7 minute read

Exness Leverage in India: A Comprehensive Guide for Traders

from Exness India

If you’re an Indian trader looking to amplify your forex trading potential, you’ve likely heard about Exness and its leverage offerings. So, what exactly is Exness leverage, and how can you use it effectively in India? Exness offers flexible leverage options, ranging from 1:2 to 1:Unlimited on MT4 and up to 1:2000 on MT5, allowing traders to control larger positions with minimal capital. However, high leverage comes with risks, and understanding how to use it wisely is key to success. In this guide, we’ll break down everything you need to know about Exness leverage in India, from its legal status to practical tips for managing risks.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

What is Leverage, and Why Does It Matter?

Let’s start with the basics. Leverage in forex trading is like a superpower that lets you control a much larger position than your actual account balance. For example, with 1:100 leverage, $100 in your account lets you trade as if you had $10,000. Exness takes this to another level, offering ratios as high as 1:2000 or even unlimited leverage on certain accounts, which is a game-changer for traders with limited capital.

But here’s the catch: leverage is a double-edged sword. It can skyrocket your profits, but it can also wipe out your account if the market moves against you. For Indian traders, understanding how to balance this power with smart risk management is crucial, especially given India’s unique forex regulations.

Is Exness Leverage Legal in India?

Yes, trading with Exness leverage is legal for Indian traders, but there’s a bit of a gray area. The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) regulate forex trading in India. They allow trading in INR-based currency pairs (like USD/INR or EUR/INR) through SEBI-regulated brokers. However, non-INR pairs (like EUR/USD) are restricted with domestic brokers.

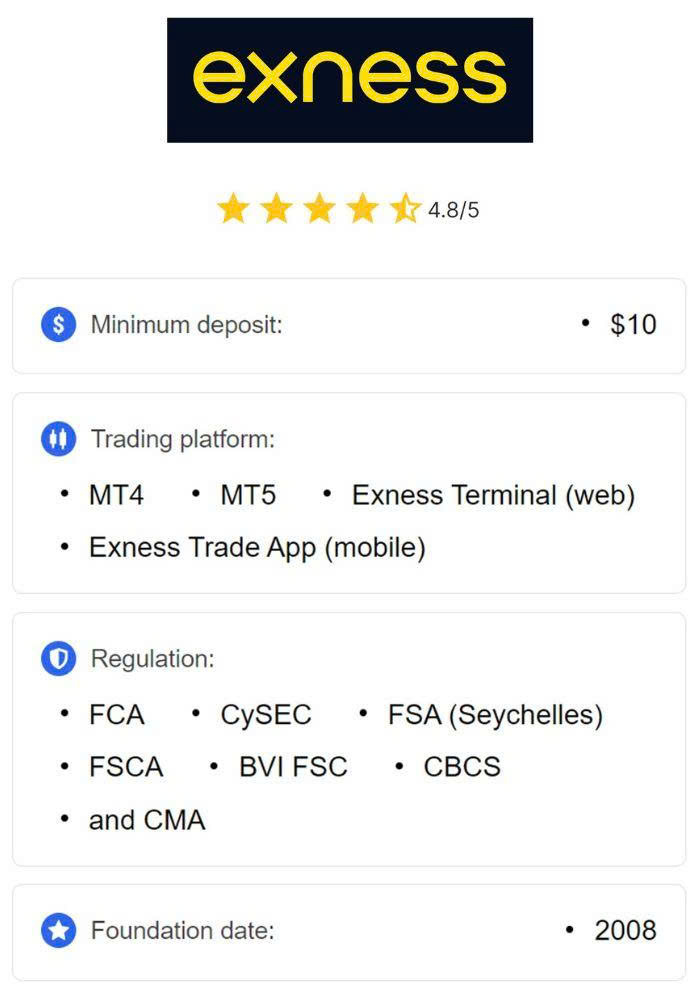

Here’s where Exness comes in. As an international broker not regulated by SEBI but overseen by global authorities like CySEC and FCA, Exness operates legally for Indian traders. There’s no explicit law banning offshore forex trading, so thousands of Indians use Exness daily without issues. That said, Indian banks often block direct forex transactions, so you’ll need to use alternative payment methods like UPI, e-wallets, or cryptocurrencies.

Exness Leverage Options: What’s Available?

Exness offers some of the most competitive leverage options in the industry, tailored to different trading styles:

Forex Leverage: Up to 1:2000 on MT5 and 1:Unlimited on MT4 for major currency pairs.

Crypto Leverage: Up to 1:400.

Stock Leverage: Up to 1:20.

Indices Leverage: Fixed at 1:400 for major US indices like US30 and US500, though it may drop to 1:50–1:100 during high-margin periods.

