2 minute read

ALERUS LAUNCHES FINANCIAL WELLNESS PROGRAM.

FINANCIAL FITNESS TOOL RELIEVES FINANCIAL STRESS AND IMPROVES FINANCIAL HEALTH.

Alerus is introducing a new benefit aimed to help solve the current financial uncertainty crisis. Recent headlines may paint a rosy picture of America’s financial health, but when looking at the numbers, many Americans are experiencing major financial distress.

Your business is only as good as your workforce, and your workforce performs best when engaged, empowered, and motivated. Long-term employees are especially great — they hold institutional knowledge, gain efficiency through long-term experience at their jobs, and engage and educate the next generation of workers.

Financial insecurity, however, can disrupt the natural balance found in vibrant workplaces. Money worries can lead to stress, absenteeism, and lowered productivity. Workers financially unprepared to retire may stay on for years, stagnating advancement in a company.

WORKPLACE FINANCIAL WELLNESS PROGRAMS CAN REDUCE STRESS.

One study says people spend three work hours a week dealing with personal finances. People worry a lot about money, which affects productivity and stress levels and can also contribute to absenteeism. Offering comprehensive financial consulting — addressing issues like building emergency savings, managing debt, and insurance coverage on top of retirement offerings — is one way to help.

Introducing My Alerus

For the past several years, Alerus has been strategically developing a solution to help relieve financial uncertainty and reduce financial stress.

continued on next page

1 IN 3 of Americans are anxious about their financial lives. Americans has $0 saved for retirement. of Americans are unable to come up with $500 at a moment’s notice.

2 IN 5

THE NUMBERS DON’T LIE. Financial stress is consuming your workforce. 85% >50% 65% of Americans are losing sleep over money.

Americans have credit card balances they can’t pay off.

Sources https://finhealthnetwork.org/research/employeefinancial-health/ https://www.gobankingrates.com/saving-money/ savings-advice/half-americans-less-savings-2017/ https://www.forbes.com/sites/ maggiemcgrath/2016/01/06/63-of-americansdont-have-enough-savings-to-cover-a-500emergency/#407151144e0d

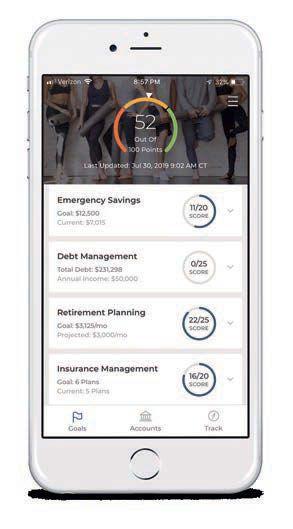

MY ALERUS is designed to help improve clients’ financial health by:

• Ensuring they have enough saved for emergencies

• Confirming they can retire on time

• Creating a plan to manage their debt

• Maximizing the benefits of health savings

• Preparing for unexpected events with insurance

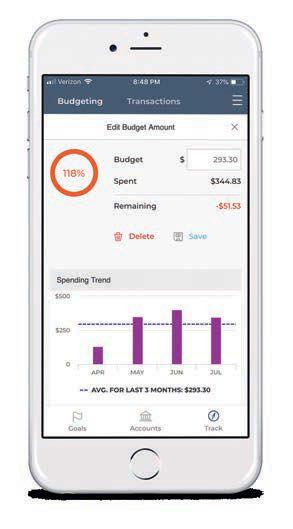

MY ALERUS is a personal hub where clients can make better decisions by tracking and improving all of their financials. Link to accounts, set goals, and start a personal path to financial confidence. Clients also have access to Alerus Financial.Fit — a mobile app that allows clients to stay on track of their budget, quickly access real-time account balances, and enjoy the convenience of completing financial workouts when on the go.

View Net Worth At A Glance

The holistic digital experience of MY ALERUS also brings the client’s entire financial picture and net worth into one single view by linking all financial accounts — including those from Alerus and other third-party institutions.

Financial Fitness Workouts

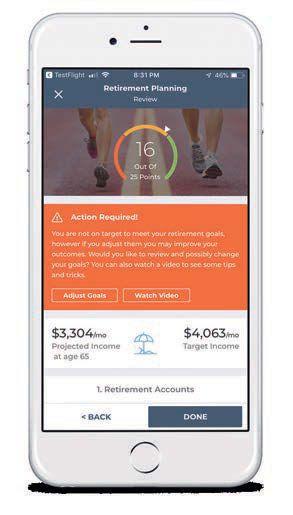

By completing a series of financial focused workouts, clients can not only see how they’re doing with their finances, but can also learn where they should improve. These easy, intuitive exercises help clients make improvements in key areas that affect their overall financial wellness.

If desired, clients can then connect with an Alerus advisor to determine an action plan aimed to improve their financial health. Clients can continue monitoring their financial health by regularly logging in to the MY ALERUS dashboard, which automatically updates with their most recent financial data.