5 minute read

EXNESS pros and cons: Broker review 2026

With the forex and crypto markets evolving rapidly, traders in 2026 need brokers that combine performance, reliability, and cost-effectiveness. One broker that consistently stands out in global discussions is EXNESS.

Known for its lightning-fast withdrawals, regulated status, and low trading fees, EXNESS has attracted a wide range of traders — from absolute beginners to algorithmic pros. But no broker is perfect. That’s why this in-depth Exness broker review 2026 gives you a detailed breakdown of its real strengths and limitations.

👉 Ready to experience Exness yourself?🔗 Open Your Account Here

Who Is EXNESS? A Brief Overview

Founded in 2008, EXNESS is a multi-asset brokerage company with a strong global footprint. The company is headquartered in Cyprus and operates under several international regulatory bodies.

By 2026, EXNESS has surpassed $4+ trillion in monthly trading volume, with hundreds of thousands of active users worldwide. Whether you're trading from Africa, Asia, Europe, or Latin America, EXNESS is likely available and fully functional in your region.

What Makes EXNESS Popular in 2026?

In 2026, EXNESS remains one of the fastest-growing brokers globally, thanks to:

Extremely fast withdrawals (under 30 minutes)

Access to over 100+ instruments

Unmatched transparency with published trading data

Ultra-low spreads on major pairs

No-requotes policy and instant execution

EXNESS continues to innovate, supporting traders with tools like VPS hosting, mobile app upgrades, and 24/7 crypto trading.

EXNESS Pros: 10 Key Advantages for Traders

Fully Regulated and TrustedExness is licensed by FCA (UK), CySEC (EU), FSCA (South Africa), and FSC (Mauritius). This makes it one of the most transparent and secure brokers globally.

Fast Withdrawals, Even on WeekendsTraders love Exness for lightning-speed withdrawals, often processed instantly or within minutes — even on holidays.

Low Spreads and Zero Commission AccountsWith Standard and Raw Spread accounts, traders enjoy tight spreads with zero to very low commissions.

Flexible Leverage Up to 1:UnlimitedExness allows high leverage, with conditions for unlimited leverage to support various strategies.

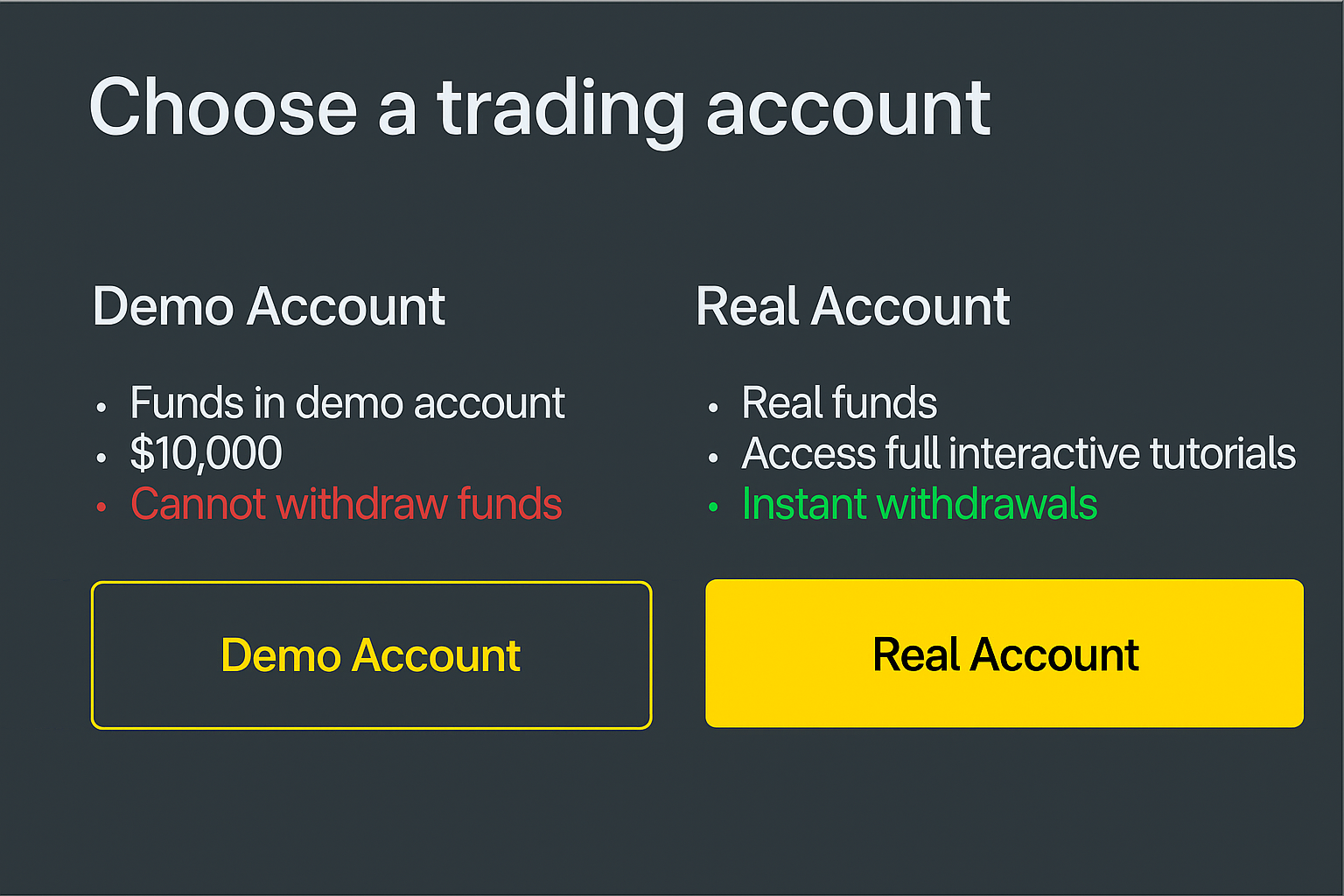

Multiple Account TypesFrom Standard (ideal for beginners) to Zero, Raw, and Pro (designed for advanced traders).

Monthly Transparency ReportsExness publishes audited reports of trading volume and financial performance, making it one of the few brokers to do so.

MT4, MT5, Web & Mobile Trading PlatformsNo matter your device, Exness supports your trading through industry-leading platforms.

24/7 Crypto TradingTrade BTC, ETH, XRP, and more even on weekends — with full liquidity.

Wide Range of Trading InstrumentsExness offers forex, indices, metals, energies, stocks, and cryptocurrencies.

Local Payment SupportMany regions, including Nigeria, South Africa, India, and Southeast Asia, benefit from local bank and fintech deposits.

👉 Experience these features now: Sign Up to EXNESS

EXNESS Cons: 6 Limitations You Should Know

No Fixed Spread AccountsTraders who rely on fixed spreads may find Exness unsuitable.

Limited Learning MaterialsExness has basic education resources, but lacks in-depth tutorials for beginners.

Unlimited Leverage RiskWhile exciting, unlimited leverage can be dangerous for undisciplined traders.

Some Tools Only on MT5You’ll need MetaTrader 5 to access full features — MT4 users have limitations.

Occasional Verification DelaysSome users report slow KYC approval times during peak periods.

No Proprietary Trading PlatformWhile MT4/MT5 are solid, there's no unique Exness-built terminal beyond the web version.

Regulation and Safety of Funds

EXNESS complies with international standards for fund protection:

Client funds are segregated from company capital.

Regulatory audits are conducted regularly.

You can file complaints through regulatory bodies if needed.

This makes Exness a legally safe choice for your capital.

EXNESS Trading Platforms: MT4, MT5, Web, Mobile

Exness offers:

MetaTrader 4 – Great for forex beginners

MetaTrader 5 – Perfect for pro traders needing more tools

Web Terminal – No downloads needed

Exness App – Available for Android & iOS, fast and intuitive

All platforms support automated trading (EAs), technical indicators, and multi-asset execution.

Deposit & Withdrawal Experience with EXNESS

Funding your account is seamless:

Instant deposits via card, crypto, or local banks

No deposit/withdrawal fees from Exness

Weekend processing for 24/7 access to your funds

This makes Exness one of the most user-friendly brokers for financial transactions.

Who Should Use EXNESS?

Beginners – Thanks to low deposits and simple interface

Scalpers & Day Traders – Tight spreads + fast execution

EA/Algo Traders – With VPS and MT4/MT5 support

Crypto Traders – 24/7 access to major coins

Who Should Avoid EXNESS?

Traders who require fixed spreads

Beginners needing hand-holding education

Traders who prefer brokers with a custom platform

EXNESS vs Other Brokers in 2026

Compared to many competitors like IC Markets, Octa, or FBS:

Exness beats them on withdrawal speed

Offers better leverage flexibility

Has stronger regulatory backing

Where it falls short is education and proprietary innovation.

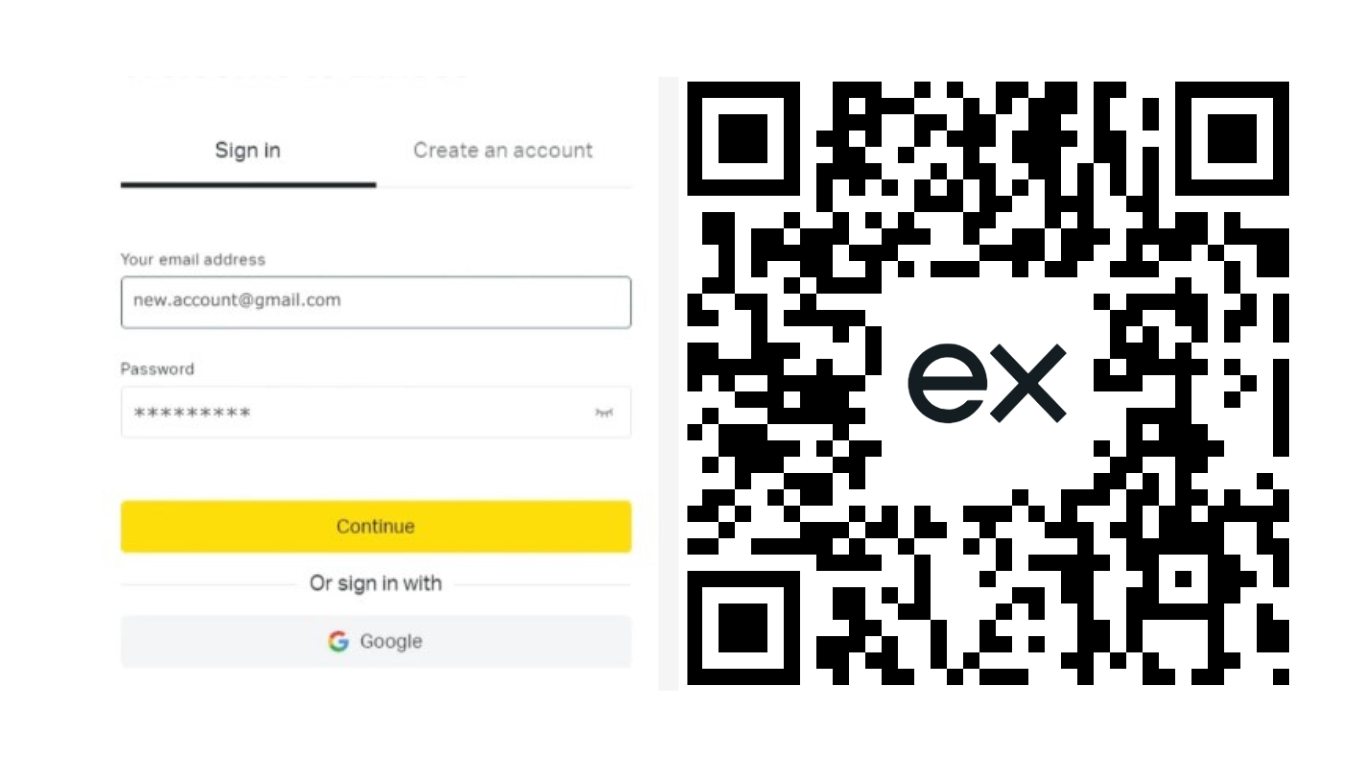

How to Sign Up with EXNESS in 2026

Visit Exness Official Site

Click “Create Account”

Enter your email and secure password

Choose account type (Standard is best for starters)

Verify identity (KYC)

Fund your account and start trading

👉 Click here to create your account now

FAQs: EXNESS Pros and Cons 2026

1. Is Exness a trusted broker in 2026?Yes, Exness is fully regulated by multiple top-tier authorities and trusted by hundreds of thousands of traders.

2. What is the biggest advantage of Exness?Fast withdrawals, tight spreads, and transparency.

3. What is the main drawback of Exness?Lack of fixed spread accounts and deep educational materials.

4. Can I use Exness from my phone?Yes, the Exness App is available for both Android and iOS.

5. What’s the minimum deposit?Only $10 for Standard accounts.

6. Does Exness charge withdrawal fees?No, Exness does not charge fees for deposits or withdrawals.

Conclusion: Is EXNESS Worth It in 2026?

Yes – Exness is one of the top brokers of 2026, especially for traders looking for fast execution, ultra-low fees, and secure platforms. While not perfect, its advantages clearly outweigh the drawbacks for most trading styles.

Whether you’re just getting started or managing large capital, Exness offers real value backed by regulation and performance.

👉 Start trading smarter with Exness now:🔗 Sign Up Now🔗 Visit the Homepage

See more:

EXNESS Global Review Safe or Scam broker?