7 minute read

Sustainability and Africa: Get Moving!

The key role to be played by country platforms, starting from those supporting firms’ working capital

Gianluca Riccio

CFA, Chair of the Business at OECD Finance Committee, Co-Chair Finance and Infrastructure Taskforce at the B20 BrazilMember of the Action Council on Women, Diversity and Inclusion at the B20 Brazil

The 2024 G20 Leaders’ final Communique of the Summit in Rio de Janeiro clearly highlighted that G20 Leaders commit to “accelerate the reform of the international financial architecture so that it can meet the urgent challenge of sustainable development, climate change and efforts to eradicate poverty”. Moreover, it is especially important that they extend their support to “the voluntary building-up of country platforms as one of the possible instruments to boost sustainable finance in emerging markets and developing economies. Platforms that are country-led, flexible, and well adapted to national circumstances work as efficient instruments to mobilise both public and private capital to finance projects and programs in developing countries, helping match mitigation, adaptation, and resilience building challenges with concrete flows of resources for just transitions“ [G20 Leaders’ Declaration, paragraph 46. November 2024]. These commitments meet the recommendations made by the B20 in the last few years, and more specifically the recommendations made by the B20 Finance and Infrastructure Taskforce [B20 Finance & Infrastructure TF policy paper, recommendation 3]; and the 2024 joint publication B20 – Business at OECD –IOE “Funding Sustainability Efforts: from aspirations to concrete mechanisms and set milestones” [B20-BIAC-IOE, 2024 - B20BIAC-IOE publication ]. Indeed, the paper recommended to G20 Leaders to seek synergies across different domains to support financing for sustainable growth and stability.

Why are these commitments so important?

Progress towards Sustainability is lagging. In 2023 in Delhi the G20 Leaders highlighted that the “global economic growth is below its long-run average and remains uneven“, and also that “global greenhouse gas (GHG) emissions continue to increase, with climate change, biodiversity loss, pollution, drought, land degradation and desertification threatening lives and livelihoods“. Even countries that have shown healthy economic growth, like India showing regular growth at an average rate of 7%, have however shown material increase in GHG, driven mostly by the heavy use of coal.

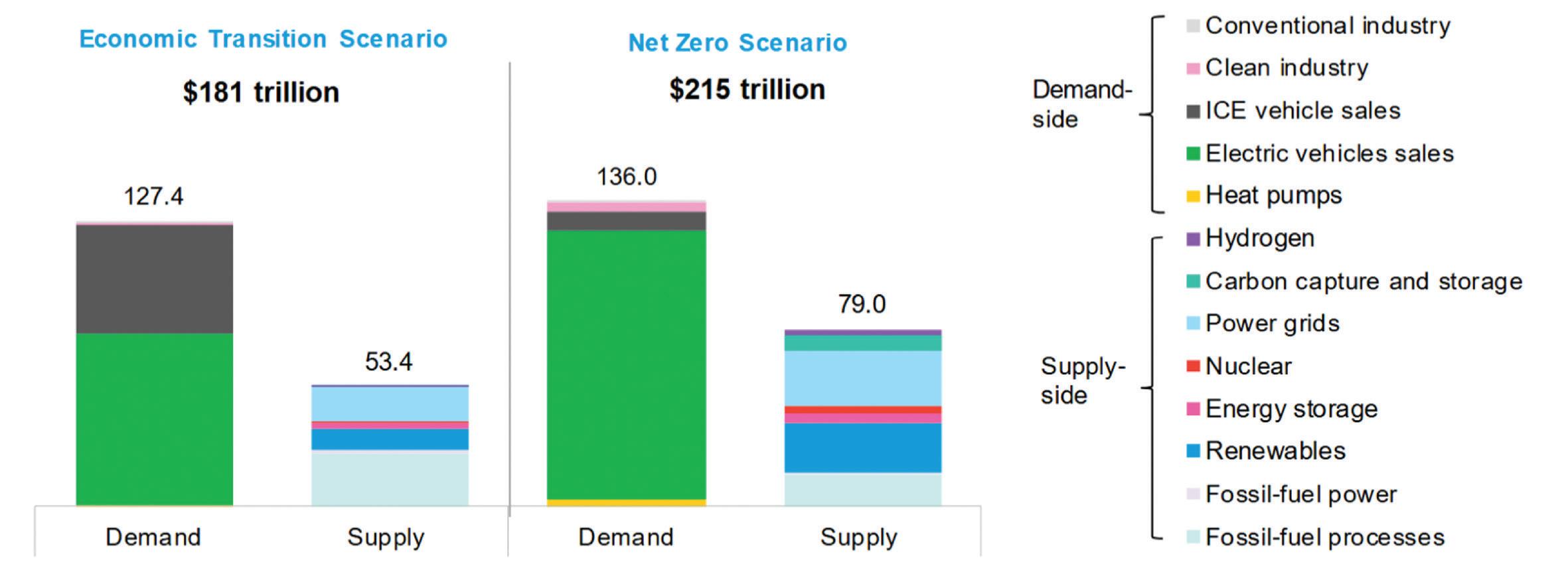

Bloomberg NEF in Delhi presented an eye-opening analysis showing that to meet the COP 2050 targets, the investments needed are in the order of USD 180 trillion to over USD 200 trillion depending how stringent of a target is set (figure 1). Ultimately, the pace the world is currently moving at is nowhere near meeting these targets.

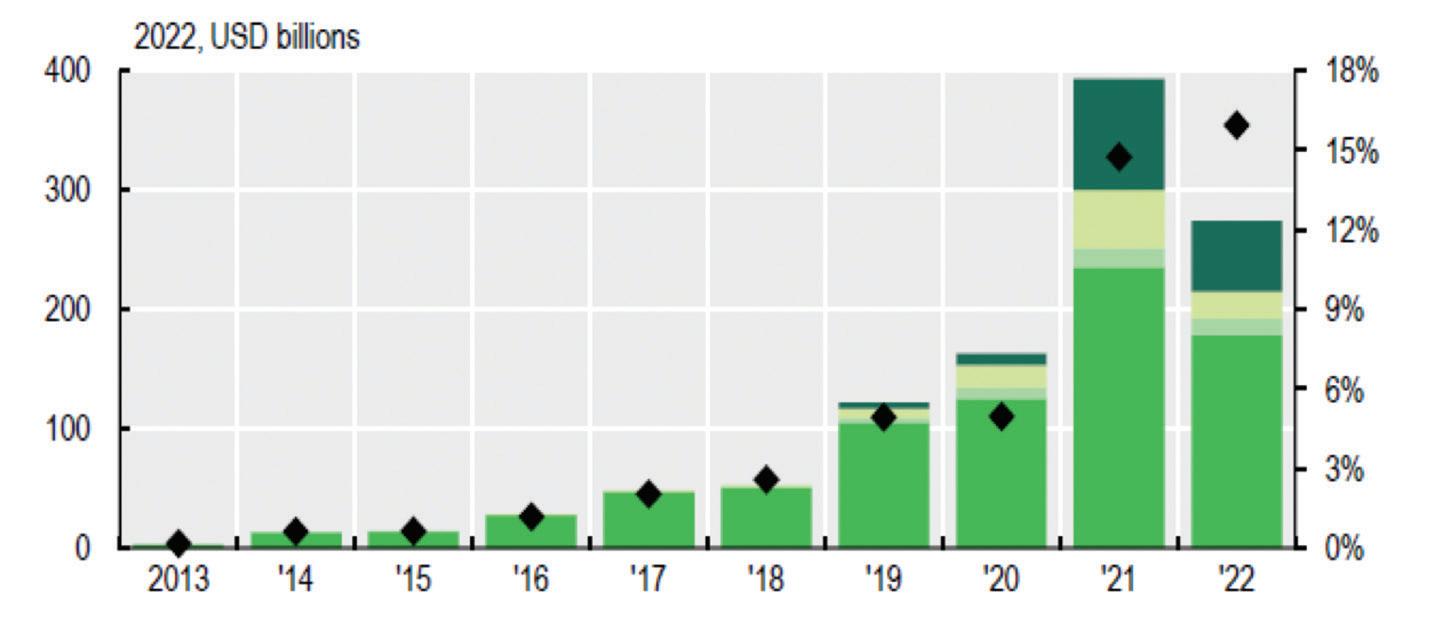

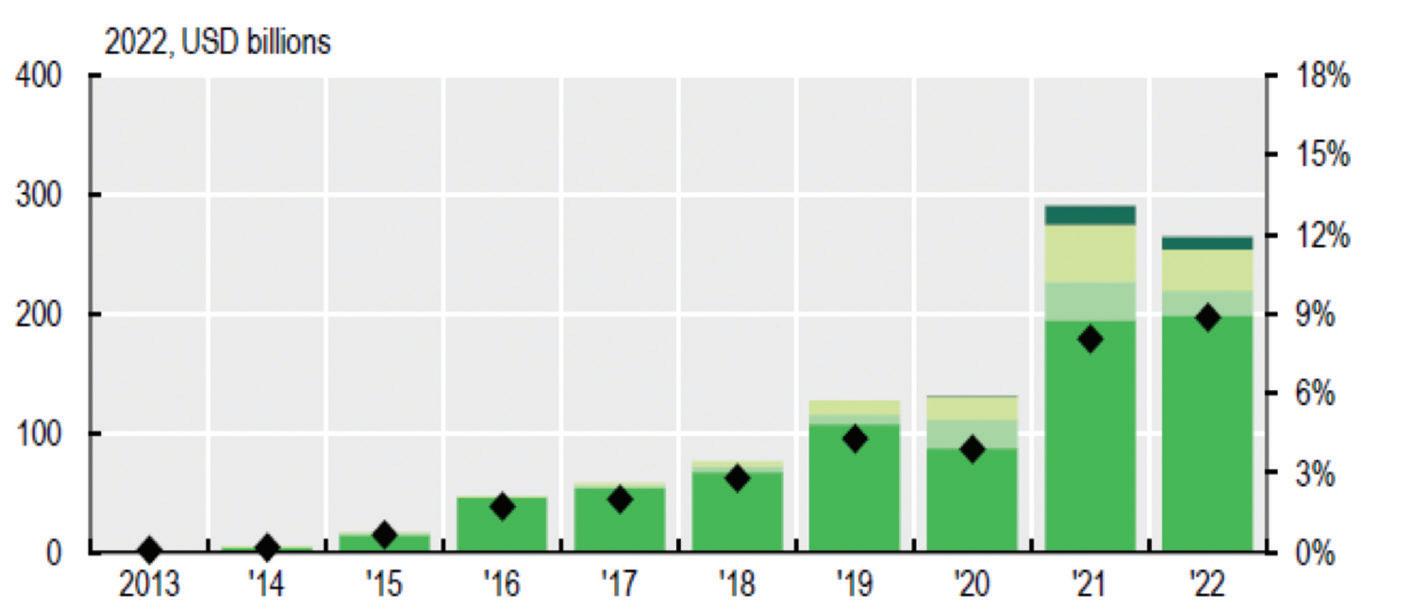

The G20 Nations have made collective commitments towards Sustainability investments, also outlining Sustainability future requirements, however they recognise that “at the midway point to 2030, the global progress on SDGs is off-track with only 12% of the targets on track”. In addition, from the corporate sector perspective the issuance of sustainable bonds, despite having increased significantly,1 remain marginal with only 16% of all bonds issued by non-financial corporates (USD 274 billion), and 9% of all bonds issued by the financial institutions (USD 265 billion) being sustainable issuances. In 2022, Sustainability-linked bonds” (SLBs) for which the issuer’s financing costs can vary depending on whether it meets specific sustainability performance targets within a timeline, represented only 13% of total sustainable bonds issued, meaning less than 2% overall (figure 2). →

The challenge is evident, but the G20 commitments made in Brazil may offer a game changer.

To deliver the ambitions targeted in sustainability, policymakers are required to

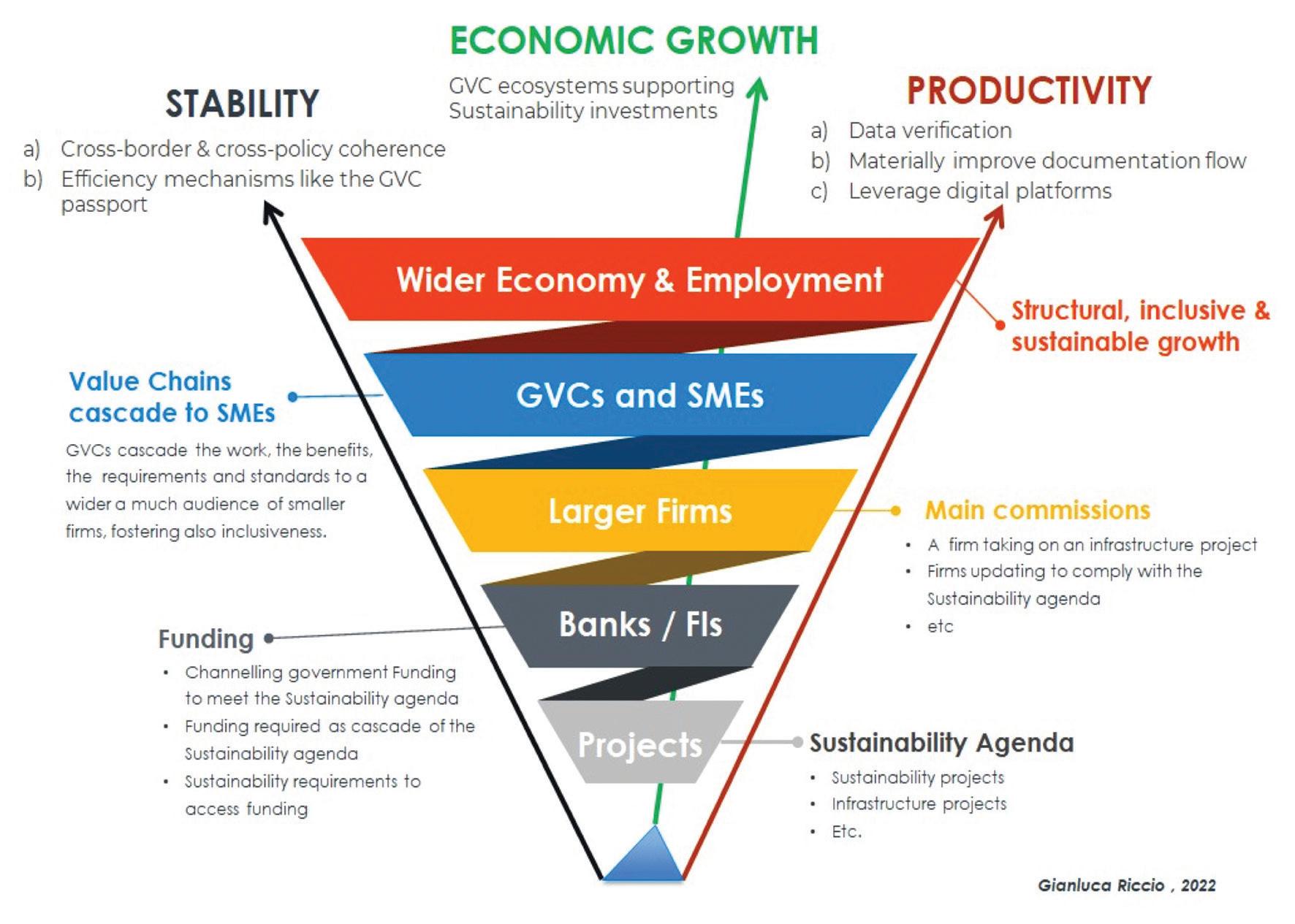

→ offer solutions that generate flywheels across GVC, so to generate positive spillover effects that cascade across the wider economy. The very same challenges and required solutions apply to the investments needed in Africa. To achieve either, funding efforts do not need to be labelled “green”, “sustainable” or “for Africa”, but need to be effective in their content and generate a virtuous circle. The answer emerging from the Brazilian G20 this year is that success can be achieved, but resources alone will not be sufficient if firms face difficulties in accessing funds due to high regulatory and transaction costs, long-dated inherent risks, and a fragmented ecosystem. There is a need of joint private-public investment efforts operating on “Platforms that are flexible, and well adapted” to either the national circumstances or those of the relevant Global Value Chains (GVCs). Such platforms will support Small and Medium-Sized Enterprises (SMEs), who appear to have been left behind in the agenda, despite being the largest employers globally. Productivity is key, and it is one of the three pillars, together with Stability, and Economic Growth, of the “Sustainable Growth Propeller” (SGP) conceptual framework introduced in the 2022 G20 cycle [B20-BIAC-IOE, 2022] outlined in figure 3 below. The DGP offers a powerful enabler to enact the G20 Sustainability agenda, while also fast-tracking inclusive economic growth and job creation. The G20 India Presidency embraced this objective focusing on the need for actionable policy recommendations on priorities towards responsible, accelerated, innovative, sustainable, and equitable businesses.

A tangible example: payment platforms supporting working capital to free up capitals towards investments. The key challenge is always in executing a strategy, however in this case, concrete examples do exist, as by addressing firms’ working capital and efficient payments. Indeed, enhancing firms’ ability to effectively manage their working capital will boost productivity, which in turn can positively result in sustainable and inclusive economic growth. The B20, Business at OECD (BIAC) and the International Organisation of Employers (IOE) published a joint paper in Delhi in this direction: “Addressing efficiency in payments and working capital to deliver Sustainability and Growth”, This paper shows the impact that creating trustworthy and interoperable national payment platforms can offer. These are platforms that would be leveraging already existing technology and standards, based on two key components:

• Enabling counterparty identification by making wide use of the Legal Entity Identifier (LEI), while including digital documentation as a key factor in the process.

• Offering trusted and interoperable early-payment platforms that match account payables and account receivables, leveraging technology with clear security and data protection requirements; fully aligning to the G20 communique’ recognition “that safe, secure, trusted, accountable and inclusive digital public infrastructure, can foster resilience, and enable service delivery and innovation”.

The resulting “GVC ecosystems” built on trustworthy interoperable early-payment platforms structured on the basis of safe principles and requirements will benefit all players across both private and public grounds, and also aligns to this year’s GPFI priority towards “Financial Inclusion and Productivity Gains”, as well as paving the road to enhance SME participation in GVCs. Ultimately, if scaled, it could produce a few trillion US dollars of new annual economic benefit globally, in multiple directions:

• Timely payments ensure effective working capital and cash flow management by firms. Working capital can amount to as much as several months’ worth of revenues, which is not trivial. Improving its management can be an effective way to free-up needed cash.

• Aligning account receivables and account payables will foster efficient GVCs.

• It strengthens financial stability as firms raise their credit standing and can borrow at lower costs. The European Central Bank (ECB) concluded that effective and timely payments allow firms to enhance their liquidity and creditworthiness, which also benefits banks having raised the credit standing of their clients, and shifting their lending towards proper Capex investments, with longer maturities. Therefore, early payment platforms accelerating invoice payments are complementary to banks, not competitors.

• 'Shifting from short-term to longer-term credit offers higher net profit ratios towards more solid customers. Taking a step further, ensuring that working capital is funded when needed through early payments, would contribute to safeguard that the significant investments towards fund longer-term Capex as intended, whether aimed towards Sustainability, Africa or other longer term objectives.

• Employment: Facilitating early payments can generate several millions of additional permanent jobs at minimal cost for all parties, including governments. Studies have shown that a fall in the need to finance working capital has material effects on job creation and is progressively stronger for small, labour-intensive firms. Since 70% of funding needed by SMEs is used to meet working capital needs, it is not surprising that research indicates that nearly 20% of every new dollar of working capital for SMEs leads to improved salaries and job creation. Considering that the SME funding gap of over USD 5 trillion (over USD 8 trillion adding informal MSMEs) or the outstanding accounts receivables of USD 30 trillion, the ability of facilitating early payments can generate several millions of additional jobs.

• Economic Growth: taking a step further, a study started in 2022 by the McKinsey Global Institute together with C2FO started a study in 2022 on the improvements of working capital on GDP. Results so far have been compelling and consistent the “rule of thumb” of Okun’s Law2: in each national economy McKinsey analysed, an effective national platform for working capital built along the lines of described in this paper would increase both GDP and employment. In a large country like Mexico, a working capital platform with national scale can contribute to unlocking up to 1.1% of GDP and up to 1.3% employment growth. In a small country like United Arab Emirates, these can go up to 3% and 5%, respectively.

• Platforms based on reliable certification increase transparency and traceability, contributing to financial crime prevention, such as money laundering or terrorist financing, and efficient sharing of ESG data.

Importantly, such working capital platforms are not a theoretical or utopistic exercise, but they do exist today. C2FO (www.C2FO.com), is a good example of global platforms where technology supports collaboration across GVCs and increases the available supply of working capital. For example, their platform has over 2 million suppliers in its network and has provided more than USD 350 billion (as December 2024) in funding to users around the world, by ensuring that companies’ invoices are paid at the “right time”, i.e. when the creditor needs the working capital, not just when the invoice is legally due (the platform averaged over 30 days earlier in payments).This offers a tangible example of how the “Sustainable Growth Propeller” (fig. 3) can work in practice, delivering a balanced approach in raising efficiencies and facilitating the transition towards a sustainable and internationally inclusive global economy; by creating jobs and supporting economic growth.

Environmentally led investments are the ideal opportunity to test innovative ideas to facilitate payments and working capital, making them more efficient throughout GVCs, across both borders and sectors, which in turn can act as an enduring flywheel that sparks employment and knowhow, aiding social sustainability. We just need to Get Moving! ■