7 minute read

Is Avatrade Regulated in Singapore

from Avatrade Review

by ForexMakets

Is Avatrade Regulated in Singapore

1. Introduction: What You Need to Know About Avatrade

In today’s dynamic world of Forex and online trading, choosing the right broker is crucial. One of the most popular choices among traders is Avatrade, a globally recognized Forex broker. But is Avatrade regulated in Singapore, and what does that mean for you as a trader? This article provides an in-depth look into the company’s regulatory status, its features, and why it could be the right fit for your trading journey.

As a trader, understanding regulatory compliance is key for ensuring a safe and legitimate trading experience. In this guide, we will break down the details of Avatrade, its regulatory bodies, and why regulation matters in the world of Forex trading.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

2. Avatrade Overview: What Makes It Stand Out in the Forex Market

Avatrade was founded in 2006 and has established itself as a leading online brokerage with a strong presence in the Forex market. The broker offers a wide range of trading options, including Forex, stocks, commodities, cryptocurrencies, and more. With offices around the world, Avatrade has a global reach and provides access to thousands of financial instruments.

Key Features of Avatrade:

Wide Range of Trading Instruments: Access Forex, stocks, commodities, cryptocurrencies, indices, and more.

Advanced Trading Platforms: Use platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and AvaTradeGO, designed for both beginners and professional traders.

Competitive Spreads and Leverage: Avatrade offers competitive pricing, with leverage up to 1:400, allowing traders to maximize their potential profits.

Strong Customer Support: Avatrade offers support in multiple languages and is available 24/5 to assist traders.

3. Is Avatrade Regulated in Singapore?

Yes, Avatrade is regulated in Singapore under the Monetary Authority of Singapore (MAS), one of the most reputable and strict financial regulators in the world. Avatrade holds a license to operate in Singapore, which means the broker adheres to the country’s strict financial regulations.

What Does Being Regulated in Singapore Mean?When a broker is regulated by a financial authority such as the MAS, it must comply with stringent requirements. These include maintaining client funds in segregated accounts, providing transparent fee structures, and ensuring fair and ethical trading practices. For traders in Singapore, choosing a regulated broker like Avatrade means they are protected by the country’s laws and regulations, ensuring a safe and secure trading environment. ✅

Key Takeaway:If you are a trader based in Singapore or you’re considering trading in the region, Avatrade’s regulation by the Monetary Authority of Singapore (MAS) offers a significant level of trust and protection.

4. How Avatrade Works: Platform Features and Trading Tools

Avatrade provides a user-friendly trading experience with multiple platforms and tools designed to cater to both beginners and professional traders.

Trading Platforms Offered by Avatrade:

MetaTrader 4 (MT4): A popular trading platform with advanced charting and analytical tools.

MetaTrader 5 (MT5): A more advanced version of MT4, offering additional features for professional traders.

AvaTradeGO: A mobile trading app designed for traders on the go.

Avatrade also offers copy trading, which allows beginners to mirror the trades of professional traders, making it easier for them to get started in the Forex market.

5. Regulations and Licensing: The Importance for Forex Traders

As a Forex trader, understanding regulations is crucial. Brokers that are licensed and regulated by reputable authorities like the Monetary Authority of Singapore (MAS) are held to strict standards. These regulations ensure that brokers operate fairly, transparently, and in the best interest of their clients. Regulation helps protect your funds, ensures fair trading practices, and provides a layer of security in case things go wrong.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

6. Avatrade's Regulatory Bodies: A Global Perspective

Avatrade’s global reach is supported by its regulation in multiple countries. In addition to Singapore, Avatrade is regulated by several other reputable authorities, including:

European Securities and Markets Authority (ESMA) for European clients.

Central Bank of Ireland for clients in Europe.

Australian Securities and Investments Commission (ASIC) for clients in Australia.

These regulatory bodies impose strict rules and oversight to ensure that Avatrade operates ethically and securely.

7. Why Traders Choose Avatrade: The Pros

Many traders around the world choose Avatrade for a variety of reasons. Let’s explore some of the major benefits that make Avatrade stand out:

Regulation: Being regulated by top-tier authorities ensures security for traders.

Range of Instruments: Access to a wide range of financial products including Forex, cryptocurrencies, commodities, stocks, and indices.

User-Friendly Platforms: The trading platforms are intuitive and easy to use, making it easier for both novices and experienced traders.

Competitive Leverage and Spreads: Avatrade offers high leverage (up to 1:400) and competitive spreads, which can enhance the potential for profits.

Customer Support: Avatrade’s support team is available 24/5, ensuring that traders always have assistance when needed.

8. The Risks of Trading with an Unregulated Broker

Trading with an unregulated broker can be risky. Without regulation, brokers are not held accountable for their actions, meaning they can engage in unethical practices such as:

Mismanagement of funds

Unfair pricing

Lack of transparency

Difficulty withdrawing funds

Regulation is a safeguard against these risks, ensuring that brokers like Avatrade adhere to standards that protect traders. ❌

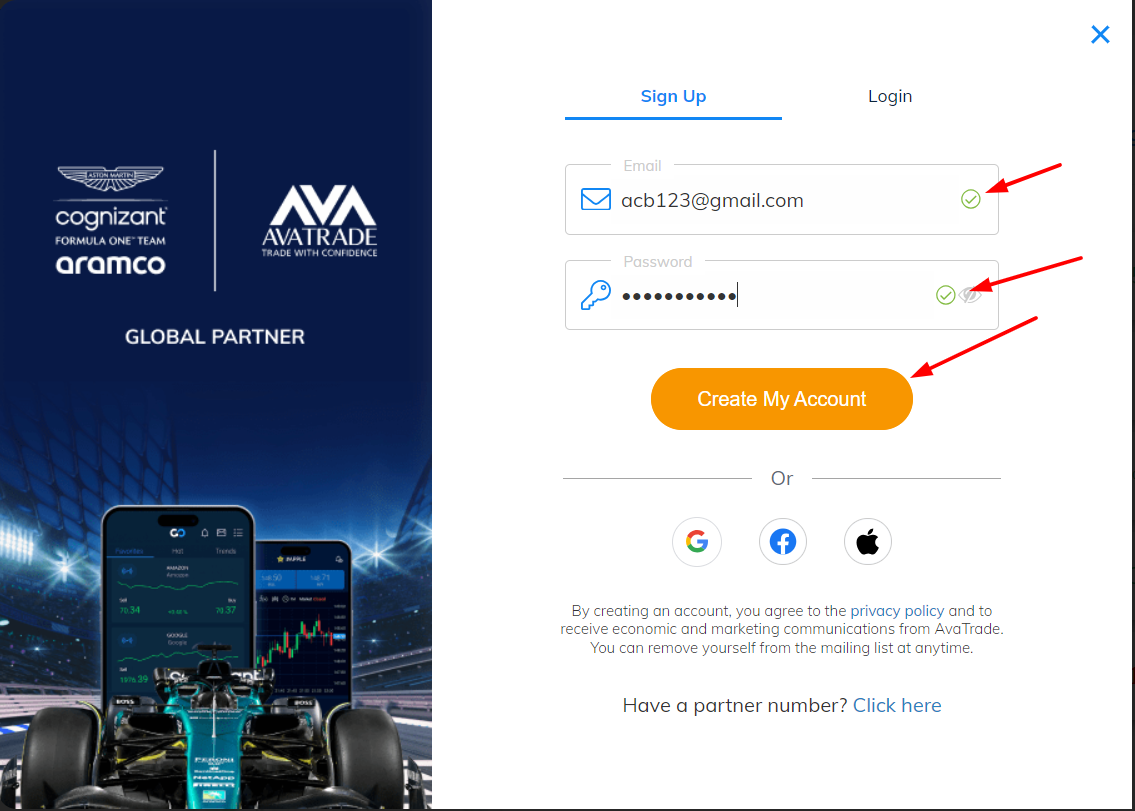

9. How to Open an Account with Avatrade: Step-by-Step Guide

Opening an account with Avatrade is straightforward. Here’s a simple guide to getting started:

Click on the 'Open Live Account' Button

Fill in Your Personal Details

Upload the Required Documents (proof of identity and address)

Make Your Initial Deposit (minimum deposit varies by region)

Start Trading!

Once your account is set up, you can begin trading immediately, using the platform of your choice.

10. The Best Forex Trading Practices for Beginners

For beginners, trading Forex can be overwhelming. Here are some essential tips to help you get started:

Start with a Demo Account: Before trading with real money, practice on a demo account to understand the platform and market dynamics.

Risk Management: Always use proper risk management strategies, including setting stop-losses and taking profits.

Stay Informed: Keep up to date with financial news and market trends.

Don’t Over-leverage: Use leverage wisely and avoid overexposing yourself to risk.

11. 10 Frequently Asked Questions (FAQ)

Is Avatrade a regulated broker?Yes, Avatrade is regulated by several global authorities, including the Monetary Authority of Singapore (MAS).

Can I trust Avatrade with my funds?Yes, Avatrade maintains client funds in segregated accounts and follows stringent regulatory guidelines.

Does Avatrade offer a demo account?Yes, Avatrade offers a free demo account for beginners to practice.

What platforms does Avatrade offer?Avatrade offers MT4, MT5, and AvaTradeGO.

What is the minimum deposit with Avatrade?The minimum deposit varies by region but generally starts around $100.

Is there a mobile app for Avatrade?Yes, Avatrade has a mobile app called AvaTradeGO.

What types of assets can I trade on Avatrade?You can trade Forex, stocks, commodities, cryptocurrencies, and more.

How do I withdraw my funds from Avatrade?Withdrawals can be made using your preferred payment method and are typically processed within 1-3 business days.

Is Avatrade safe for beginners?Yes, Avatrade is designed for both beginner and experienced traders, offering a variety of educational resources.

Can I open an account if I am not from Singapore?Yes, Avatrade accepts clients from many countries worldwide.

12. Conclusion: Should You Trade with Avatrade in Singapore?

If you’re a Forex trader in Singapore, Avatrade provides a secure, regulated, and user-friendly platform for trading. With its regulation under the Monetary Authority of Singapore (MAS), competitive spreads, and advanced trading tools, Avatrade is a trustworthy choice for both beginners and experienced traders.

If you're ready to take the next step in your trading journey, consider opening an account with Avatrade today and start exploring the world of Forex trading. Don’t miss out on the opportunity to maximize your trading potential with a trusted broker!

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker