9 minute read

Is Exness Registered in Pakistan? A Comprehensive Guide for Traders

Forex trading has surged in popularity across Pakistan, attracting both novice and seasoned traders seeking to tap into global financial markets. Among the many brokers available, Exness stands out as a globally recognized platform, known for its competitive spreads, advanced trading tools, and user-friendly interface. However, a critical question arises for Pakistani traders: Is Exness registered in Pakistan? This article dives deep into Exness’s regulatory status, its operations in Pakistan, the legal landscape for forex trading in the country, and what traders need to know to make informed decisions.

✅ Join Exness now! Open An Account or Visit Brokers 👈

What is Exness? An Overview of the Broker

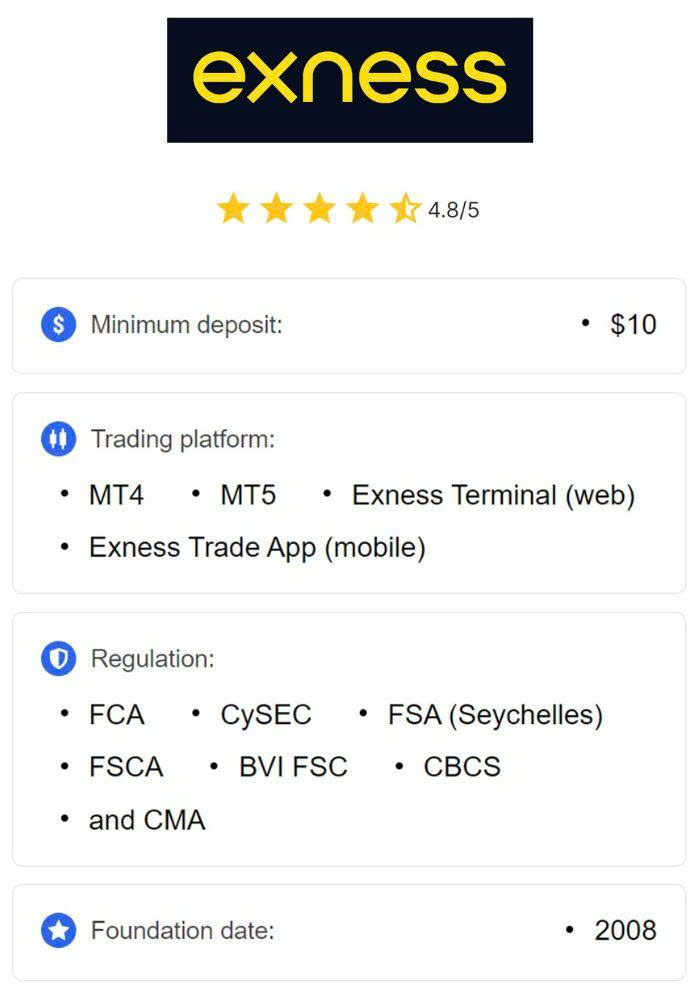

Founded in 2008, Exness is a leading online forex and CFD (Contracts for Difference) broker headquartered in Limassol, Cyprus. It has built a strong global presence, serving millions of traders across Europe, Asia, Africa, and beyond. Exness offers a wide range of trading instruments, including forex pairs, commodities, cryptocurrencies, indices, and stocks. Its reputation is bolstered by ultra-fast trade execution, low spreads, high leverage (up to 1:2000), and a commitment to transparency.

Exness operates multiple trading platforms, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which cater to diverse trading styles. The broker also provides localized support, including Urdu-language assistance, making it appealing to Pakistani traders. But before diving into trading, understanding Exness’s regulatory status in Pakistan is crucial for ensuring a secure and compliant trading experience.

Forex Trading in Pakistan: The Legal Framework

To determine whether Exness is registered in Pakistan, it’s essential to first understand the regulatory environment for forex trading in the country. Forex trading is legal in Pakistan, but it operates under a specific framework governed by two key authorities:

· Securities and Exchange Commission of Pakistan (SECP): The SECP is the primary regulatory body overseeing financial markets, including securities and non-banking financial institutions. While the SECP does not directly regulate forex brokers, it monitors financial activities to ensure transparency, investor protection, and compliance with local laws.

· State Bank of Pakistan (SBP): The SBP, Pakistan’s central bank, regulates foreign exchange transactions and currency reserves. It imposes guidelines on how foreign currency transactions, including those related to forex trading, should be conducted. Traders are required to use authorized dealers or banks for deposits and withdrawals to comply with anti-money laundering (AML) and foreign exchange regulations.

While forex trading is permitted, the SECP and SBP emphasize the importance of working with regulated brokers to mitigate risks. The SECP has issued warnings about unregistered or unlicensed brokers, highlighting the need for traders to verify a broker’s credentials before engaging in trading activities.

Is Exness Registered with the SECP in Pakistan?

As of 2025, Exness is not directly registered with the Securities and Exchange Commission of Pakistan (SECP) or the State Bank of Pakistan (SBP). This means Exness does not hold a local license to operate as a forex broker within Pakistan’s jurisdiction. Instead, Exness operates as an offshore broker for Pakistani traders, accessible through its global entities.

Exness is regulated by several reputable international authorities, including:

· Cyprus Securities and Exchange Commission (CySEC): License number 178/12, ensuring compliance with European Union financial standards.

· Financial Conduct Authority (FCA): Regulates Exness (UK) Ltd, providing oversight in the United Kingdom.

· Financial Services Commission (FSC): Authorizes Exness entities in Mauritius and the British Virgin Islands (BVI).

· Financial Sector Conduct Authority (FSCA): Regulates Exness in South Africa.

· Capital Markets Authority (CMA): Licenses Exness (KE) Limited in Kenya as a non-dealing online forex broker.

These global licenses demonstrate Exness’s commitment to adhering to high regulatory standards, including client fund protection, transparent operations, and robust AML and KYC (Know Your Customer) policies. However, the absence of SECP registration creates a legal gray area for Pakistani traders, as local oversight is limited when using offshore brokers.

Can Pakistani Traders Use Exness Legally?

Yes, Pakistani traders can use Exness for forex and CFD trading, provided they comply with local regulations set by the SECP and SBP. Since Exness is not banned in Pakistan, traders can access its platform through international channels. However, there are important considerations to keep in mind:

· Compliance with Local Laws: Traders must ensure that all foreign exchange transactions, such as deposits and withdrawals, are conducted through authorized banks or dealers as mandated by the SBP. Failure to do so could result in penalties or restrictions on fund transfers.

· Tax Obligations: Profits from forex trading are subject to taxation in Pakistan. Traders should report their earnings to the Federal Board of Revenue (FBR) and consult a tax professional to ensure compliance.

· Risks of Offshore Brokers: Since Exness is not regulated by the SECP, Pakistani traders may face challenges in resolving disputes or seeking legal recourse in case of issues. Offshore brokers are not subject to the same level of local oversight as SECP-registered entities, which could impact fund security.

Despite these considerations, Exness’s global regulatory framework provides a layer of security for traders. Its adherence to international standards, such as those set by CySEC and FCA, ensures that client funds are segregated, and transactions are monitored for suspicious activity.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Why Choose Exness for Trading in Pakistan?

Exness offers several features that make it an attractive choice for Pakistani traders, even without local registration:

1. Competitive Trading Conditions

Exness is renowned for its low spreads, starting from 0.0 pips on certain account types, and high leverage options (up to 1:2000). This allows traders to maximize their potential returns, though high leverage also increases risk.

2. Diverse Trading Instruments

Traders can access a wide range of assets, including major and minor forex pairs, commodities (e.g., gold and oil), cryptocurrencies (e.g., Bitcoin and Ethereum), indices, and stocks like Apple, Tesla, and Google. This diversity enables Pakistani traders to build varied portfolios.

3. User-Friendly Platforms

Exness supports MT4 and MT5, both of which are accessible on desktop, mobile, and web platforms. These platforms offer advanced charting tools, automated trading capabilities, and real-time market data, catering to traders of all experience levels.

4. Localized Support

Exness provides customer support in Urdu, making it easier for Pakistani traders to communicate and resolve queries. Support is available 24/7 in English, Chinese, and Thai, with additional language options via live chat, email, and phone.

5. Fast Deposits and Withdrawals

Exness offers multiple payment methods suitable for Pakistani traders, including bank transfers, e-wallets, and cryptocurrency options. Withdrawals are processed instantly in many cases, though currency conversion fees may apply.

6. Islamic Accounts

As Pakistan is a Muslim-majority country, Exness offers swap-free Islamic accounts that comply with Sharia law. These accounts eliminate interest-based charges, making them suitable for Pakistani traders who adhere to Islamic financial principles.

7. Transparency and Audits

Exness undergoes regular audits by Deloitte, one of the Big Four global accounting firms, ensuring transparency in its financial operations. The broker also publishes monthly reports on trading volume, active clients, and withdrawal amounts, fostering trust among users.

Risks of Trading with an Unregistered Broker in Pakistan

While Exness’s global licenses provide a degree of security, trading with an unregistered broker in Pakistan carries certain risks:

· Limited Legal Recourse: In the event of disputes, Pakistani traders may find it challenging to seek resolution through local authorities, as Exness is not governed by SECP regulations.

· Fund Protection Concerns: Although Exness segregates client funds and complies with international standards, the lack of local oversight means traders rely on global regulators for protection.

· Regulatory Ambiguity: The SECP and SBP may impose stricter regulations in the future, potentially affecting the operations of offshore brokers like Exness in Pakistan.

To mitigate these risks, traders should verify Exness’s global licenses, review its legal documents (available on the Exness website), and ensure compliance with SBP guidelines for foreign exchange transactions.

How to Start Trading with Exness in Pakistan

For Pakistani traders interested in using Exness, the registration process is straightforward and takes approximately 5–7 minutes. Here’s a step-by-step guide:

· Visit the Exness Website: Go to the official Exness website exness.com and click on the “Register” button.

· Complete the Registration Form: Enter your email address, country of residence (Pakistan), and a secure password.

· Verify Your Identity: Exness requires KYC verification, which involves submitting identity documents such as a CNIC, passport, or utility bill. This ensures compliance with AML regulations.

· Choose an Account Type: Exness offers various account types, including Standard, Pro, Zero, and Raw Spread accounts, each tailored to different trading needs. Islamic accounts are also available.

· Fund Your Account: Deposit funds using bank transfers, e-wallets, or cryptocurrencies. Ensure transactions are conducted through SBP-authorized channels to comply with local regulations.

· Start Trading: Download MT4 or MT5, log in with your account credentials, and begin trading.

Exness’s Potential for Expansion in Pakistan

Exness has expressed interest in expanding its presence in emerging markets like Pakistan. Obtaining SECP registration could enhance its credibility and accessibility in the country. The registration process would require Exness to meet stringent requirements, such as maintaining capital adequacy, adhering to AML protocols, and establishing a local office. Successful registration would position Exness as a top choice for Pakistani traders seeking a regulated broker.

In the meantime, Exness’s global regulatory compliance, Urdu support, and tailored trading conditions make it a viable option for Pakistani traders. The broker’s commitment to transparency and innovation suggests it could adapt to meet local regulatory demands in the future.

Tips for Pakistani Traders Using Exness

To trade safely and effectively with Exness in Pakistan, consider the following tips:

· Verify Global Licenses: Check Exness’s regulatory status on its website or directly with authorities like CySEC or FCA to ensure credibility.

· Use Authorized Payment Channels: Comply with SBP regulations by using authorized banks or dealers for deposits and withdrawals.

· Understand Risks: Forex trading carries high risks, especially with leverage. Educate yourself on market dynamics and risk management strategies.

· Consult a Tax Professional: Ensure compliance with Pakistan’s tax laws by reporting trading profits to the FBR.

· Leverage Educational Resources: Exness offers webinars, tutorials, and market analysis to help traders improve their skills.

Conclusion: Is Exness a Good Choice for Pakistani Traders?

Exness is not registered with the SECP in Pakistan, operating instead as an offshore broker under international regulations from CySEC, FCA, FSCA, and other authorities. While this creates a legal gray area, Pakistani traders can legally use Exness by adhering to SBP and SECP guidelines for foreign exchange transactions and tax obligations. The broker’s competitive trading conditions, diverse instruments, Urdu support, and Islamic accounts make it an attractive option for traders in Pakistan.

However, traders should weigh the benefits against the risks of using an unregistered broker, such as limited local recourse in disputes. By verifying Exness’s global credentials, using authorized payment methods, and staying informed about local regulations, Pakistani traders can leverage Exness’s platform for a secure and rewarding trading experience.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Read more: