6 minute read

Is Avatrade Regulated by MAS

from Avatrade Review

by ForexMakets

Is Avatrade Regulated by MAS

In the dynamic world of forex trading, regulatory compliance is a cornerstone of trust and reliability. Traders often seek brokers regulated by reputable authorities to ensure their investments are safeguarded. One such esteemed regulatory body is the Monetary Authority of Singapore (MAS). This article delves into whether AvaTrade, a prominent name in the forex industry, is regulated by MAS and what that means for traders.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Understanding MAS Regulation

The Monetary Authority of Singapore (MAS) serves as Singapore's central bank and financial regulatory authority. MAS oversees all financial institutions in Singapore, ensuring they adhere to stringent standards that promote transparency, stability, and consumer protection. Brokers regulated by MAS are subject to rigorous compliance requirements, including:

Capital Adequacy: Maintaining sufficient capital to cover potential losses.

Segregation of Funds: Keeping client funds separate from company funds.

Regular Audits: Undergoing periodic reviews to ensure compliance.

Transparent Operations: Providing clear and accurate information to clients.

Being regulated by MAS signifies a broker's commitment to maintaining high operational standards and offers traders an added layer of security.

AvaTrade's Global Regulatory Landscape

While AvaTrade is not regulated by MAS, it boasts a robust global regulatory framework, being licensed and overseen by several top-tier financial authorities:

Central Bank of Ireland (CBI): AvaTrade EU Ltd is authorized and regulated by the CBI, ensuring compliance with European Union financial directives.

Australian Securities and Investments Commission (ASIC): Ava Capital Markets Australia Pty Ltd operates under ASIC's regulation, adhering to Australia's financial laws.

Financial Services Agency (FSA) of Japan: Ava Trade Japan K.K. is licensed by the FSA, complying with Japan's stringent financial regulations.

Financial Sector Conduct Authority (FSCA) of South Africa: Ava Capital Markets Pty Ltd is regulated by the FSCA, upholding South Africa's financial standards.

Abu Dhabi Global Market (ADGM) Financial Regulatory Services Authority (FRSA): Ava Trade Middle East Ltd operates under the FRSA's oversight, aligning with international financial norms.

British Virgin Islands Financial Services Commission (BVI FSC): Ava Trade Ltd is licensed by the BVI FSC, facilitating global operations.

Israel Securities Authority (ISA): ATrade Ltd is regulated by the ISA, ensuring adherence to Israel's financial regulations.

Polish Financial Supervision Authority (KNF): AvaTrade's Polish branch operates under the KNF's supervision, complying with Poland's financial laws.

These regulatory bodies enforce strict guidelines, including client fund protection, transparent operations, and regular audits, ensuring AvaTrade maintains high standards across its global operations.

Implications of Not Being MAS-Regulated

For traders in Singapore, AvaTrade's lack of MAS regulation means:

Limited Local Recourse: In case of disputes, traders may not have access to MAS's dispute resolution mechanisms.

Absence of MAS-Specific Protections: Traders won't benefit from MAS's specific investor protection schemes.

Potential Regulatory Restrictions: AvaTrade may face limitations in marketing or offering certain services to Singapore residents.

However, AvaTrade's adherence to other reputable regulatory frameworks still offers a significant degree of protection and operational integrity.

Comparing AvaTrade to MAS-Regulated Brokers

When evaluating AvaTrade against MAS-regulated brokers, consider the following aspects:

Regulatory Oversight:

✅ AvaTrade: Regulated by multiple top-tier authorities globally.

✅ MAS-Regulated Brokers: Supervised by MAS, ensuring compliance with Singapore's financial standards.

Client Fund Protection:

✅ AvaTrade: Implements fund segregation and offers negative balance protection.

✅ MAS-Regulated Brokers: Also maintain fund segregation and may offer additional investor compensation schemes.

Leverage and Trading Conditions:

✅ AvaTrade: Offers leverage up to 1:400, depending on the jurisdiction.

✅ MAS-Regulated Brokers: Typically offer lower leverage, adhering to MAS's risk management guidelines.

Market Access:

✅ AvaTrade: Provides access to a wide range of markets, including forex, commodities, indices, and cryptocurrencies.

✅ MAS-Regulated Brokers: Offer diverse market access, though some instruments may be restricted based on MAS regulations.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Why Choose AvaTrade Despite MAS Non-Regulation

Despite not being MAS-regulated, AvaTrade offers several compelling advantages:

Global Regulatory Compliance: AvaTrade's adherence to multiple international regulatory standards ensures a high level of operational integrity.

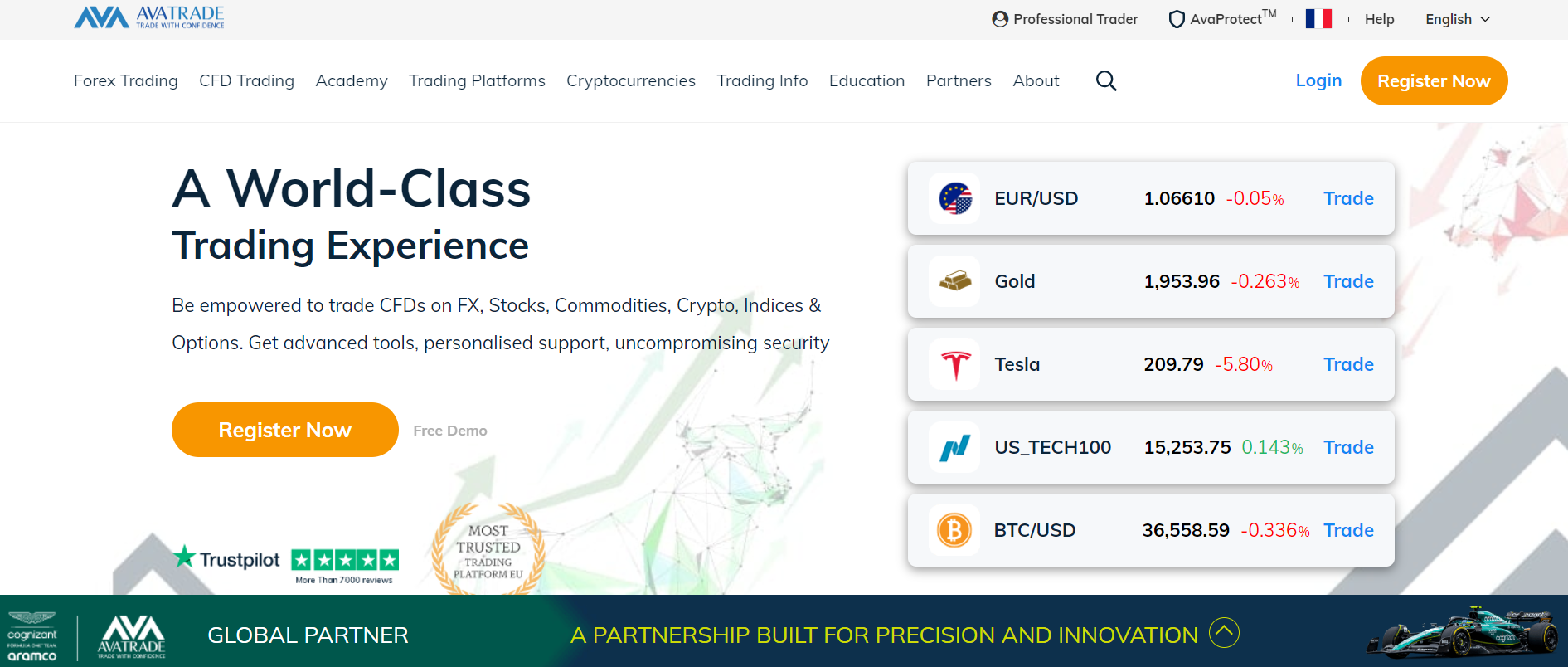

Diverse Trading Instruments: Traders have access to over 1,000 instruments, including forex, commodities, indices, stocks, and cryptocurrencies.

Advanced Trading Platforms: AvaTrade supports platforms like MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGO, catering to various trading preferences.

Educational Resources: AvaTrade provides comprehensive educational materials, webinars, and market analysis to support traders at all levels.

Customer Support: With multilingual support available 24/5, traders can receive assistance whenever needed.

These features make AvaTrade a viable option for traders seeking a reliable and feature-rich trading environment.

Conclusion

While AvaTrade is not regulated by the Monetary Authority of Singapore, its extensive global regulatory framework, diverse trading offerings, and commitment to trader education and support make it a noteworthy choice for traders worldwide. Singaporean traders should weigh the importance of local regulation against the benefits AvaTrade provides to determine the best fit for their trading needs.

Frequently Asked Questions

1. Is AvaTrade regulated by MAS?

❌ No, AvaTrade is not regulated by the Monetary Authority of Singapore.

2. Can Singapore residents open an account with AvaTrade?

✅ Yes, Singapore residents can open an account with AvaTrade, but they should be aware of the lack of MAS regulation.

3. What protections does AvaTrade offer to its clients?

✅ AvaTrade offers fund segregation, negative balance protection, and operates under multiple reputable regulatory bodies.

4. Does AvaTrade offer a demo account?

✅ Yes, AvaTrade provides a free demo account for traders to practice and familiarize themselves with the platform.

5. What trading platforms does AvaTrade support?

✅ AvaTrade supports MetaTrader 4, MetaTrader 5, AvaTradeGO, and other proprietary platforms.

6. Are there any restrictions for Singapore traders using AvaTrade?

❌ While Singapore traders can use AvaTrade, they won't benefit from MAS-specific protections and may face certain limitations.

7. How does AvaTrade ensure the security of client funds?

✅ AvaTrade maintains segregated accounts for client funds and complies with stringent regulatory standards.

8. What leverage does AvaTrade offer?

✅ AvaTrade offers leverage up to 1:400, depending on the trader's jurisdiction and the regulatory body overseeing their account.

9. Does AvaTrade provide educational resources?

✅ Yes, AvaTrade offers a range of educational materials, including webinars, tutorials, and market analysis.

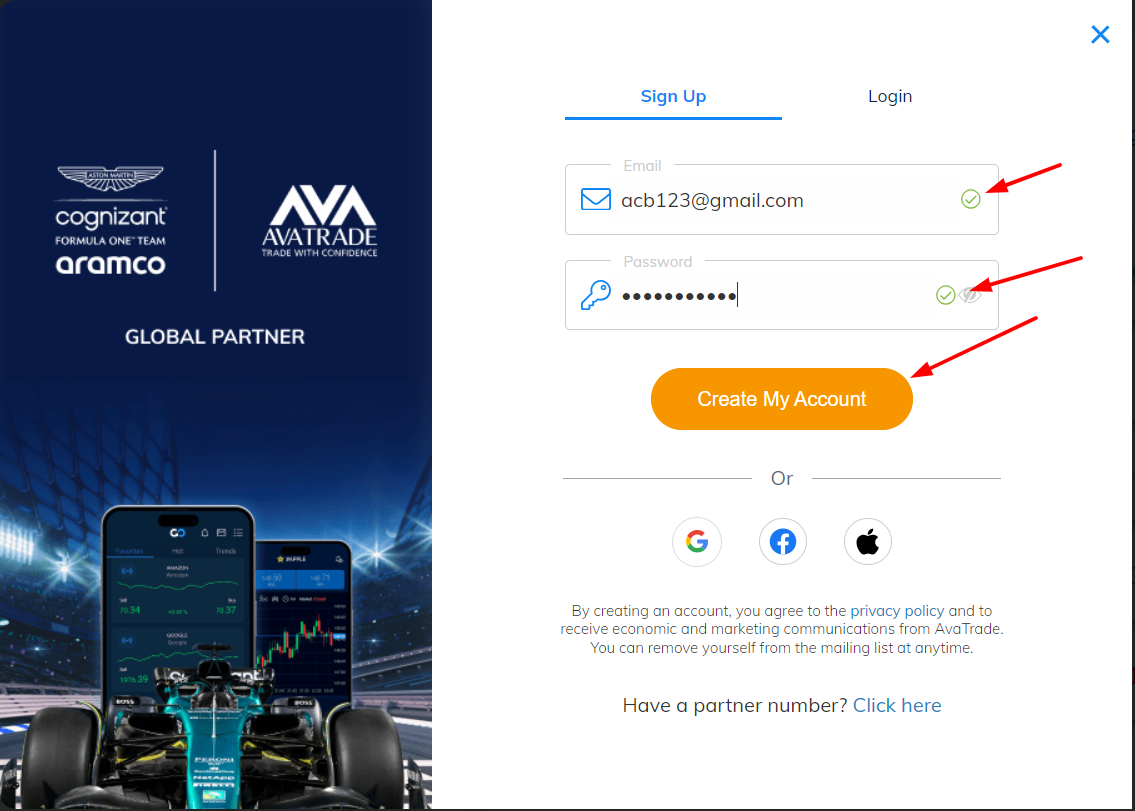

10. How can I open an account with AvaTrade?

✅ You can open an account by visiting AvaTrade's official website and completing the registration process.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker