6 minute read

Thailand's challenging path to energy transition

Frank Malerius

The conditions for decarbonising the electricity sector seem comparatively good. However, affordability is a major obstacle for the emerging economy.

Thailand is committed to a green future. As a signatory to the 2015 Paris Agreement on climate change, the country aims to peak its emissions by 2030, and then become carbon neutral by 2050 and finally climate neutral by 2065.

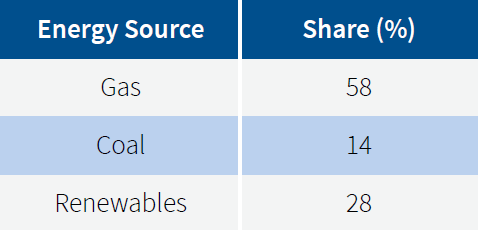

The electricity sector in Thailand is one of the largest CO₂ emitters. Nevertheless, it has a fairly environmentally friendly mix compared to the rest of ASEAN, with 58 per cent of electricity generation coming from natural gas, 14 per cent from coal, and 28 per cent from renewables, more than half of which is imported from hydropower plants in Laos.

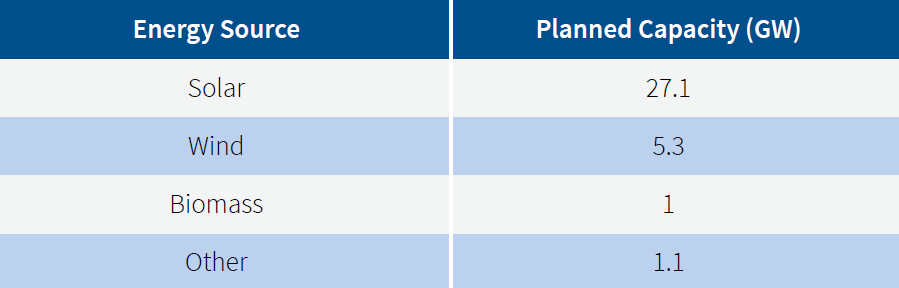

So, where does Thailand want to go? According to the Power Development Plan 2024 (PDP), which is still in the political coordination process, 51 per cent of electricity is to be green by 2037. The largest share of this is to come from solar power, while wind power is a long way behind. The kingdom is starting almost from scratch. So far, there is solar capacity of just 3 GW (compared to Germany’s 100 GW) and an installed wind capacity of 1.5 GW (compared to Germany’s 75 GW). Currently, biomass accounts for nearly half of Thailand's renewable electricity generation.

SOLAR TO BE EXPANDED

FOREIGN PLAYERS AVOID TENDERS

Foreign investment in Thailand's renewable sector remains minimal. Such projects are put out to tender by the state-run Electricity Authority of Thailand (EGAT). According to an industry expert, the awarding of contracts is too opaque for them, and it is mainly local companies that are awarded contracts. The feed-in tariffs (FiTs), set at 2.2 cents (in US currency) per kWh, are considered attractive. They can enable a return on investment (ROI) within a few years, though contracts are awarded for 25 years. Ultimately, these practices burden the end consumer.

The production of green hydrogen is not in sight in Thailand. It remains prohibitively expensive, particularly for electricity generation. Thailand currently lacks both the demand and infrastructure for it.

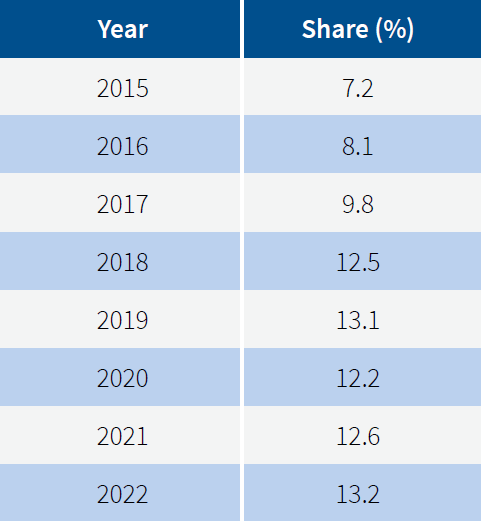

THE EXPANSION OF RENEWABLE ELECTRICITY

Share of green electricity produced in Thailand in the electricity mix (in per cent)

LITTLE MOMENTUM IN CAPACITY EXPANSION

Nevertheless, at first glance, Thailand's conditions for the planned energy transition appear to be quite favourable. The proportion of renewables is already high. In addition, the population is shrinking. The Thai economy is also the least dynamic of the six large ASEAN economies.

So far, there is solar capacity of just 3 GW (compared to Germany’s 100 GW) and an installed wind capacity of 1.5 GW (compared to Germany’s 75 GW). Currently, biomass accounts for nearly half of Thailand's renewable electricity generation.

One incentive to promote renewable energies in Thailand is its increasing dependence on energy imports. The oil and gas sources in the Gulf of Thailand are less and less able to satisfy the country's hunger for energy. Increasing quantities of crude oil have to be imported and are weighing on the foreign trade balance. Heavy air pollution in Thailand's cities is also making a switch to renewables popular.

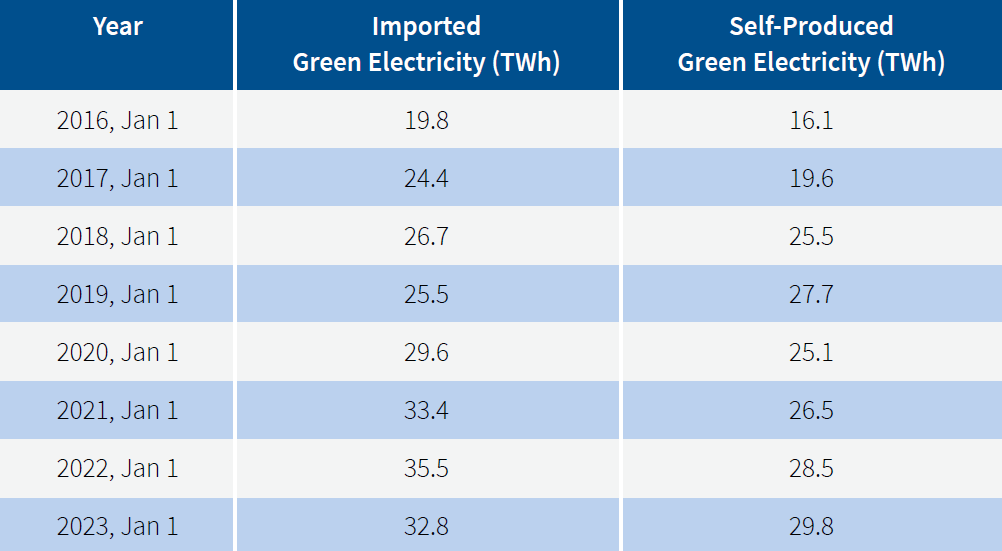

However, despite these favourable conditions, expansion is stalling. In recent years, only a small amount of new generation capacity has been tendered and installed. As a result, the share of renewables in the electricity mix is stagnating. Without even larger imports of hydroelectricity, the share of renewables in the electricity mix would have declined.

FEAR OF HIGH ELECTRICITY TARIFFS

The main reason for the hesitant expansion is the high cost. This is because non-baseload-capable forms of generation, such as solar and wind, are particularly expensive.

The highest daily demand for electricity in Thailand is between 7 and 8 pm, when the sun has set. This is when gas-fired power plants would have to be available – even after a major expansion of solar power. This is because there are no tried and tested or affordable large-scale storage facilities. At the same time, a decentralised energy supply – through many small photovoltaic and wind power plants instead of a few large conventional power plants –would require an extensive expansion of transmission lines. This is very expensive.

GAS DOMINATES

Thailand's electricity generation in 2023 (share in per cent)

At the same time, electricity costs in Thailand – as in most emerging countries – are significantly higher, in comparison to incomes, than in many industrialised countries. A kilowatt hour of household electricity costs 4.15 baht (12.3 cents). The influential former Prime Minister Thaksin Shinawatra is calling for it to be reduced to 3.70 baht (10.9 cents) due to the exorbitantly high household debt.

But even a reduction of just 1.4 cents would cost the state more than 3 billion US dollars a year, according to a financial expert’s calculations published in the Bangkok Post. Due to EGAT's monopoly position, such a price cut would be nothing more than a subsidy. EGAT's newly introduced voluntary Utility Green Tariff (UGT) with a price premium of just 0.14 cents per kilowatt hour is merely symbolic.

SHARP RISE IN ELECTRICITY DEMAND

The major challenge facing emerging countries such as Thailand, in decarbonising the electricity sector, is the expansion of renewables in the face of rapidly rising energy demand. While electricity consumption in Germany, for example, has largely remained the same over the past 35 years, it has increased fivefold in Thailand over the same period. And demand will continue to rise for a long time to come. According to the market analysts at Krungsri Research, electricity demand will increase by 5 to 6 per cent annually between 2025 and 2027 alone. The reasons for this are industrial growth, major infrastructure projects, and the increase in electromobility.

There is generally a high level of acceptance for an energy transition in Thailand, and the media is fuelling the issue. However, so far it seems to be largely driven by large companies that are installing solar panels on their buildings to boost their image. At a macroeconomic level, the path to an energy transition is likely to be much more difficult. This is because Thailand cannot afford to be at a disadvantage as a business location due to high electricity prices in the regional competition for industrial settlements, which are a prerequisite for combating poverty and creating a middle-class society.

IMPORTS MORE IMPORTANT THAN DOMESTIC PRODUCTION

Origin of green electricity in Thailand (in terawatt hours)

Contact details:

Frank Malerius

Director Thailand, Cambodia, Myanmar and Laos

German Trade & Invest (GTAI)

https://www.gtai.de/en/invest