6 minute read

Where is Justmarkets Broker Located? From which country

from JustMarkets Trading

by ForexMakets

The world of Forex trading is vast, dynamic, and filled with opportunities. Among the many brokers available, JustMarkets stands out as a notable name for both beginner and seasoned traders. But one of the most frequently asked questions is: Where is JustMarkets broker located? From which country does this broker operate? In this deep-dive JustMarkets Review, we will not only uncover the location but also explore every important aspect of the JustMarkets broker, with a sharp focus on helping you make an informed trading decision.

💥💥💥 Trader with JustMarkets: 👉 Open An Account or 👉 Go to broker

1. Introduction to JustMarkets

JustMarkets has rapidly grown to become a globally recognized broker, serving traders across continents. Known for its user-friendly interface, reliable execution, and wide range of account options, JustMarkets is the go-to platform for many. Whether you are an expert or just starting out, this broker offers solutions tailored to different trading needs.

2. Where is JustMarkets Broker Located?

✅ JustMarkets is headquartered in Seychelles, a well-known offshore financial hub. The official company that manages this broker is Just Global Markets Ltd, registered under the Seychelles Financial Services Authority (FSA).

Seychelles has become a preferred jurisdiction for many Forex brokers due to its balanced regulation policies that favor both business and client security.

Why Seychelles?

Favorable tax environment

Pro-business legal infrastructure

Growing reputation in the financial services sector

This location allows JustMarkets to offer competitive trading conditions globally, without being bound by overly restrictive frameworks that can hinder innovation.

3. Regulatory Environment and Legal Structure

The JustMarkets Broker Review wouldn’t be complete without analyzing its regulatory framework. The broker operates under:

FSA of Seychelles (Financial Services Authority): While it may not have the same weight as FCA or ASIC, it ensures a foundational level of regulatory compliance.

Internal risk management policies to protect traders ✅

Segregated client funds to prevent misuse ❌

The regulatory landscape may not be Tier-1, but for retail traders looking for high leverage and fewer restrictions, this can be an advantage.

4. Trading Instruments Offered by JustMarkets

JustMarkets provides a wide range of financial instruments for diversified trading:

Forex pairs (Majors, Minors, Exotics)

Metals like Gold and Silver

Indices such as S&P 500, NASDAQ, FTSE 100

Cryptocurrencies (BTC, ETH, LTC, and more)

Commodities including oil and agricultural products

Stocks of global giants

This rich portfolio allows traders to explore various market conditions and spread their risk across multiple assets.

5. Account Types and Their Benefits

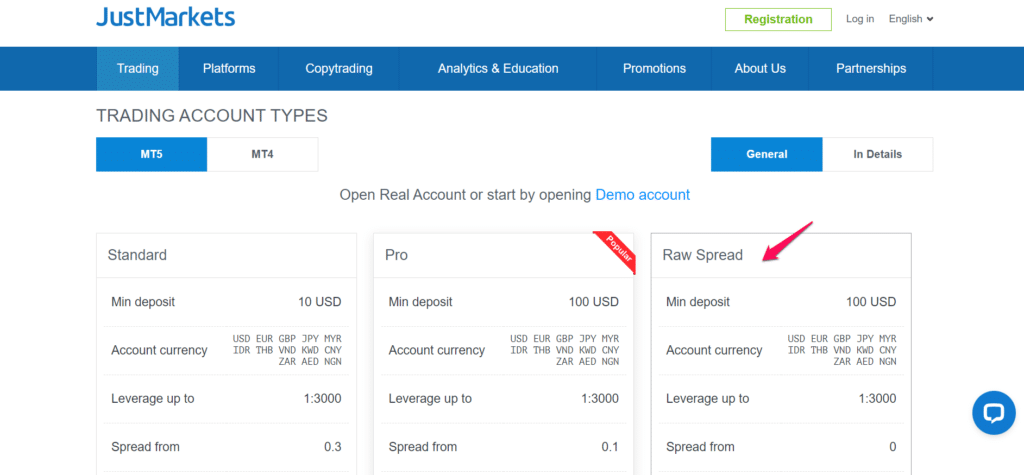

JustMarkets offers multiple account options:

Standard Account – No commission, average spreads

Pro Account – Tighter spreads, no commission

Raw Spread Account – Ultra-low spreads, minimal commission ✅

Cent Account – Ideal for beginners to practice with micro lots

Each account type caters to a different trading style. Advanced traders often opt for Raw Spread for precise scalping and day trading.

6. Spreads, Commissions, and Leverage

Spreads: Starting from 0.0 pips (Raw Spread account)

Commission: Only applicable on Raw accounts

Leverage: Up to 1:3000 depending on jurisdiction and account type ✅

Such aggressive leverage can be a double-edged sword, but when used wisely, it allows traders to maximize potential returns with smaller capital.

7. Trading Platforms and Tools

JustMarkets provides access to the industry’s best tools:

MetaTrader 4 (MT4)

MetaTrader 5 (MT5)

Web Trader for browser-based trading

Multi-terminal support

Technical indicators, EA support, charting tools ✅

Whether you’re a technical analyst or an automated trader, JustMarkets equips you with professional-grade platforms.

8. Deposit and Withdrawal Methods

JustMarkets supports multiple funding methods:

Bank transfers

Credit/debit cards

E-wallets like Skrill, Neteller

Crypto payments

Withdrawals are typically processed within 1–2 business days. The fee-free structure on many methods is a key highlight.

9. JustMarkets Safety and Security Features

Security is not compromised at JustMarkets:

SSL encryption ✅

2FA for account login

Negative balance protection

Segregated funds ❌ (A concern, but mitigated with internal policies)

These measures ensure that your funds and personal information are protected.

10. Educational Resources and Trader Support

JustMarkets understands the power of education:

Video tutorials

Webinars

Market analysis

E-books and trading guides

The multilingual customer support is available 24/7, offering timely and relevant solutions to all inquiries.

11. Mobile Trading Experience

JustMarkets' mobile apps mirror the desktop version’s features:

Instant execution

Full charting package

Push notifications

User-friendly navigation

This means you can trade efficiently on-the-go, making the most of every market opportunity.

12. Pros and Cons ✅❌

✅ Wide range of assets✅ High leverage options✅ Variety of account types✅ MT4 and MT5 access❌ Offshore regulation might deter some❌ No Tier-1 license like FCA or ASIC

13. Comparison with Other Brokers (Listed Analysis)

Offers higher leverage than most regulated brokers

Provides access to both MT4 and MT5, unlike some competitors

Allows cent account trading which many big-name brokers do not

14. Trader Community Feedback

Most users highlight:

Fast execution

Easy withdrawals

Helpful customer support

Advanced features even for basic accounts

Some concerns include:

Lack of detailed transparency about internal operations ❌

More educational depth could be added

15. JustMarkets Affiliate and Partnership Opportunities

JustMarkets offers lucrative affiliate models:

Revenue share

CPA programs

Introducing broker (IB) schemes

If you have a network of traders, this can be a profitable avenue for passive income.

16. How to Register and Start Trading

Ready to start? Here's how:

Visit the JustMarkets website

Click on “Open Account”

Complete KYC verification ✅

Fund your account

Start trading global markets!

Tip: Start with a demo account, then move to a Cent or Raw account for live experience.

👉 Open JustMarkets Account Fast!

17. Final Thoughts: Is JustMarkets Worth It?

If you’re looking for a broker with flexibility, strong leverage, and intuitive trading platforms, JustMarkets delivers. While the offshore regulation may raise eyebrows for some, the advantages far outweigh the drawbacks for many retail traders.

Join thousands of traders who trust JustMarkets and tap into global financial opportunities with ease and confidence.

👉 Don’t wait. Take your trading journey to the next level. Sign up today and experience the power of JustMarkets!

18. FAQs

Q1: Where is JustMarkets broker based?A1: JustMarkets is headquartered in Seychelles.

Q2: Is JustMarkets regulated?A2: Yes, under the Financial Services Authority (FSA) of Seychelles.

Q3: Can I trade crypto on JustMarkets?A3: Yes, major cryptocurrencies are available.

Q4: What trading platforms does JustMarkets support?A4: MT4, MT5, and web-based platforms.

Q5: Is JustMarkets safe?A5: It uses SSL encryption and other security features.

Q6: What’s the minimum deposit?A6: It varies by account type, but is generally low.

Q7: Does JustMarkets have demo accounts?A7: Yes, demo accounts are available.

Q8: Can beginners use JustMarkets?A8: Absolutely. Cent accounts and education tools make it beginner-friendly.

Q9: Are there fees for deposits or withdrawals?A9: Many methods are free, but check terms based on region.

Q10: How can I open a JustMarkets account?A10: Go to their official site, click “Open Account,” complete KYC, and start trading.

Start trading smarter, not harder — with JustMarkets!👉 Join JustMarkets Now

💥 Read more: