8 minute read

Exness vs Forex.com: Which Forex Broker Is Right for You in 2025?

from Exness, Forex.com

So, you’re diving into forex trading and stuck choosing between Exness vs Forex.com? Both are heavyweights in the forex world, but they cater to different types of traders. If you’re wondering which one’s better for your trading style, I’ve got you covered. In this article, I’ll break down the key differences between Exness vs Forex.com—covering fees, platforms, regulation, account types, and more—in a no-fluff way. By the end, you’ll know exactly which broker suits your needs. Let’s jump in!

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Why This Comparison Matters

Choosing a forex broker is like picking the right tool for a job—it can make or break your trading experience. Exness, founded in 2008, is known for ultra-low spreads, high leverage, and lightning-fast withdrawals, making it a favorite among scalpers and high-frequency traders. Forex.com, established in 2001, offers robust platforms, strong regulation, and advanced tools like Capitalise AI, appealing to both beginners and pros. But which one’s better for you? Let’s compare the critical factors.

Regulation and Safety: Who’s Got Your Back?

Trust is everything when you’re trading real money. Both Exness vs Forex.com are legit, but their regulatory frameworks differ slightly.

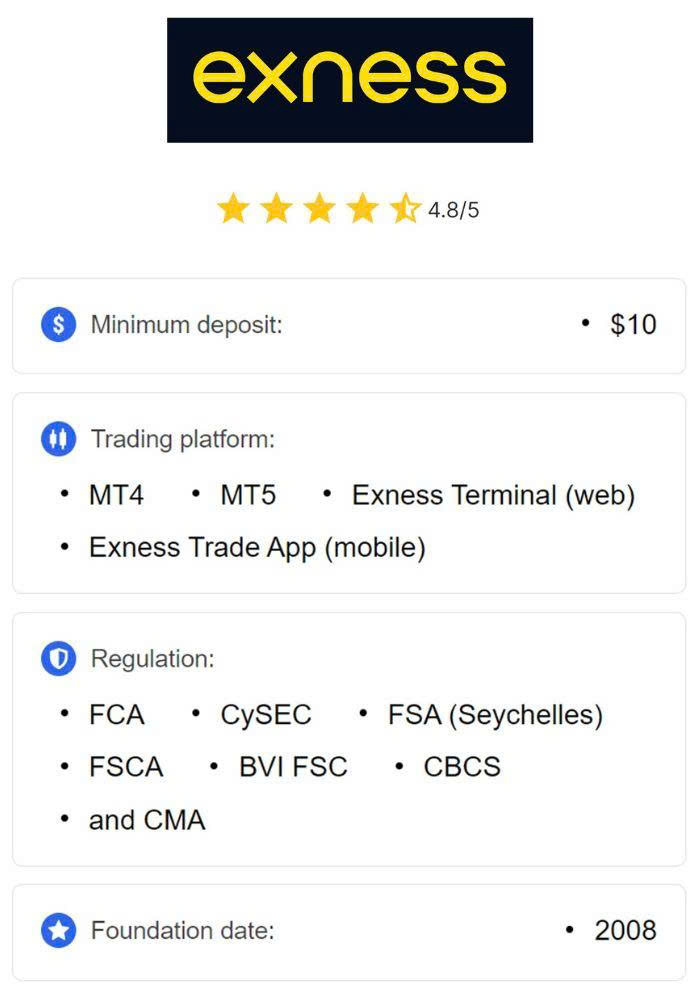

Exness: Regulated by multiple authorities, including the Financial Conduct Authority (FCA) in the UK (for professional traders), Cyprus Securities and Exchange Commission (CySEC), and others like the FSA in Seychelles. Exness also offers negative balance protection and is a member of the Financial Commission, which provides up to €20,000 in dispute resolution coverage. However, retail clients in the UK and EU are often directed to offshore entities (like Seychelles), which have less stringent oversight. Trust score: 94/99.

Forex.com: A powerhouse in regulation, Forex.com is overseen by top-tier bodies like the FCA, CySEC, the U.S. National Futures Association (NFA), and the Australian Securities and Investments Commission (ASIC). It’s a great pick for U.S. traders or anyone prioritizing ironclad regulation. Client funds are segregated, and negative balance protection is standard.

Verdict: Forex.com edges out for traders in highly regulated regions like the U.S. or UK, while Exness is a solid choice for non-U.S. traders comfortable with offshore entities.

Fees and Costs: Where’s the Better Deal?

Nobody likes hidden fees eating into their profits. Let’s see how these brokers stack up.

Exness: Known for ultra-low spreads, especially on its Raw Spread and Zero accounts (as low as 0.0 pips for EUR/USD). Commissions are $3.50 per lot per side on Raw accounts, but Standard accounts are commission-free with slightly wider spreads. No inactivity, deposit, or withdrawal fees, and instant withdrawals are a game-changer. Swap-free accounts are available for all majors, minors, gold, crypto, and indices, perfect for Muslim traders.

Forex.com: Offers competitive variable spreads, though slightly higher than Exness on average (EUR/USD around 0.7 pips with price improvement). Commission-based accounts (like DMA) can lower costs for high-volume traders, with rebates up to $50 per $1M traded. However, no swap-free Islamic accounts, which is a drawback for some. Withdrawal times are slower (1-3 days) compared to Exness’s instant processing.

Verdict: Exness wins for low spreads and fast, free withdrawals, especially for high-frequency traders. Forex.com is better for high-volume traders who can leverage rebates but falls short on swap-free options.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Trading Platforms: Which Feels Better to Use?

Your trading platform is your cockpit—ease of use and features matter.

Exness: Offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Exness Terminal (web-based) and Exness Trade App (mobile). The Exness Terminal is sleek with one-click trading, while the mobile app includes Trading Central signals and market news. Social trading is available, but the $500 minimum for copy trading might deter beginners. VPS hosting and API trading are also supported for algo traders.

Forex.com: Provides MT4, MT5, and its proprietary Forex.com Web Trader, which is beginner-friendly and doesn’t require downloads. The platform shines with Capitalise AI for code-free algorithmic trading and super-fast execution (99.69% of trades under one second). The mobile app is solid, but it lacks the social trading feature Exness offers.

Verdict: Exness is great for social trading and mobile-first traders, while Forex.com’s Capitalise AI and user-friendly Web Trader make it ideal for beginners and algo enthusiasts.

Account Types and Minimum Deposits: Flexibility for All?

Your trading style and budget dictate the account you’ll choose.

Exness: Offers a range of accounts to suit everyone:

Standard: $10 minimum deposit, no commission, ideal for beginners.

Standard Cent: Micro-lot trading for tiny budgets (as low as $1).

Raw Spread/Zero: $200 minimum, ultra-low spreads with commissions, great for scalpers.

Pro: $200 minimum, tailored for experienced traders.Islamic swap-free accounts are available across all types, and there’s no minimum deposit on Standard accounts in some regions.

Forex.com: Offers Standard, Commission, and DMA accounts with a $100 minimum deposit for Standard accounts—higher than Exness’s $10. No Islamic accounts, which is a limitation. Demo accounts are available, but some platforms (like MT4) are limited to 30 days.

Verdict: Exness is more flexible with lower deposits and more account options, especially for beginners and Muslim traders. Forex.com’s higher minimum and lack of swap-free accounts make it less accessible.

Trading Instruments: What Can You Trade?

Diversifying your portfolio? Here’s what each broker offers.

Exness: Focuses heavily on forex (100+ currency pairs) and cryptocurrencies (11 major coins like Bitcoin and Ethereum). It also includes 15 precious metals, 3 energy commodities, stocks, and 11 global indices. While the range is solid, it’s narrower than some competitors for non-forex assets.

Forex.com: Boasts 80+ currency pairs and over 5,500 equity-focused CFDs, including stocks, indices, and commodities. Its crypto offering is smaller than Exness’s, but the broader CFD selection makes it a go-to for diversified traders.

Verdict: Exness is better for forex and crypto traders, while Forex.com excels for those wanting a wide range of CFDs.

Leverage: How Much Risk Can You Take?

Leverage can amplify your gains—or losses. Both brokers offer flexibility, but there are differences.

Exness: Offers some of the highest leverage in the industry—up to 1:2000 (or unlimited in some regions), though this varies by regulator and account type. Great for aggressive traders but risky if you’re not careful.

Forex.com: Caps leverage at 1:50 for U.S. traders (due to NFA rules) and up to 1:200 elsewhere. You can adjust leverage to lower risk, which is a plus for cautious traders.

Verdict: Exness is the go-to for high-leverage traders, while Forex.com suits those who prefer safer, regulated leverage levels.

Customer Support: Who’s There When You Need Them?

Good support can save you during a market meltdown.

Exness: Offers 24/7 support via live chat, email, and phone in multiple languages (English, Chinese, Vietnamese, Thai, Swahili, etc.). Traders praise its responsiveness and instant replies, especially for withdrawal issues.

Forex.com: Provides 24/5 support (not weekends) via phone, email, and live chat. It’s professional and multilingual but slightly less accessible than Exness’s round-the-clock service.

Verdict: Exness takes the lead with 24/7 availability, especially for traders in different time zones.

Educational Resources: Learning to Trade Better

Beginners need guidance, and both brokers deliver, but in different ways.

Exness: Offers webinars, tutorials, and articles, plus Trading Central for market analysis. However, some content feels promotional, which can dilute its value. Demo accounts and a Help section cover trading basics.

Forex.com: Stands out with high-quality educational content, including videos, articles, and live webinars. Its integration with Capitalise AI also helps beginners learn algorithmic trading without coding.

Verdict: Forex.com wins for comprehensive, beginner-friendly education, while Exness is decent but could cut the promotional fluff.

Who Should Choose Exness?

Exness is perfect if you:

Want ultra-low spreads and instant withdrawals.

Trade forex or crypto with high leverage.

Need swap-free Islamic accounts.

Prefer 24/7 customer support and social trading.

Are a beginner with a small budget (as low as $10).

Exness shines for scalpers, high-frequency traders, and non-U.S. traders who value flexibility and low costs.

Who Should Choose Forex.com?

Forex.com is your pick if you:

Prioritize top-tier regulation, especially in the U.S. or UK.

Want a broader range of CFDs (stocks, indices, etc.).

Need beginner-friendly platforms and tools like Capitalise AI.

Trade high volumes and can benefit from rebates.

Value robust educational resources.

Forex.com is ideal for beginners, diversified traders, and those in highly regulated markets.

The Final Word

So, Exness vs Forex.com? If you’re a scalper, crypto trader, or budget-conscious beginner, Exness’s low spreads, high leverage, and instant withdrawals make it a no-brainer. But if you’re in the U.S., prioritize safety, or want a wider range of CFDs and top-notch education, Forex.com is the better fit. Ultimately, your trading goals—whether it’s low costs, flexibility, or regulatory trust—will decide the winner.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Read more: