí and The Café Mocha All Star Salsa Band

established nearby in 1876. At first it was called Navajo, but in 1886, it was changed to the biblical name of Ramah (usually pronounced RAY-mah), as it is known today. The town retains its distinctively Mormon character, with broad streets neatly laid out in a grid pattern and lined with stately Lombardy poplars. Ramah Lake, a 50-acre irrigation reservoir just above the town, offers fishing and recreation.

At around the same time, other Mormon settlers from the area around Bluff, Utah, were moving into the San Juan country in the northwest corner of New Mexico. Fruitland, Kirtland, Waterflow, and Bloomfield all began as Mormon communities, with Fruitland apparently the center of most church activities.

In the 1880s, as the good farmland around the Four Corners was taken up, other settlers ventured south into the valleys of the White Mountains on both side of the ArizonaNew Mexico border, and on into the Gila country, where they founded the villages of Luna, Pleasanton, and Gila. Bluewater, west of Grants, was another early Mormon settlement.

These are the communities that have survived. Many others disappeared after a few years, for life was hard in those remote valleys. Disease outbreaks, crop failures, and Apache raids all took their toll. White “gentiles” (the Mormon term for non-Mormons) could be just as dangerous. In the San Juan country, friction with their gentile neighbors led to Mormon fences being cut, cattle stolen, and irrigation systems wrecked. Occasional gunfire broke out.

But the Mormons repaid them in kind. In 1906, a saloon opened in Fruitland over the vociferous objections of the teetotaling Saints. On Halloween night of that year, a group of masked women wearing Halloween costumes surrounded the saloon and tossed lighted torches against the building, then quickly disbursed. The place went up in flames but the arsonists could not be identified, so no one was ever prosecuted.

A second wave of Mormon emigration to New Mexico began around 1911. At that time, some 1,300 Mormons (members of families that had gone to Mexico in the 1880s to escape aggressive enforcement of the U.S. government’s antipolygamy laws) were forced to flee back across the border when the 1910 Mexican Revolution made it unsafe to remain there. Some of the refugees pooled their resources and purchased the little village of Richmond, about 30 miles northwest of Lordsburg. The landowner, the Gila Ranch Co., sold them the site at very favorable terms, and in gratitude they renamed the town Virden, in honor of the company’s president. Many descendants of those families still live in the area.

It should be noted that the LDS Church officially ended the practice of plural marriage in 1890, and disavows any connection with the various splinter groups that continue to adhere to it. To my knowledge, no polygamous sects exist in New Mexico.

FREE MEMORY ASSESSMENT

For more information please contact us at: Phone: 505-848-3773

101 Hospital Loop N.E., Suite 209, Albuqueruqe, NM 87109 Email: albneuro@albneuro.com Website: www.albneuro.com

Do You or Someone You Love Have Alzheimer’s Disease?

Consider Participating in the GAIN Trial

GAIN is a clinical trial evaluating whether an investigational oral drug is safe and

can halt the progression of Alzheimer’s disease by reducing the damage caused by bacteria in the brain. Eligible study participants are being recruited at study sites around the country.

The safety and effectiveness of COR388 for the treatment of Alzheimer’s disease have not been established

Study participation, testing and medication are free to all subjects. Some people may receive stipends to cover meals and travel related to study visits.

You or a loved one may be eligible for the study if you:

Are 55 to 80 years old

Have been diagnosed with mild to moderate Alzheimer’s disease

Have a caregiver or family member who will attend study visits, report on daily activities and oversee you taking medication

To find out about participating contact:

Institution City, State Study coordinator name Email Phone number Albuquerque Neuroscience Inc. Albuquerque, NM

Robert Kushner robert@albneuro.com

505-848-3773

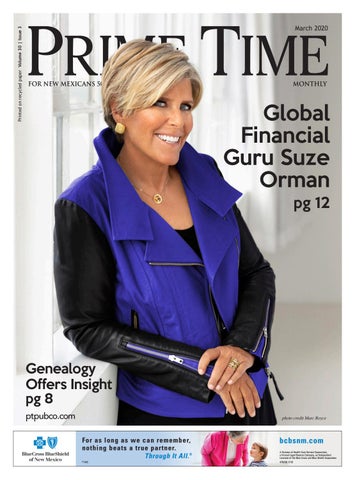

March 2020 12 PRIME TIME Global Financial Guru Suze Orman Talks Retirement Planning With Prime Time New Book, PBS show advises to plan at 50, downsize early, retire at 70

By Autumn Gray

Suze Orman may have been blessed with financial superpowers, but she still ages just like the rest of us. Soon to be 69, the author of nine New York Time bestsellers just released a new hardcover about saving for retirement. She says it differs from her previous writings because she is

older, with a new perspective, and because today’s economy requires new strategies.

Her latest book, The Ultimate Retirement Guide for 50+: Winning Strategies to Make Your Money Last a Lifetime, was released in late February in conjunction with a 60-minute PBS special of the same name. It airs at various times through March 21 on local Channels 5.1 and 9.1. For a full schedule, visit https://www.newmexicopbs.org/ schedule/.

In a February phone interview with Prime Time from her beach home in the Bahamas, Orman said this book is unique because “I’m not talking to (readers) about their money; I’m talking to them about living their lives far beyond money that you have and what you don’t have, but about facing your fears of less years to live than you have lived and knowing my next big

birthday is 80 and my friends are dying. You come at it from a whole different perspective. It’s from the perspective of someone who’s there.”

