7 minute read

Exness vs FXPesa: Which Forex Broker Should You Choose in 2025?

from Exness, FXPesa

If you’re diving into forex trading and trying to pick between Exness vs FXPesa, you’re not alone. Choosing the right broker can feel like picking the perfect coffee order—too many options, and you just want something that works for you. So, which one’s better? Exness is the go-to for traders who want tight spreads, high leverage, and a globally trusted platform, while FXPesa shines for East African traders, especially in Kenya, with its local focus and mobile money support. But there’s more to it than that. Let’s break it down in a no-nonsense to help you decide which broker fits your trading style, goals, and needs.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Why This Comparison Matters

Forex trading is a high-stakes game, and your broker is your gateway to the markets. A good broker can make trading smoother, cheaper, and more reliable, while a bad one can leave you frustrated with hidden fees or clunky platforms. Exness vs FXPesa are both solid players, but they cater to slightly different audiences. Whether you’re a newbie testing the waters or a seasoned trader chasing profits, this comparison will help you weigh their strengths and weaknesses.

Exness: The Global Heavyweight

Exness, founded in 2008, is a global giant in forex trading. It’s regulated by top-tier authorities like the FCA (UK), CySEC (Cyprus), and FSCA (South Africa), which gives it serious credibility. With over 600,000 active clients and a trading volume of $4.8 trillion in 2024, Exness is a household name for traders worldwide.

What Exness Does Well

Tight Spreads and Low Costs: Exness is known for ultra-competitive spreads, especially on its Zero and Raw Spread accounts. For example, you can trade major pairs like EUR/USD with spreads as low as 0.0 pips (plus a small commission). If you’re a scalper or high-frequency trader, this is a game-changer.

High Leverage: Exness offers leverage up to 1:2000 (or even unlimited in some regions), which is among the highest in the industry. This can amplify your profits but also your risks—tread carefully!

Wide Range of Instruments: You’re not limited to forex. Exness offers CFDs on stocks, indices, commodities, and cryptocurrencies, giving you plenty of options to diversify.

Fast Withdrawals: Exness processes withdrawals instantly in many cases, with support for multiple payment methods like bank cards, e-wallets (Skrill, Neteller), and crypto.

Platform Variety: You can trade on MetaTrader 4, MetaTrader 5, or Exness’s proprietary mobile app, which is sleek and user-friendly.

Where Exness Falls Short

Limited Local Support in Africa: While Exness operates globally, it doesn’t have the same localized focus as FXPesa in East Africa. For example, it doesn’t support mobile money payments like M-Pesa, which is a big deal in Kenya.

Complex Account Types: Exness offers multiple account types (Standard, Pro, Zero, Raw Spread), which can be overwhelming for beginners trying to figure out what’s best.

High Leverage Risks: That 1:2000 leverage is a double-edged sword. If you’re not disciplined, it can wipe out your account fast.

FXPesa: The East African Champion

FXPesa, formerly known as EGM Securities, is a Kenyan-based broker launched in 2018. It’s regulated by the Capital Markets Authority (CMA) in Kenya and has quickly become a favorite in East Africa, particularly for its seamless integration with local payment systems like M-Pesa.

What FXPesa Does Well

Tailored for East Africa: FXPesa is built for traders in Kenya and surrounding countries. It supports deposits and withdrawals via M-Pesa and Airtel Money, making it super convenient for local users.

Low Minimum Deposit: You can start trading with just $5, which is perfect for beginners or those with limited capital.

User-Friendly Experience: FXPesa uses MetaTrader 4, which is reliable and familiar to most traders. Its mobile app is also intuitive, with a focus on ease of use for newbies.

Local Customer Support: FXPesa offers support in Swahili and English, with a Nairobi-based team that understands the local market. This is a big plus if you prefer dealing with someone who “gets” your context.

Educational Resources: FXPesa provides free webinars, tutorials, and market analysis tailored to African traders, helping beginners build confidence.

Where FXPesa Falls Short

Limited Global Reach: Unlike Exness, FXPesa is primarily focused on East Africa. If you’re outside the region or want a broker with a global footprint, it might feel restrictive.

Higher Spreads: FXPesa’s spreads aren’t as tight as Exness’s, especially on its Executive account. For example, EUR/USD spreads might start at 1.4 pips, which can eat into profits for frequent traders.

Fewer Instruments: FXPesa offers forex and some CFDs, but its range of assets is narrower than Exness’s, limiting your trading options.

Less Regulatory Oversight: While CMA regulation is solid for Kenya, it’s not as globally recognized as FCA or CySEC, which might concern traders prioritizing security.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

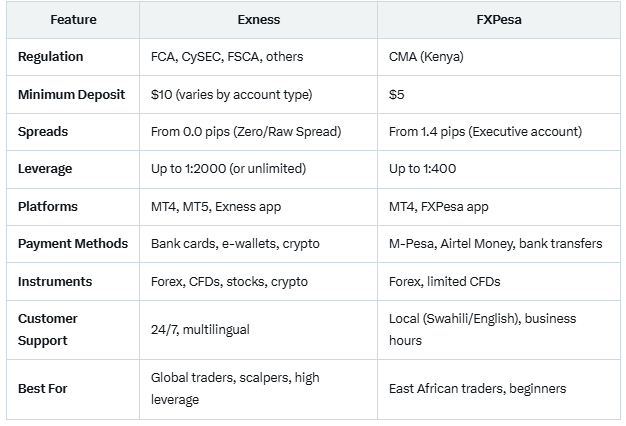

Head-to-Head: Key Differences

Let’s put Exness vs FXPesa side by side to see how they stack up on critical factors:

Who Should Choose Exness?

Exness is your pick if you’re a trader who values:

Low-cost trading: Tight spreads and low commissions make it ideal for scalpers or those trading large volumes.

Global exposure: If you’re trading from outside East Africa or want access to a wide range of markets, Exness’s offerings are unmatched.

High leverage: Experienced traders comfortable with risk can maximize their capital with Exness’s high leverage options.

Advanced tools: If you rely on sophisticated platforms like MT5 or want a broker with a proven global track record, Exness delivers.

For example, if you’re a Kenyan trader living abroad or someone trading forex alongside crypto and stocks, Exness’s flexibility and low costs make it a strong choice.

Who Should Choose FXPesa?

FXPesa is the better option if you:

Live in East Africa: The M-Pesa integration and local support make it a no-brainer for Kenyan traders or those in neighboring countries.

Are a beginner: With a $5 minimum deposit and beginner-friendly resources, FXPesa is perfect for those just starting out.

Prefer local convenience: If you want a broker that understands the East African market and offers payment methods you already use, FXPesa nails it.

For instance, if you’re a Nairobi-based student or small-scale trader who wants to deposit via M-Pesa and learn the ropes without risking much, FXPesa is tailored for you.

Things to Consider Before Choosing

Your Trading Style: Are you scalping with tight spreads or holding positions long-term? Exness suits scalpers, while FXPesa’s higher spreads might not matter for swing traders.

Location: If you’re in Kenya, FXPesa’s local focus is a huge advantage. Outside East Africa, Exness’s global infrastructure is more practical.

Capital: Got a small budget? FXPesa’s $5 entry point is hard to beat. If you’re trading bigger volumes, Exness’s low spreads save more in the long run.

Risk Tolerance: Exness’s high leverage is tempting but risky. FXPesa’s 1:400 cap is more conservative, which might suit cautious traders.

Regulation Needs: If you prioritize top-tier regulation (FCA, CySEC), Exness wins. If local regulation (CMA) is enough, FXPesa is fine.

Tips for Choosing the Right Broker

Demo Accounts: Both Exness vs FXPesa offer free demo accounts. Test their platforms, spreads, and execution speeds before committing real money.

Check Fees: Look beyond spreads. Exness has commissions on some accounts, while FXPesa might charge withdrawal fees for certain methods.

Read Reviews: Platforms like Trustpilot or Forex Peace Army have user reviews that reveal real-world experiences with both brokers.

Ask Questions: Contact their support teams. Exness offers 24/7 chat, while FXPesa’s local team might be more responsive during business hours.

Start Small: Deposit the minimum and trade small lots to get a feel for the broker’s reliability and platform.

Final Thoughts: Exness vs FXPesa?

So, who wins the Exness vs. FXPesa showdown? It depends on you. If you’re after low spreads, high leverage, and a global platform with tons of instruments, Exness is the better bet. It’s a powerhouse for serious traders who want flexibility and top-tier regulation. But if you’re in East Africa, especially Kenya, and value local payment options, Swahili support, and a low entry barrier, FXPesa is your best friend.

No broker is perfect, and both have their quirks. Exness might overwhelm beginners with its account options, while FXPesa’s higher spreads could frustrate cost-conscious traders. The key is to match the broker to your needs—geographic, financial, and trading-style-wise.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Read more: