12 minute read

What is Exness broker? What does Exness do? 2025

from Exness Broker

When it comes to online trading, there are a plethora of brokers to choose from, but one stands out for its unique offerings and reputation in the market: Exness. As traders continually seek the best platforms for their investments, understanding the essentials of what makes Exness a popular choice becomes paramount. In this blog post, we will delve deep into various aspects of Exness, exploring what is Exness:

What is Exness: A Comprehensive Overview

Before diving into the specifics, it is essential to establish an overall understanding of what Exness is. Founded in 2008, Exness has made a considerable mark in the forex brokerage industry over the years. It is designed primarily for online trading in Forex, CFDs (Contracts for Difference), cryptocurrencies, and various other financial instruments.

Start Exness Trade: Open Exness Account and Visit site

Exness has gained significant traction and popularity among traders globally, thanks to its competitive trading conditions, advanced technological platform, and transparent operations. It caters to both beginner and expert traders, offering features that promote ease of use while including sophisticated tools for experienced investors. But what specifically does Exness offer?

Company History and Background

The inception of Exness took place in Cyprus, where it was founded by a group of finance professionals who envisioned creating a better trading environment. Over the years, the firm expanded its services internationally and received several licenses and regulatory approvals from reputable jurisdictions. This growth trajectory speaks volumes about its dedication to providing quality service.

Initially focusing solely on Forex trading, Exness has diversified its offerings to include commodities, indices, stocks, and cryptocurrencies. This diversification allows traders to explore multiple asset classes and provides them with a holistic trading experience.

Since its establishment, Exness has prioritized leveraging technology to enhance user experience. The broker understands that the trading landscape is constantly evolving, necessitating innovative solutions and responsive platforms. Therefore, they have developed an intuitive trading platform that can be accessed via desktop, web, and mobile devices.

Trading Platforms Offered by Exness

Exness users can choose between two main trading platforms - MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are renowned for their robust capabilities and user-friendly interface. MT4 is ideal for Forex trading, while MT5 offers enhanced functionality, making it suitable for trading various assets.

Start Exness Trade: Open Exness Account and Visit site

In addition to standard desktop and mobile applications, Exness also provides a web-based trading solution that allows users to trade directly through their browser without needing to download additional software. This flexibility ensures that traders can access their accounts from anywhere, making it convenient for those who are always on the move.

Instruments Available for Trading

One of the standout features of Exness is the extensive range of instruments available for trading. From major currency pairs to exotic options, commodities like gold and oil to global indices, and even cryptocurrencies such as Bitcoin and Ethereum, Exness provides a comprehensive suite of instruments to cater to diverse trading strategies.

Moreover, traders at Exness can leverage different account types, each designed to accommodate varying levels of experience and investment goals. By offering tailored accounts, Exness allows traders to find a specific match for their financial aspirations, fostering a more personalized trading experience.

Understanding the Type of Broker Exness Represents

To gain a clearer perspective on what kind of broker is Exness, one must first understand the classification of brokers within the financial markets. Broadly speaking, brokers can be categorized into two primary types: market makers and ECN (Electronic Communication Network) brokers.

Exness operates primarily as an ECN broker, which means it facilitates direct transactions between traders and liquidity providers without dealing in-house. This structure yields several advantages for traders who are inclined towards transparency and lower spreads.

Market Maker vs. ECN Broker

Market makers act as intermediaries who buy and sell securities from their own inventory. They control the bid-ask spread and profit from the difference between buying and selling prices. While this model may provide some stability, it can lead to conflicts of interest since market makers might benefit from a client's loss.

On the other hand, ECN brokers like Exness connect traders directly with the interbank market, allowing them to execute trades at the best available prices. With no conflict of interest, traders can enjoy tighter spreads and more favorable execution.

Start Exness Trade: Open Exness Account and Visit site

Benefits of Being an ECN Broker

Being an ECN broker means that Exness can provide several benefits to its clients:

Tight Spreads: Since pricing comes directly from the interbank network, traders can enjoy very tight spreads, enhancing their potential profitability.

High Transparency: Trades are executed at market prices, and clients can see the same quotes as liquidity providers. This transparency builds trust with traders who are wary of potential manipulations by market makers.

Scalping and Hedging Allowed: Many retail traders employ strategies such as scalping or hedging, which may not always be permissible with market maker brokers. Exness supports these strategies, aligning with the needs of various trading styles.

Regulatory Considerations

As an ECN broker, Exness adheres strictly to regulatory standards. Regulation varies by jurisdiction, and Exness operates under multiple licenses from respected organizations, such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies enforce stringent guidelines that ensure the safety of client funds and promote fair trading practices.

Geographical Presence: Which Country is Exness Based In?

Understanding the geographical presence of Exness is crucial for grasping its operational legitimacy. Originally set up in Cyprus, Exness has established itself as an international brokerage service provider with offices in various countries around the world.

Global Headquarters in Cyprus

Cyprus remains home to the corporate headquarters of Exness. The regulatory framework in Cyprus is known for being trader-friendly, which attracts many international companies looking for a reliable base. The licenses obtained from CySEC signify that Exness meets the required standards for operation, ensuring adequate protection for traders.

Expansion into Other Regions

Over the years, Exness has expanded its reach beyond Cyprus, catering to clients in Asia, Europe, Africa, and Latin America. This global approach enables them to attract a diverse clientele and adapt services to meet the specific needs of different regions.

As they build partnerships and create localized marketing strategies, Exness continues to grow its presence in emerging markets, showcasing the adaptability and commitment of the brokerage.

Regional Offices and Support

In addition to its headquarters in Cyprus, Exness has opened regional offices in various locations. This strategy not only enhances its customer service by providing localized support but also helps the broker navigate regional regulations effectively. The multilingual support team ensures that clients around the world receive assistance in their preferred language, further improving the trading experience.

Evaluating Trustworthiness: Is Exness a Reliable Broker?

Trust plays a pivotal role in choosing a trading broker. So, is Exness a trusted broker? The evaluation of trustworthiness encompasses several factors, including regulatory compliance, customer support, and user reviews.

Regulatory Compliance and Licensing

As previously mentioned, Exness holds licenses from reputable regulatory authorities, such as FCA and CySEC. Such licenses guarantee that Exness operates under comprehensive regulations that protect clients' interests. These regulatory bodies impose strict guidelines regarding capital adequacy, transparency, reporting, and treating clients fairly.

Additionally, Exness uses segregated accounts for clients’ funds, ensuring that the money is kept separate from the company's operational funds. This practice increases security and assures traders that their deposits are safeguarded.

Security Measures in Place

Security measures are integral to maintaining a trusted trading environment. Exness employs state-of-the-art encryption technologies to ensure that all data transfers between users and the platform are secure. Furthermore, two-factor authentication (2FA) adds an extra layer of protection, requiring verification through multiple channels during login attempts.

Customer Support and Responsiveness

A reliable broker must prioritize customer support. Exness has invested in building a strong support team that is available 24/7 through various channels, including live chat, email, and phone. Providing timely responses to inquiries or issues demonstrates Exness's commitment to ensuring a seamless trading experience for its clients.

Exness Explained: Features and Offerings

Now that we have an overview of what is Exness and its operational legitimacy, let's dive deeper into the features and offerings that make this broker appealing to traders.

Start Exness Trade: Open Exness Account and Visit site

Account Types Available

Exness offers multiple account types, each designed to cater to different trading styles and financial goals. Whether you're a novice trader or a seasoned professional, you will likely find an account type that suits your needs.

Standard Accounts: These accounts typically have low spreads and are designed for beginners who require a simple trading experience.

Pro Accounts: For experienced traders, Pro accounts offer tighter spreads, faster execution, and additional leverage options.

Cent Accounts: Cent accounts allow traders to deposit smaller amounts and trade in cents rather than dollars, making it an excellent option for those starting with limited funds.

✅ Exness: Open An Account or Go to Website

Educational Resources for Traders

Recognizing that knowledge is power in trading, Exness provides a wealth of educational resources to help its clients become better traders. From webinars, tutorials, and articles to market analysis, Exness covers various topics relevant to both new and experienced traders.

By investing in education, Exness empowers its customers to make informed decisions, encouraging them to develop effective trading strategies and mitigate risks.

Advanced Trading Tools

Exness also equips traders with advanced trading tools designed to enhance their performance. From technical analysis tools, indicators, and charting functionalities to economic calendars and news feeds, traders have access to invaluable resources.

These tools facilitate strategic planning, enabling traders to identify opportunities and make data-driven decisions, ultimately improving their overall trading success.

The Nature of Exness: Market Maker or ECN?

Given that Exness primarily operates as an ECN broker, it is essential to dissect this concept further to understand its implications for traders.

ECN Execution Model

The ECN model employed by Exness allows for direct market access. This means that traders can place orders that are executed at the best possible prices without delay. The absence of a dealing desk minimizes slippage, making it ideal for high-frequency traders.

Liquidity Providers

Exness connects its clients with a vast network of liquidity providers. This diverse pool of participants ensures competitive pricing and quick order execution. Traders can expect reduced spreads and improved chances at filling orders, particularly during volatile market conditions.

Impact on Trading Strategies

The ECN model significantly influences trading strategies. Scalpers, for example, thrive in an ECN environment due to the reduced latency and tight spreads offered. Such traders rely on rapid movements in the market to capitalize on small price changes, something made feasible with Exness's infrastructure.

Exness Corporate Headquarters: Where is Exness Located?

Understanding the corporate location of Exness brings us back to its roots in Cyprus. This location is pivotal in shaping the broker’s operations and regulatory compliance.

Importance of Cyprus as a Financial Hub

Cyprus has long been recognized as an important financial center in Europe. It offers a transparent regulatory environment conducive to online trading businesses. Countries establishing their headquarters in Cyprus benefit from EU regulations, leading to increased credibility and operational efficiency.

Operational Facilities and Staff

Exness maintains operational facilities in Cyprus and has expanded its workforce to accommodate its growing international footprint. Having local staff fluent in multiple languages contributes to the brokerage's ability to meet the needs of its diverse clientele effectively.

While Exness has established its base in Cyprus, continued growth means potentially expanding operations elsewhere. Given the ever-evolving nature of the forex brokerage industry, Exness must remain adaptable in adopting new markets and regions while retaining its core values of trust, transparency, and customer satisfaction.

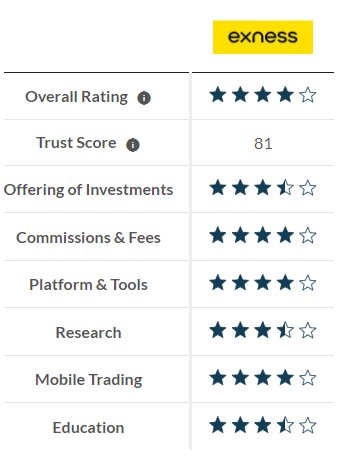

Assessing Exness: User Reviews and Trust Ratings

User feedback and trust ratings provide critical insights into how Exness operates and how traders perceive its services.

Gathering User Experiences

Various online forums, review websites, and social media platforms provide spaces for traders to share their experiences. Analyzing this feedback gives potential clients a well-rounded view of what to expect.

Many users praise Exness for its user-friendly platform, variety of account types, and the comprehensive educational resources provided. Compliments often highlight prompt customer support responses, indicating a commitment to resolving issues swiftly.

Addressing Negative Feedback

While most reviews are positive, some users express concerns regarding withdrawal processes, particularly regarding certain payment methods. It's essential for Exness to acknowledge this feedback and work towards enhancing its withdrawal protocols to sustain its reputation as a reliable broker.

Trust Ratings from Third-Party Entities

Independent assessments by regulatory agencies or industry experts lend credibility to Exness. High trust ratings coupled with compliance with regulatory standards reinforce the broker's position as a trustworthy trading partner.

Broker Classification: What Kind of Broker is Exness?

Finally, classifying Exness involves recognizing its unique offerings in contrast to other brokers in the market. As discussed earlier, its primary operational model is that of an ECN broker.

Comparison with Other Brokers

When compared to market makers who may face criticism for potential conflicts of interest, Exness shines as a beacon of transparency. The ECN model aligns closely with the principles of ethical trading, promoting a fair playing field for all clients.

Onboarding New Clients

Exness simplifies the onboarding process for new clients. The registration is straightforward, with minimal barriers to entry. Easy account verification procedures ensure that traders can start trading quickly, thus attracting beginners eager to venture into forex trading.

Start Exness Trade: Open Exness Account and Visit site

Conclusion on Classification

Based on its operational model, adherence to regulatory standards, and commitment to transparency, Exness can be classified as a reputable ECN broker. This classification sets it apart from traditional market-making brokers and emphasizes its dedication to providing a superior trading experience.

Conclusion

In conclusion, Exness has successfully positioned itself as a prominent player in the online trading market, standing out for its commitment to transparency, security, and user-friendly offerings.

We explored the definition of what is Exness, delved into its classification as an ECN broker, examined its geographical presence, and evaluated its trustworthiness. Additionally, we highlighted the extensive features and resources available to traders, affirming that Exness seeks to empower users for successful trading journeys.

Traders considering platforms for their investment endeavors would do well to consider Exness as a viable option, bolstered by its positive reputation and commitment to providing an exceptional trading environment. Ultimately, it is essential for every trader to conduct thorough research and determine if Exness aligns with their personal trading goals and preferences.

See more: