This report is not an insured product or service or a representation of the condition of title to real property. It is not an abst ract, legal opinion, opinion of title, title insurance commitment or preliminary report, or any form of Title Insurance or Guaranty. This report is issued exclusively for the benefit of the Applicant therefor and may not be used or relied upon by any other person. This report may not be reproduced in any manner without First American or Title Security's prior written consent. First American or Title Security does not represent or warrant that the information herein is complete or free from error, and the information herein is provided without any warranties of any kind, as-is, and with all faults. As a material part of the consideration given in exchange for the issuance of this report, recipient agrees that First American or Title Security's sole liability for any loss or damage caused by an error or omission due to inaccurate information or negligence in preparing this report shall be limited to the fee charged for the report. Recipient accepts this report with this limitation and agrees that First American or Title Security would not have issued this report but for the limitation of liability described above. First American or Title Security makes no representation or warranty as to the legality or propriety of recipient's use of the information herein.

11105 N Broadstone Dr Tucson AZ 85737 APN: 224-24-0540

Data Provided By:

First American Title Ins Co

This REiSource report is provided "as is" without warranty of any kind, either express or implied, including without limitations any warrantees of merchantability or fitness for a particular purpose. There is no representation of warranty that this information is complete or free from error, and the provider does not assume, and expressly disclaims, any liability to any person or entity for loss or damage caused by errors or omissions in this REiSource report without a title insurance policy.

The information contained in the REiSource report is delivered from your Title Company, who reminds you that you have the right as a consumer to compare fees and serviced levels for Title, Escrow, and all other services associated with property ownership, and to select providers accordingly. Your home is the largest investment you will make in your lifetime and you should demand the very best.

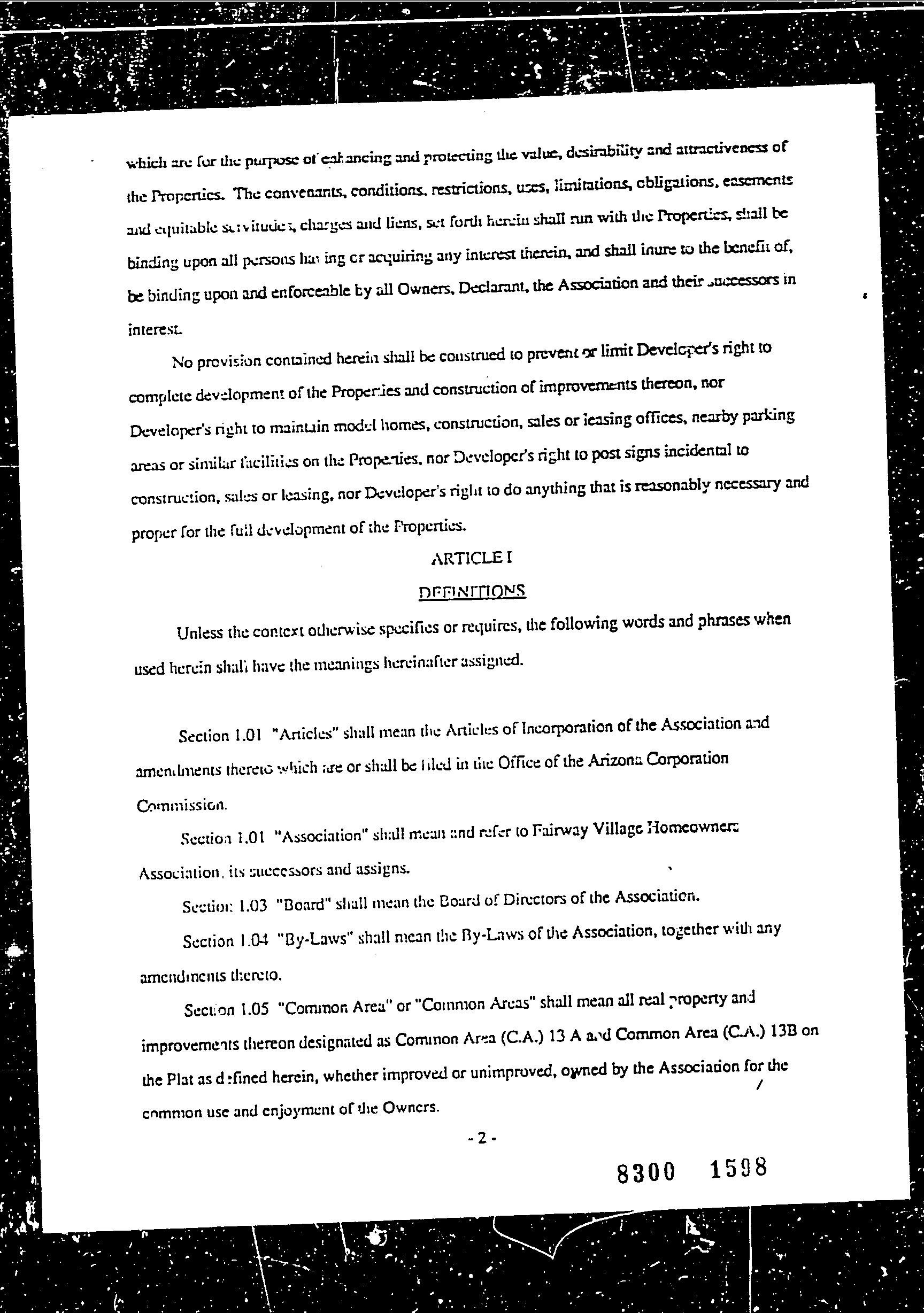

Subject Property : 11105 N Broadstone Dr Tucson AZ 85737

Owner Name : Baron Joan

Mailing Address : 11105 N Broadstone Dr, Tucson AZ 85737-8923 R072

Vesting Codes : / / Trust

Owner Occupied Indicator : O

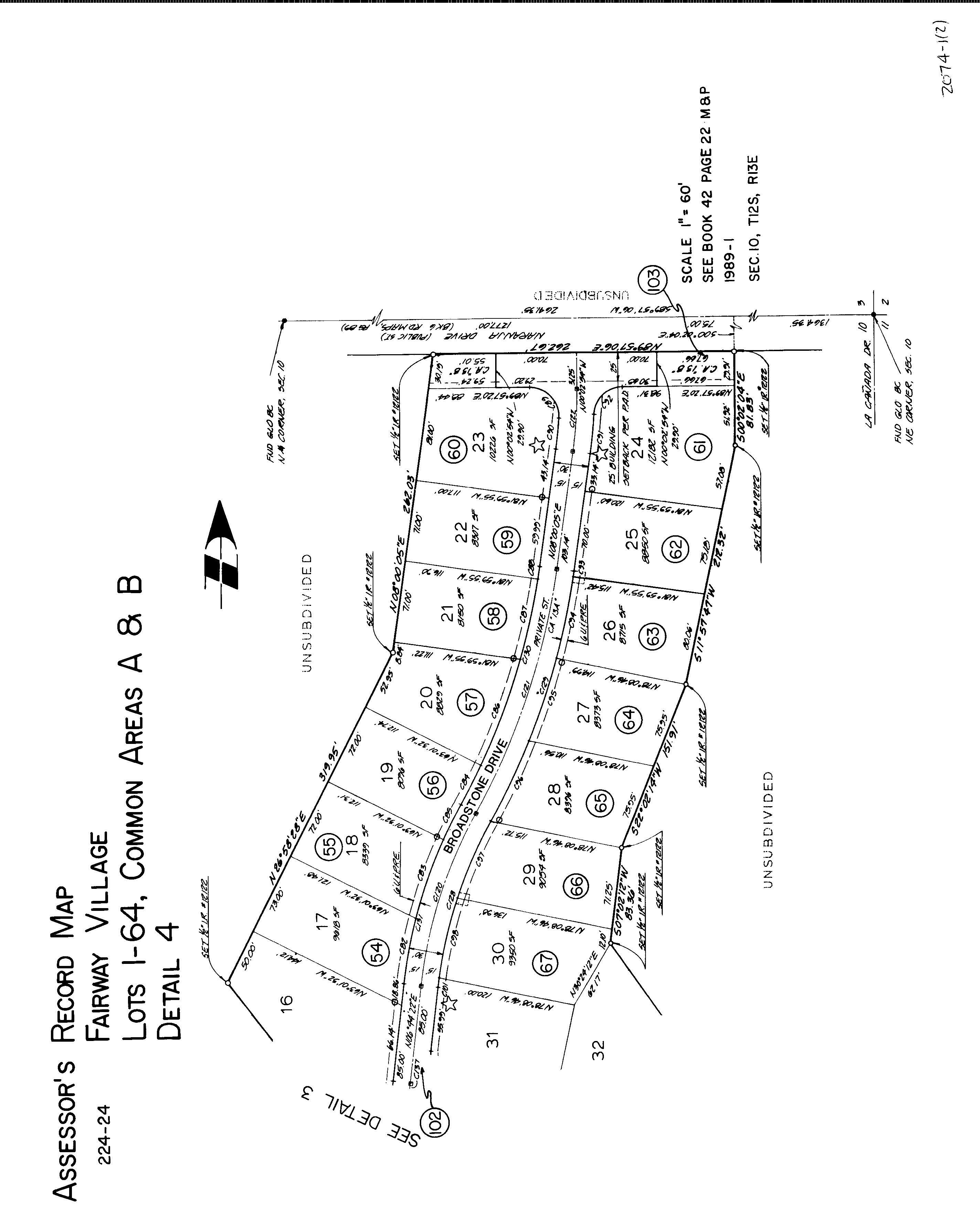

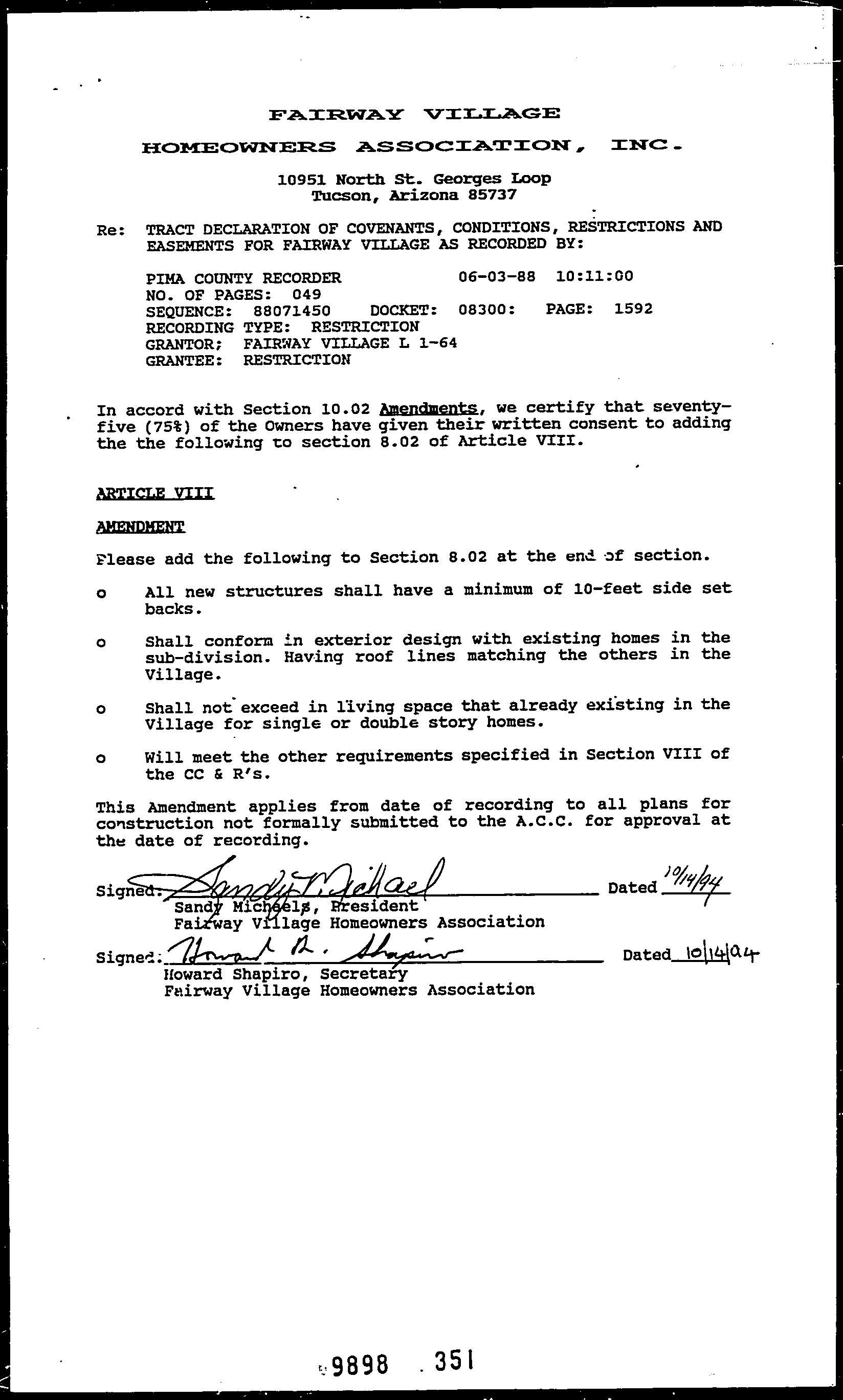

Legal Description : Fairway Village Lot 0017 (11276/277 11353/1864 & 1875)

County : Pima, Az

Census Tract / Block : 46.35 / 1

Township-Range- Sect : 12S-13E-10

Legal Book/Page : 42-22

Legal Lot : 17

Market Area : 11

Recording/Sale Date : 07/26/1990 / 07/26/1990

Sale Price : $128,110

Document # : 8838-1564

Prior Rec/Sale Date : / 03/00/1990

Prior Sale Price : $128,110

Gross Area : 1,717

Garage Capacity : 3

APN : 224-24-0540

Subdivision : Fairway Village

Map Reference : 10-12S-13E

School District : Amphitheater

Munic/Township : Amphitheater

Deed Type : Joint Tenancy Deed

Price Per SqFt : $74.61

Prior Doc Number : 8838-1563

Prior Deed Type : Special Warranty Deed

Patio Type : Covered Patio

Living Area : 1,717 Roof Material : Tile Air Cond : Refrigeration

Total Rooms : 6

Year Built / Eff : 1990

# of Stories : 1

Parking Type : Garage

Heat Type : Forced Air Quality : Fair

Cooling Type : Forced Air Condition : Excellent

Exterior wall : Frame Wood Bath Fixtures : 8

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

CoreLogic.

Land Use : Sfr

County Use : Single Fam Resurban Subd

Total Value : $235,491

Zoning : PAD Lot Size : 9,476

Lot Acres : 0.22

State Use : Single Fam Resurban Subd

Property Tax : $2,450.06

Total Taxable Value : $22,866 Tax Rate Area : 1012

Assessed Year : 2021

Market Value : $235,491

Tax Year : 2021 Current Assessed Year : 2023

Current Year Total Value : $29,290

Current Year Improvement Value :

$29,240

Current Year Land Value : $50

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

CoreLogic.

Sale Price $128,110 $356,500 $550,000 $423,528

Bldg/Living Area 1717 1633 1923 1776

Price Per Square Foot $74.61 $209 $320 $239.37

Year Built 1990 1988 1999 1994

Lot Size 9,476 4,872 13,765 6,846

Bedrooms

Bathrooms 3 2 3 3

Stories 1 1 1 1

Total Assessed Value $235,491 $215,394 $280,793 $241,055

Distance From Subject 0 0.12 0.51 0.26

Summary

#

Comparables

S 11105 N Broadstone Dr 128,110 235,491 07/26/1990 3 1,717 9,476 1990 PAD

1 11151 N Desert Flower Dr 356,500 225,392 09/16/2022 3 1,691 4,919 1995 0.12 PAD

2 11082 N Desert Flower Dr 400,000 221,906 03/03/2022 3 1,642 6,742 1996 0.15 PAD

3 1527 W Sand Pebble Dr 433,258 243,630 07/19/2022 3 1,910 5,719 1995 0.16 PAD

4 11070 N Sand Pointe Dr 400,000 244,318 10/25/2021 3 1,910 5,161 1996 0.17 PAD

5 11086 N Sand Pointe Dr 400,000 223,949 10/08/2021 3 1,681 6,450 1994 0.18 PAD

6 11124 N Eagle Crest Dr 404,900 238,732 08/30/2022 3 1,859 5,903 1994 0.19 R-4

7 10965 N Broadstone Dr 550,000 260,051 03/30/2022 3 1,717 7,022 1990 0.2 PAD

8 11150 N Sand Pointe Dr 405,000 221,906 08/24/2022 3 1,642 4,887 1996 0.21 PAD

9 1486 W Sand Pebble Dr 412,000 221,906 04/20/2022 3 1,642 5,219 1996 0.21 PAD

Customer Company

Customer Name : Chantel Cortez

: FIRST AMERICAN TITLE

Prepared On : 10/03/2022

Bath Living Area Size10 10960 N Broadstone Dr

459,900 247,853 05/12/2022 3 1,717 7,773 1988 0.21 PAD

11 11109 N Eagle Crest Dr 430,000 239,060 08/10/2022 3 1,855 5,825 1995 0.21 R-4

12 11166 N Sand Pointe Dr 425,000 242,301 03/01/2022 3 1,894 4,872 1995 0.22 PAD

13 1781 W Eagle Crest Pl 400,000 215,394 07/07/2022 2 1,633 6,481 1994 0.26 R-4

14 11272 N Placita Alameda Dorada 475,000 279,305 10/20/2021 3 1,722 13,765 1999 0.28 R-4

15 1860 W Hawkridge St 405,000 280,793 10/27/2021 3 1,923 8,027 1995 0.34 R-4

16 1879 W Hawkridge St 405,000 251,237 10/27/2021 3 1,923 8,028 1995 0.36 R-4

17 1890 W Moonshadow St 405,000 255,810 10/27/2021 3 1,923 8,186 1995 0.37 R-4

18 10817 N Glen Abbey Dr 495,000 263,802 11/15/2021 3 1,870 8,150 1993 0.39 PAD

19 10760 N Ridgewind Ct 384,000 221,984 03/29/2022 3 1,699 6,718 1988 0.45 PAD

20 10749 N Eagle Eye Pl 425,000 221,776 03/18/2022 3 1,662 7,070 1993 0.51 PAD

Distressed Sales =

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

CoreLogic.

Subject Property: 11105 N Broadstone Dr Tucson Az 85737

Owner Name: Baron Joan / APN / Alternate APN: 224-24-0540 / Deed Type: Joint Tenancy Deed Land Use: Sfr

Subdivision / Tract: Fairway Village / Lot Size: 9,476

Rec. Date / Price: 07/26/1990 / $128,110 Living Area: 1,717

Year Built / Eff: 1990 /

# of units:

Document #: 8838-1564 Bedrooms: Pool:

Total Tax Value: $235,491 Bath(F/H): /

#1 11151 N Desert Flower Dr Tucson Az 85737

Owner Name: Arvm 5 Llc / APN / Alternate APN: 224-24-6760 / Deed Type: Warranty Deed Land Use: Sfr

Subdivision / Tract: Canada Hills Village

14 / Lot Size: 4,919

Rec. Date / Price: 09/16/2022 / $356,500 Living Area: 1,691

Year Built / Eff: 1995 /

# of units:

Document #: 2590409 Bedrooms: Pool:

Total Tax Value: $225,392 Bath(F/H): /

#2 11082 N Desert Flower Dr Tucson Az 85737

Owner Name: Barney Arthur H / APN / Alternate APN: 224-24-6940 / Deed Type: Warranty Deed Land Use: Sfr

Subdivision / Tract: Canada Hills-vlg 14 / Lot Size: 6,742

Rec. Date / Price: 03/03/2022 / $400,000 Living Area: 1,642

Year Built / Eff: 1996 /

# of units:

Document #: 620366 Bedrooms: Pool:

Total Tax Value: $221,906 Bath(F/H): /

#3 1527 W Sand Pebble Dr Tucson Az 85737

Owner Name: Clark Andrew L / APN / Alternate APN: 224-24-6820 / Deed Type: Warranty Deed Land Use: Sfr

Subdivision / Tract: Canada Hills Village

14 / Lot Size: 5,719

Rec. Date / Price: 07/19/2022 / $433,258 Living Area: 1,910

Year Built / Eff: 1995 /

# of units:

Document #: 2000124 Bedrooms: Pool:

Total Tax Value: $243,630 Bath(F/H): /

#4 11070 N Sand Pointe Dr Tucson Az 85737

Owner Name: Dougherty Peter / APN / Alternate APN: 224-24-6610 / Deed Type: Warranty Deed

Land Use: Sfr

Subdivision / Tract: Canada Hills Village

14 / Lot Size: 5,161

Rec. Date / Price: 10/25/2021 / $400,000 Living Area: 1,910

Year Built / Eff: 1996 /

# of units:

Document #: 2981107 Bedrooms: Pool:

Total Tax Value: $244,318 Bath(F/H): /

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

Owner Name: Lara Jose W /Lara Marisela

APN / Alternate APN: 224-24-6590 / Deed Type: Warranty Deed

Subdivision / Tract: Canada Hills Village 14 / Lot Size: 6,450

Rec. Date / Price: 10/08/2021 / $400,000 Living Area: 1,681

Land Use: Sfr

Year Built / Eff: 1994 /

# of units:

Document #: 2810786 Bedrooms: Pool:

Total Tax Value: $223,949 Bath(F/H): /

Owner Name: Opendoor Property I Llc / APN / Alternate APN: 224-24-5110 / Deed Type: Warranty Deed Land Use: Sfr

Subdivision / Tract: Canada Ridge / Lot Size: 5,903

Rec. Date / Price: 08/30/2022 / $404,900 Living Area: 1,859

Year Built / Eff: 1994 /

# of units:

Document #: 2420200 Bedrooms: Pool:

Total Tax Value: $238,732 Bath(F/H): /

Owner Name: Metsker Peter L & Juli / APN / Alternate APN: 224-24-0460 / Deed Type: Warranty Deed Land Use: Sfr

Subdivision / Tract: Fairway Village / Lot Size: 7,022 Year Built / Eff: 1990 /

Rec. Date / Price: 03/30/2022 / $550,000 Living Area: 1,717

# of units:

Document #: 890337 Bedrooms: Pool: Pool

Total Tax Value: $260,051 Bath(F/H): /

Owner Name: Holaway Kimberlee A /

APN / Alternate APN: 224-24-6510 / Deed Type: Warranty Deed

Land Use: Sfr

14 / Lot Size: 4,887 Year Built / Eff: 1996 /

Subdivision / Tract: Canada Hills Village

Rec. Date / Price: 08/24/2022 / $405,000 Living Area: 1,642

# of units:

Document #: 2360163 Bedrooms: Pool:

Total Tax Value: $221,906 Bath(F/H): /

Owner Name: Dwf Vi Atlas Sfr-az Llc /

APN / Alternate APN: 224-24-6450 / Deed Type: Warranty Deed

Land Use: Sfr

14 / Lot Size: 5,219 Year Built / Eff: 1996 /

Subdivision / Tract: Canada Hills Village

Rec. Date / Price: 04/20/2022 / $412,000 Living Area: 1,642

# of units:

Document #: 1100683 Bedrooms: Pool:

Total Tax Value: $221,906 Bath(F/H): /

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

CoreLogic.

Owner Name: Muir Ryan /Cordero Kelsey

APN / Alternate APN: 224-24-0960 / Deed Type: Warranty Deed

Subdivision / Tract: Fairway Village / Lot Size: 7,773

Rec. Date / Price: 05/12/2022 / $459,900 Living Area: 1,717

Document #: 1320477

Land Use: Sfr

Year Built / Eff: 1988 /

# of units:

Bedrooms: Pool: Pool

Total Tax Value: $247,853 Bath(F/H): /

Owner Name: Schiffer William P / APN / Alternate APN: 224-24-5490 / Deed Type: Warranty Deed

Subdivision / Tract: Canada Ridge / Lot Size: 5,825

Rec. Date / Price: 08/10/2022 / $430,000 Living Area: 1,855

Land Use: Sfr

Year Built / Eff: 1995 /

# of units:

Document #: 2220471 Bedrooms: Pool:

Total Tax Value: $239,060 Bath(F/H): /

Owner Name: Sequence Champions Llc / APN / Alternate APN: 224-24-6490 / Deed Type: Warranty Deed

Land Use: Sfr

Subdivision / Tract: Canada Hills Village 14 / Lot Size: 4,872 Year Built / Eff: 1995 /

Rec. Date / Price: 03/01/2022 / $425,000 Living Area: 1,894

# of units:

Document #: 600316 Bedrooms: Pool:

Total Tax Value: $242,301 Bath(F/H): /

Owner Name: Hallcox Family Trust / APN / Alternate APN: 224-24-5270 / Deed Type: Warranty Deed Land Use: Sfr

Subdivision / Tract: Canada Ridge / Lot Size: 6,481

Rec. Date / Price: 07/07/2022 / $400,000 Living Area: 1,633

Year Built / Eff: 1994 /

# of units:

Document #: 1880502 Bedrooms: Pool:

Total Tax Value: $215,394 Bath(F/H): /

Owner Name: Sunshine 13 Llc / APN / Alternate APN: 224-08-0090 / Deed Type: Warranty Deed

Subdivision / Tract: Naranja Ranch 01 / Lot Size: 13,765

Rec. Date / Price: 10/20/2021 / $475,000 Living Area: 1,722

Document #: 2930435

Land Use: Sfr

Year Built / Eff: 1999 /

# of units:

Bedrooms: Pool:

Total Tax Value: $279,305 Bath(F/H): /

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

Owner Name: Pedigo Alexander /Pedigo Susan

APN / Alternate APN: 224-24-5840 / Deed Type: Warranty Deed

Subdivision / Tract: Canada Ridge / Lot Size: 8,027

Rec. Date / Price: 10/27/2021 / $405,000 Living Area: 1,923

Land Use: Sfr

Year Built / Eff: 1995 /

# of units:

Document #: 3000729 Bedrooms: Pool: Pool

Total Tax Value: $280,793 Bath(F/H): /

Owner Name: Kehl Kenyon L /Kehl Josette

APN / Alternate APN: 224-24-5880 / Deed Type: Warranty Deed Land Use: Sfr

Subdivision / Tract: Canada Ridge / Lot Size: 8,028

Rec. Date / Price: 10/27/2021 / $405,000 Living Area: 1,923

Year Built / Eff: 1995 /

# of units:

Document #: 3000729 Bedrooms: Pool:

Total Tax Value: $251,237 Bath(F/H): /

Owner Name: Swan Ronald L /Swan Karoline A

APN / Alternate APN: 224-24-5920 / Deed Type: Warranty Deed

Land Use: Sfr

Subdivision / Tract: Canada Rdg / Lot Size: 8,186 Year Built / Eff: 1995 /

Rec. Date / Price: 10/27/2021 / $405,000 Living Area: 1,923

# of units:

Document #: 3000729 Bedrooms: Pool:

Total Tax Value: $255,810 Bath(F/H): /

Owner Name: Mandal Michael B /Kerns Nanette M

APN / Alternate APN: 224-24-2830 / Deed Type: Warranty Deed

Land Use: Sfr

11 / Lot Size: 8,150 Year Built / Eff: 1993 /

Subdivision / Tract: Canada Hills Village

Rec. Date / Price: 11/15/2021 / $495,000 Living Area: 1,870

# of units:

Document #: 3190249 Bedrooms: Pool: Pool

Total Tax Value: $263,802 Bath(F/H): /

#19 10760 N Ridgewind Ct Tucson Az 85737

Owner Name: Fusselman Gregg /Fusselman Patti

APN / Alternate APN: 224-24-0210 / Deed Type: Warranty Deed Land Use: Sfr

Subdivision / Tract: Canada Hills Village

12 / Lot Size: 6,718

Rec. Date / Price: 03/29/2022 / $384,000 Living Area: 1,699

Year Built / Eff: 1988 /

# of units:

Document #: 880562 Bedrooms: Pool:

Total Tax Value: $221,984 Bath(F/H): /

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

Owner Name: Radliff Gary / APN / Alternate APN: 224-24-2380 /

Deed Type: Warranty Deed

Subdivision / Tract: Canada Hills Village 16 / Lot Size: 7,070

Land Use: Sfr

Year Built / Eff: 1993 /

# of units: Document #: 770773 Bedrooms: Pool: Total Tax Value: $221,776 Bath(F/H): /

Rec. Date / Price: 03/18/2022 / $425,000 Living Area: 1,662

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

2022 CoreLogic.

#20 10749 N Eagle Eye Pl Tucson Az 85737Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

2022 CoreLogic. All rights reserved

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

CoreLogic.

