8 minute read

How Does Forex Trading Work in Nigeria? A Comprehensive Guide

Forex trading has gained immense popularity in Nigeria over the past decade, attracting both seasoned investors and curious beginners. With Nigeria’s growing internet penetration and the increasing interest in alternative income streams, the foreign exchange market (forex) has become a viable option for many. But How Does Forex Trading Work In Nigeria? This comprehensive guide will walk you through the fundamentals, the opportunities, and the challenges of forex trading in Nigeria, helping you navigate this dynamic financial market.

Top 4 Best Forex Brokers in Nigeria

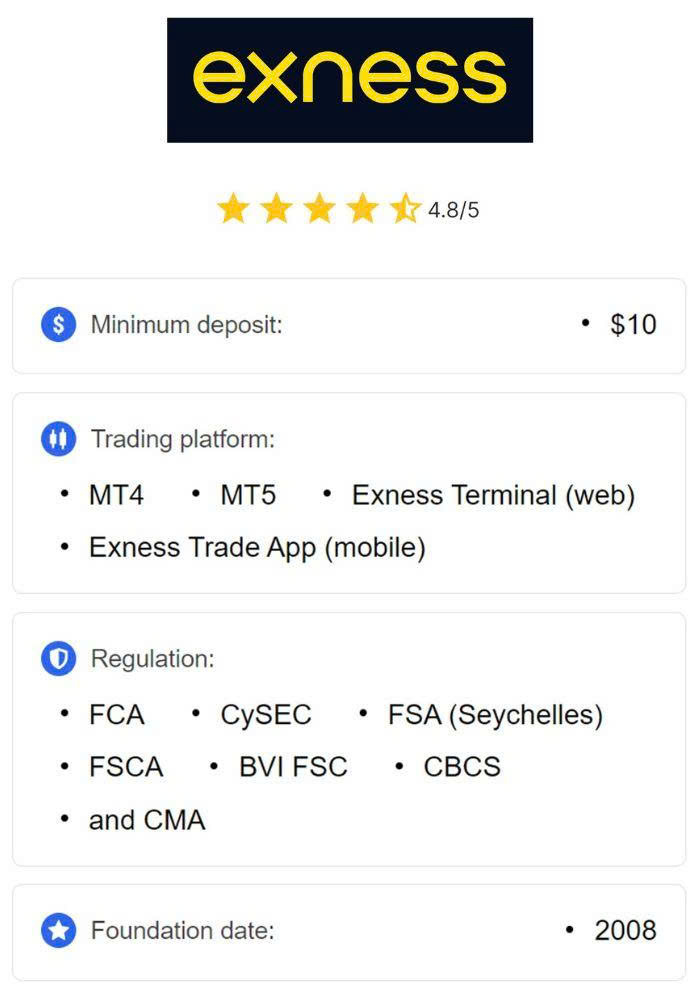

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ XM: Open An Account or Visit Brokers 💥

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

What is Forex Trading?

Forex trading, short for foreign exchange trading, involves buying and selling currencies to profit from fluctuations in their exchange rates. The forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $7 trillion. Unlike stock markets, forex operates 24 hours a day, five days a week, across major financial hubs like London, New York, and Tokyo.

In Nigeria, forex trading allows individuals to speculate on the value of one currency against another, such as the Nigerian Naira (NGN) against the US Dollar (USD) or the Euro (EUR) against the British Pound (GBP). Traders aim to buy low and sell high or sell high and buy low, capitalizing on price movements.

Why is Forex Trading Popular in Nigeria?

Forex trading has surged in Nigeria for several reasons:

· Accessibility: The rise of online trading platforms has made forex accessible to Nigerians with just a smartphone and an internet connection.

· Low Entry Barriers: Many brokers allow traders to start with small amounts, sometimes as low as $10, making it appealing for beginners.

· Economic Factors: Nigeria’s volatile economy and fluctuating Naira value push individuals to explore forex as a hedge against inflation and currency devaluation.

· Youthful Population: Nigeria’s tech-savvy youth are eager to explore global financial markets, seeking financial independence.

· High Returns Potential: While risky, forex trading offers the possibility of significant profits, attracting ambitious traders.

However, the popularity of forex trading also comes with risks, including scams and unregulated brokers, which we’ll discuss later.

How Does Forex Trading Work?

To understand how forex trading works in Nigeria, let’s break it down into key components:

1. Currency Pairs

Forex trading revolves around currency pairs, such as USD/NGN, EUR/USD, or GBP/JPY. Each pair consists of a base currency (the first currency) and a quote currency (the second currency). For example, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency. The price of the pair indicates how much of the quote currency is needed to buy one unit of the base currency.

2. Brokers

To trade forex, Nigerians need a reliable broker, an intermediary that provides access to the global forex market. Popular brokers in Nigeria include XM, HotForex, FXTM, and OctaFX, which offer user-friendly platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). When choosing a broker, ensure they are regulated by reputable authorities like the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC).

3. Trading Platforms

Most forex trading in Nigeria is done through online platforms or mobile apps provided by brokers. These platforms allow traders to analyze charts, place trades, and manage their accounts. MT4 and MT5 are widely used due to their advanced charting tools, indicators, and automated trading features.

4. Leverage and Margin

Leverage allows traders to control larger positions with a smaller amount of capital. For example, with a 1:100 leverage, a $100 deposit can control a $10,000 position. While leverage can amplify profits, it also increases the risk of significant losses. Margin is the amount of money required to open a leveraged position, acting as collateral.

5. Types of Analysis

Successful forex trading relies on analysis to predict price movements:

· Technical Analysis: Involves studying historical price charts and using indicators like Moving Averages, Relative Strength Index (RSI), and Fibonacci retracements.

