7 minute read

The Opposition’s Budget Debate...

In this regard, the current expenditure of the budget since the Government assumed office in 2020 only increased cumulatively by 51 per cent or an average Y-o-Y increase of 12.76 per cent. In theory, substantial increases in the current expenditure side of the budget would drive inflationary pressures on consumption, and which would be difficult to scale back because this would include, for example, larger increases, as the Opposition is advocating for, in wages and salaries and social welfare programmes. Conversely, to accelerate the development trajectory, there have been substantial increases in capital expenditure by over 400 per cent cumulatively since FY 2020 with an average Y-o-Y increase of 102 per cent.

Notwithstanding, capital expenditure and capital projects can easily be scaled back to contain any inflationary impact or overheating of the economy. So far there are no indications of the economy overheating and this can be explained by another inherent constraint, that is a default mechanism anchoring the overheating risk of the economy.

One of the major challenges that the Government has to confront is absorptive capacity, wherein, this speaks to the rate of implementation of projects coupled with the bureaucracy in the system. While this is a constraint to the fastpaced development, it is also naturally working as an anchor by staving off any strong inflationary impact that would lead to overheating.

Poverty reduction, investing for the future through a balanced budget

The notion that the budget is void of a poverty reduction strategy and that the budget is not sufficiently balanced on the social side–was not compellingly articulated by the critics. One of the key counter-proposals by the Opposition, for example, in response to the cost of living and poverty reduction is to distribute the oil revenues in the sum of $300,000 per household.

The Opposition also argued that the cost-of-living phenomenon may persist for the next three years (citing international agencies’ analysis). Hence, this is suggestive that the Opposition proposal is to be maintained for the next three years.

As illustrated earlier, the COL measures implemented by the Government translate to about $400,000 per household albeit indirectly, which is more than the Opposition’s proposal of $300,000 per household through direct cash transfers. Assuming that the Opposition is proposing an additional $300,000 per household through direct cash transfers in addition to the COL measures implemented already, this will translate to another $66 billion per household on the current expenditure side of the budget. This amount represents 8.4 per cent of the budget, 32 per cent of the NRF inflow to the budget and 21 per cent of the current revenue. To make this possible, it means that the Government would have to cut the capital expenditure side of the budget. The question is, which project should the Government cut and/or delay to accommodate such a proposal.

For demonstration purposes, two major projects are the new bridge across the demerara river and the gas-to-energy project. The budgetary allocation for both projects in budget 2023 amounts to $45 billion giving rise to a shortfall of $21 billion. This means that the Government would have to slash some of the road infrastructure projects in the budget to reach the $66 billion for this proposal. With these adjustments, the configuration of the budget will move from a 50:50 ratio to 59 per cent (current expenditure) and 41 per cent (capital expenditure). Apart from such a proposal having the potential to engender uncontained inflationary pressures driven by consumer spending, it would effectively delay the development of the projects that are actually designed to mitigate the impact of inflationary pressures attributed to external factors. Consequently, not only Guyana but the entire region will be subject to pro-longed risks of externalities on the regional and domestic economies. As such, the gas-to-energy project, together with the infrastructure development is absolutely critical to achieving the objectives of the regional energy and food security agenda that the Government has positioned Guyana to lead.

Social services sector

The budgetary allocations in the social services sector, which include allocations towards employment cost for public sector employees, health, education, social welfare programmes, housing and water, culture, and youth amounts to $255.2 billion, reflecting a 36 per cent increase over the previous year and accounting for 33 per cent of budget 2023, and 79.73 per cent of current revenues. In view of this, there are substantial budgetary allocations towards the social services sector– while noting that the approximate sum of $255.2 billion is exclusive of allocations towards the public safety and security sector.

Determining whether the budget is a balanced budget?

With respect to the argument that the budget is not a balanced budget and not peo- ple-centric, the proponents of this view failed to state and justify what are the determinants of a balanced budget and how is it that the budget is not people focused. In this regard, the author attempts to put context to this notion and demonstrate evidently how the budget is a people-focused budget, and to further contextualise the term “investment for the future”, or, drawing the theme of the budget, “improving lives today, building prosperity for tomorrow.”

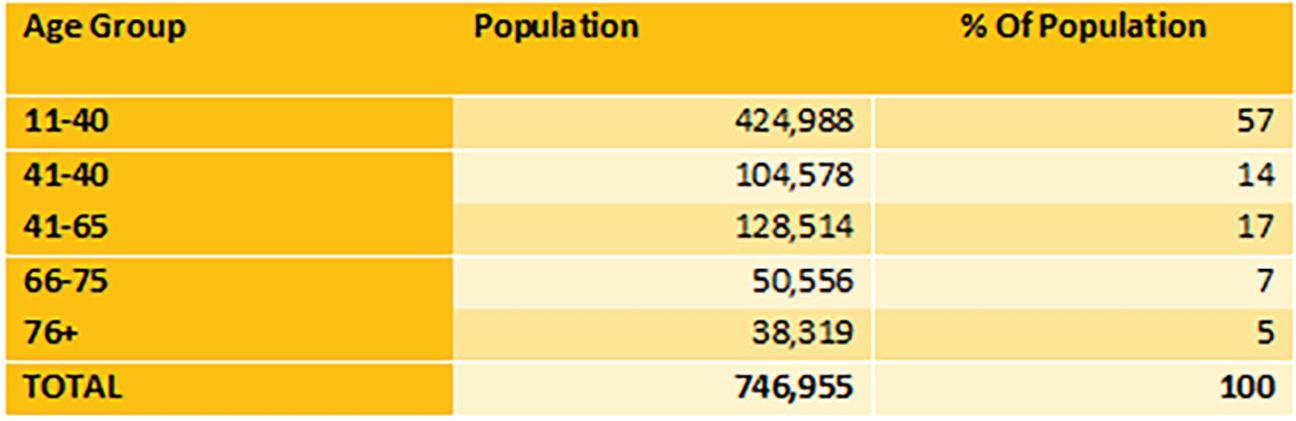

In doing so, the author examined the composition of the population age groups using the 2012 population census data (which is 11 years ago), whereby for the purpose of this analysis, the age groups were adjusted upwards by 11 years, since the study was done 11 years ago.

In examining the age groups of the population from the above illustration, 71 per cent of the population are in the age group of 11–40, 17 per cent of the population is in the age group 41–65, 7 per cent of the population is in the age group 66–75, and the remaining 5 per cent of the population are 76 and over. Putting this into context, investing for the future and creating prosperity for tomorrow essentially means investing in the economy that will create sustainable prosperity for the 71 per cent of the population comprising of the present and future generation, who in turn have their entire working life ahead of them–and in the process building and developing the economy. Another 24 per cent of the population in the age group which is made of 17 per cent in the age group of 41-65 and 7 per cent in the age group 66–75, these age

FROM PAGE 4 groups are also in the working population all of whom ought to have the framework for an improved standard of living and quality of life today and securing their future as well.

Aligning this with the configuration of the budget whereby 33 per cent of the budgetary allocations are towards the social services sector and the remaining 67 per cent allocated towards investing in the infrastructure to enable the future growth trajectory and prosperity, this ratio configuration virtually mirrors the composition of the population in terms of age group where the future is for the 71 per cent of the population (11-40 years old).

While this segment of the population needs social services, more importantly, they also need the opportunity to build profitable enterprises for those who have entrepre-

740, why can't they receive

740/750 of the monthly benefits?

Something needs to be done to make the system fair and equitable to all.

The Minister responsible needs to take a more proactive approach to this issue.

Sincerely,

Rahman Mohammed

neurial ambitions, and job opportunities that can only be created through investing in the economy and creating a conducive business and investment climate to so facilitate.

Conclusion

It is within these contexts, therefore, that it can be safely concluded that the budget is people focused. It is a balanced budget catering adequately to the present and future generations of professionals and entrepreneurs – while improving the present-day conditions upon which their livelihoods hinged. The budget also sufficiently caters to the elderly who account for about 5 per cent of the population within the limitations of the financial resources available.

Yours sincerely, Joel Bhagwandin

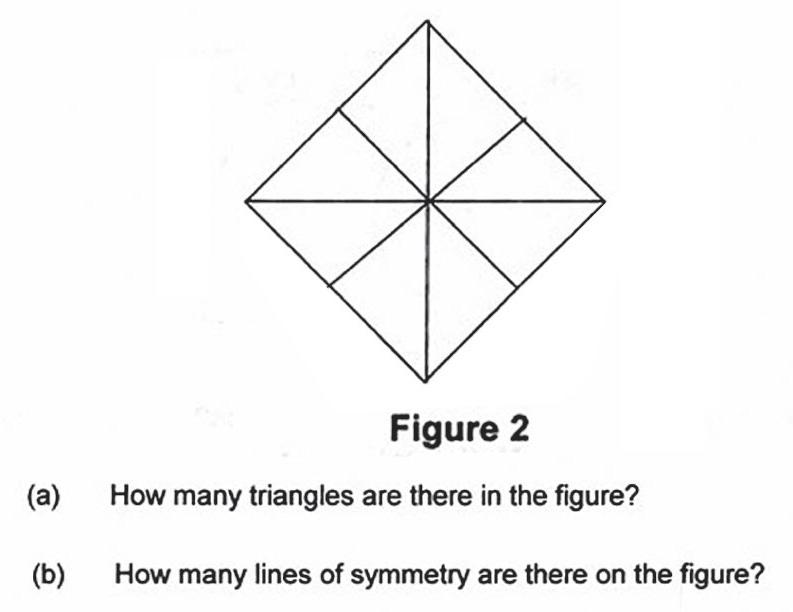

Question 1:

CONTINUED FROM MONDAY

And whilst she was dancing, he contrived, without her noticing it, to slip a golden ring on her finger, and he had given orders that the dance should last a very long time. When it was ended, he wanted to hold her fast by her hands, but she tore herself loose, and sprang away so quickly through the crowd that she vanished from his sight. She ran as fast as she could into her den beneath the stairs, but as she had been too long, and had stayed more than half-anhour she could not take off her pretty dress, but only threw over it her mantle of fur, and in her haste she did not make herself quite black, but one finger remained white. Then Allerleirauh ran into the kitchen, and cooked the bread soup for the king, and as the cook was away, put her golden reel into it.

When the king found the reel at the bottom of it, he caused Allerleirauh to be summoned, and then he espied the white finger, and saw the ring which he had put on it during the dance. Then he grasped her by the hand, and held her fast, and when she wanted to release herself and run

By The BroThers Grimm

away, her mantle of fur opened a little, and the star-dress shone forth. The king clutched the mantle and tore it off. Then her golden hair shone forth, and she stood there in full splendor, and could no longer hide herself. And when she had washed the soot and ashes from her face, she was more beautiful than anyone who had ever been seen on earth. But the king said, you are my dear bride, and we will never more part from each other. Thereupon the marriage was solemnised, and they lived happily until their death.

(THE END)

Myths are stories told aloud that have been passed down from generation to generation for thousands of years. Myth is from the Greek word, “mythos” — which means “word of mouth” — oral stories shared from person to person.

Myths have helped people from different cultures to make sense of the natural world, before scientific discoveries guided our understanding. Myths explained the reason for an erupting volcano, or thunder and lightning, or even night following day. Many myths feature gods, goddesses or humans with supernatural powers. Kids may be familiar with Zeus, the king of all gods in Greek mythology, who could throw lightning bolts from the sky down to Earth. Myths often include a lesson, suggesting how humans should act.

A legend is a traditional story about a real place and time in the past. Legends are rooted in the truth, but have changed over time and retelling and taken on fictional elements. The heroes are human (not gods and goddesses), but they often have adventures that are larger-than-life. The tales of Odysseus from Ancient Greece and King Arthur from Medieval England are two examples of legends.

Myths and legends can be found throughout the world. Many of these traditional stories feature similar subjects, but express the unique culture and history of the regions where they are from. There are flood myths from India, aboriginal legends from Australia, Taino creation stories from Puerto Rico, the legend of the Chinese zodiac, Norse myths, and many more.

Count how many myths and legends you know. What is a common theme?