This

W

WAnamax

15 AJO UNIFIED 111 N. Well Road, Ajo, AZ 85321

51 ALTAR VALLEY ELEMENTARY 10105 S. Sasabe Road, Tucson, AZ 85736 520.822.1484

10 AMPHITHEATER UNIFIED 701 W. Wetmore, Tucson, AZ 85705 520.696.5000

16 CATALINA FOOTHILS UNIFIED 2101 E. River Road, Tucson, AZ 85718 520.209.7500

39 CONTINENTAL ELEMENTARY 1991 E. Whitehouse Canyon, Green Valley, AZ 85614 520.625.4581

08 FLOWING WELLS UNIFIED 1556 W. Prince Road, Tucson, AZ 85705 520.696.8800

06 MARANA UNIFIED 11279 W. Grier Road, Marana, AZ 85653 520.682.3243

11 PIMA COUNTY JTED 2855 W. Master Pieces Dr, Tucson, AZ 85741 520.352.5833

30 SAHUARITA UNIFIED 350 W. Sahuarita Road, Sahuarita, AZ 85629 520.625.3502

12

SUNNYSIDE UNIFIED 2238 E. Ginter Road, Tucson, AZ 85706 520.545.2000

13 TANQUE VERDE UNIFIED 2300 N. Tanque Verde Loop, Tucson, AZ 85749 520.749.5751

01 TUCSON UNIFIED 1010 E. 10th Street, Tucson, AZ 85717 520.225.6000

20 VAIL UNIFIED 10701 E. Mary Ann Cleveland Way, Tucson, AZ 85747 520.879.2000

Copper Creek Elementary School Distance 1.11 Miles

11620 N Copper Spring Trl Tucson AZ 85737

Telephone : (520) 696-6800

Lowest Grade : Pre-K

School District : Amphitheater Unified District (4406)

Highest Grade : 5th

Kindergarten : Yes School Enrollment : Enrollment : 381

Richard B Wilson Junior School

2330 W Glover Rd Oro Valley AZ 85742

Telephone : (520) 696-5800

Lowest Grade : Pre-K

Total Expenditure/Student : 132

Distance 1.23 Miles

School District : Amphitheater Unified District (4406)

Highest Grade : 8th

Kindergarten : Yes School Enrollment : Enrollment : 1017

Total Expenditure/Student : 132

Leman Academy Of Excellence-oro Valley Arizona Distance 1.27 Miles

1410 W Tangerine Rd Oro Valley AZ 85755

Telephone : (520) 912-4005

Lowest Grade : K

School District : Leman Academy Of Excellence Inc. (92730)

Highest Grade : 8th

Kindergarten : Yes School Enrollment : Enrollment : 749

Total Expenditure/Student :

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

CoreLogic.

Pcjted - Ironwood Ridge High School Distance 1.13 Miles

2475 W Naranja Dr Oro Valley AZ 85742

Telephone : (520) 696-3902

School District : Pima County Jted (89380)

Highest Grade : 12th School Enrollment : Enrollment : 0

Lowest Grade : 9th

Total Expenditure/Student : Advanced Placement : No

2475 W Naranja Dr Oro Valley AZ 85742

Telephone : (520) 696-3902

School District : Amphitheater Unified District (4406)

Highest Grade : 12th School Enrollment : Enrollment : 1713

Lowest Grade : 9th

Total Expenditure/Student : 132 Advanced Placement : No

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

CoreLogic.

Name Address

Jamielee Art, Llc

Telephone Distance (Miles)

1780 W Eagle Crest Pl Tucson Az (520) 575-8176 0.26

Oro Valley Ata Martial Arts 11133 N La Canada Dr Oro Valley Az (520) 877-7767 0.32

Choi Taekwondo Usa Inc 11133 N La Canada Dr # 10 Tucson Az (520) 877-7767 0.32

Blythe Spirit Yoga, Llc

11301 N Plmetto Dunes Ave Tucson Az (520) 742-4270 0.4

Name Address

Nova Financial & Investment Corporation

Telephone Distance (Miles)

11115 N La Canada Dr # 15 Tucson Az (520) 219-4400 0.32

Westar Mortgage And Realty Corporation 1775 W Wimbledon Way Tucson Az (520) 298-1993 0.62

Name Address

Nicos Mexican Food

Telephone Distance (Miles)

11165 N La Canada Dr # 11 Tucson Az (520) 297-9610 0.32

Z Pizza 11165 N La Canada Dr Oro Valley Az (520) 329-8851 0.32

Brueggers

11165 N La Canada Dr # 16 Tucson Az (520) 575-0651 0.32

Wolf Big Bad Bbwft Llc 11667 N Ribbonwood Dr Oro Valley Az (520) 270-6902 0.72

Name Address

Pueblo Del Sol Dental Care, L.l.c.

Roy Dmd Llc

Wong Doreen-sierra Md

Strategic Therapeutics, Llc

Telephone Distance (Miles)

1736 W Windgate Pl Tucson Az (520) 297-5728 0.13

11254 N Meadow Sage Dr Oro Valley Az (520) 344-9679 0.26

11115 N La Canada Dr # 25 Oro Valley Az (781) 424-7121 0.32

11020 N Canada Ridge Dr Tucson Az (916) 521-0505 0.38

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

Name Address

Telephone Distance (Miles)

Hilton Worldwide 10555 N La Canada Dr Oro Valley Az (520) 544-1900 0.47

Mrhp Marana, Inc. 10891 N Canada Hills Ct Oro Valley Az (520) 742-7082 0.55

The Tombstone Grand Hotel 10906 N Sand Canyon Pl Oro Valley Az (520) 797-0430 0.64

Name Address Telephone Distance (Miles)

The Church Of Jesus Christ Of Latterday Saints 1976 W Silver Rose Pl Tucson Az (520) 878-9123 0.55

Casas Adobes Baptist Church 10801 N La Cholla Blvd Oro Valley Az (520) 297-0922 0.78

Name Address Telephone Distance (Miles)

Viking Strength & Fitness, Llc 1639 W Silver Berry Pl Oro Valley Az (520) 219-5149 0.57

Chosen Path Health And Fitness 2014 W Golden Rose Pl Tucson Az (520) 229-8566 0.57

Name Address

Telephone Distance (Miles)

American Home Digital Llc 11100 N Broadstone Dr Oro Valley Az (520) 838-4873 0.02

Tucson Hydroponics Llc 11654 N Red Creek Pl Tucson Az (520) 240-3590 0.73

Ace Pima Hardware Inc 10560 N La Canada Dr Tucson Az (520) 624-4059 0.81

The Kroger Co 10450 N La Canada Dr Oro Valley Az (520) 877-9269 0.88

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

11120 N BROADSTONE DR

Owner Name : Yost John

Sale Date : 03/00/1992

Total Value : $275,377

Bed / Bath : / 3

Land Use : Sfr

Stories : 1

Distance 0.03 Miles

Subdivision : Fairway Village

Recording Date : 04/06/1992

Sale Price : $188,000

Property Tax : $3,537.80

Lot Acres : 0.21

Living Area : 2,215

Yr Blt / Eff Yr Blt : 1989 / APN : 224-24-0660

1701 W NARANJA DR Distance 0.04 Miles

Owner Name : Canada Hills Villages 17 & 18

Total Value : $500

Property Tax : $7.36

Lot Acres : 5.70

Land Use : Open Space APN : 224-49-0760

Recording Date : 04/29/1994

11135 N BROADSTONE DR Distance 0.04 Miles

Owner Name : Morrell Gary H

Sale Date : 07/16/2012

Total Value : $291,331

Bed / Bath : / 3

Subdivision : Fairway Village

Recording Date : 07/27/2012

Sale Price : $195,000

Property Tax : $3,752.12

Land Use : Sfr Lot Acres : 0.20

Stories : 1

Living Area : 2,100

Yr Blt / Eff Yr Blt : 1990 / APN : 224-24-057A

11140 N BROADSTONE DR Distance 0.06 Miles

Owner Name : Vail Myrna K

Sale Date : 04/00/1998

Total Value : $288,980

Bed / Bath : / 3

Land Use : Sfr

Stories : 1

Subdivision : Fairway Village

Recording Date : 04/02/1998

Sale Price : $195,000

Property Tax : $3,750.54

Lot Acres : 0.19

Living Area : 2,215

Yr Blt / Eff Yr Blt : 1989 / APN : 224-24-0640

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE

Prepared On : 10/03/2022

CoreLogic.

Owner Name : Rutledge David R

Sale Date : 05/30/2012

Total Value : $258,126

Bed / Bath : / 4

Land Use : Sfr

Stories : 1.5

Subdivision : Fairway Village

Recording Date : 05/31/2012

Sale Price : $240,000

Property Tax : $3,751.17

Lot Acres : 0.22

Living Area : 2,301

Yr Blt / Eff Yr Blt : 1989 / APN : 224-24-0720

Owner Name : Mazzetta Oswald J

Sale Date : 01/30/1995

Total Value : $309,008

Bed / Bath : / 5

Land Use : Sfr

Stories : 1

Subdivision : Canada Hills Village 17-18

Recording Date : 03/09/1995

Sale Price : $251,033

Property Tax : $4,000.02

Lot Acres : 0.21

Living Area : 2,275

Yr Blt / Eff Yr Blt : 1994 / APN : 224-49-0210

Owner Name : Priem Tr

Sale Date : 12/00/1994

Total Value : $313,567

Bed / Bath : / 4

Land Use : Sfr

Stories : 1.5

Yr Blt / Eff Yr Blt : 1995 /

Subdivision : Canada Hills Village 17-18

Recording Date : 05/30/1995

Sale Price : $258,496

Property Tax : $4,097.61

Lot Acres : 0.19

Living Area : 3,015

APN : 224-49-0180

Owner Name : Gray Frederick H Jr

Sale Date : 12/10/2004

Total Value : $378,467

Bed / Bath : / 4

Land Use : Sfr

Stories : 1.5

Yr Blt / Eff Yr Blt : 1998 /

Subdivision : Canada Hills Village 17-18

Recording Date : 12/15/2004

Sale Price : $385,000

Property Tax : $4,977.73

Lot Acres : 0.20

Living Area : 3,527

APN : 224-49-0220

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE

Prepared On : 10/03/2022

2022 CoreLogic.

Owner Name : Wendel Michael

Sale Date : 07/19/2020

Total Value : $374,925

Bed / Bath : / 4

Land Use : Sfr

Stories : 1.5

Subdivision : Canada Hills Village 17-18

Recording Date : 07/30/2020

Sale Price : $469,000

Property Tax : $4,925.58

Lot Acres : 0.20

Living Area : 3,527

Yr Blt / Eff Yr Blt : 1995 / APN : 224-49-0230

Owner Name : Wold Of Harris Living Trust

Sale Date : 03/12/2014

Total Value : $275,377

Bed / Bath : / 3

Land Use : Sfr

Stories : 1

Subdivision : Fairway Village

Recording Date : 03/24/2014

Sale Price : $328,500

Property Tax : $3,537.80

Lot Acres : 0.20

Living Area : 2,215

Yr Blt / Eff Yr Blt : 1989 / APN : 224-24-0620

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

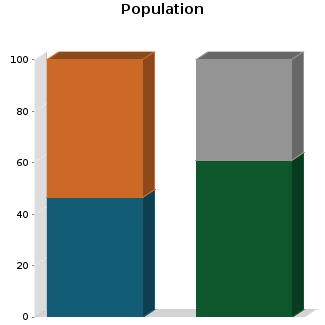

Census Tract / block: 46.35 / 1 Year: 2018

Count: 5,294 0 - 11

Estimate Current Year: 5,254 12 - 17

Estimate in 5 Years: 5,098 18 - 24 8.82%

Growth Last 5 Years: 4.16% 25 - 64 43.71%

Growth Last 10 Years: -104.24% 65 - 74 14.92% 75+

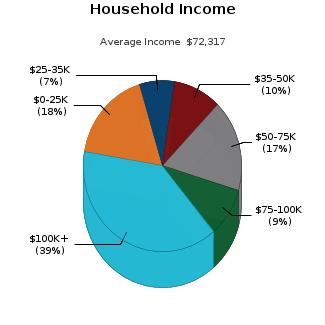

Current Year: 2,312 0 - $25,000 17.56%

Average Current Year: 2.29 $25,000 - $35,000 7.14%

Estimate in 5 Years: 2,545 $35,000 - $50,000 9.73%

Growth Last 5 Years: 13.32% $50,000 - $75,000 17.34%

Growth Last 10 Years: 10.8% $75,000 - $100,000 9.26%

Male Population: 46.56% Above $100,000 38.97%

Female Population: 53.44% Average Household Income: $72,317

Married People: 60.98%

Unmarried People: 39.02%

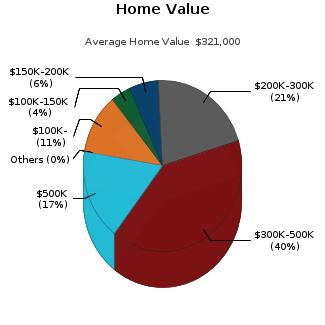

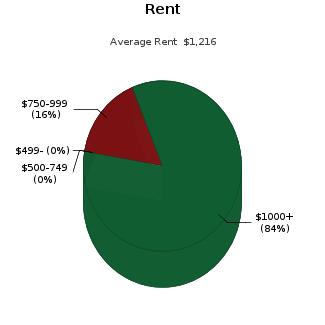

Under $300: 7.24% Below $100,000: 11.48%

$300 - $799: 29.19% $100,000 - $150,000: 3.94%

$800 - $1,999: 48.5% $150,000 - $200,000: 5.94%

Over $2,000: 15.07% $200,000 - $300,000: 21.13%

Median Home Value: $321,000 $300,000 - $500,000: 40.14%

Unit Occupied Owner: 73.49% Above $500,000: 17.36%

Median Mortgage: $1,297

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

Unit Occupied Renter: 26.51% 1999 - 2000

Median Gross Rent: $1,216 1995 - 1998

Less Than $499 0% 1990 - 1994

$500 - $749 0% 1980 - 1989 14.34%

$750 - $999 15.96% 1970 - 1979 9.44%

$1000 and Over 84.04% 1900 - 1969 1.79%

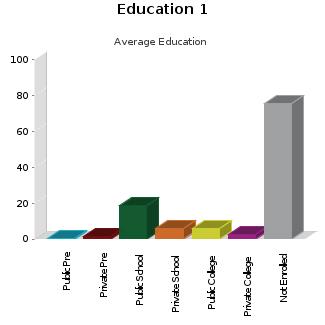

Public Pre-Primary School: 0.27%

Not Enrolled in School: 75.55%

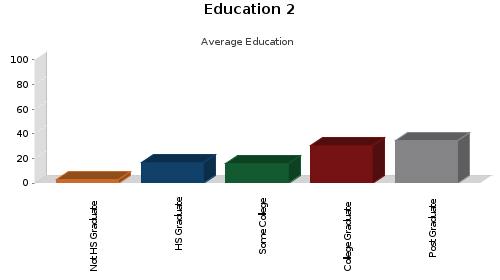

Private Pre-Primary School: 1.61% Not A High School Graduate: 2.89%

Public School: 18.55% Graduate Of High School: 16.64%

Private School: 5.89% Attended Some College: 15.73%

Public College: 5.93% College Graduate: 30.51%

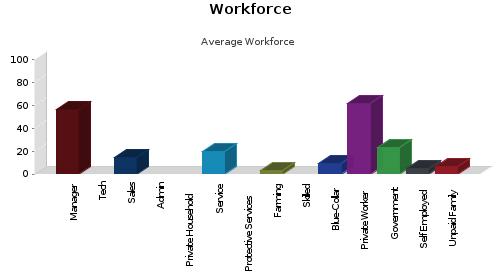

Private College: 2.54% Graduate Degree: 34.23% Workforce

Occupation:

Manager/Prof: 56.43% Private Worker: 62.21%

Technical: Government Worker: 22.92%

Sales: 14.59% Self Employed Worker: 4.57%

Administrative: Unpaid Family Worker: 6.26%

Private House Hold: Farming: 2.89%

Service: 19.4% Skilled:

Protective Services: Blue-Collar: 9.58%

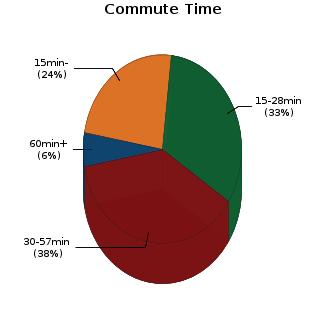

Commute Time

Less Than 15 Min: 24%

15 min - 28 min: 32.51%

30 min - 57 min: 37.83%

Over 60 min: 5.66%

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

CoreLogic.

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

CoreLogic.

Customer Name : Chantel Cortez

Customer Company Name : FIRST AMERICAN TITLE Prepared On : 10/03/2022

CoreLogic.

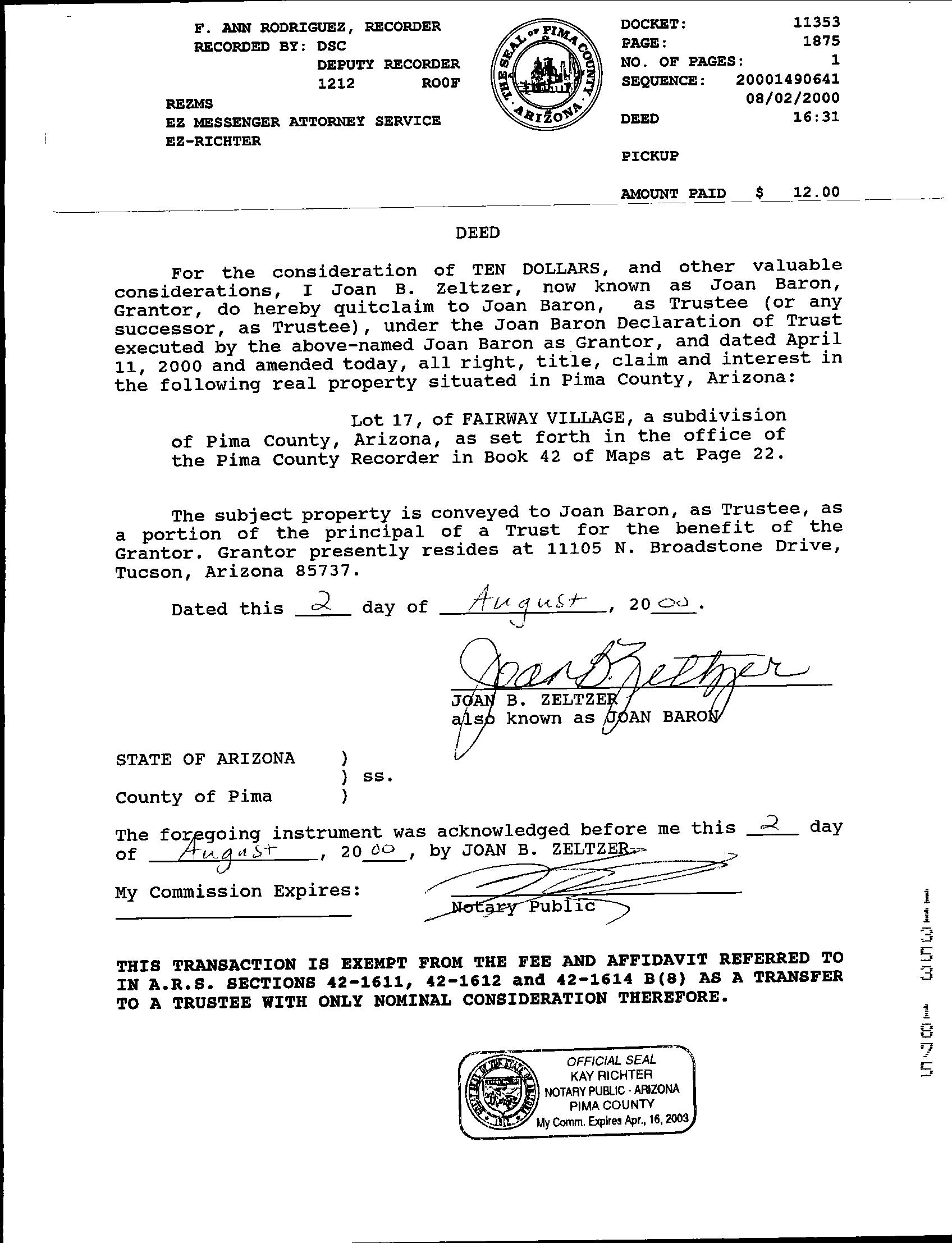

PARCEL: 224-24-0540

PARCEL: 224-24-0540

INSTRUMENT REC DATE

OWNER: BARON JOAN TR 8838 1564 07/26/1990

SITUS: 11105 N BROADSTONE DR OV

MAIL: 11105 N BROADSTONE DR TUCSON AZ 85737

PLAT: LOT 00017 BLOCK LEGAL: FAIRWAY VILLAGE LOT 0017 (11276/277 11353/1864 & 1875)

CURRENT TAXES

LAND

RATE AREA

PRIMARY 22,866 0 0 9.4097 1012

SECONDARY 50 23,499 0 5.3279 2021 TOTAL TAX BILLED 2,450.06

2021 TAX AMT TAX DUE INTEREST DATE PAID

INFORMATION THROUGH 07/28/2022

SPECIAL DISTRICTS

TOTAL DUE

FIRST HALF 1,225.03 0.00 0.00 10/27/2021 0.00

SECOND HALF 1,225.03 0.00 0.00 04/19/2022 0.00

TOTAL CURRENT TAXES DUE 10/22 0.00 11/22 0.00

BLDG SQFT

YEAR BUILT

FULL CASH VALUE 235,491

LAND USE 01 41

LOT SIZE 1 STDLT

SCHOOL DISTRICT 1012

LAND FULL CASH VALUE 502

IMPR FULL CASH VALUE

Thank you for the opportunity to be of service.

Restrictions indicating a preference, limitation or discrimination based on race, color, religion, sex, handicap, familial status, or national origin are hereby deleted to the extent such restrictions violate 42 USC 3604(c).

This information is furnished without fee and without benefit of a complete title search. No liability is assumed by First American Title or Title Security. If it is desired that liability be assumed, you may apply for a policy of title insurance with First American Title Insurance Company.

Southwest Gas 1.877.860.6020 www.swgas.com Cox 602.277.1000 www.cox.com

Direct TV 1.888.777.2454 www.directv.com

Dish Network 1.800.823.4929 www.dishnetwork.com

CenturyLink 800.366.8201 www.centurylink.com AT&T 1.800.222.0300 www.att.com

Verizon 1.877.300.4498 www.connecttoverizon.com

Salt River Project 602.236.8888 www.srpnet.com APS 602.371.7171 www.aps.com

Welcome to the home-selling process. Throughout this process, you can count on First American Title to guide you smoothly through your transaction and provide expert answers to your questions. We are happy to serve you.

First American Title’s professionals are proud to provide the title insurance that assures people’s home ownership. Backed by First American Title Insurance Company, your transaction will be expertly completed in accordance with state-specific underwriting standards and state and federal regulatory requirements.

First American Title is the principal subsidiary of First American Financial Corporation, and one of the largest suppliers of title insurance services in the nation. With roots dating back to 1889, we’ve served families for generations.

First American Title has a direct office or agent near you, offering convenient locations throughout Arizona. We also have an extensive network of offices and agents throughout the United States, and internationally.

First American Financial Corporation offers more than title insurance and escrow services through its subsidiaries. Our subsidiaries also provide property data, title plant records and images, home warranties, property and casualty insurance, and banking, trust and advisory services.

Before you make the decision to try to sell your home alone, consider the benefits a REALTOR ® can provide that you may not be aware of.

› Understands market conditions and has access to information not available to the average homeowner.

› Can advertise effectively for the best results.

› Knows how to price your home realistically, to give you the highest price possible within your time frame.

› Is experienced in creating demand for homes and how to show them to advantage.

› Knows how to screen potential buyers and eliminate those who can’t qualify or are looking for bargain-basement prices.

› Knows how to go toe-to-toe in negotiations.

› Is always “on-call,” answering the phone at all hours, and showing homes evenings and weekends.

› Can remain objective when presenting offers and counter-offers on your behalf.

› Maintains errors-and-omissions insurance.

› Will listen to your needs, respect your opinions and allow you to make your own decisions.

› Can help protect your rights, particularly important with the increasingly complicated real estate laws and regulations.

› Is experienced with resolving problems to facilitate a successful closing on your home.

Only you can determine whether you should attempt to sell your home—probably your largest investment—all alone. Talk with a REALTOR® before you decide. You may find working with a professional is a lot less expensive and much more beneficial than you ever imagined!

Many people believe they can save a considerable amount of money by selling their homes themselves. It may seem like a good idea at the time, but while you may be willing to take on the task, are you qualified? The following are some questions to help you realistically assess what’s involved.

- have the knowledge, patience, and sales skills needed to sell your home?

- know how to determine your home’s current market value?

- know how to determine whether or not a buyer can qualify for a loan?

- understand the steps of an escrow and what’s required of you and the buyer?

- need to hire a real estate attorney? If so, do you know what the cost will be and how much liability they will assume in the transaction?

- know how to advertise effectively and what the costs will be?

- understand the various types of loans buyers may choose and the advantages and disadvantages for the seller?

- have arrangements with an escrow and title company, home warranty company, pest-control service and lender to assist you with the transaction?

- aware of conditions in the marketplace today that affect value and length of time to sell?

- concerned about having strangers walking through your home?

- familiar enough with real estate regulations to prepare a binding sales contract? Counter-offers?

- aware that every time you leave your home, you are taking it off the market until you return?

- aware that prospective buyers and bargain hunters will expect you to lower your cost because there’s no REALTOR® involved?

- prepared to give up your evenings and weekends to show your home to potential buyers and “just-looking” time wasters?

A REALTOR ® is a licensed real estate agent and a member of the National Association of REALTORS,® a real estate trade association. REALTORS ® also belong to their state and local Association of REALTORS.®

A real estate agent is licensed by the state to represent parties in the transfer of property. Every REALTOR ® is a real estate agent, but not every real estate agent has the professional designation of a REALTOR.®

A key role of the listing agent or broker is to form a legal relationship with the homeowner to sell the property and place the property in the Multiple Listing Service.

A key role of the buyer’s agent or broker is to work with the buyer to locate a suitable property and negotiate a successful home purchase.

The MLS is a database of properties listed for sale by REALTORS ® who are members of the local Association of REALTORS.® Information on an MLS property is available to thousands of REALTORS ®

These are the people who carry out the title search and examination, work with you to eliminate the title exceptions you are not willing to take subject to, and provide the policy of title insurance regarding title to the real property.

An escrow officer leads the facilitation of your escrow, including escrow instructions preparation, document preparation, funds disbursement, and more.

Mow and edge the lawn regularly, and trim the shrubs.

Make your entry inviting: Paint your front door and buy a new front door mat.

Paint or replace the mailbox, if needed.

If screens or windows are damaged, replace or repair them.

Repair or replace worn shutters and other exterior trim.

Make sure the front steps are clear and hazard-free. Make sure the doorbell works properly and has a pleasant sound.

Ensure that all exterior lights are working.

Check stucco walls for cracks and discoloration.

Remove any oil and rust stains from the driveway and garage.

Clean and organize the garage, and ensure the door is in good working order.

Shampoo carpeting or replace if worn. Clean tile floors, particularly the caulking.

Brighten the appearance inside by painting walls, cleaning windows and window coverings, and removing sunscreens.

Repair leaky faucets and caulking in bathtubs and showers.

Repair or replace loose knobs on doors and cabinets. If doors stick or squeak, fix them.

Make sure toilet seats look new and are firmly attached.

First impressions have a major impact on potential buyers. Try to imagine what potential buyers will see when they approach your house for the first time and walk through each room. Ask your REALTOR ® for advice; they know the marketplace and what helps a home sell. Here are some tips to present your home in a positive manner:

Repair or replace loud ventilating fans.

Replace worn shower curtains.

Rearrange furniture to make rooms appear larger. If possible, remove and/or store excess furniture, and avoid extension cords in plain view.

Remove clutter throughout the house. Organize and clean out closets.

Clean household appliances and make sure they work properly.

Air conditioners/heaters, evaporative coolers, hot water heater should be clean, working and inspected if necessary. Replace filters.

Check the pool and/or spa equipment and pumps. Make sure all are working properly and that the pool and/or spa are kept clean.

Inspect fences, gates and latches. Repair or replace as needed.

To make the best impression, keep your home clean, neat, uncluttered and in good repair. Please review this list prior to each showing:

Keep everything clean. A messy or dirty home will cause prospective buyers to notice every flaw.

Clear all clutter from counter tops.

Let the light in. Raise shades, open blinds, pull back the curtains and turn on the lights.

Get rid of odors such as tobacco, pets, cooking, etc., but don’t overdo air fresheners or potpourri. Fresh baked bread and cinnamon can make a positive impact.

Send pets away or secure them away from the house, and be sure to clean up after them.

Close the windows to eliminate street noise.

If possible you, your pets, and your children should be gone while your home is being shown.

Clean trash cans and put them out of sight.

If you must be present while your home is shown, keep noise down. Turn off the TV and radio. Soft, instrumental music is fine, but avoid vocals.

Keep the garage door closed and the driveway clear. Park autos and campers away from your home during showings

Hang clean attractive guest towels in the bathrooms.

Check that sink and tub are scrubbed and unstained.

Make beds with attractive spreads.

Stash or throw out newspapers, magazines, junk mail.

An estimate of value of property resulting from analysis of facts about the property; an opinion of value.

The borrower’s costs of the loan term expressed as a rate. This is not their interest rate.

The recipient of benefits, often from a deed of trust; usually the lender.

Closing Disclosure form designed to provide disclosures that will be helpful to borrowers in understanding all of the costs of the transaction. This form will be given to the consumer three (3) business days before closing.

Generally the date the buyer becomes the legal owner and title insurance becomes effective.

Sales that have similar characteristics as the subject real property, used for analysis in the appraisal. Commonly called “comps.”

Occurs when the borrower becomes contractually obligated to the creditor on the loan, not, for example, when the borrower becomes contractually obligated to a seller on a real estate transaction. The point in time when a borrower becomes contractually obligated to the creditor on the loan depends on applicable State law. Consummation is not the same as close of escrow or settlement.

An instrument used in many states in place of a mortgage.

Limitations in the deed to a parcel of real property that dictate certain uses that may or may not be made of the real property.

The date the amounts are to be disbursed to a buyer and seller in a purchase transaction or the date funds are to be paid to the borrower or a third party in a transaction that is not a purchase transaction.

Down payment made by a purchaser of real property as evidence of good faith; a deposit or partial payment.

A right, privilege or interest limited to a specific purpose that one party has in the land of another.

As to a title insurance policy, a rider or attachment forming a part of the insurance policy expanding or limiting coverage.

Real estate insurance protecting against fire, some natural causes, vandalism, etc., depending upon the policy. Buyer often adds liability insurance and extended coverage for personal property.

A trust type of account established by lenders for the accumulation of borrower’s funds to meet periodic payments of taxes, mortgage insurance premiums and/or future insurance policy premiums, required to protect their security.

A description of land recognized by law, based on government surveys, spelling out the exact boundaries of the entire parcel of land. It should so thoroughly identify a parcel of land that it cannot be confused with any other.

A form of encumbrance that usually makes a specific parcel of real property the security for the payment of a debt or discharge of an obligation. For example, judgments, taxes, mortgages, deeds of trust.

Form designed to provide disclosures that will be helpful to borrowers in understanding the key features, costs and risks of the mortgage loan for which they are applying. Initial disclosure to be given to the borrower three (3) business days after application.

The instrument by which real property is pledged as security for repayment of a loan.

A payment that includes Principal, Interest, Taxes, and Insurance.

A written instrument whereby a principal gives authority to an agent. The agent acting under such a grant is sometimes called an “Attorney-in-Fact.”

Filing documents affecting real property with the appropriate government agency as a matter of public record.

Provides a complete breakdown of costs involved in a real estate transaction.

TILA-RESPA Integrated Disclosures

Gets pre-approval letter from Lender and provides to Real Estate Agent.

Makes offer to purchase. Upon acceptance, opens escrow and deposits earnest money.

Finalizes loan application with Lender. Receives a Loan Estimate from Lender.

Completes and returns opening package from First American Title.

Schedules inspections and evaluates findings. Reviews title commitment/ preliminary report.

Provides all requested paperwork to Lender (bank statements, tax returns, etc.) All invoices and final approvals should be to the lender no later than 10 days prior to loan consummation.

Lender (or Escrow Officer) prepares CD and delivers to Buyer at least 3 days prior to loan consummation.

Escrow officer or real estate agent contacts the buyer to schedule signing appointment.

Buyer consummates loan, executes settlement documents, & deposits funds via wire transfer.

Documents are recorded and the keys are delivered!

Chooses a Real Estate Agent

Accepts Buyer’s offer to purchase.

Completes and returns opening package from First American Title, including information such as forwarding address, payoff lender contact information and loan numbers.

Orders any work for inspections and/or repairs to be done as required by the purchase agreement.

Escrow officer or real estate agent contacts the seller to schedule signing appointment.

Documents are recorded and all proceeds from sale are received.

Upon receipt of order and earnest money deposit, orders title examination.

Requests necessary information from buyers and sellers via opening packages.

Reviews title commitment / preliminary report.

Upon receipt of opening packages, orders demands for payoffs. Contacts buyer or seller when additional information is required for the title commitment/ preliminary report.

All demands, invoices, and fees must be collected and sent to lender at least 10 days prior to loan consummation.

Coordinates with lender on the preparation of the CD.

Reviews all documents, demands, and instructions and prepares settlement statements and any other required documents.

Schedules signing appointment and informs buyer of funds due at settlement.

Once loan is consummated, sends funding package to lender for review.

Prepares recording instructions and submits docs for recording.

Documents are recorded and funds are disbursed. Issues final settlement statement.

Accepts Buyer’s application and begins the qualification process. Provides Buyer with Loan Estimate.

Orders and reviews title commitment / preliminary report, property appraisal, credit report, employment and funds verification.

Collects information such as title commitment / preliminary report, appraisal, credit report, employment and funds verification. Reviews and requests additional information for final loan approval.

Underwriting reviews loan package for approval.

Coordinates with Escrow Officer on the preparation of the Closing Disclosure, which is delivered to Buyer at least 3 days prior to loan consummation.

Delivers loan documents to escrow.

Upon review of signed loan documents, authorizes loan funding.

1. Downpayment BUYER BUYER BUYER BUYER

2. Termite (Wood Infestation) Inspection (negotiable except on VA) SELLER

3. Property Inspection (if requested by buyer) BUYER BUYER BUYER BUYER

4. Property Repairs, if any (negotiable) SELLER SELLER SELLER SELLER

5. New Loan Origination Fee (negotiable) BUYER BUYER BUYER

6. Discount Points (negotiable) BUYER BUYER BUYER

7. Credit Report BUYER BUYER BUYER

8. Appraisal or Extension Fee (negotiable) BUYER BUYER BUYER

9. Existing Loan Payoff SELLER SELLER SELLER SELLER

10. Existing Loan Payoff Demand SELLER SELLER SELLER SELLER

11. Loan Prepayment Penalty (if any) SELLER SELLER SELLER SELLER

12. Next Month’s PITI Payment BUYER BUYER BUYER

13. Prepaid Interest (approx. 30 days) BUYER BUYER BUYER

14. Reserve Account Balance (Credit seller / Charge buyer) PRORATE PRORATE PRORATE

15. FHA MIP, VA Funding Fee, PMI Premium BUYER BUYER BUYER

16. Assessments payoff or proration (sewer, paving, etc.) SELLER

Taxes PRORATE PRORATE PRORATE PRORATE

Tax Impounds BUYER BUYER BUYER

Tax Service Contract SELLER SELLER BUYER

Fire/Hazard Insurance BUYER BUYER BUYER BUYER

Flood Insurance BUYER BUYER BUYER

Homeowners Association (HOA) Transfer Fee BUYER or SELLER BUYER or SELLER BUYER or SELLER BUYER or SELLER

SELLER SELLER SELLER SELLER

PRORATE PRORATE PRORATE PRORATE

BUYER BUYER BUYER BUYER

BUYER

SELLER BUYER or SELLER BUYER or SELLER BUYER or SELLER

SELLER SELLER SELLER SELLER

SELLER SELLER SELLER SELLER

BUYER BUYER BUYER

SPLIT SPLIT SELLER SPLIT

SPLIT SPLIT SPLIT SPLIT

SELLER SELLER SELLER SPLIT

SPLIT SPLIT SELLER SPLIT

The escrow is the process of having a neutral party manage the exchange of money for real property. The escrow holder is known as an escrow or settlement officer or agent. The buyer deposits funds and the seller deposits a deed with the escrow holder along with all of the other documents required to remove all "contingencies" (conditions and approvals) in the purchase agreement prior to closing.

Once a purchase agreement is signed by all necessary parties, the agent representing the party who will pay the fee selects an escrow holder and the buyer's earnest money deposit and contract are submitted to the escrow holder. From this point, the escrow holder will follow the mutual written instructions of the buyer and seller, maintaining a neutral stance to ensure that neither party has an unfair advantage over the other. The escrow holder also follows the instructions of the Buyer's new lender, the seller's existing lender, and both parties' agents. The escrow holder ensures the transparency of the transaction, while carefully maintaining the privacy of the consumers.

Open escrow and deposit good faith funds into an escrow account

Conduct a title search to determine the ownership and title status of the real property

Review the title commitment and begin the process of working with you and the title officer to eliminate the title exceptions the buyer and the buyer’s new lender are not willing to take subject to. This includes ordering a payoff demand from your existing lender.

Coordinate with the buyer’s lender on the preparation of the Closing Disclosure (CD)

Prorate fees, such as real property taxes, per the contract and prepare the settlement statement

Set separate appointments allowing the buyer and seller to sign documents and deposit funds

Review documents and ensure all conditions are fulfilled and certain legal requirements are met

Request funds from buyer and buyer’s new lender

When all funds are deposited and conditions met, record documents with the County Recorder to transfer the real property to the buyer

After recording is confirmed, close escrow and disburse funds, including proceeds, loan payoffs, tax payments, and more

Prepare and send final documents to all parties

Prior to the development of the title industry in the late 1800s, a home-buyer received a grantor’s warranty, attorney’s title opinion, or abstractor’s certificate as assurance of home ownership. The buyer relied on the financial integrity of the grantor, attorney, or abstractor for protection. Today, home-buyers look primarily to title insurance to provide this protection. Title insurance companies are regulated by state statute. They are required to post financial guarantees to ensure that any claims will be paid in a timely fashion. They also must maintain their own “title plants” which house duplicates of recorded deeds, mortgages, plats, and other pertinent county property records.

Title insurance provides coverage for certain losses due to defects in the title that, for the most part, occurred prior to your ownership. Title insurance protects against defects such as prior fraud or forgery that might go undetected until after closing and possibly jeopardize your ownership and investment.

Title insurance insures buyers against the risk that they did not acquire marketable title from the seller. It is primarily designed to reduce risk or loss caused by defects in title from the past. A loan policy of title insurance protects the interest of the mortgage lender, while an owner’s policy protects the equity of you, the buyer, for as long as you or your heirs (in certain policies) own the real property.

You pay for your owner’s title insurance policy only once, at the close of escrow. Who pays for the owner’s policy and loan policy varies depending on local customs.

Protection from:

1 Someone else owns an interest in your title

2 A document is not properly signed

3 Forgery, fraud, duress in the chain of title

4 Defective recording of any document

5 There are restrictive covenants

6 There is a lien on your title because there is:

a) a deed of trust

b) a judgement, tax, or special assessment

c) a charge by a homeowner’s association

7 Title is unmarketable

8 Mechanics lien

9 Forced removal of a structure because it:

a) extends on another property and/or easement

b) violates a restriction in Schedule B

c) violates an existing zoning law*

10 Cannot use the land for a Single-Family Residence because the use violates a restriction in Schedule B or a zoning ordinance

11 Unrecorded lien by a homeowners association

12 Unrecorded easements

13 Building permit violations*

14 Restrictive covenant violations

15 Post-policy forgery

16 Post-policy encroachment

17 Post-policy damage from extraction of minerals or water

18 Lack of vehicular and pedestrian access

19 Map not consistent with legal description

20 Post-policy adverse possession

21

22

23

Post-policy prescriptive easement

Covenant violation resulting in your title reverting to a previous owner

Violation of building setback regulations

24 Discriminatory covenants

Other benefits:

25 Pays rent for substitute land or facilities

26 Rights under unrecorded leases

27

28

29

30

Plain language statements of policy coverage and restrictions

Compliance with Subdivision Map Act

Coverage for boundary wall or fence encroachment*

Added ownership coverage leads to enhanced marketability

31 Insurance coverage for a lifetime

32

Post-policy inflation coverage with automatic increase in value up to 150% over five years

33 Post-policy Living Trust coverage

* Deductible and maximum limits apply. Not available to investors on 1- to 4-unit residential properties. Coverage may vary based on an individual policy.

As with any insurance contract, the insuring provisions express the coverage afforded by the title insurance policy and there are exceptions, exclusions and conditions to coverage that limit or narrow the coverage afforded by the policy. Also, some cov erage may not be available in a particular area or transaction due to legal, regulatory, or underwriting considerations. Please contact a First American representative for further information. The services described above are typical basic services. The services provided to you may be different due to the specifics of your transaction or the location of the real property involved.

EAGLE ALTA Standard or CLTA EAGLE ALTA Standard or CLTAOne escrow transaction could involve more than 20 individuals, including real estate agents, buyers, sellers, attorneys, escrow officer, escrow technician, title officer, loan officer, loan processor, loan underwriter, home inspector, termite inspector, insurance agent, home warranty representative, contractor, roofer, plumber, pool service, and so on. And often, one transaction depends on another.

When you consider the number of people involved, you can imagine the opportunities for delays and mishaps. Your experienced escrow team can’t prevent unforeseen problems from arising; however, they can help smooth out the process.

Once the loan is approved and all invoices and paperwork have been provided, the lender and escrow officer will collaborate on the preparation of the Closing Disclosure (CD). In order to close on time, all paperwork and invoices should be submitted at least 10 days prior to the expected close of escrow date. The borrower must receive the CD at least three days* prior to consummation of the loan (typically the signing date). The escrow officer will also prepare an estimated settlement statement and inform the buyer of the balance of the down payment and closing costs needed to close escrow.

*For purposes of the Closing Disclosure“business day” is defined as every day except Sundays and Federal legal holidays.

The escrow holder will contact you or your agent to schedule a closing or signing appointment. In some states, this is the "close of escrow." In some others, the close of escrow is either the day the documents record or that funds are disbursed. Ask your escrow holder if you would like clarification about your state's laws.

You will have a chance to review the settlement statement and supporting documentation. This is your opportunity to ask questions and clarify terms. You should review the settlement statement carefully and report discrepancies to the escrow officer. This includes any payments that may have been missed. You are responsible for all charges incurred even if overlooked by the escrow holder, so it's better to bring these to their attention before closing.

The escrow holder is obligated by law to have the designated amount of money before releasing any funds. If you have questions or foresee a problem, let your escrow holder know immediately.

You will need valid identification with your photo I.D. on it when you sign documents that need to be notarized (such as a deed). A driver's license is preferred. You will also be asked to provide your social security number for tax reporting purposes, and a forwarding address.

If the buyer is obtaining a new loan, the buyer’s signed loan documents will be returned to the lender for review. The escrow holder will ensure that all contract conditions have been met and will ask the lender to "fund the loan."

If the loan documents are satisfactory, the lender will send funds directly to the escrow holder. When the loan funds are received, the escrow holder will verify that all necessary funds are in. Escrow funds will be disbursed to the seller and other appropriate payees. Then, the REALTOR® will present the keys to the property to the buyer.

Create an inventory sheet of items to move.

Research moving options You’ll need to decide if yours is a do-it-yourself move or if you’ll be using a moving company.

Request moving quotes Solicit moving quotes from as many moving companies and movers as possible. There can be a large difference between rates and services within moving companies.

Discard unnecessary items Moving is a great time for ridding yourself of unnecessary items. Have a yard sale or donate unnecessary items to charity.

Packing materials. Gather moving boxes and packing materials for your move.

Contact insurance companies. (Life, Health, Fire, Auto) You’ll need to contact your insurance agent to cancel/transfer your insurance policy. Do not cancel your insurance policy until you have and closed escrow on the sale.

Seek employer benefits. If your move is work-related, your employer may provide funding for moving expenses. Your human resources rep should have information on this policy.

Changing Schools. If changing schools, contact new school for registration process.

Contact utility companies Set utility turnoff date, seek refunds and deposits and notify them of your new address.

Obtain your medical records. Contact your doctors, physicians, dentists and other medical specialists who may currently be retaining any of your family’s medical records. obtain these records or make plans for them to be delivered to your new medical facilities.

Note food inventory levels Check your cupboards, refrigerator and freezer to use up as much of your perishable food as possible.

Service small engines for your move by extracting gas and oil from the machines. This will reduce the chance to catch fire during your move.

Protect jewelry and valuables. Transfer jewelry and valuables to safety deposit box so they can not be lost or stolen during your move.

Borrowed and rented items. Return items which you may have borrowed or rented. Collect items borrowed to others.

Plan your itinerary. Make plans to spend the entire day at the house or at least until the movers are on their way. Someone will need to be around to make decisions. Make plans for kids and pets to be at the sitters for the day.

Change of address. Visit USPS for change of address form.

Bank accounts Notify bank of address change. Make sure to have a money order for paying the moving company if you are transferring or closing accounts.

Service automobiles If automobiles will be driven long distances, you’ll want to have them serviced for a trouble-free drive.

Cancel services. Notify any remaining service providers (newspapers, lawn services, etc) of your move.

Start packing. Begin packing for your new location.

Travel items. Set aside items you’ll need while traveling and those needed until your new home is established. Make sure these are not packed in the moving truck!

Scan your furniture. Check furniture for scratches and dents before so you can compare notes with your mover on moving day.

Prepare Floor Plan. Prepare floor plan for your new home. This will help avoid confusion for you and your movers.

Review the house. Once the house is empty, check the entire house (closets, the attic, basement, etc) to ensure no items are left or no home issues exist.

Sign the bill of lading. Once your satisfied with the mover’s packing your items into the truck, sign the bill of lading. If possible, accompany your mover while the moving truck is being weighed.

Double check with your mover. Make sure your mover has the new address and your contact information should they have any questions during your move.

Vacate your home. Make sure utilities are off, doors and windows are locked and notify your real estate agent you’ve left the property.

First American Title Branch Locator

623.299.3644

13940 W. Meeker Blvd., #119

Sun City West, AZ 85375

N of Meeker Blvd

W of R.H. Johnson

2 GOODYEAR

623.936.8001

1626 N. Litchfield Rd. Ste. #170

Goodyear, AZ 85395

NW corner of McDowell & Litchfield

623.487.0404

16165 N. 83rd Ave , #100

Peoria, AZ 85382

S of Bell/E side of 83rd Ave

4 THE LEGENDS

623.537.1608

20241 N. 67th Ave , #A-2

Glendale, AZ 85308

E side 67th Ave/N of 101

5 ANTHEM

623.551.3265

39508 N. Daisy Mountain Dr., #128 Anthem, AZ 85086

NE corner Daisy Mtn Dr/ Gavilan Peak Pkwy

602.954.3644

3200 E Camelback Rd., #123

Phoenix, AZ 85018

NE Corner of Camelback/32nd Street

480.515 4369

20860 N. Tatum Blvd , #100 Phoenix, AZ 85050

NW corner of Tatum/Loop 101

8 CAREFREE 480.575.6609

7202 E. Carefree Dr , Bldg 1, #1 Carefree, AZ 85377

NE corner of Tom Darlington/ Carefree Dr.

480.948.6488

14648 N Scottsdale Rd., Ste. #100 Scottsdale, AZ 85254

W of Scottsdale Road, S side of Greenway

480.551.0480

6263 N. Scottsdale Rd., #110 Scottsdale, AZ 85250

E Side Scottsdale/S of Lincoln

480.563.9034

18291 N. Pima Rd , #145 Scottsdale, AZ 85255

SE corner of Pima/Legacy

480.753.4424

4435 E. Chandler Blvd , #100 Phoenix, AZ 85048

SW corner Chandler/45th St.

480.777.0051

2121 W. Chandler Blvd., #215 Chandler, AZ 85224

SW Corner Chandler Blvd./ Dobson Rd.

1528 E. Williams Field Rd., #101 Gilbert, AZ 85295

NW corner of Williams Field Rd./ Val Vista Rd.

1630 S. Stapley Dr., #123 Mesa, AZ 85204

N of Baseline / W of Stapley

480.534.3599

1135 N. Recker Rd , #103 Mesa, AZ 85205

SE corner of Recker & Brown

480.288.0883

6877 South Kings Ranch Rd., #5 Gold Canyon, AZ 85118

E of 60/

South Side Kings Ranch Rd.

For more information please contact your First American representative. www.firstam.com

©2021 First American Financial Corporation and/or its affiliates. All rights reserved. NYSE: FAF

First American Title Insurance Company, and the operating divisions thereof, make no express or implied warranty respecting the information presented and assume no responsibility for errors or omissions. First American, the eagle logo, First American Title, and firstam.com are registered trademarks or trademarks of First American Financial Corporation and/or its affiliates.

05110281121