5 minute read

ECONOMIC UNCERTAINTY

ECONOMIC UNCERTAINTY BRINGS OUT BIG CHANGES IN THE ART WORLD

By: James R. Hedges, IV

Advertisement

Art is a curious asset class- often viewed as a discretionary expenditure by the world’s wealthiest people. In the 1970’s, 1980’s and even into the 1990’s, the art world was a very insular, small circle of private individuals and collecting institutions. It was a world inhabited by those with a passion for the art who largely amassed remarkable collections over the course of collecting for decades. From time to time, one would read about a collector whose collection was worth extraordinary amounts of money, but the art world was never pedestrianized, and it was always viewed as an insider’s game which required special connections for access to the highest quality investment-grade works of art.

However, the 1990’s and early aught’s saw a massive change in the way in which the art world operated. During this period, wealth creation was at the fastest pace in human history. Newly minted millionaires and billionaires wanted in on the art game, and the art market of galleries and auction houses responded with an ample supply of new product to acquire. Aware of the outsized returns that could be achieved in the art world, a new breed of collector entered the market: the speculator: those who felt art was not only something that afforded social status and represented a very high level of achievement and cultivation, but also a world in which one could easily and regularly flip works into an appreciating market and make remarkable returns, which often outpaced traditional investment markets.

ANDY WARHOL, DOLLY PARTON, 1985, 3.75 X 4.25 IN

diversifying impact on one’s investment portfolio. It can generate great returns, short term and long term. It is also a very global market with investor demand coming from nearly all corners of the globe. Therefore, as one market may be depressed, there are also collectors in other markets who may not be impacted, thereby keeping overall global demand for art high. Adding to this global demand picture, one must also acknowledge the store of value aspect of the art world. It is not uncommon for wealthy individuals in countries with currency controls and other limitations on their local investments to use art as an asset class to transcend their local borders in favor of a global currency. While art is illiquid and costs money to store and insure without any offsetting yield, it is also a market in which there is a rather broad set of categories and artists that are ‘investment-grade.’ The higher one goes up in the food chain, the more stable the values tend to be, and as such, we increasingly see more investors looking for ways to diversify their portfolios into art. The greatest counter-intuitive surprise about the art world is that it does tend to perform very well in periods of financial market uncertainty. As both a collector and private art dealer (of Andy Warhol photographs and outsider art), I have been struck by how well art performs in times of uncertainty. For example, in the current COVID-19 pandemic and its subsequent financial volatility, one would naturally assume that art sales would be down. My experience is the exact opposite. Collectors view art as a store of value, a more stable form of wealth protection that the stock markets which are routinely up and down 20-40% from peak-to-trough at a time and a means to put assets into things of personal value, rather than financial value alone.

With all this said, it’s also worth pointing out that financial volatility, such as that we are now experiencing, draws a whole new set of sellers into the market, and there can be extremely interesting distressed asset investment opportunities for those collectors who need to raise cash in a short time frame. Said another way, the “bid” is still strong in the art market, but there are certain “offers” which can offer great opportunities for making some great

ANDY WARHOL, DIANE VON FURSTENBERG AND EGON VON FURSTENBERG, 1976, 3.375 X 4.25 IN

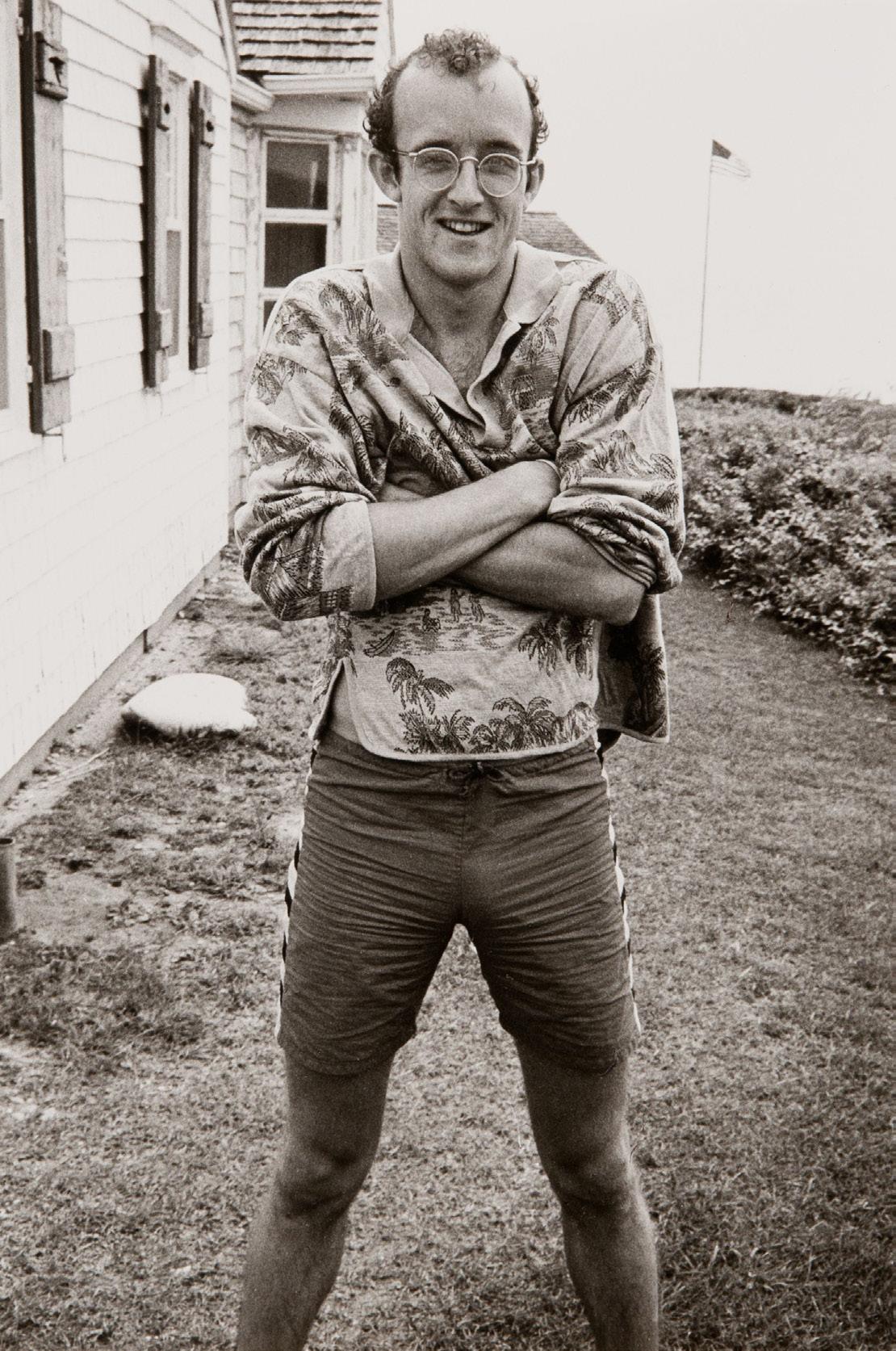

ANDY WARHOL, KEITH HARING AT ANDY WARHOL’S MONTAUK ESTATE, “ EOTHEN”, 1984, 8 X 10 IN

Enter the new art world: art-as-an-asset-class. Art does have a money over the long term.

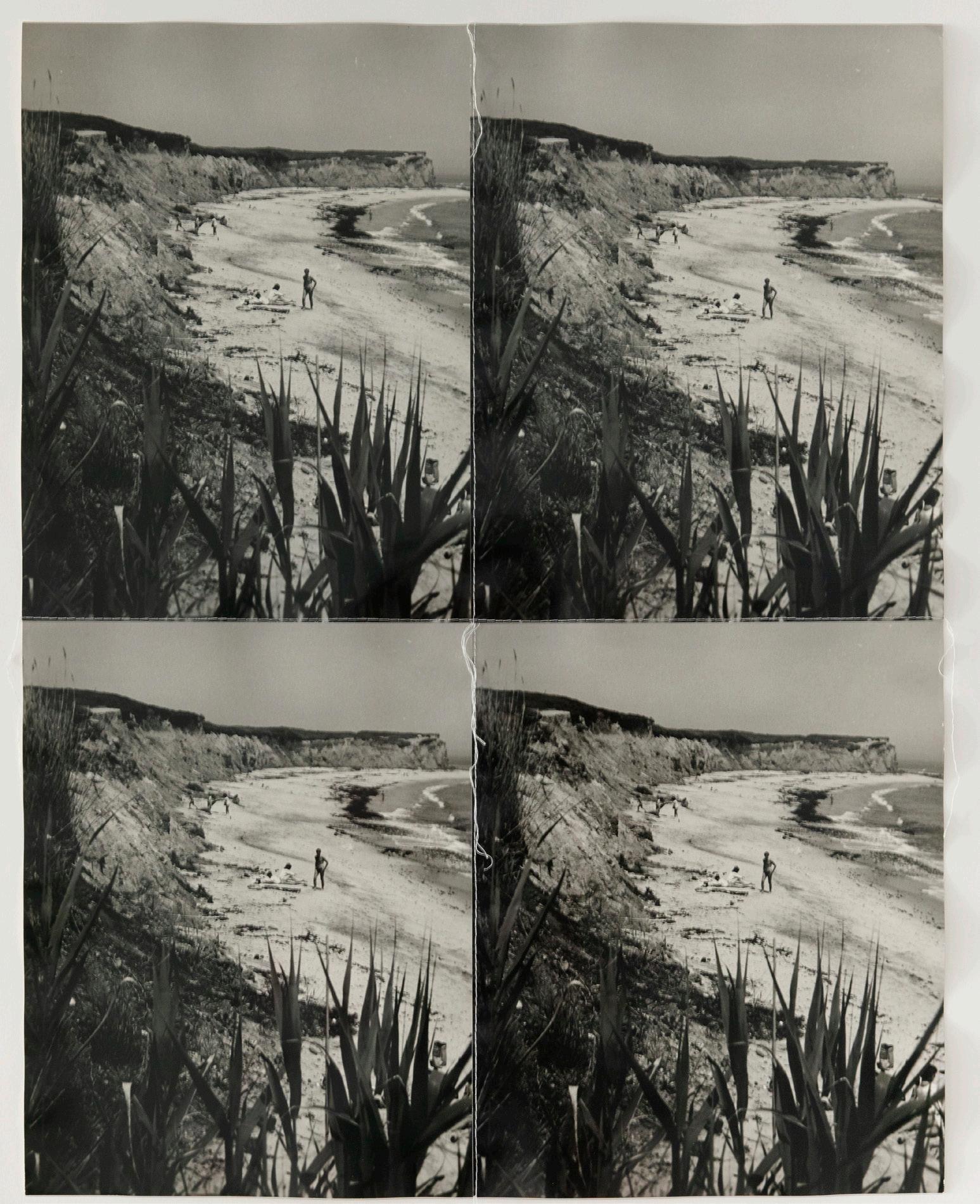

ANDY WARHOL, MONTAUK BEACH, 1977, 21.25 X 27.25 IN

In closing, one final word of caution, this current moment of stress has also brought more fraudulent sellers to the market than are normally visible. Recently, I was presented an opportunity to acquire a small collection of works by Andy Warhol valued at approximately $5 million. The story and purported provenance made this situation attractive enough for me to board an airplane to fly cross-country to evaluate the works in a warehouse. Upon my arrival, it took me about a half hour to determine that the works were, indeed, fake. I’ve also noted in recent months a number of works attributed to artists which I can determine to be fakes as well. Second tier auction houses which are easily sourced through platforms like Live Auctioneers are regularly offering works that are not authentic. I’ve seen around a dozen examples of this in the past few months. So, extra caution and diligence is really needed at this time, more than ever. Hedges Projects, LLC is the world’s leading private dealer of photo-based works by Andy Warhol and a leading advocate for Outsider Art. Hedges Projects is also active in making both equity and debt investments into art.

ABOUT THE AUTHOR:

James Hedges is an avid investor and art collector. Hedges founded alternative investment advisor LJH Global Investments in 1992 and later founded art-finance lender Montage Finance in 2010. Art & Antique Magazine named Hedges as one of “The 100 Collectors in America. He has been an active philanthropist and art collector for over 25 years. Hedges resides in Los Angeles and spends his time between there, a ranch property in Aspen, and a home in Europe.