Both the book and the TV special, cover topics such as long-term care insurance, living revocable trusts, annuities and IRAs, and how to choose a financial planner. More broadly, Orman offers her personable and understandable insight on steps you can take today to have the ultimate retirement. “For most people, that means two things: time with friends and family, and not having to worry about money stress. ... It’s about a life that you enjoy, and if you’re not on track, why not and what can you do to get there?” she says in the TV show introduction.

In our interview with her, she shared the following just for Albuquerque: Q: You mention in the show that your retirement advice today is vastly different from what it would have been 20, 10, even five years ago. Why is that, and what does this say for the relevance of this book in five to 10 years? A: It’s very difficult to write a book that’s relevant all the time, especially when it comes to finances. I think one always needs to look at the date of the book they’re buying, but I don’t think we’re going to see changes in the economy for many years to come. When I first started many years ago, most people retired with a pension, health insurance, when interest rates were high enough to get 5 percent to 10 percent in a certificate of deposit, the stock market had not gone up, real estate was not nearly as expensive, and there

(continued on next page)

were all kinds of things that made your retirement really quite easy to navigate. Today, that’s not true.

Q: What do you suggest couples do when they largely disagree on a retirement strategy or even on something as fundamental as how much they need to be saving? A: Men are 10 times more unrealistic than women when it comes to retirement planning. Men have a difficult time facing reality. They don’t want to do a will, they don’t want to do a trust, they don’t want to pay down the mortgage. He would rather put the money in the stock market because for the past 10 years, he has been making money and he thinks that will continue forever. The problem with that is, men die before women do, and they don’t usually have to deal with the aftermath of their bad decisions. … The goal of money is for you to be secure, and therefore, if there is love and respect in this family, the partner that really wants to do thing that’s making the other partner feel insecure should cave.

Q: What should someone expect to pay a financial advisor? And is hiring a professional the best use of money when you don’t have a lot but you also don’t really know what to do with what you have? A: I really do not like commission-based financial advisers. I like registered investment advisors, who take no more than 1 percent. They make money for you; they make money for themselves. They would never buy mutual funds but individual stocks. If you feel you need to see a financial advisor, there’s a whole thing in the book about what to look for.

Q: What is the biggest mistake you see people make in their planning?

A: They wait to downsize. They don’t really get that as they get older how the house is harder to take care of, more expensive to take care of. They think they’re never going to get sick, never gonna have a car accident. They don’t have a will; they don’t have a trust. … There are moves you have to make in your 50s and 60s to make sure you are OK in your 70s and 80s. …You need to start looking at guaranteed income: How much income do you have guaranteed starting at the age of 70, and how does that meet your expenses? You do not wait till 70 to sell the home.”

While the new book and PBS special are for all ages – “to guide you from wherever you are right now, to where you want to be” - Orman says that 50 is the prime age to begin retirement planning and that 70 is the new retirement age thanks to longer life expectancies. “If you physically can, we should all be working till at least 70. The perfect scenario is you retire at 70, Social Security starts at 70, you can take money out of retirement accounts at 70. You have more time to have your home paid off in full so you don’t have a mortgage.”

Though economies change and financial strategies must, too, to be successful, Orman says one piece of advice will always remain: The earlier, the better.

Orman grew up on the South Side of Chicago, earned a bachelor’s degree in social work specializing in geriatrics at the University of Illinois, and was still a waitress at age 30 making $400 a month. In 1980, she borrowed money from friends to start a restaurant before training as an account executive for a global financial services firm. After an advisor made harmful investments for her, Orman decided to make her own way. She has since become America’s most recognized expert on personal finance. Among

a host of accolades and awards, Orman has been named one of “The World’s 100 Most Powerful Women” by Forbes; she has been presented with the Amelia Earhart Award for her message of financial empowerment for women; and she has garnered an unprecedented eight Gracie awards, more than anyone in the entire history of this prestigious award. The Gracies recognize the nation’s best radio, television, and cable programming for, by, and about women.

As if recollecting her own life’s path, Orman offers these words of wisdom: “Every little action that you take can make a tremendous difference in our life. Can you all live the ultimate retirement? You can, but you have to take the actions to make it possible. You have to have a plan.”

Watch on New Mexico PBS (NMPBS) throughout March: Ch. 5.1 – Sat., 2/29, 2 p.m.; Sun., 3/1, 11 a.m.; Mon., 3/2, 7 p.m.; Sun., 3/8, 3 p.m.; Tues., 3/10, 9 p.m.; Sat., 3/14, 5 a.m.; Sat., 3/14, 2 p.m.; Sun., 3/15, 6 p.m.; and on Ch. 9.1 – Sat., 2/29, 6 p.m.; Wed., 3/4, 7 p.m.; Thurs., 3/12, 9 p.m.; Thurs., 3/19, 7 p.m.; Sat., 3/21, 9:30 p.m.

• Downsizing? • Fixed Income? • Don’t want to live alone?

Rent a room and share a house, the living room, dining, kitchen, laundry and yard. We provide all utilities and Wi-Fi. Close to bus lines, restaurants and shopping. No smoking and No pets

If you have a home and want to sell, talk to us before you list and we may be able to get you more.

505-234-1150 2921 Carlisle NE Suite 200B Alb., NM 87110

TOMORROW ISN’T PROMISED... LET’S PLAN FOR IT TODAY. Wills Trusts Powers of Attorney Advance Health Care Directives (living wills)

Call today for a free consultation: (505) 503-7782 or visit www.MossGeorge.com

MOSS GEORGE LLP experienced. effective. trustworthy. attorneys at law.