8 minute read

Exness vs AvaTrade: Which Forex Broker Should You Choose?

from Exness, AvaTrade

If you’re diving into forex trading and wondering whether Exness vs AvaTrade is the better pick, you’re not alone. Both platforms have carved out solid reputations in the trading world, but they cater to slightly different needs. In short, Exness is great for low-cost trading with tight spreads and high leverage, while AvaTrade shines with its user-friendly platform and diverse asset offerings. But which one’s right for you? Let’s break it down in this comparison, written in a to help you decide.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Why Compare Exness vs AvaTrade?

Forex trading is a fast-paced game, and choosing the right broker can make or break your success. Exness vs AvaTrade are two heavyweights in the industry, each with unique strengths. Exness is known for its lightning-fast execution and low fees, while AvaTrade stands out for its educational resources and beginner-friendly tools. Whether you’re a newbie or a seasoned trader, this head-to-head will cover everything from fees to features, so you can pick the platform that aligns with your goals.

Overview of Exness

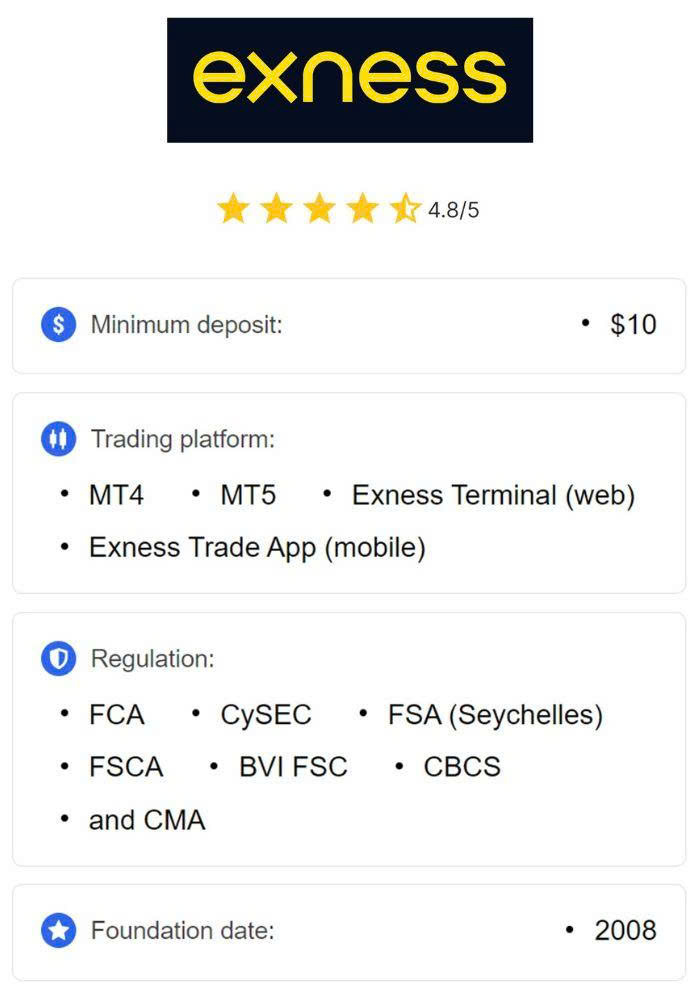

Exness, founded in 2008, has grown into a global powerhouse with over 600,000 active clients by 2025. It’s regulated by top-tier authorities like the FCA (UK), CySEC (Cyprus), and FSCA (South Africa), so you know your funds are safe. Exness is all about transparency and low-cost trading, offering some of the tightest spreads in the industry. It’s particularly popular among scalpers and high-volume traders who need fast execution and minimal fees.

Key Features of Exness:

Spreads: As low as 0.0 pips on some accounts.

Leverage: Up to 1:2000 (yes, you read that right!).

Account Types: Standard, Pro, Raw Spread, and Zero accounts.

Platforms: MetaTrader 4, MetaTrader 5, and Exness’s proprietary app.

Instruments: Forex, metals, cryptocurrencies, stocks, and indices.

Minimum Deposit: $10 for Standard accounts, making it super accessible.

Exness is a go-to for traders who prioritize low costs and flexibility. Its high leverage is a double-edged sword—great for maximizing profits but risky if you’re not careful.

Overview of AvaTrade

AvaTrade, established in 2006, is another trusted name with a global presence. It’s regulated by bodies like ASIC (Australia), FSCA, and the Central Bank of Ireland, ensuring top-notch security. AvaTrade is a favorite among beginners thanks to its intuitive platforms and extensive educational content. It also offers a broader range of assets compared to Exness, including options trading and social trading features.

Key Features of AvaTrade:

Spreads: Competitive, starting at 0.9 pips for major pairs.

Leverage: Up to 1:400 (varies by region).

Account Types: Standard, Islamic, and Demo accounts.

Platforms: MetaTrader 4/5, AvaTradeGO, AvaOptions, and DupliTrade.

Instruments: Forex, stocks, commodities, indices, ETFs, and cryptocurrencies.

Minimum Deposit: $100, slightly higher than Exness.

AvaTrade’s strength lies in its versatility and beginner-friendly approach, making it ideal for those who want a well-rounded trading experience with plenty of learning resources.

Head-to-Head Comparison

Let’s dive into the nitty-gritty and compare Exness vs AvaTrade across key factors to help you decide.

1. Fees and Spreads

Exness: If you’re obsessed with keeping costs low, Exness is hard to beat. Its Raw Spread and Zero accounts offer spreads starting at 0.0 pips, with a small commission per trade. Even its Standard account has no commission and spreads as low as 0.3 pips for major pairs like EUR/USD. This makes Exness a dream for scalpers and day traders who trade frequently.

AvaTrade: AvaTrade’s spreads are slightly higher, starting at 0.9 pips for major pairs on its Standard account. The good news? It’s a no-commission broker for most accounts, which simplifies cost calculations. However, if you’re trading exotic pairs or high volumes, Exness’s tighter spreads might save you more in the long run.

Winner: Exness for ultra-low spreads, but AvaTrade’s no-commission model is great for beginners who prefer simplicity.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

2. Leverage

Exness: Exness offers jaw-dropping leverage of up to 1:2000, one of the highest in the industry. This is a game-changer for experienced traders with small accounts who want to amplify their positions. However, high leverage comes with high risk, so proceed with caution.

AvaTrade: AvaTrade’s maximum leverage is 1:400, which is still generous but more conservative. This makes it a safer choice for beginners who might not be ready to handle extreme leverage.

Winner: Exness for high rollers, AvaTrade for those who want a safer balance.

3. Trading Platforms

Exness: Exness sticks to the classics—MetaTrader 4 and 5—along with its own mobile app. MT4 and MT5 are industry standards, loved for their advanced charting, automation (Expert Advisors), and reliability. The Exness app is sleek and user-friendly, perfect for trading on the go.

AvaTrade: AvaTrade goes all out with platform options. You get MT4 and MT5, plus AvaTradeGO (a mobile-first platform), AvaOptions (for options trading), and social trading platforms like DupliTrade and ZuluTrade. This variety makes AvaTrade more versatile, especially for traders interested in copy trading or options.

Winner: AvaTrade for its diverse platform lineup, though Exness’s simplicity appeals to MT4/5 loyalists.

4. Asset Variety

Exness: Exness offers over 100 forex pairs, plus metals, cryptocurrencies, stocks, and indices. It’s a solid selection, but it leans heavily toward forex and metals, with fewer options for stocks and ETFs.

AvaTrade: AvaTrade boasts a broader range, including forex, stocks, commodities, indices, ETFs, cryptocurrencies, and even options trading. If you want to diversify your portfolio beyond forex, AvaTrade gives you more flexibility.

Winner: AvaTrade for its wider asset range.

5. Minimum Deposit and Accessibility

Exness: With a $10 minimum deposit for Standard accounts, Exness is incredibly accessible, especially for beginners or traders in regions with lower capital. Higher-tier accounts like Pro or Zero may require $200–$500, depending on your region.

AvaTrade: AvaTrade’s $100 minimum deposit is still reasonable but less beginner-friendly than Exness. It’s a small hurdle, but it might deter absolute newbies.

Winner: Exness for its low entry point.

6. Educational Resources

Exness: Exness offers basic educational content, including webinars, tutorials, and market analysis. It’s decent but not the main focus of their platform. They assume you already know the ropes or can learn elsewhere.

AvaTrade: AvaTrade excels here, with a treasure trove of resources—videos, eBooks, webinars, and a demo account for practice. Their SharpTrader platform is essentially a learning hub, perfect for beginners who need guidance.

Winner: AvaTrade, hands down, for its robust educational tools.

7. Customer Support

Exness: Exness provides 24/7 support via live chat, email, and phone, with multilingual options. Traders praise its quick response times and helpful staff, especially for technical issues.

AvaTrade: AvaTrade also offers 24/5 support (not weekends) in multiple languages. Their support is reliable, but some users report slower response times compared to Exness.

Winner: Exness for its round-the-clock availability and speed.

8. Regulation and Safety

Both brokers are top-tier in terms of regulation. Exness is overseen by the FCA, CySEC, and FSCA, while AvaTrade is regulated by ASIC, FSCA, and the Central Bank of Ireland. Both offer negative balance protection and segregated client funds, so your money is safe with either.

Winner: Tie—both are highly regulated and trustworthy.

Who Should Choose Exness?

Exness is your go-to if you’re a cost-conscious trader who values:

Tight spreads and low fees for frequent trading.

High leverage to maximize small accounts.

Fast execution for scalping or day trading.

Simple platforms like MT4/MT5.

It’s ideal for experienced traders or those in emerging markets who need low entry barriers. However, if you’re new and need hand-holding, Exness’s limited educational resources might leave you wanting more.

Who Should Choose AvaTrade?

AvaTrade is perfect for traders who want:

Diverse assets to trade beyond forex.

Beginner-friendly tools, including copy trading and options.

Extensive education to learn the ropes.

Multiple platforms for a customized experience.

It’s a great fit for beginners or those who prefer a well-rounded platform with lots of learning support. However, its slightly higher spreads and deposit requirements might not suit high-volume traders.

My Verdict: Exness vs AvaTrade?

Here’s the bottom line: Exness is the better choice if you’re an experienced trader or scalper who wants the lowest possible costs and doesn’t mind high leverage risks. Its $10 minimum deposit and tight spreads make it accessible and cost-effective. On the other hand, AvaTrade is the way to go if you’re a beginner or want a broader range of assets and top-notch educational resources. Its platforms are more versatile, and its learning tools are unmatched.

Ultimately, your choice depends on your trading style, experience level, and priorities. If you’re still unsure, try both! Exness vs AvaTrade offer demo accounts, so you can test their platforms without risking a dime. Whichever you choose, both are solid, regulated brokers that won’t steer you wrong.

Tips for Choosing Your Forex Broker

Define Your Goals: Are you scalping, swing trading, or investing long-term? Your strategy will dictate which broker suits you.

Check Regulation: Always go with a broker regulated by a reputable authority.

Test the Platform: Use a demo account to get a feel for the interface and execution speed.

Consider Costs: Compare spreads, commissions, and overnight fees (swaps).

Look at Support: 24/7 support is crucial for forex, as markets never sleep.

Final Thoughts

Exness vs AvaTrade are both excellent choices, but they cater to different traders. Exness is your budget-friendly, high-leverage option for fast-paced trading, while AvaTrade offers a more comprehensive experience for beginners and diversified portfolios. Weigh your needs, test their platforms, and pick the one that feels right. Happy trading!

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Read more: