6 minute read

Mates Rates

Would you buy a home with a friend?

As property prices rise beyond the reach of some single-income buyers, more Aussies are turning to mates to get a foot on the real estate ladder.

And support for this alternative ownership pathway is growing. Last year, the Federal Government changed rules around first homebuyers’ schemes to allow friends and family to access financial support for the first time. Previously it was limited to couples and singles.

Lenders are responding with new loans designed to simplify the process of borrowing together.

Of course, if you struggle to split a pizza with your mates or are still holding a grudge over something your sister said in high school, it may not be for you. But advocates say buying with friends and family is not necessarily any riskier than buying with a spouse, given Australian marriages last on average eight years.

And for younger Australians watching property prices rise, this may also offer an opportunity to break into the property market sooner than flying solo.

But for those considering giving mates rates a go, getting sound legal and financial advice is crucial.

The legals

First up, get a good lawyer. You’re going to need a pretty comprehensive friendship version of a pre-nup. The good news is this can actually be a positive experience.

Planning for a future where you may not be living with each other is a whole lot easier with a friend than a romantic partner. And if it’s not – that’s probably a big red flag.

The first thing to settle is the legal structure of your co-ownership. Friends who buy property together most often do so as tenants in common, rather than joint tenants.*

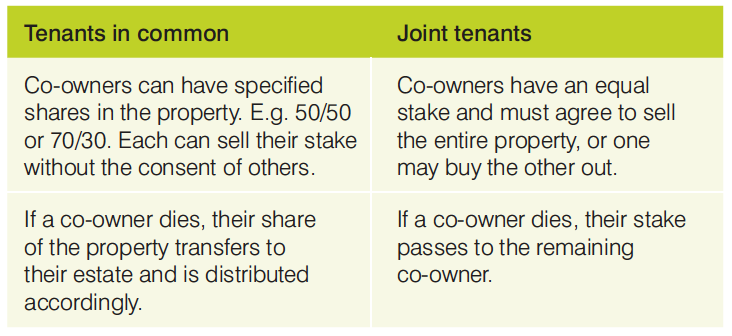

The major differences are:

A lawyer will draft a tenants in common agreement which should address possible sources of conflict, including ways to remedy unforeseen issues. Many law firms now offer online templates outlining potential issues, such as:

• Renovation/decorating disputes.

• Maintenance responsibilities.

• Insurance arrangements (including income insurance for co-owners).

• Contingency plans if one or both owners are unable to make loan payments.

• Exit strategies.

The financials

One of your broker’s greatest skills is they’re the voice of other people’s experience and will have undoubtedly helped others in your situation.

They will also, of course, talk you through the range of products to suit tenants in common, some of which allow co-owners to hold and pay separate loans for jointly owned property.

The friendship

Respect isn’t just a song, it’s the basis of any healthy relationship. Before you go house-hunting, draw up a list of must-haves and negotiable features. This will obviously be much easier if you are looking for an investment property, rather than one you plan to live in together.

Be prepared to consider everything and think how it will work in the long term. For example, many co-owners look for properties that either have dual living or have the potential to add it. Be prepared to let properties go if they don’t tick both your wish lists.

Case study

Emily and Kit

Blue Mountains, Victoria

“Friendship and money don’t mix.” That was the advice Emily and Kit heard time and again from well-meaning relatives and friends concerned about their unconventional plan to buy a property together in 2020.

Back then, the long-time friends – both separated and house hunting – were comparing notes about the lack of affordable options in their Blue Mountains community when Emily had an idea.

“Hey, would you consider going in with me and doing this together?” she asked Kit.

While neither could afford what they wanted on their own, pooling their resources could slingshot them into a different league, making it achievable and then some.

“Immediately, we both really liked the idea and started talking about what it might look like. We went to a mortgage broker to get an idea of what our combined buying capacity might be,” Emily says.

Everyone, including the broker, thought it was a pretty unusual plan.

“Everybody warned us to be careful, which I found very interesting because nobody had warned me, ‘Oh, you might want to watch out,’ when I was buying property with my ex-husband,” Emily notes with a wry smile. “The financial settlement in our marriage was very difficult to negotiate and took a very, very long time.”

By comparison, buying with a friend – where both parties go in with their eyes open and contracts drawn up – seems far more sensible.

“I think we were smart in that we got ourselves a mortgage broker, we made a list of our pre-requisites, and we signed a legal contract.” she says.

The pair purchased a property together in 2021 and haven’t looked back.

“Time will tell, obviously, but we’ve just had such a positive experience,” Emily says. “It’s given us a quality of life that we would not have been able to achieve on our own.

“These alternative pathways to property ownership are going to become more of a necessity because it’s extremely difficult to get that first buy in the property market now.”

Emily and Kit’s key recommendation to others is to get legal advice at the outset.

“Our lawyer was great. He took us through a whole lot of different contingencies. Obviously, we discussed what would happen if somebody wanted to leave, but there were also things we hadn’t thought of, like what would happen if somebody died, or somebody wanted to renovate. Or what if one of us wanted to move someone else in?”

Their lawyer also helped Emily and Kit work out how to structure the purchase, opting for a tenants in common arrangement, with each holding separate loans, paid independently.

When it came to settling on a property, they weren’t fussy on aesthetics, but respected each other’s non-negotiable requirements. For Emily, it was a bath and storage for music equipment. For Kit, it was a garden and proximity to a train station.

They landed on an ideal property with two dwellings on one block, setting them up to live more as neighbours than co-owners.

“It couldn’t have turned out better,” Emily says. “And we’re very aware we couldn’t have done it without each other.”

“It’s like owning our own homes, but it’s also like we’re in it together and we definitely have each other’s backs. There’s more than one way to make a home and more than one way to be happy in life.”

* https://sunstateconveyancing.com.au/understanding-ownership-options