3 minute read

Term Deposit Renewal.................................................................................................................12

from Strategy Text

by finuragroup

6. Establish a Budget for your Cash Flow

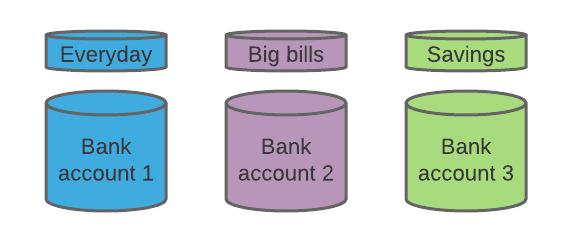

We recommend you establish and implement a budget by using your existing / our proposed cash accounts. We recommend a transaction account/s for everyday costs. You will then have a separate account for larger expenses and another for savings. We will undertake a review of your budget every quarter / six months / 12 months. We recommend the use of cash accounts as follows:

Advertisement

Benefits:

You are more likely to meet your savings goals if you actively track your expenses and your progress. We estimate that if you stick to your budget, after 12 months you will have $XXX in your savings account for your savings goals and / or as an emergency cash reserve. [Retirement] We estimate that your retirement goal to retire at age XX on an income of $XXX p.a. in after-tax dollars, will be met with adherence to this cash flow strategy. Smoothing out bill payments by making small contributions often, can ease the financial stress of paying big bills. The budget we have recommended allows for all known expenses.

Points to Consider:

You will have unexpected expenses from time to time. This is where your cash savings will assist you as needed. Keeping to budget requires discipline. You need to be consistent in applying your budget on a daily, weekly, monthly basis. You will have less money for discretionary spending so that we can cater for your longer-term needs and goals. The budget we have recommended is based on the expenditure details you have provided. If this information is inaccurate, the budget may be unrealistic and difficult to follow. We will review the accuracy of the budget at each budget review.

7. Cash flow monitoring

We recommend that you commence a cash flow monitoring service. This can be linked to your existing bank accounts / our recommended cash accounts so that we have full visibility of your income and expenditure. We will track this to ensure your budgeted expenditure is in line with your actual spending and provide reporting on this each month / quarter. The monitoring will also show how you are tracking towards your savings and retirement goals.

Benefits:

You are more likely to meet your savings goals if you actively track your expenses and your progress. We estimate that if you stick to your budget, after 12 months you will have $XXX in your savings account for your savings goals and / or as an emergency cash reserve. [Retirement] We estimate that your retirement goal to retire at age XX on an income of $XXX p.a. in after-tax dollars, will be met with adherence to this cash flow strategy. Smoothing out bill payments by making small contributions often can ease the financial stress of paying big bills. We have considered all planned expenditure to ensure your savings and retirement goals are realistic.

Points to Consider:

You will have unexpected expenses from time to time. This is where your cash savings will be able to assist you as needed. Keeping to budget requires discipline. You need be consistent in applying your budget on a daily, weekly, monthly basis. You will have less money for discretionary spending so that we can cater for your longer-term needs and goals. The cash flow outcomes we have considered are based on the income and expenditure details you have provided. If this information is inaccurate, the strategy may be unrealistic and difficult to follow. We will review the accuracy of the income and expenditure estimates at each cash flow review.