· Fundamental Analysis: Focuses on economic factors like interest rates, inflation, and geopolitical events that affect currency values.

· Sentiment Analysis: Gauges market sentiment by analyzing trader behavior and positioning.

6. Trading Strategies

Nigerian traders use various strategies, such as:

· Scalping: Making quick, small trades to capture minor price movements.

· Day Trading: Opening and closing trades within a single day.

· Swing Trading: Holding trades for days or weeks to profit from larger price swings.

· Position Trading: Taking long-term positions based on fundamental trends.

How to Start Forex Trading in Nigeria

Getting started with forex trading in Nigeria is straightforward, but it requires preparation. Follow these steps:

Step 1: Educate Yourself

Before risking your money, learn the basics of forex trading. Resources like Babypips.com, YouTube tutorials, and free webinars from brokers can help. Understand key concepts like pips, lots, spreads, and risk management.

Step 2: Choose a Reliable Broker

Select a broker that is regulated, offers low spreads, and supports Nigerian payment methods like bank cards, mobile money, or cryptocurrency. Check user reviews on platforms like Trustpilot to avoid scams.

Step 3: Open a Trading Account

Most brokers offer demo accounts where you can practice trading with virtual money. Once confident, open a live account. You’ll need to provide identification documents for verification, as required by anti-money laundering regulations.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Step 4: Fund Your Account

Nigerian traders can fund their accounts using local bank cards, wire transfers, or e-wallets like Paystack or Flutterwave. Some brokers also accept cryptocurrencies like Bitcoin.

Step 5: Develop a Trading Plan

A trading plan outlines your goals, risk tolerance, and strategy. Decide how much you’re willing to risk per trade (typically 1-2% of your account balance) and stick to your plan to avoid emotional decisions.

Step 6: Start Trading

Begin with small trades to gain experience. Use a demo account to test strategies before risking real money. Monitor your trades and keep a trading journal to track your progress.

Is Forex Trading Legal in Nigeria?

Yes, forex trading is legal in Nigeria, but it operates in a relatively unregulated environment. The Central Bank of Nigeria (CBN) oversees financial markets, but there is no specific legislation governing retail forex trading. This lack of regulation has led to the proliferation of unregulated brokers and scams targeting unsuspecting Nigerians.

To stay safe, trade with brokers regulated by international bodies like the FCA, CySEC, or ASIC. Avoid brokers promising guaranteed profits or “get-rich-quick” schemes, as these are often fraudulent.

Challenges of Forex Trading in Nigeria

While forex trading offers opportunities, Nigerian traders face unique challenges:

· Currency Volatility: The Naira’s frequent devaluation impacts trading, especially for USD/NGN pairs.

· High Internet Costs: Reliable internet is essential for trading, but data costs in Nigeria can be high.

· Scams and Fraud: Unregulated brokers and Ponzi schemes posing as forex trading platforms are common.

· Limited Financial Literacy: Many beginners lack the knowledge to navigate the complex forex market, leading to losses.

· Payment Restrictions: CBN restrictions on international transactions can complicate funding and withdrawing from trading accounts.

Tips for Successful Forex Trading in Nigeria

To succeed in forex trading, consider these tips:

· Start Small: Begin with a small account and avoid over-leveraging to minimize losses.

· Use Risk Management: Set stop-loss orders to limit potential losses and never risk more than you can afford.

· Stay Informed: Follow global economic news and events that impact currency prices, such as CBN policies or US Federal Reserve decisions.

· Avoid Emotional Trading: Stick to your trading plan and avoid impulsive decisions driven by fear or greed.

· Join a Community: Engage with Nigerian forex trading communities on platforms like Nairaland or Telegram to share knowledge and stay motivated.

The Role of Technology in Forex Trading in Nigeria

Technology has revolutionized forex trading in Nigeria. Mobile apps allow traders to monitor markets on the go, while social trading platforms like eToro enable beginners to copy trades from experienced traders. Automated trading systems, or Expert Advisors (EAs), are also popular, allowing traders to execute strategies without manual intervention.

However, reliance on technology comes with risks, such as platform downtime or cybersecurity threats. Always use secure devices and avoid sharing sensitive account information.

Opportunities for Nigerian Traders

Forex trading offers several opportunities for Nigerians:

· Income Diversification: Forex can supplement income, especially in an economy with high unemployment.

· Global Exposure: Trading connects Nigerians to global financial markets, broadening their investment horizons.

· Skill Development: Learning forex trading enhances financial literacy and analytical skills.

Common Mistakes to Avoid

· Overtrading: Trading too frequently or with large positions can lead to significant losses.

· Ignoring Risk Management: Failing to use stop-loss orders or risking too much capital per trade is a recipe for disaster.

· Chasing Losses: Trying to recover losses by taking bigger risks often worsens the situation.

· Trusting Unregulated Brokers: Always verify a broker’s credentials before depositing funds.

The Future of Forex Trading in Nigeria

The future of forex trading in Nigeria looks promising, driven by increasing internet access, a growing middle class, and interest in financial markets. However, the industry needs better regulation to protect traders from scams. As financial literacy improves and technology advances, more Nigerians are likely to embrace forex trading as a legitimate wealth-building tool.

Conclusion

Forex trading in Nigeria offers a world of opportunities for those willing to learn and approach it with discipline. By understanding how the market works, choosing a reliable broker, and practicing sound risk management, Nigerian traders can navigate the complexities of forex trading and potentially achieve financial success. However, caution is key—avoid scams, start small, and continuously educate yourself to stay ahead in this dynamic market.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Read more: