8 minute read

Is Exness Legal in Qatar? A Comprehensive Guide for Traders

from Exness Legal Qatar

The world of forex and CFD trading has gained significant traction in Qatar, thanks to the country’s growing economy and increasing interest in global financial markets. Among the many brokers available, Exness stands out as a popular choice for traders worldwide. However, a common question among Qatari traders is: Is Exness legal in Qatar? In this article, we’ll explore Exness’s legal status in Qatar, its regulatory framework, and why it’s a trusted platform for Qatari traders. Whether you’re a beginner or an experienced trader, this guide will provide all the information you need to make an informed decision.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Understanding Exness: A Global Broker with a Strong Reputation

Founded in 2008, Exness has grown into one of the leading online brokers in the forex and CFD trading industry. Headquartered in Cyprus, Exness serves over a million active clients globally, offering trading services in forex, commodities, indices, stocks, and cryptocurrencies. The broker is renowned for its competitive spreads, user-friendly platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), and robust customer support available in multiple languages, including Arabic.

Exness has built a reputation for transparency, reliability, and innovation, making it a go-to choice for traders in the Middle East, including Qatar. But before diving into trading with Exness, it’s crucial to understand the legal and regulatory landscape in Qatar to ensure compliance and security.

The Legal Framework for Forex Trading in Qatar

Qatar boasts one of the world’s richest economies, driven by its oil and natural gas reserves. As a result, many Qatari residents are turning to forex trading as a way to diversify their investment portfolios. However, forex trading in Qatar operates within a tightly regulated financial environment to protect investors and maintain market integrity.

The primary regulatory body overseeing financial services in Qatar is the Qatar Financial Centre Regulatory Authority (QFCRA), which operates under the Qatar Financial Centre (QFC). The QFCRA enforces strict guidelines to ensure that financial institutions, including forex brokers, adhere to legal and regulatory standards. These standards include:

Licensing Requirements: Brokers must obtain a license to operate within the QFC.

Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT): Brokers are required to implement robust Know Your Customer (KYC) procedures to verify client identities and prevent illegal activities.

Client Fund Protection: Licensed brokers must segregate client funds from company funds to ensure security.

While forex trading is legal for Qatari residents, brokers must comply with these regulations to offer services legally within the country. This raises the question: Does Exness meet these requirements?

Is Exness Legal in Qatar?

Yes, Exness is legal for traders in Qatar. Although Exness is not directly licensed by the QFCRA, it operates under multiple reputable international regulatory bodies, ensuring compliance with global financial standards. These include:

Cyprus Securities and Exchange Commission (CySEC): License number 178/12, ensuring compliance with European Union regulations.

Financial Conduct Authority (FCA) in the UK: Reference number 730729, known for its stringent investor protection measures.

Financial Services Authority (FSA) in Seychelles.

Financial Sector Conduct Authority (FSCA) in South Africa.

Other regulators such as the Financial Services Commission (FSC) in Mauritius and the Central Bank of Curaçao and Sint Maarten (CBCS).

These licenses demonstrate Exness’s commitment to maintaining high standards of transparency, security, and client protection. For Qatari traders, this means that while Exness is not regulated locally by the QFCRA, its adherence to international regulations provides a level of legitimacy and safety recognized globally.

Additionally, Exness complies with strict AML and KYC requirements, ensuring that all transactions are transparent and secure. Traders in Qatar are required to complete a verification process, which includes submitting a valid Qatari ID, passport, or driver’s license and proof of residence (e.g., a recent utility bill or bank statement). This process aligns with Qatar’s regulatory framework to prevent financial crimes.

Exness also offers Islamic (swap-free) accounts, which comply with Sharia law, making it a suitable choice for Muslim traders in Qatar. These accounts eliminate interest-based charges, catering to the cultural and religious needs of the local trading community.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Why Qatari Traders Choose Exness

Exness has become a popular choice among Qatari traders for several reasons. Here’s a breakdown of the key features that make Exness stand out:

1. Regulation and Security

Exness’s multiple regulatory licenses ensure that it adheres to strict financial standards. Client funds are kept in segregated accounts, meaning they are separate from the company’s operational funds, providing an additional layer of security. Exness is also a member of the Financial Commission, which offers compensation of up to €20,000 per client in case of broker insolvency.

2. Low Minimum Deposit

Exness offers a low minimum deposit of just $1, making it accessible for beginners and those with limited capital. This is particularly appealing to Qatari traders who are just starting their trading journey.

3. Advanced Trading Platforms

Exness provides access to industry-standard platforms like MetaTrader 4 and MetaTrader 5, which offer advanced charting tools, automated trading capabilities, and a user-friendly interface. These platforms are available on desktop, mobile, and web, allowing traders to manage their accounts on the go.

4. Competitive Spreads and Low Fees

Exness is known for its tight spreads, starting from 0.0 pips on certain account types, and no hidden fees. This allows traders to maximize their profits, which is a significant advantage in Qatar’s competitive trading market.

5. 24/7 Multilingual Support

Exness offers round-the-clock customer support in multiple languages, including Arabic, ensuring that Qatari traders can receive prompt assistance whenever needed.

6. Diverse Financial Instruments

Traders in Qatar can access over 200 financial instruments, including forex pairs, commodities (e.g., gold, oil), indices, stocks, and cryptocurrencies. This variety allows traders to diversify their portfolios and explore different markets.

7. Fast Deposits and Withdrawals

Exness supports a variety of deposit and withdrawal methods, including local bank transfers, e-wallets, and credit/debit cards. Most transactions are processed instantly, with no deposit fees, making it convenient for Qatari traders to manage their funds.

How to Start Trading with Exness in Qatar

Getting started with Exness in Qatar is simple and straightforward. Here’s a step-by-step guide to opening an account:

Visit the Exness Website: Navigate to the official Exness website and click on the “Open Account” button.

Complete the Registration Form: Enter your email address, select Qatar as your country of residence, and create a secure password. Choose your preferred account currency (e.g., Qatari Riyal or USD).

Verify Your Identity: Upload a valid ID (Qatari ID, passport, or driver’s license) and proof of residence (e.g., utility bill or bank statement) to comply with KYC requirements.

Choose an Account Type: Exness offers various account types, including Standard, Pro, and Islamic accounts. Select the one that suits your trading style and experience level.

Deposit Funds: Log in to your Exness Personal Area, select a deposit method, and fund your account. Deposits are typically processed instantly.

Start Trading: Download the MT4 or MT5 platform, log in with your account credentials, and begin exploring the markets.

Comparing Exness to Other Brokers in Qatar

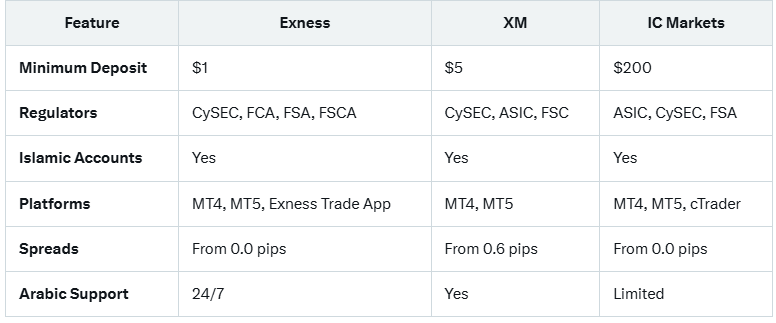

To help Qatari traders make an informed decision, here’s a brief comparison of Exness with two other popular brokers available in Qatar: XM and IC Markets.

Exness stands out for its low minimum deposit, tight spreads, and dedicated Arabic support, making it an excellent choice for Qatari traders.

Potential Risks and Considerations

While Exness is a reliable and legal option for trading in Qatar, forex and CFD trading carries inherent risks. Traders should be aware of the following:

Market Volatility: Forex and CFD markets can be highly volatile, leading to potential losses.

Leverage Risks: Exness offers unlimited leverage on certain accounts, which can amplify both profits and losses. Traders should use leverage cautiously and implement risk management strategies.

Regulatory Gray Area: Although Exness is not banned in Qatar, its lack of a QFCRA license means it operates under international regulations rather than local ones. Traders should ensure they understand the implications of trading with an offshore broker.

Conclusion: Is Exness a Good Choice for Qatari Traders?

Exness is a legal and reputable broker for traders in Qatar, offering a secure, transparent, and user-friendly trading experience. Its multiple international regulatory licenses, low fees, and tailored features like Islamic accounts make it a top choice for both novice and experienced traders. By complying with global standards and Qatar’s AML and KYC requirements, Exness ensures a safe trading environment for Qatari residents.

If you’re considering trading with Exness in Qatar, take the time to understand the risks, choose the right account type, and leverage the broker’s educational resources to enhance your skills. With its competitive offerings and commitment to client satisfaction, Exness is well-positioned to meet the needs of Qatari traders looking to explore the global financial markets.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Read more: