6 minute read

EXNESS Vs Deriv (2025) | Which One is Better? Review, Fees, Spread

from Exness Guide

Confused between EXNESS vs Deriv in 2025? Discover which broker is better for Forex, crypto, and synthetic indices. A complete review comparing fees, spreads, trading platforms, and why EXNESS or Deriv might fit your trading style.

Introduction: Why Compare EXNESS vs Deriv?

Choosing a broker can directly affect your trading costs, flexibility, and long-term results.EXNESS and Deriv are both popular global brokers but built for different types of traders.

This guide covers:

Which broker has lower spreads & fees

Which supports more instruments

Who is better regulated

And which broker might suit new or experienced traders in 2025

👉 Want to explore EXNESS now? Open your EXNESS account here

EXNESS Overview

🌍 Founded in 2008

✅ Regulated by FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSC (Mauritius)

📈 Offers Forex, gold, silver, indices, stocks, oil, crypto CFDs

📊 Supports MT4, MT5, WebTerminal, mobile apps

⚡ Known for ultra-tight spreads & instant withdrawals

🌙 24/7 crypto trading

Deriv Overview

🌍 Founded in 1999 (formerly Binary.com)

✅ Regulated by MFSA (Malta), FSC (Mauritius), VFSC (Vanuatu), BFSC (BVI)

📈 Offers Forex, synthetic indices, crypto, commodities

🛠 Uses its own proprietary platforms: DTrader, DBot, Deriv MT5 (DMT5)

🔄 Famous for synthetic indices — tradeable 24/7

Deriv: Open a account

Spreads & Fees

EXNESS:

Raw & Zero accounts: spreads from 0.0 pips + low commission (around $3.5 per lot)

Standard account: average spreads 0.3–1.0 pips, no extra commission

Transparent, real-time spreads

Deriv:

Offers floating spreads, typically starting around 0.5–1.0 pips on major Forex pairs

Commission-free on most Forex trading, except some synthetic or derived instruments

Synthetic indices have fixed or variable spreads unique to Deriv

👉 See EXNESS live spreads: Check EXNESS spreads her

Trading Instruments

EXNESS: 250+ instruments — Forex, gold, silver, oil, indices, stocks, crypto CFDs

Deriv: Forex, synthetic indices (unique), crypto CFDs, commodities, volatility indices

Deriv is unique because of synthetic indices, created by them and tradable 24/7.EXNESS stands out for broader assets, especially real Forex, metals, and equities.

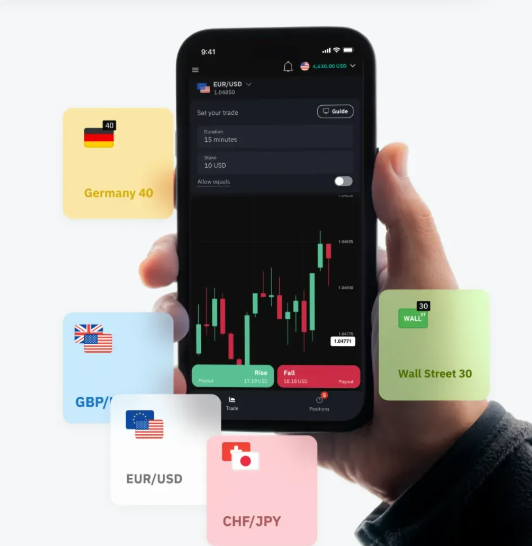

Platforms & Tools

EXNESS: MT4, MT5, WebTerminal, mobile apps — ideal for scalping, EAs, and manual trading

Deriv: DTrader (web), DBot (automated bot building), Deriv MT5

If you’re used to MT4/MT5, EXNESS is a natural choice.Deriv’s platforms are user-friendly and creative, but synthetic indices are only tradable on Deriv.

👉 Prefer MT4/MT5? Start with EXNESS here

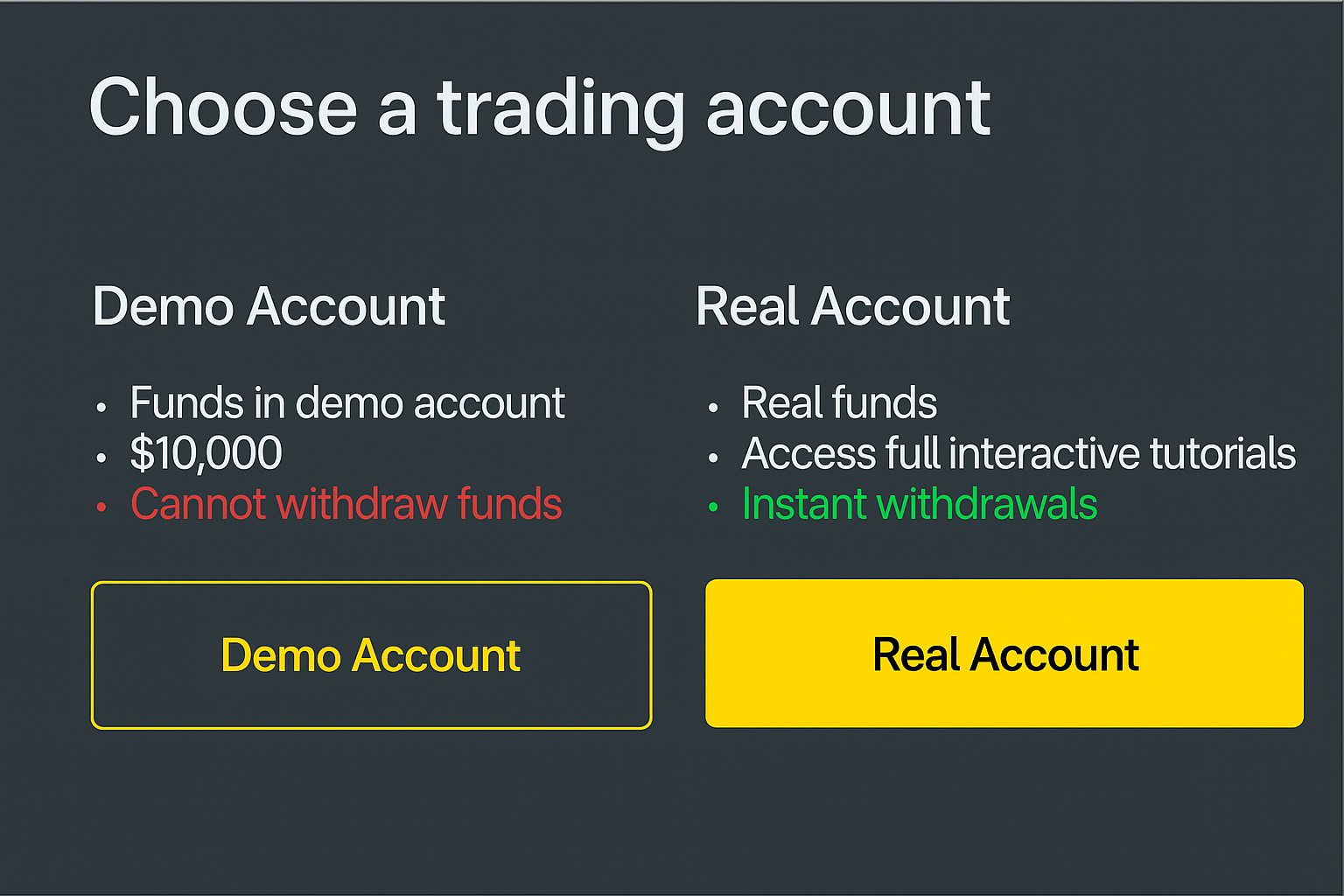

Account Types & Minimum Deposit

EXNESS: Standard, Pro, Raw Spread, Zero; minimum deposit from just $10

Deriv: Standard accounts; minimum deposit starts around $5–$10, depending on method

Both brokers offer low entry points, great for beginners.

Leverage

EXNESS: Up to 1:2000 for Forex, variable by instrument and regulation

Deriv: Up to 1:1000 on Forex (for certain entities)

EXNESS generally offers higher leverage, especially for experienced traders.

Regulation & Trust

EXNESS: Regulated by FCA, CySEC, FSCA — strong, tier-one global licenses

Deriv: Regulated in offshore and mid-tier jurisdictions (FSC, VFSC, BFSC)

If regulation matters most, EXNESS has the edge.

Deposit & Withdrawals

EXNESS: Famous for instant withdrawals, often processed automatically within seconds

Deriv: Withdrawals usually processed within 1 day; supports crypto, e-wallets, and cards

👉 Experience EXNESS instant withdrawals: Join EXNESS now

Why Choose EXNESS?

✅ Lower average spreads & tight pricing

⚡ Instant withdrawals, great for active traders

📈 Wide market choice: Forex, gold, crypto, stocks, indice

📊 MT4 & MT5 — perfect for scalpers and EA traders

🔒 Strong global regulation

🌙 24/7 crypto trading

👉 Try EXNESS here: Open your EXNESS account

Why Choose Deriv?

⭐ Unique synthetic & volatility indices tradable 24/7

📱 Easy-to-use proprietary platforms (DTrader, DBot)

💡 Good for binary options and CFD traders wanting non-forex markets

🛠 Automated trading with DBot without coding

Conclusion: EXNESS vs Deriv — Which One is Better in 2025?

Choose EXNESS if you:

Want lower spreads and tight Forex execution

Trade real market assets (gold, oil, stocks, crypto)

Prefer MT4/MT5 and instant withdrawals

Value strict global regulation

Choose Deriv if you:

Want to trade synthetic or volatility indices

Prefer web-based platforms and automated bot tools

Like binary options style trading

See more:

EXNESS Vs XM (2025) | Which One is Better? Review, Fees, Spread

EXNESS Vs XTB (2025) | Which One is Better? Review, Fees, Spread

EXNESS Vs CMS Prime (2025) | Which One is Better? Review, Fees, Spread

EXNESS Vs Coindcx (2025) | Which One is Better? Review, Fees, Spread

EXNESS: 250+ instruments — Forex, gold, silver, oil, indices, stocks, crypto CFDsDeriv: Forex, synthetic indices (unique), crypto CFDs, commodities, volatility indicesDeriv is unique because of synthetic indices, created by them and tradable 24/7.EXNESS stands out for broader assets, especially real Forex, metals, and equities.Platforms & ToolsEXNESS: MT4, MT5, WebTerminal, mobile apps — ideal for scalping, EAs, and manual tradingDeriv: DTrader (web), DBot (automated bot building), Deriv MT5If you’re used to MT4/MT5, EXNESS is a natural choice.Deriv’s platforms are user-friendly and creative, but synthetic indices are only tradable on Deriv.👉 Prefer MT4/MT5?Start with EXNESS hereAccount Types & Minimum DepositEXNESS: Standard, Pro, Raw Spread, Zero; minimum deposit from just $10Deriv: Standard accounts; minimum deposit starts around $5–$10, depending on methodBoth brokers offer low entry points, great for beginners.LeverageEXNESS: Up to 1:2000 for Forex, variable by instrument and regulationDeriv: Up to 1:1000 on Forex (for certain entities)EXNESS generally offers higher leverage, especially for experienced traders.Regulation & TrustEXNESS: Regulated by FCA, CySEC, FSCA — strong, tier-one global licensesDeriv: Regulated in offshore and mid-tier jurisdictions (FSC, VFSC, BFSC)If regulation matters most, EXNESS has the edge.Deposit & WithdrawalsEXNESS: Famous for instant withdrawals, often processed automatically within secondsDeriv: Withdrawals usually processed within 1 day; supports crypto, e-wallets, and cards👉 Experience EXNESS instant withdrawals:Join EXNESS nowWhy Choose EXNESS?✅ Lower average spreads & tight pricing⚡ Instant withdrawals, great for active traders📈 Wide market choice: Forex, gold, crypto, stocks, indices📊 MT4 & MT5 — perfect for scalpers and EA traders🔒 Strong global regulation🌙 24/7 crypto trading👉 Try EXNESS here:Open your EXNESS accountWhy Choose Deriv?⭐ Unique synthetic & volatility indices tradable 24/7📱 Easy-to-use proprietary platforms (DTrader, DBot)💡 Good for binary options and CFD traders wanting non-forex markets🛠 Automated trading with DBot without codingConclusion: EXNESS vs Deriv — Which One is Better in 2025?Choose EXNESS if you:Want lower spreads and tight Forex executionTrade real market assets (gold, oil, stocks, crypto)Prefer MT4/MT5 and instant withdrawalsValue strict global regulationChoose Deriv if you:Want to trade synthetic or volatility indicesPrefer web-based platforms and automated bot toolsLike binary options style trading👉 For most Forex, crypto, and commodity traders, EXNESS offers broader choices and better regulation.Start with EXNESS now