Unlimited leverage on MT4 is a standout feature, but it’s not for everyone. To access it, your account equity must be below $1,000, and you need to have traded at least 10 positions and 5 lots (or 500 cent-lots). This makes it ideal for experienced traders who understand the risks. For beginners, starting with lower leverage, like 1:50 or 1:100, is safer.

You can also manually adjust leverage on Exness through the MetaTrader platform. Just head to the “Account Settings” in MT4 or MT5, select your desired ratio, and save. This flexibility lets you align leverage with your risk tolerance.

Why Choose Exness for Leverage Trading in India?

Exness stands out for Indian traders for several reasons:

High Leverage Flexibility: With ratios up to 1:2000 or unlimited, Exness gives you unmatched control over your trades. This is perfect for scalpers or traders working with small accounts.

Low Spreads: Starting from 0.0 pips on Raw Spread and Zero accounts, Exness ensures you keep more of your profits.

Fast Execution: With execution speeds under 25ms and no requotes, your trades happen instantly, which is critical when using high leverage.

Secure Payment Options: Indian traders can deposit and withdraw using UPI, cryptocurrencies (like USDT or Bitcoin), or e-wallets (Skrill, Neteller). Withdrawals are often processed within 24 hours, sometimes instantly.

Regulatory Oversight: Exness is regulated by top-tier authorities like CySEC and FCA, with segregated client funds and negative balance protection to keep your money safe.

Educational Resources: From webinars to tutorials, Exness provides tools to help you understand leverage and manage risks effectively.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Risks of High Leverage and How to Manage Them

High leverage can feel like driving a sports car—exhilarating but dangerous if you don’t know how to handle it. A 1% market move with 1:100 leverage can double your capital or wipe it out entirely. Here’s how to stay safe:

Start Small: If you’re new to trading, begin with low leverage (e.g., 1:50) and practice on an Exness demo account. This lets you test strategies without risking real money.

Use Stop Losses: Set stop-loss orders to automatically close trades at a certain loss level. This limits your downside.

Monitor Margin Levels: Exness provides real-time alerts to track your equity and margin. A margin call or forced liquidation can occur if your funds drop too low, so stay vigilant.

Diversify Your Portfolio: Don’t put all your capital into one trade. Spread your risk across different assets or even multiple brokers.

Stay Informed: Leverage limits can change during high-volatility periods, like major news releases (e.g., US Non-Farm Payroll). Exness caps leverage at 1:200 for new positions during these times to protect you.

How to Set Up and Use Exness Leverage in India

Ready to start trading with Exness leverage? Here’s a step-by-step guide:

Open an Account: Sign up on Exness’s website with your email, phone number, and a strong password. Verify your identity using a government-issued ID (Aadhaar, PAN Card, or Passport).

Choose Your Account Type: Exness offers Standard, Pro, Raw Spread, and Zero accounts. Standard accounts are great for beginners, while Pro and Zero suit advanced traders.

Fund Your Account: Use UPI, crypto, or e-wallets to deposit funds. The minimum deposit can be as low as $10, depending on the account type.

Set Leverage: Log into MT4 or MT5, go to “Account Settings,” and select your preferred leverage ratio. Start low if you’re new.

Start Trading: Download MT4, MT5, or use the Exness Web Terminal. Use technical indicators and charting tools to plan your trades.

Monitor and Adjust: Keep an eye on your margin levels and use Exness’s trading calculator to manage risks.

Common Pitfalls to Avoid

Even with Exness’s robust platform, mistakes can happen. Here are some traps to watch out for:

Overleveraging: Using 1:2000 leverage on a small account can lead to massive losses. Stick to a leverage ratio that matches your experience level.

Ignoring Regulations: While Exness is legal, ensure you comply with RBI rules by declaring forex profits under capital gains tax. Keep proper financial records.

Skipping Education: Don’t dive in without learning. Use Exness’s webinars and tutorials to understand leverage mechanics.

Emotional Trading: High leverage can amplify emotions. Stick to a trading plan and avoid impulsive decisions.

Real-Life Example: How Leverage Works

Imagine you have $500 in your Exness account and use 1:100 leverage. This lets you control a $50,000 position. If the EUR/USD pair rises by 1%, your profit is $500—doubling your capital. But if the market drops by 1%, you lose $500, wiping out your account. This shows why risk management, like setting stop losses, is non-negotiable.

Conclusion: Is Exness Right for You?

Exness is a top choice for Indian traders thanks to its high leverage, low spreads, and secure platform. However, it’s not perfect. It’s not SEBI-regulated, which might concern some traders, and high leverage can be risky for beginners. Still, with proper education and risk management, Exness offers a powerful platform to maximize your trading potential.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Read more: