7 minute read

Is Exness Available in Nigeria? A Comprehensive Guide for Traders

Forex trading has become a popular avenue for financial independence in Nigeria, fueled by increased internet access, a growing middle class, and the allure of global financial markets. Among the many brokers vying for attention, Exness stands out as a globally recognized platform. But the pressing question for many Nigerian traders is: Is Exness available in Nigeria? This article provides an in-depth exploration of Exness’s availability, services, regulatory status, and suitability for Nigerian traders, ensuring you have all the information needed to make an informed decision.

✅ Join Exness now! Open An Account or Visit Brokers 👈

What is Exness?

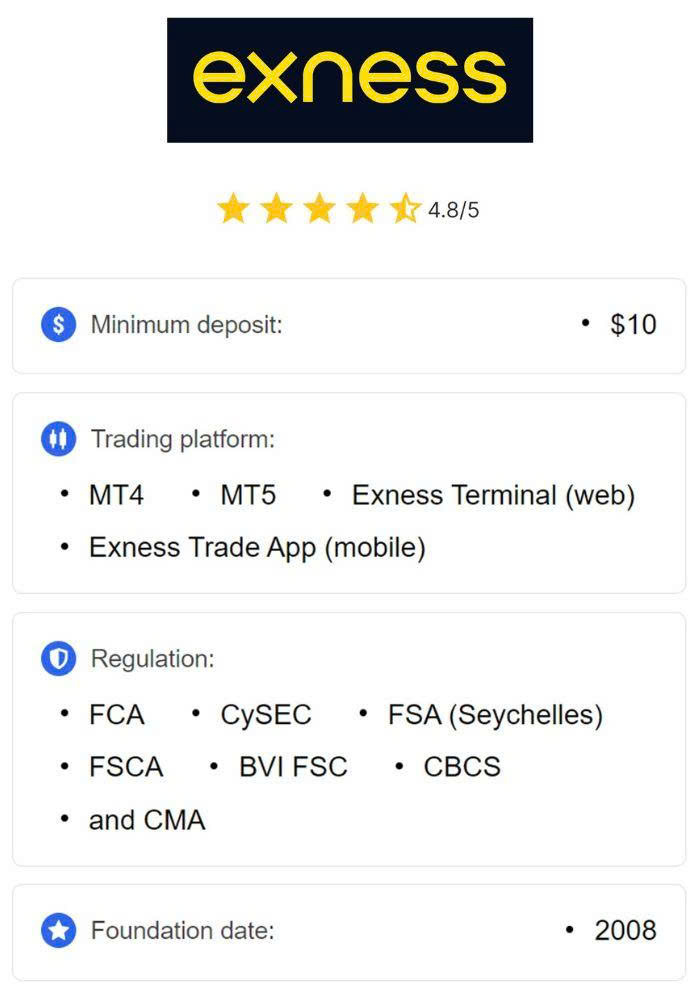

Founded in 2008, Exness is a leading forex and Contracts for Difference (CFD) broker headquartered in Limassol, Cyprus. With over a decade of experience, it serves millions of clients across more than 200 countries, offering a wide range of financial instruments, including forex pairs, commodities, cryptocurrencies, indices, and stocks. Exness is renowned for its user-friendly platforms, competitive spreads, high leverage options, and robust customer support, making it a preferred choice for both novice and experienced traders.

Exness operates on popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary WebTrader, ensuring flexibility and advanced tools for traders. Its commitment to transparency, cutting-edge technology, and client-centric services has solidified its reputation as a trusted broker worldwide.

Is Exness Available in Nigeria?

The short answer is yes, Exness is fully available in Nigeria. Nigerian traders can access the platform’s full suite of services, including account registration, trading, deposits, and withdrawals. Exness has tailored its offerings to meet the needs of the Nigerian market, making it a popular choice among local traders. Here’s why Exness stands out in Nigeria:

Low Minimum Deposit: Exness offers one of the lowest entry points in the industry, with a minimum deposit as low as $1 for its Standard Cent account. This accessibility is particularly appealing in Nigeria, where economic disparities may limit initial capital for many traders.

Naira (NGN) Accounts: Exness supports accounts denominated in Nigerian Naira, eliminating the need for currency conversion and shielding traders from exchange rate fluctuations. This feature ensures seamless and cost-effective transactions.

Localized Payment Methods: Exness provides a variety of payment options tailored for Nigerian traders, including local bank transfers, e-wallets like Skrill and Neteller, and even cryptocurrency transactions (Bitcoin and Tether). These options ensure fast and convenient deposits and withdrawals.

24/7 Customer Support: Exness offers round-the-clock customer support in multiple languages, including English, which is widely spoken in Nigeria. Traders can access assistance via live chat, email, or phone, ensuring timely resolution of issues.

Competitive Trading Conditions: With spreads starting from 0.0 pips on certain account types (e.g., Zero and Raw Spread accounts) and leverage up to 1:2000 (or unlimited for eligible accounts), Exness provides cost-effective and flexible trading conditions.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Is Exness Legal in Nigeria?

Forex trading is legal in Nigeria, regulated primarily by the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC). The CBN oversees foreign exchange transactions and monetary policies, while the SEC regulates investment-related activities. However, Nigeria lacks a dedicated regulatory body for forex brokers, creating a grey area for international platforms like Exness.

Exness is not directly regulated by Nigerian authorities but operates legally under international licenses from reputable bodies, including:

Financial Conduct Authority (FCA), United Kingdom: A Tier-1 regulator ensuring robust client protections.

Cyprus Securities and Exchange Commission (CySEC): Adheres to European Union financial standards.

Financial Services Authority (FSA), Seychelles: Nigerian traders are onboarded under this offshore regulation.

Financial Sector Conduct Authority (FSCA), South Africa: Reinforces Exness’s commitment to African markets.

These licenses mandate strict standards, such as client fund segregation, negative balance protection, and regular audits by firms like Deloitte, ensuring a secure trading environment. While the FSA in Seychelles is considered a weaker regulator, Exness’s global reputation and transparency measures provide additional reassurance for Nigerian traders.

How to Start Trading with Exness in Nigeria

Getting started with Exness is straightforward for Nigerian traders. Here’s a step-by-step guide:

Visit the Official Website: Navigate to the legitimate Exness website to avoid phishing scams. The platform is user-friendly and available in English, making it accessible for Nigerian users.

Register an Account: Click the “Open Account” button and fill out the registration form with your personal details, including name, email, phone number, and country (select Nigeria). The process takes just a few minutes.

Verify Your Identity: To comply with Know Your Customer (KYC) regulations, upload a government-issued ID (e.g., passport or national ID card) and proof of address (e.g., utility bill or bank statement). Verification typically takes a few hours but may extend to a day or two during peak times.

Choose an Account Type: Exness offers various account types to suit different trading styles:

Standard Account: Ideal for beginners with low spreads and no commissions.

Standard Cent Account: Designed for new traders, allowing trading in cents to minimize risk.

Pro, Zero, and Raw Spread Accounts: Tailored for experienced traders with tighter spreads and commission-based structures.

Fund Your Account: Select from multiple deposit methods, including local bank transfers, e-wallets, or cryptocurrencies. The minimum deposit is as low as $10 (approximately ₦16,000, depending on exchange rates).

Start Trading: Once your account is funded, choose a trading platform (MT4, MT5, or WebTrader) and begin trading. Exness also offers demo accounts for risk-free practice.

Key Features of Exness for Nigerian Traders

Exness has tailored its services to meet the unique needs of Nigerian traders, making it a compelling choice in the market:

Diverse Trading Instruments: Exness offers access to major forex pairs (e.g., EUR/USD), commodities (e.g., gold), cryptocurrencies (e.g., Bitcoin), and global indices, enabling portfolio diversification.

High Leverage: With leverage up to 1:2000 or unlimited for eligible accounts, Exness allows traders to amplify their positions. However, high leverage carries significant risks and should be used cautiously.

Educational Resources: Exness provides webinars, tutorials, market analysis tools, and economic calendars to help traders improve their skills. These resources are invaluable for beginners and seasoned traders alike.

Swap-Free Accounts: For traders adhering to Sharia law, Exness offers swap-free accounts, ensuring compliance with Islamic finance principles.

Fast Execution and Low Spreads: Exness’s proprietary pricing algorithms and strategically located servers ensure fast, slippage-free execution and tight spreads, even during volatile market conditions.

Potential Drawbacks and Considerations

While Exness is a strong choice for Nigerian traders, there are some considerations to keep in mind:

Regulatory Gaps: Exness is not directly regulated by Nigerian authorities, which may concern some traders. However, its international licenses and transparency measures mitigate this risk.

Withdrawal Delays: Some users report occasional delays during peak trading hours, though Exness generally processes transactions within 24 hours.

High Leverage Risks: While high leverage can amplify profits, it also increases the potential for significant losses, especially for inexperienced traders.

Limited Local Regulation: Nigeria’s lack of a dedicated forex regulatory body means traders must rely on international oversight, which may not offer the same level of local protection.

Alternatives to Exness in Nigeria

While Exness is a reliable option, Nigerian traders may also consider other globally regulated brokers, such as:

IC Markets: Known for low spreads and strong regulatory oversight.

OANDA: Offers a wide range of instruments and robust customer support.

HotForex: Provides competitive trading conditions and diverse account types.

When choosing a broker, evaluate factors like regulatory compliance, trading conditions, platform features, and customer support to ensure alignment with your trading goals.

Conclusion: Is Exness the Right Choice for Nigerian Traders?

Exness is not only available in Nigeria but also well-suited to the needs of local traders. Its low minimum deposits, Naira-denominated accounts, localized payment methods, and competitive trading conditions make it an attractive option for both beginners and experienced traders. While it operates under international regulations rather than local Nigerian oversight, its licenses from reputable bodies like the FCA, CySEC, and FSCA, combined with regular audits, ensure a secure trading environment.

For Nigerian traders seeking a reliable, user-friendly, and cost-effective platform, Exness is a strong contender. However, it’s crucial to approach forex trading with caution, especially given the high risks associated with leveraged products. By leveraging Exness’s educational resources, demo accounts, and robust support, Nigerian traders can navigate the forex market with confidence.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Read more: