4 minute read

EXNESS Broker Review 2025: Pros and Cons for Traders in The Gambia

In 2025, online trading has expanded in The Gambia—especially among youth using mobile devices and aspiring to access global financial markets. EXNESS is recognized globally for its tight spreads and leverage options. But for Gambian users, crucial concerns include:

Local deposit and withdrawal availability

Regulatory trust in a foreign broker

English-language support capacity

Education and risk management tailored to a Gambian context

Throughout this review, we provide a clear overview of what Gambian users need to know about choosing EXNESS as their trading platform.

👉 Ready to register? Open your EXNESS account here

🔐 2. Regulation & Security

EXNESS operates under CySEC (Cyprus), FCA (UK), and FSCA (South Africa) licensing

Client funds are held in segregated accounts, beyond corporate liabilities

Offers negative balance protection so you never lose more than you deposit

Independent audits ensure financial transparency

✅ For maximum protection, Gambian traders are advised to register via FCA or CySEC.

💹 3. Trading Conditions: Spreads, Leverage & Fees

✅ Key Advantages

Spreads from 0.0 pips on Zero or Raw Spread accounts

Standard account has variable spreads but no commission

Raw/Zero accounts charge ~$3.50 per lot

Up to 1:2000 leverage, depending on jurisdiction

⚠️ Points to Consider

Commission applies for Raw/Zero accounts

High leverage also means high losses if unmanaged

Account conditions depend on your selected regulatory region

Pro tip for Gambian traders: begin with a Standard account to practice risk control before switching to Raw or Zero accounts.

📈 4. Instruments Available

You can trade:

90+ Forex pairs, including exotic ones not tied to USD

Crypto CFDs like BTC, ETH, LTC, USDT

Major indices such as S&P 500, NASDAQ, FTSE 100

Commodities including gold, silver, oil

CFD access to global stocks (e.g., Apple, Tesla, Amazon)

⚠️ Important note: EXNESS does not offer real stock ownership or ETF investments—only CFD products are supported.

👉 Open your EXNESS account now

🖥️ 5. Platform & Tech Tools

Exness Terminal (Web-based)

Runs in browser with no installation

Lightweight enough for Gambian internet speeds

MetaTrader 4 & 5

Popular trading platforms with charting, automation (EAs), and backtesting capabilities

Exness Trade App

Available on both Android and iOS

Offers full account management, charts, and order-entry

Optimal for Gambian users with irregular connectivity or mobile-only setups.

💳 6. Funding: Deposits & Withdrawals

Deposits

Accepts credit/debit cards, bank wire, Skrill, Neteller, and cryptocurrency

Many methods allow near-instant funding

Withdrawals

Usually processed within minutes to 1 hour

No hidden charges on most methods

KYC required prior to first withdrawal (verification within hours or up to 24h)

👉 Ready to fund your account? Open EXNESS account now

📚 7. Education & Market Resources

Weekly free webinars in English

Video tutorials for all skill levels, from beginner to advanced

Real-time economic calendar to track global trends

Daily expert analysis and targeted trade ideas

Tools like VPS, pip calculators, and sentiment trackers

Designed for Gambian traders to learn while trading confidently.

🧑💼 8. Customer Support

Support available 24/7 through chat, email, or help desk

Offered in English, ideal for Gambian users

Average response time: under 5 minutes

Experienced in guiding African traders with local needs

👉 Got questions after registration? Contact EXNESS support anytime

🌍 10. Feedback from Gambian Traders

Many report fast account approval after document submission

The platform functions well even with low-speed internet

Crypto-based funding is appreciated for flexibility

Minimal technical complaints or downtime issues

👉 Want to give it a try? Open your EXNESS account now

✅ 11. Pros vs Cons

Pros

Highly regulated with strong depositor protection

Ultra-low spreads and fast order execution

Quick deposit and withdrawal speeds

High flexibility in leverage

Generous educational tools and English support

Reliable customer service tailored to African traders

Cons

Cannot buy real stocks or ETFs—CFD only

Raw/Zero accounts carry per-lot commission

High leverage increases trading risk

Local banking options limited—USD or crypto preferred

❓ 12. FAQ – Gambian Edition

Q1: Can I trade EXNESS legally from Gambia?Yes—registration is straightforward, though you'd need to convert funds to USD or use crypto as local payment transfer options remain limited.

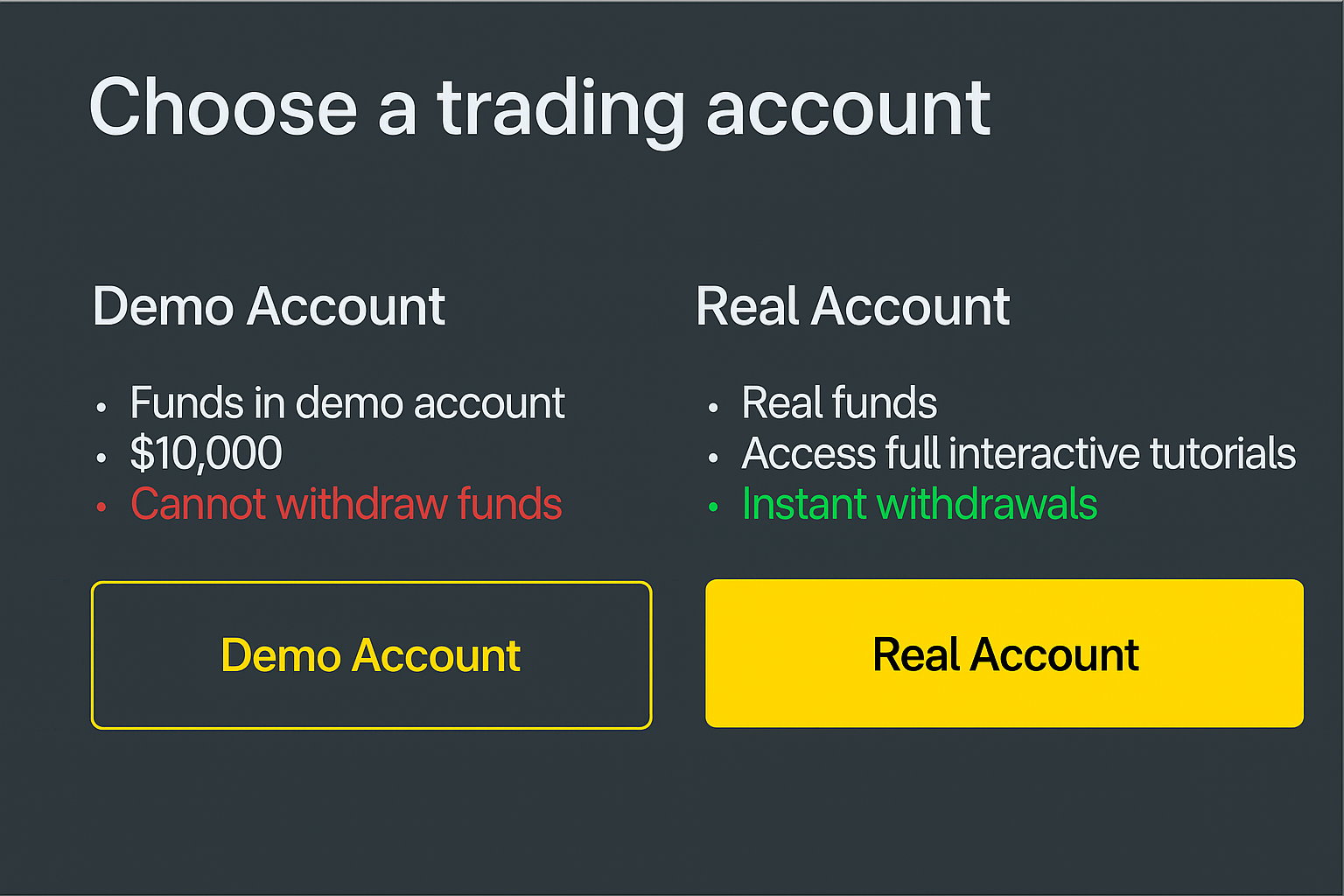

Q2: Minimum deposit required?Standard account starts from USD 10, and some micro options allow USD 1.

Q3: Withdrawal speed?Usually processed within minutes to an hour, depending on verification.

Q4: Is it suitable for beginners?Absolutely—Standard accounts with zero commission and robust tutorials make it accessible.

Q5: Hidden fees?Standard account = zero commission; Raw/Zero clearly display per-lot fees. No hidden charges or inactivity fees.

Q6: Is customer support accessible in Gambian time zone?Yes—EXNESS offers 24/7 support in English, relevant across time zones.

🧭 14. Conclusion & Strategy Advice

In 2025, EXNESS offers a compelling platform for Gambian traders, combining regulation, low costs, modern tools, and reliable support.

Use this recommended path:

Beginner: start with a Standard account, leverage low, and learn how to manage risk

Experienced: consider Zero or Raw accounts for more competitive conditions

Ready to take the next step?👉 Open your EXNESS account now

See more:

Revizyon Broker EXNESS 2025 : Bon Épi Mové Koté

EXNESS Broker Review 2025: Pros y Contras para República Dominicana