1 minute read

FISCAL YEAR 2024 BUDGET SUMMARY

School districts heavily rely on the money from local taxpayers to help pay for necessary expenses that directly impact the classroom. The value of a well-rounded Glynn County Schools education is nowhere more evident than in the educationally-enriching opportunities our students are afforded.

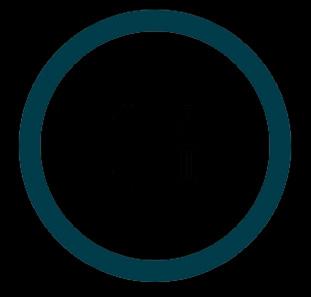

Local Sources

Advertisement

50%

Local revenues account for 50% of the district’s total budget. Property taxes are the largest source of revenue from local funding.

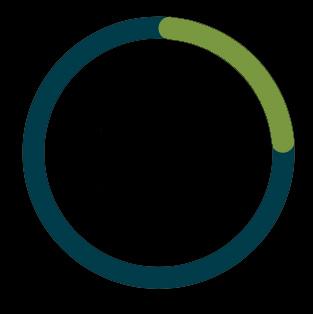

State Sources

Total estimated revenues in the 2024 budget are $273,449,200. Total expenditures are $278,534,600. Mandated budget changes this year include state-required salary increases and rising health insurance costs. Additional changes include the cost of new positions, athletic supplements and the new child care center. 28%

State revenue makes up less than one-third of the revenues GCSS receives. The Georgia Department of Education oversees state funding and distributes funds to all districts through numerous formulas, grants, allotments and programs.

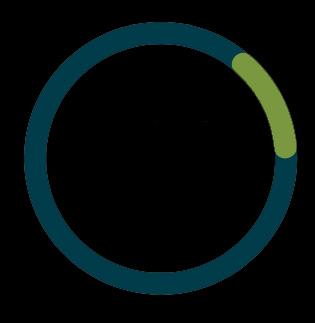

Federal Sources

22% LOCAL TAXES

15.65 Millage Rate, 8% Increase in Property Values and 98% Collection Rate

Federal funds are very restrictive and may only be used for specifically designated programs. Federal funds are the smallest source of revenue for GCSS and account for 22% of the district’s budget.

HOW IS THE MONEY USED?

General Fund Capital Project Funds

Operating budget that guides day-today activities.

Majority of this fund goes to salaries and benefits.

Our long-term school construction and repair needs.

Special Revenue Funds Debt Service Funds

Includes federal grants and entitlements that are received by GCSS.

Used to pay the principal and interest on bonds that we issue to finance school construction and renovation.