8 minute read

Is Forex Trading Profitable in Dubai? A Comprehensive Guide

Forex trading, or foreign exchange trading, has gained immense popularity worldwide, and Dubai, a global financial hub, is no exception. With its strategic location, advanced infrastructure, and business-friendly environment, Dubai attracts traders looking to capitalize on the dynamic forex market. But the burning question remains: Is forex trading profitable in Dubai? In this article, we’ll explore the profitability of forex trading in Dubai, the factors that influence success, the regulatory landscape, and practical tips for aspiring traders. This guide is designed to provide valuable insights for both beginners and seasoned traders interested in Dubai’s forex market.

Top 4 Best Forex Brokers in Dubai

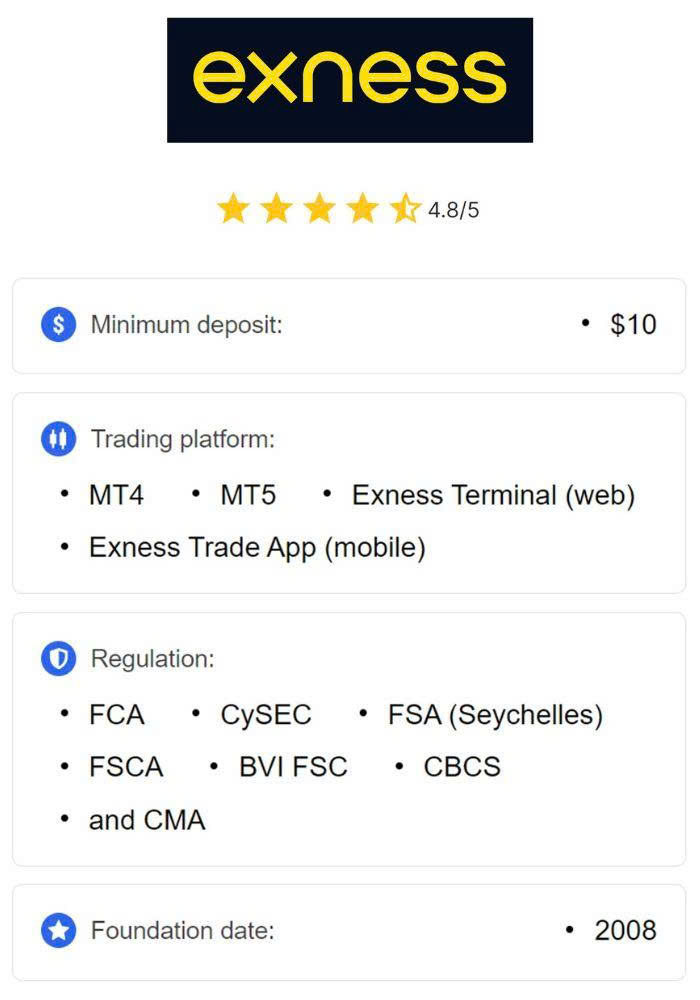

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ XM: Open An Account or Visit Brokers 💥

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Understanding Forex Trading in Dubai

Forex trading involves buying and selling currencies to profit from fluctuations in their exchange rates. The forex market is the largest and most liquid financial market globally, with a daily trading volume exceeding $7 trillion. Dubai’s unique position as a bridge between East and West, coupled with its tax-free environment and robust financial ecosystem, makes it an attractive destination for forex traders.

However, profitability in forex trading is not guaranteed. It depends on several factors, including market knowledge, trading strategies, risk management, and the ability to adapt to Dubai’s specific economic and regulatory conditions.

Why Dubai is a Hotspot for Forex Trading

1. Strategic Location and Time Zone AdvantageDubai’s geographic location places it in a time zone (GST, Gulf Standard Time) that overlaps with major financial markets in Asia, Europe, and North America. This allows traders to access multiple trading sessions, including the London, New York, and Tokyo sessions, increasing opportunities for profitable trades.

2. Tax-Free EnvironmentOne of Dubai’s biggest draws for forex traders is its tax-free status. Unlike many countries where trading profits are subject to capital gains tax, Dubai imposes no personal income tax, allowing traders to keep more of their earnings. This is particularly appealing for high-net-worth individuals and professional traders.

3. Advanced Infrastructure and ConnectivityDubai offers state-of-the-art technology and high-speed internet, essential for executing trades in real-time. The city’s financial districts, such as the Dubai International Financial Centre (DIFC), provide access to world-class trading platforms and financial services.

4. Regulated Forex MarketForex trading in Dubai is regulated by the Dubai Financial Services Authority (DFSA) within the DIFC and the Securities and Commodities Authority (SCA) for mainland Dubai. These regulatory bodies ensure a secure trading environment, protecting traders from fraudulent brokers and ensuring transparency.

Is Forex Trading Profitable in Dubai?

The profitability of forex trading in Dubai depends on several key factors:

1. Knowledge and Expertise

Forex trading is not a get-rich-quick scheme. Success requires a deep understanding of market trends, technical analysis, and fundamental factors like geopolitical events and economic data releases. Traders in Dubai have access to numerous educational resources, including online courses, webinars, and trading communities, which can help build expertise.

However, without proper knowledge, traders risk significant losses. According to industry statistics, approximately 70-80% of retail forex traders lose money due to poor strategies or lack of discipline. To be profitable, traders must invest time in learning and practicing on demo accounts before risking real capital.

2. Risk Management

Effective risk management is crucial for profitability. Dubai-based traders can leverage tools like stop-loss orders, position sizing, and diversification to minimize losses. For example, risking only 1-2% of your trading capital per trade is a common strategy to protect your account from significant drawdowns.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

3. Trading Strategy

A well-defined trading strategy tailored to the forex market’s volatility is essential. Popular strategies include day trading, swing trading, and scalping. Dubai’s time zone allows traders to capitalize on high-volatility periods, such as the overlap between the London and New York sessions. Testing strategies on a demo account before applying them in live trading can improve profitability.

4. Broker Selection

Choosing a reliable forex broker is critical. In Dubai, traders should opt for brokers regulated by the DFSA or SCA to ensure safety and transparency. Reputable brokers offer competitive spreads, low fees, and access to advanced trading platforms like MetaTrader 4 or 5. Be cautious of unregulated offshore brokers, which may pose risks to your funds.

5. Capital and Leverage

Forex trading requires capital, but profitability doesn’t necessarily depend on having a large account. Many brokers in Dubai offer high leverage (e.g., 1:50 or 1:100), allowing traders to control larger positions with smaller capital. However, high leverage can amplify both profits and losses, so it must be used cautiously.

6. Market Conditions

The forex market is influenced by global economic events, such as interest rate changes, inflation reports, and geopolitical developments. Dubai’s economy is closely tied to oil prices, tourism, and real estate, which can impact currency pairs like USD/AED. Staying informed about global and local economic trends can help traders make informed decisions.

Challenges of Forex Trading in Dubai

While forex trading offers significant opportunities, it also comes with challenges:

1. High RiskThe forex market is highly volatile, and even experienced traders can face losses. Emotional decision-making, overtrading, or failing to follow a strategy can erode profits.

2. Regulatory ComplianceWhile Dubai’s regulatory framework is robust, traders must ensure they comply with local laws. For example, trading with unregulated brokers or engaging in speculative practices could lead to legal issues.

3. Market CompetitionThe forex market is highly competitive, with institutional traders and algorithms dominating price movements. Retail traders in Dubai must stay updated on market trends and use advanced tools to stay competitive.

4. Time CommitmentForex trading requires time and dedication. Monitoring charts, analyzing data, and executing trades can be demanding, especially for part-time traders balancing other responsibilities.

Tips for Profitable Forex Trading in Dubai

To maximize profitability in Dubai’s forex market, consider the following tips:

1. Educate YourselfTake advantage of free and paid resources, such as online courses, books, and webinars. Platforms like BabyPips and Investopedia offer beginner-friendly guides to forex trading.

2. Choose a Regulated BrokerVerify that your broker is regulated by the DFSA or SCA. Check reviews and compare spreads, fees, and platform features before committing.

3. Start with a Demo AccountPractice trading with virtual funds to test strategies and build confidence. Most brokers in Dubai offer demo accounts with real-time market data.

4. Develop a Trading PlanCreate a detailed trading plan outlining your goals, risk tolerance, and strategies. Stick to your plan to avoid impulsive decisions.

5. Stay InformedFollow global economic news and events that impact currency markets. Tools like economic calendars can help you track important announcements.

6. Leverage TechnologyUse trading platforms with advanced charting tools, indicators, and automated trading options. Dubai’s high-speed internet ensures seamless access to these tools.

7. Network with Local TradersJoin forex trading communities in Dubai, such as meetups or online forums, to exchange ideas and learn from experienced traders.

The Role of Regulation in Dubai’s Forex Market

Dubai’s regulatory environment plays a significant role in ensuring a safe trading ecosystem. The DFSA oversees forex brokers operating in the DIFC, enforcing strict standards for transparency, capital requirements, and client fund protection. The SCA regulates brokers in mainland Dubai, ensuring compliance with UAE laws.

Before trading, verify your broker’s license and read their terms and conditions. Regulated brokers are required to segregate client funds, reducing the risk of fraud. Additionally, Dubai’s authorities actively combat scams, making it a safer environment for forex trading compared to less-regulated jurisdictions.

Success Stories and Realities

Many traders in Dubai have achieved profitability through dedication and discipline. For example, some traders leverage Dubai’s tax-free environment to reinvest profits and grow their portfolios. However, success stories are often overshadowed by the reality that most retail traders lose money due to lack of experience or poor risk management.

To join the ranks of successful traders, focus on continuous learning, disciplined trading, and adapting to market conditions. Joining a mentorship program or trading group in Dubai can provide valuable insights and support.

Conclusion: Can You Profit from Forex Trading in Dubai?

Forex trading in Dubai can be profitable, but it’s not a guaranteed path to wealth. The city’s tax-free environment, strategic location, and robust regulations create a favorable ecosystem for traders. However, profitability depends on your knowledge, strategy, and discipline. By educating yourself, choosing a regulated broker, and implementing effective risk management, you can increase your chances of success.

If you’re considering forex trading in Dubai, start small, practice on a demo account, and stay informed about market trends. With patience and persistence, forex trading can become a rewarding venture in the heart of the UAE’s financial hub.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Read more: