4 minute read

Economists: Warehouse Construction Leads Post-Pandemic Recovery

Recent economic data from the construction industry depict an upswing from the fiscal downfalls associated with the pandemic, but those numbers are being skewed by specific construction sectors that have exploded in the last year. Warehouse and data center construction have shown meteoric growth, while nearly all other sectors have declined and are only recently showing signs of recovery.

According to the third-quarter construction outlook released in late August by Dodge Data & Analytics, the economy — at least for the construction industry — is “moving sideways.” Steady growth is being hampered by skyrocketing material prices, shortages of skilled labor, the threat of runaway inflation, and a surge in the delta variant of the coronavirus.

Dodge predicts a 7 percent increase in total construction spending, totaling $855 billion by year’s end, which would be similar to pre-pandemic totals in 2019. However, Dodge chief economist Richard Branch notes that if residential construction data were removed from the total, “we are looking at another year, potentially two years, before nonresidential building is back to its 2019 peak.” The good news is that most analysts predict a surge in spending in the coming months. “Projects entering the planning stage remain at levels not seen in several years,” Branch says, “and forward progress on an infrastructure program and the federal budget provides hope that brighter days are ahead.”

He says the importance of the five-year infrastructure bill cannot be overemphasized. “Our models are suggesting that thanks to the $550 billion infrastructure package, the total nonbuilding starts will increase by 34 percent from 2021 till the end of our forecast window in 2026.”

Dodge has not included the bill in this year’s forecast for total construction spending.

Cost of materials impacts spending

The numbers this year remain sluggish, but eight construction economists from varying investment and consulting firms that make up the Washington, D.C.-based American Institute of Architects’ midyear Consensus Construction Forecast panel predict a 4.6 percent increase in nonresidential construction spending in 2022, compared with a decrease of 3.9 percent this year.

The rising cost of construction materials threatens to stagnate construction spending throughout the U.S. in the coming months. In general, construction material costs have risen more than 33 percent in the last year,

according to data from the U.S. Bureau of Labor Statistics. Branch says that recent data suggest that lumber prices are beginning to stabilize and even slightly decline, but the cost of other materials like metals and plastics continues to rise dramatically.

When it comes to material prices, he notes that “we are likely to see escalated prices at least till the midpoint of 2022.” This will continue to exert downward pressure on construction starts, according to Branch.

For commercial building starts, Dodge predicts a 9 percent growth rate for 2021, led by the warehouse subcategory. If the warehouse category is removed from the commercial construction starts data, growth in 2021 becomes just 2 percent for the year.

While companies are desperately searching for labor and are offering hiring bonuses and higher wages, amid a record number of unfilled job openings, still 6.1 million fewer people were working in July than before the pandemic, and 13 million people were still claiming state or federal unemployment benefits. But this weird phenomenon is showing signs of loosening up. Employment in construction rose by 11,000 workers in July, after two months of declines, for a net decline over those three months of 18,000 workers, to 7.4 million workers.

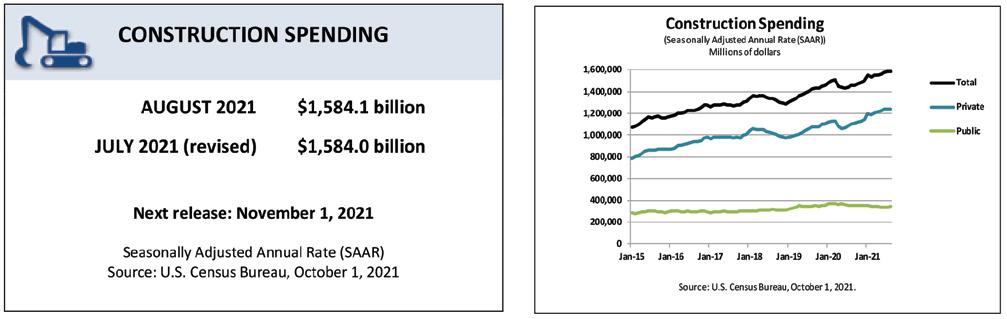

Construction spending saw modest gains

Construction spending during August 2021 was estimated at a seasonally adjusted annual rate of $1.5 billion, virtually unchanged from the revised July estimate, according to the U.S. Census Bureau. The August figure is 8.9 percent above the August 2020 estimate of $1.4 billion. During the first eight months of this year, construction spending rose 7.0 percent above the same period in 2020.

• Nonresidential construction was at a seasonally adjusted annual rate of $455.6 billion in August, 1.0 percent below the revised July estimate.

• Public Construction spending in August was at an estimated seasonally adjusted annual rate of $341.9 billion, 0.5 percent above the revised July estimate.

• Educational construction was at a seasonally adjusted annual rate of $79.8 billion, 1.1 percent above the revised July estimate.

• Highway construction was at a seasonally adjusted annual rate of $98.3 billion, 1.6 percent above the revised July estimate.

The COVID-19 pandemic brought a halt to the growth of the construction industry nationwide which, prior to the pandemic, had been growing strongly. This was especially true in New York State and New York City.

Before 2020, the nation’s construction employment increased for nine consecutive years, though it never met the peak reached before the Great Recession. However, in the State and the City, jobs reached a record high by 2015.

As the overall picture of the construction industry economy depicts a sluggish recovery, Branch says that “significant dollars in the pipeline gives us hope that construction starts will begin to post more modest and broad-based growth patterns as we transition from 2021 into 2022.”