6 minute read

EXNESS Broker South Africa Review 2026: Pros and Cons

If you’re exploring whether EXNESS is a legitimate and feature-rich broker for forex and CFD trading in 2026, this comprehensive review covers it all. From licensing to trading conditions, app functionality, account setup, and common questions—you’ll get a clear picture in one place.

👉 Visit Exness Official Website👉 Create Your Exness Account Today

✅ Is EXNESS Legit and Regulated?

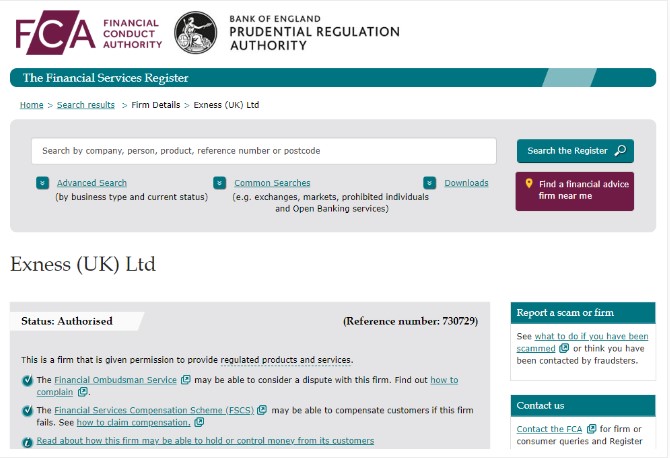

Regulated by top-tier authorities such as FCA (UK), CySEC (EU), FSCA (South Africa).

Includes negative balance protection, segregated client funds, and regular audits.

Filipino and other international traders access it via offshore entities that honor these standards.

No Philippine SEC or BSP license—but global regulation ensures compliance and security.

🧾 Account Types & Trading Conditions

Account Types:

Standard & Standard Cent: Zero commission, floating spreads from ~0.3 pips, ideal for beginners.

Pro Account: Lower spreads (~0.1 pips), no commission, faster execution.

Raw Spread: Near-zero spreads with ~$3.50 commission per side per lot.

Zero Account: Fixed 0.0 pip spread on select pairs with commission from ~$0.20 per side.

Trading Instruments:Forex, metals, indices, commodities, stocks, and crypto CFDs are available—all from a single platform.

Leverage & Execution:

Up to 1:2000 leverage on major pairs (subject to conditions).

Fast, low-latency execution even on mobile, with spreads especially tight during London/New York overlaps.

📱 Platforms & Features

Trading Terminal: High-performance browser platform integrated into Exness dashboard.Exness Go App: Full mobile ecosystem supporting account creation, KYC, deposits, withdrawals, charts, trading, and analytics.

Well-suited for both Android and iOS with:

One-click trading and mobile-optimized interface

Interactive charts with indicators and drawing tools

Built-in trading calculators and notifications

24/5 multilingual live support

🚀 Benefits of EXNESS

Regulatory safety and audit transparency

Low barrier to entry: Standard Cent account requires just USD 1

Amazing flexibility: Multiple account types, smooth mobile/desktop access

Fast funding and withdrawals, especially via crypto or e-wallets

Integrated tools: Economic calendar, calculators, price alerts, and wallet

Accessible support in English, Tagalog, and other languages

In 2026, EXNESS remains one of the most popular forex brokers for South African traders. Known for its fast execution, flexible account types, and global regulation, this platform offers robust tools for both new and experienced users. This detailed review explores EXNESS’s strengths and limitations specifically from a South African perspective.

👉 Sign up and start trading with EXNESS

Regulatory & Legal Standing in South Africa

EXNESS operates globally from a South African entity regulated by the FSCA (Financial Sector Conduct Authority).

Additional licenses from FCA (UK) and CySEC (EU) reinforce compliance standards.

FSCA registration provides local clients with recourse to dispute resolution and compensation mechanisms, making EXNESS a legally sound choice for South African traders.

🧾 Account Types & Trading Conditions Tailored to ZAR Users

EXNESS offers a range of account types, accommodating everything from small capital to high-volume traders:

Standard/Cent Account: No commissions and floating spreads from ~0.3 pips—ideal for beginners and micro-trading in ZAR.

Pro Account: Lower spreads (~0.1 pips), no commission—ideal for intermediate traders.

Raw Spread Account: Near-zero spreads combined with a $3.50 commission per lot per side—preferred by scalpers.

Zero Account: Fixed 0.0 pips on many instruments with tiered commission—ideal for high-frequency strategies.

👉 Sign up and start trading with EXNESS

Spreads and Leverage

Forex pairs like EUR/USD may have spreads from 0.0–0.3 pips on Raw/Zero accounts.

Leverage up to 1:2000 (subject to South African regulations) is available, helping experienced traders amplify potential gains—but also require disciplined risk management.

📱 Trading Platforms & Tools

South African traders can use multiple platforms:

Web Terminal (browser): No installation required—ideal for quick access and strategy testing.

MetaTrader 4 & 5: Standard desktop versions with full EA and indicator support.

Exness Go App (mobile): Trade, deposit, withdraw, manage accounts, and use calculators, all within one mobile-friendly interface.

Trading tools available include: pip, swap, and margin calculators, economic calendar, real-time notifications, and multi-currency account dashboards. ZAR-based accounts can monitor equity, exposure, and withdrawals in source currency.

Deposits & Withdrawals for ZAR Clients

South African users benefit from fast and low-cost funding options:

Local bank transfers in ZAR processed via trusted payment processors.

Credit/debit cards, e-wallets, and cryptocurrency funding (USDT or BTC) with near-instant execution.

Most withdrawals are processed within minutes to a few hours depending on chosen method; bank transfers may take 1–2 business days.

✅ Pros of Using EXNESS in South Africa

FSCA regulation and international authority compliance ensure peace of mind.

Multiple account options suit all trading styles—from cent accounts to pro scalping setups.

Mobile-first tools in the Exness Go app, optimized for Android & iOS devices.

Competitive spreads especially on Raw Spread and Zero accounts.

Automated, fast deposit/withdrawal system, especially with crypto or e-wallets.

Multilingual support and content, including South African-friendly payment and service channels.

❌ Cons to Be Aware Of

EXNESS is not BSP regulated, meaning no protection via local South African financial authorities.

Some account types (Raw/Zero) require higher minimum capital and volume consideration.

Bank withdrawals may take longer depending on banking partner processes.

The app only supports MT5, so MT4 users need the separate MT4 mobile app.

🧭 Ideal Use Cases for EXNESS in South Africa

Novice traders: Start with Standard or Cent accounts to test strategies with minimal risk.

Day traders and scalpers: Use Raw Spread or Zero, where every pip matters.

Mobile-first traders: The Exness Go app supports full trading and account functions on a phone.

Deposit-heavy traders: Use ZAR local banking or e-wallets for rapid, currency-aligned funding.

Frequently Asked Questions

Q1: Is EXNESS legitimately regulated in South Africa?

Yes—EXNESS operates under FSCA South African regulation along with global licenses.

Q2: What’s the minimum deposit in ZAR?

From as little as USD 1 (equivalent in ZAR) for Cent accounts, or USD 10 (ZAR equivalent) for Standard.

Q3: Can I fund and trade ZAR directly?

Yes—ZAR accounts are supported via local bank transfers and currency-convertible deposits.

Q4: Does EXNESS support mobile trading?

Absolutely—through the Exness Go app, you can handle everything from account opening to execution and funding.

Q5: What spreads can I expect on major pairs?

Standard/Pro: ~0.3–1.0 pips; Raw/Zero: 0.0–0.3 pips depending on liquidity.

Q6: Is ZAR withdrawal fast?

Yes—particularly via e-wallet or crypto. Bank transfer withdrawals can take up to 1–2 business days.

✅ Final Verdict

For South African forex and CFD traders in 2026, EXNESS provides a reliable, globally regulated platform with flexible account types, competitive execution, and strong mobile support. While it lacks BSP licensing, its FSCA compliance and integrated tools make it a strong contender for traders of all levels.

👉 Visit EXNESS official website👉 Sign up and start trading today

See more:

Isesengura rya Broker EXNESS: Ivyiza n'Ibibi

ការពិនិត្យឈ្មួញកណ្តាល EXNESS ឆ្នាំ៖ គុណសម្បត្តិ និងគុណវិបត្តិ

Avis sur le courtier EXNESS: Avantages et inconvénients

Revisão da Corretora EXNESS: Prós e Contras