8 minute read

How to Open Forex Account in Pakistan: A Step-by-Step Guide

Forex trading has gained significant popularity in Pakistan as an avenue for individuals to explore financial markets and potentially generate income. With the rise of online trading platforms, opening forex account in Pakistan has become more accessible than ever. However, navigating the process can be daunting for beginners due to regulatory considerations, broker selection, and account setup requirements. This comprehensive guide will walk you through the steps to open forex account in Pakistan, ensuring you make informed decisions while adhering to best practices.

Top 4 Best Forex Brokers in Pakistan

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ XM: Open An Account or Visit Brokers 💥

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Why Forex Trading in Pakistan?

Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from fluctuations in exchange rates. For Pakistanis, forex trading offers several benefits:

· Accessibility: Forex markets operate 24/5, allowing traders to participate at their convenience.

· Low Entry Barriers: Many brokers offer accounts with minimal deposits, making it affordable for beginners.

· Potential for Profit: With proper knowledge and strategy, forex trading can be a lucrative venture.

· Global Market Exposure: Traders gain access to international markets, diversifying their investment portfolio.

However, forex trading also carries risks, including market volatility and potential financial losses. Therefore, understanding the process of opening a forex account and choosing a reliable broker is crucial.

Step-by-Step Guide to Opening a Forex Account in Pakistan

1. Understand Forex Trading Basics

Before diving into the account-opening process, familiarize yourself with forex trading fundamentals. Key concepts include:

· Currency Pairs: Forex trading involves trading currency pairs, such as USD/PKR or EUR/USD.

· Leverage: Leverage allows you to control larger positions with smaller capital but increases risk.

· Pip and Lot Sizes: A pip is the smallest price movement in forex, while lots represent trade sizes.

· Risk Management: Learn strategies like stop-loss orders to protect your capital.

Consider taking free online courses or reading reputable forex trading books to build a strong foundation. Platforms like Babypips offer beginner-friendly resources tailored to new traders.

2. Research and Choose a Reputable Forex Broker

Selecting a reliable forex broker is the most critical step in opening a forex account. In Pakistan, forex trading is not regulated by the Securities and Exchange Commission of Pakistan (SECP), so you’ll need to choose an international broker regulated by reputable authorities like:

· FCA (UK): Financial Conduct Authority

· ASIC (Australia): Australian Securities and Investments Commission

· CySEC (Cyprus): Cyprus Securities and Exchange Commission

When evaluating brokers, consider the following factors:

· Regulation and Security: Ensure the broker is regulated to protect your funds.

· Trading Platform: Popular platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) are user-friendly and widely used.

· Account Types: Look for brokers offering micro or cent accounts for beginners with low capital.

· Spreads and Fees: Compare spreads, commissions, and withdrawal fees.

· Customer Support: Opt for brokers with 24/7 support and a local presence or Urdu-speaking staff.

· Deposit and Withdrawal Methods: Ensure the broker supports convenient payment methods in Pakistan, such as bank transfers, JazzCash, EasyPaisa, or cryptocurrencies.

Some popular brokers for Pakistani traders include:

· XM

· FBS

· Exness

· IC Markets

· HotForex (HF Markets)

Always check user reviews on platforms like Trustpilot or Forex Peace Army to gauge a broker’s reputation.

3. Gather Required Documents

To open a forex account, brokers typically require identity verification to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. Prepare the following documents:

· Valid ID: A scanned copy of your Computerized National Identity Card (CNIC) or passport.

· Proof of Address: A recent utility bill, bank statement, or rental agreement showing your name and address.

· Bank Details: If you plan to fund your account via bank transfer, have your bank account details ready.

Ensure all documents are clear and up-to-date to avoid delays during the verification process.

4. Register with the Broker

Once you’ve chosen a broker, follow these steps to register:

· Visit the Broker’s Website: Go to the official website of your chosen broker.

· Click on “Open Account” or “Register”: This is usually prominently displayed on the homepage.

· Fill in Personal Information: Provide your name, email address, phone number, and country of residence (Pakistan).

· Select Account Type: Choose an account type that suits your trading goals (e.g., micro, standard, or Islamic/swap-free for Muslim traders).

· Submit Documents: Upload your CNIC/passport and proof of address for KYC verification.

· Agree to Terms and Conditions: Read and accept the broker’s terms, ensuring you understand their policies.

Most brokers verify documents within 1-2 business days. You’ll receive a confirmation email once your account is approved.

✅ Join Exness now! Open An Account or Visit Brokers 👈

5. Fund Your Forex Account

After your account is verified, you’ll need to deposit funds to start trading. In Pakistan, funding options vary by broker but commonly include:

· Bank Transfers: Most brokers accept wire transfers from Pakistani banks like HBL, MCB, or UBL.

· Mobile Payment Apps: Some brokers support JazzCash and EasyPaisa for quick deposits.

· E-Wallets: Platforms like Skrill, Neteller, or Perfect Money are popular among Pakistani traders.

· Cryptocurrency: Certain brokers allow deposits via Bitcoin or other cryptocurrencies.

Check the minimum deposit requirement (often $10-$100 for beginner accounts) and any associated fees. For example, micro accounts with brokers like FBS or XM allow deposits as low as $5.

Tip: Start with a small deposit to test the broker’s services before committing larger amounts.

6. Download and Set Up a Trading Platform

Most brokers offer MetaTrader 4 or MetaTrader 5, which are available for desktop, mobile, and web platforms. Follow these steps:

· Download the Platform: Get MT4/MT5 from the broker’s website or app store (iOS/Android).

· Log In: Use the login credentials provided by the broker (account number, password, and server name).

· Customize the Interface: Adjust charts, indicators, and settings to suit your trading style.

Many brokers also offer demo accounts, allowing you to practice trading with virtual funds. Use this feature to familiarize yourself with the platform and test strategies risk-free.

7. Start Trading

Once your account is funded and the platform is set up, you’re ready to trade. Here are some tips for beginners:

· Start Small: Begin with micro-lots to minimize risk.

· Use a Demo Account: Practice strategies before trading with real money.

· Learn Technical and Fundamental Analysis: Study charts, trends, and economic news to make informed decisions.

· Implement Risk Management: Never risk more than 1-2% of your account on a single trade.

· Stay Updated: Follow global economic events, as they impact currency prices.

8. Understand Local Regulations and Taxes

While forex trading is not explicitly regulated by the SECP in Pakistan, it is not illegal for individuals to trade with international brokers. However, keep the following in mind:

· Foreign Exchange Regulations: The State Bank of Pakistan (SBP) imposes restrictions on foreign currency transactions. Ensure your broker complies with international regulations to avoid issues with fund transfers.

· Tax Implications: Profits from forex trading may be subject to capital gains tax. Consult a tax professional to understand your obligations.

· Islamic Accounts: If you follow Islamic finance principles, choose a broker offering swap-free (Islamic) accounts to avoid interest-based charges.

9. Avoid Common Mistakes

New traders often make mistakes that can lead to losses. Here’s how to avoid them:

· Overleveraging: High leverage can amplify losses. Stick to conservative leverage ratios (e.g., 1:10 or 1:50).

· Lack of Strategy: Avoid trading based on emotions or hunches. Develop a trading plan and stick to it.

· Ignoring Risk Management: Always use stop-loss orders and avoid risking too much capital.

· Choosing Unregulated Brokers: Stick to well-regulated brokers to ensure the safety of your funds.

10. Continue Learning and Improving

Forex trading is a skill that requires continuous learning. Stay updated with market trends, attend webinars, and join trading communities in Pakistan. Platforms like X or local forex forums can provide valuable insights from experienced traders.

Tips for Successful Forex Trading in Pakistan

· Start with a Demo Account: Practice for at least 2-3 months before trading with real money.

· Choose Low-Cost Brokers: Look for brokers with tight spreads and low or no withdrawal fees.

· Stay Disciplined: Follow your trading plan and avoid impulsive decisions.

· Monitor Economic Events: Use economic calendars to track events like interest rate decisions or US non-farm payroll data.

· Network with Local Traders: Join Pakistani forex trading groups on WhatsApp, Telegram, or X for tips and support.

Popular Forex Brokers for Pakistani Traders

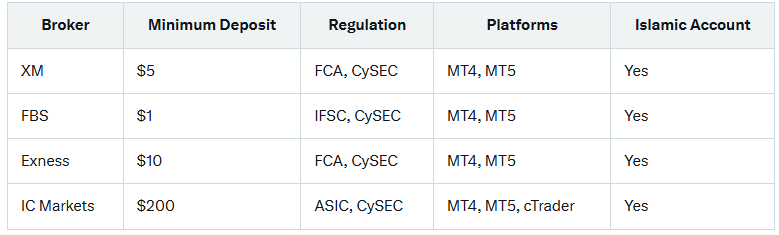

Here’s a quick comparison of brokers suitable for Pakistani traders:

Always verify the broker’s credentials and test their services with a demo account before committing funds.

Conclusion

Opening a forex account in Pakistan is a straightforward process if you follow the right steps. By choosing a reputable broker, understanding the market, and practicing disciplined trading, you can embark on a rewarding forex trading journey. Start small, prioritize risk management, and continuously educate yourself to improve your skills. With dedication and patience, forex trading can become a valuable addition to your financial portfolio.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Read more: